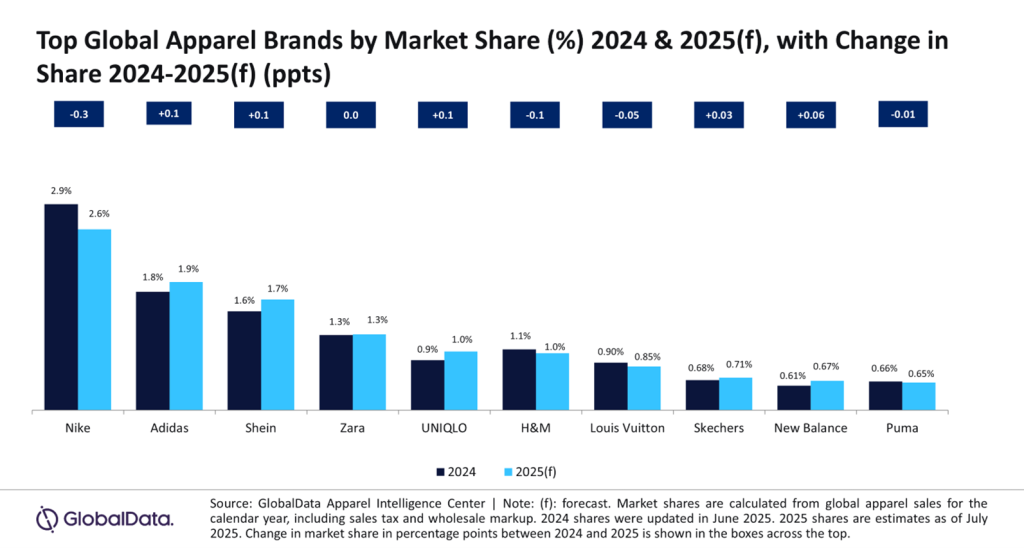

In an update on the global apparel sector, GlobalData forecasted Adidas will “remain one of the biggest winners within the global apparel market in 2025,” and take market share from Nike. Other share gainers within the sportswear category, including apparel and footwear, are expected to be New Balance, Skechers and Shein.

“Brands that can quickly react to trends and offer good value for money will have the opportunity to gain share, whereas those that are unable to compete on price or style are forecast to lose out,” said Tom Ljubojevic, apparel analyst at the UK-based data analytics and consulting firm.

Adidas’ global market share in apparel is estimated to rise by 10 basis points to 1.9 percent in 2025, driven by the continued popularity of its Originals lines and the success of its performance footwear. Elsewhere within sportswear, New Balance and Skechers are seen gaining share, “bolstered by their versatility, alongside their high-profile athlete and brand partnerships,” according to Ljubojevic.

Nike is forecast to see the biggest loss in share, sliding 30 basis points to 2.6 percent. Ljubojevic said, “A combination of a lag in innovation and weaker style credentials has caused this decline. Although the recent delay of NikeSKIMS will not help the brands’ situation, it is now focusing on its performance categories, and its athlete strategy to help it return to growth.”

Among other brands in the active lifestyle space, ranking among the Top 10 global apparel brands, Puma is also seen showing a slight decline in global market share.

Among more fashion-driven brands, Shein is expected to continue gaining a significant share in 2025, expanding 10 basis points to 1.7 percent. Ljubojevic stated, “While the company’s growth is now slowing due to its established presence, its low-cost products and ability to capitalize quickly on trends help it to keep stealing share from competitors.

Among other mass market fashion brands, Uniqlo is seen gaining 10 basis points to 1.0 percent “as its timeless designs and good quality products resonate with consumers seeking value for money,” said Ljubojevic.

Conversely, Zara is expected to maintain a flat market share, and H&M gives back 10 basis points of share to 1.0 percent, as both face challenges competing against lower-priced outlets such as Shein.

Luxury brands in general will face a “wider slowdown” in the category. Hermès is forecast to buck the trend, with an estimated 2025 market share increase of 0.03 percentage points to 0.59 percent. Ljubojevic credited the performance to Hermès’ “focus on a more affluent consumer base, who are less impacted by economic difficulties, due to its high-quality craftsmanship and status-signifying exclusivity of products.”

Gucci is expected to decline 0.10 percentage points to 0.28 percent, as aspirational shoppers remain cautious with their spending and the ultra-wealthy are not engaging with its latest designs due to a lack of exclusivity. Former Creative Director of the brand, Sabato De Sarno’s lackluster minimalism failed to create excitement. Louis Vuitton is likewise expected to give back 0.05 percentage points to reach 0.85 percent as the French brand “particularly loses younger luxury consumers to brands like Prada and Miu Miu, which offer more trendy aesthetics.”

Image courtesy Adidas