Gartner, Inc. Marketing’s survey respondents are more pessimistic about the Holiday 2024 season than those surveyed by others; however, one group appears to be consistently in the majority—those who expect to spend about the same and plan to start earlier.

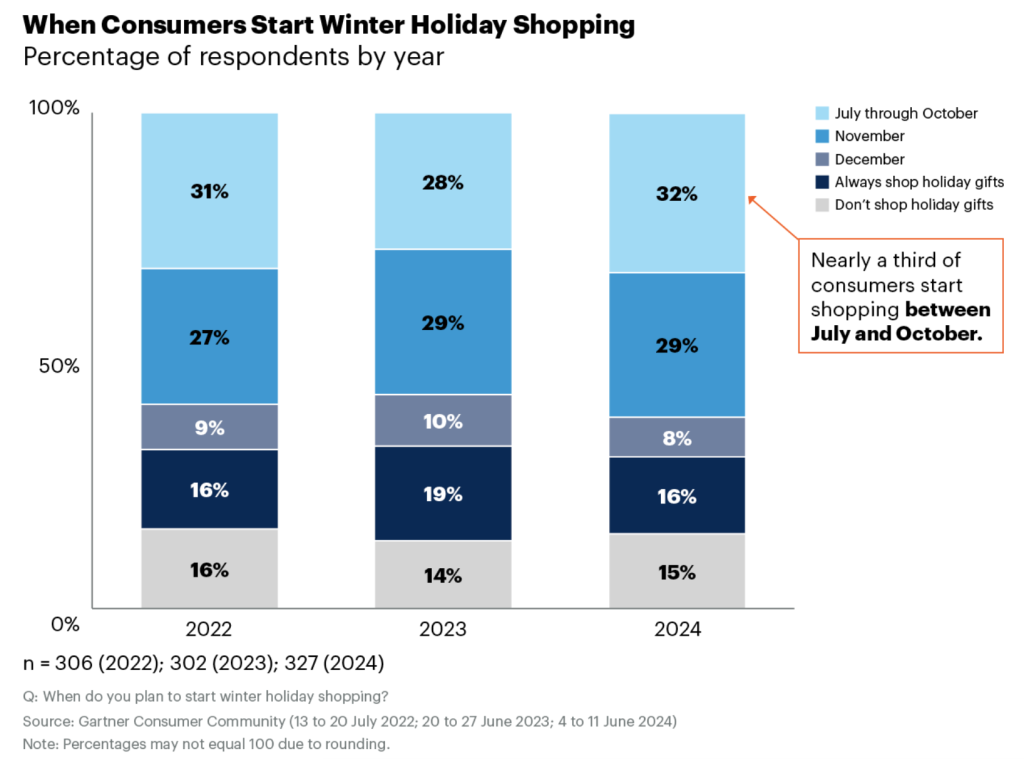

According to the latest survey from Gartner, 32 percent of consumers reported that they plan to begin holiday shopping before November.

A June 2024 survey of 327 consumers conducted by Gartner found that just 14 percent of U.S. consumers plan to spend more year-over-year, with 64 percent planning to maintain their spend and 21 percent pulling back.

“Over three-quarters of holiday shoppers continue to say that higher prices are what causes them to spend more for holiday gifts, not having increased discretionary spending,” said Kassi Socha, director analyst in the Gartner Marketing practice. “The effects of high inflation and supply chain issues in the post-pandemic economy mean holiday shoppers are still on edge.”

A New Holiday Shopping Calendar

Gartner said in its survey summary that brands continue to push their holiday marketing and special promotions to late summer, and consumers have followed their lead. Nearly a third of consumers start for the holidays before November.

“Successful chief marketing officers (CMOs) should begin holiday planning in Q1 and revisit their long-standing promotional and holiday plans throughout the year, launching execution in Q3,” Socha said. “This strategy allows marketing teams to take into account timely consumer insights and market analysis and ensures the hypotheses they made earlier in the year will meet the expectations of their target consumers.”

Online Shopping Continues to Stay Hot As Shoppers Seek Bargains

Gartner said consumers responded in its survey that they are concerned in-store prices are not competitive with online prices, with 20 percent of respondents planning to increase their online shopping this year.

“A majority (60 percent) of consumers have at least one concern about shopping in-store this holiday season, Gartner wrote in its summary. “After showing interest in returning to in-store shopping last year, shoppers now report a variety of reasons for their concern, including higher prices (40 percent), inventory (28 percent), selection issues (18 percent), and security concerns (14 percent) all of which saw increases in the last year.”

Consumers Expect to Return to Hybrid Shopping Behaviors This Holiday Season

Gartner also reported that 57 percent of consumers plan to use one or more value-added services during the holiday period this year, such as Buy Online, Pickup In-Store (BOPIS), curbside pickup, same-day delivery, or expedited shipping.

“Marketers should promote value-added services to differentiate their offerings. Interest in services like BOPIS and same-day delivery indicate that consumers prefer the convenience and money-saving aspects of in-store shopping over the experience itself,” said Socha.

Extended Holiday Return Policies

The company said extended return policies are also a growing aspect of consumer preference as holiday shopping shifts earlier each year.

“Consumers want the ability to return gifts well outside of the traditional 30 to 60-day window of purchase,” said Socha. “This is particularly true for younger shoppers with over seven out of 10 reporting they would be at least a little persuaded to purchase if offered an extended holiday return policy.”

Image courtesy Data and graphics courtesy Gartner, Inc.