Garmin, Ltd. delivered another quarter of outstanding financial results as its products continue to resonate with customers after 35 years in operation. A strong report for the fourth quarter and full year, along with genuine excitement about the year ahead, sent GRMN shares up nearly 13 percent on Wednesday, February 19, as the market reacted to continued good news.

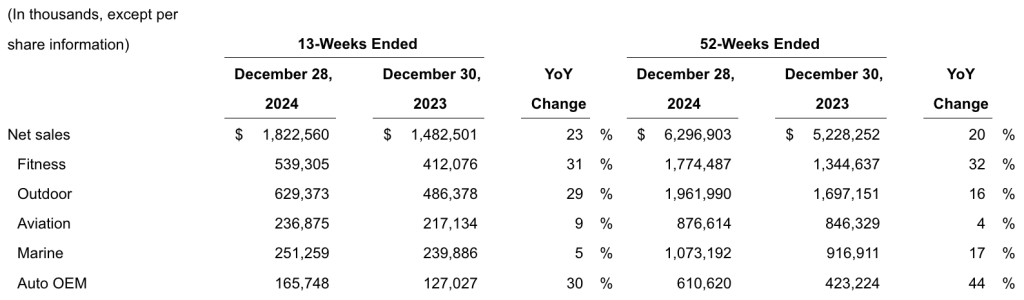

Consolidated revenue for the fourth quarter increased 23 percent to $1.82 billion, a new Q4 record, as the company said it achieved growth and record revenue in each of its five business segments. Consolidated revenue for the year increased 20 percent to $6.3 billion. Gross margin expanded over 100 basis points to nearly 59 percent of sales for the year.

“We achieved growth in every segment, resulting in record segment revenue and record consolidated revenue,” said Cliff Pemble, president and CEO of Garmin, Ltd, on a conference call with analysts. “2024 was also a year of historical significance, marking our 35th year in operation. Since we were founded in 1989, we have delivered more than 300 million navigation and communication devices, including more than 18 million delivered in 2024.”

Company CFO Doug Boessen said that Garmin achieved record revenue on a consolidated basis for each of its five segments in the fourth quarter.

“We achieved double-digit growth in three of our five segments, followed by the Fitness segment with 31 percent growth, followed by the Auto OEM segment with 30 percent growth and the Outdoor segment with 29 percent growth,” Boessen shared.

“By geography, we achieved double-digit growth across all regions, led by the EMEA region with 34 percent growth. APAC region and Americas region at 18 percent and 17 percent growth, respectively,” the CFO added.

Segment Summary

Fitness Segment

Pemble said 2024 was an exciting year in the Fitness segment as demand for running, cycling and wellness products has been robust, and new customers are embracing the healthy, active lifestyles the brand represents.

Fitness segment revenue increased 31 percent in the fourth quarter with growth across all categories led by strong demand for wearables. Gross margin was 57 percent of sales in the quarter and segment operating margin amounted to 30 percent of segment sales, resulting in $159 million of operating income.

“We experienced growth in every product category, led by strong contributions from advanced wearables,” he noted. “During the quarter, we launched Lily 2 Active, our smallest GPS-enabled smartwatch featuring an elegant design and up to 9 days of battery life in smartwatch mode.”

For the year, Fitness segment revenue increased 32 percent to $1.77 billion. Gross margin was 58 percent, a 480 basis point improvement year-over-year, said to be primarily driven by lower product cost and favorable mix. Segment operating income more than doubled year-over-year to $483 million in 2024. Segment operating margin expanded approximately 1,000 basis points to 27 percent of sales, reflecting “both improved gross margin and operating leverage.”

Looking ahead, Pemble said the company anticipates another strong year for the Fitness segment with many new product introductions planned throughout the year.

“With this in mind, we expect Fitness revenue to increase approximately 10 percent for the year,” he projected.

Outdoor Segment

The Outdoor segment delivered a strong year of product achievements and revenue growth, according to Pemble.

Revenue from the Outdoor segment increased 29 percent in the fourth quarter, with growth reportedly led by adventure watches. Gross margin was 67 percent of segment sales and operating margin was 40 percent of segment sales, resulting in $251 million of operating income.

“During the quarter, we launched the Approach R50, the only portable golf launch monitor with a built-in simulator, featuring a 10″ built-in color touchscreen display and more than 43,000 preloaded golf courses worldwide. We also launched the Descent X50i, our largest dive computer with a vivid 3″ color display providing rich information that is readable at a glance,” Pempble offered.

Full-year 2024 Outdoor segment revenue increased 16 percent to $1.96 billion, said to be driven primarily by adventure watches following the launch of the highly successful Fenix 8 series. Gross margin was 67 percent of segment sales for the year, a 340 basis point improvement over the prior year, said to be primarily driven by lower product cost and favorable mix.

Segment operating income exceeded $700 million and operating margin expanded 550 basis points to 36 percent of segment sales, reflecting both improved gross margin and operating leverage.

Pemble said the company is strategically focused on creating growth opportunities by introducing new product categories and penetrating new markets.

“During the quarter, we launched two products that are rising to the definition of a HALO product because they are changing the game in their respective markets,” the CEO detailed. “The first product I want to mention is the Approach R50, which is the only portable golf launch monitor with a built-in simulator. It features a 10-inch color touchscreen display and includes a preloaded database of more than 43,000 golf courses that can be played on the course or virtually using a built-in simulator.

“We also launched the Descent X50i, our first large format dive computer,” he continued. “This device includes a vivid 3-inch color display providing rich information that is readable at a glance, and its rugged design is purpose-built with leak-proof buttons, a sapphire lens, a 20 ATM dive rating, and an integrated backup dive light.”

Looking ahead, Pemble said the company expected that its strong Outdoor segment product lineup would result in revenue growth of approximately 10 percent for the year.

Marine Segment

Revenue from the Marine segment increased 5 percent to $251.3 million in the fourth quarter with growth across multiple categories. Gross and operating margins were 58 percent and 20 percent, respectively, resulting in $51 million of operating income.

Full-year revenue in the Marine segment increased 17 percent to nearly $1.1 billion, exceeding the $1 billion threshold for the first time.

“Growth was primarily driven by new revenue from the 2023 acquisition of JL Audio,” Pemble explained. “Excluding JL Audio, Marine revenue increased 6 percent, outperforming the broader market and strengthening our position as the world’s largest consumer marine electronics company.”

Full-year gross margin was 55 percent of segment sales, a 180 basis-point improvement over the prior year, and was said to be favorably impacted by lower product cost. Operating income increased 32 percent year-over-year, and operating margin expanded 240 basis points to 22 percent of segment sales, reflecting both improved gross margin and operating leverage.

“As I previously mentioned, Garmin has been consistently outperforming the broader marine market,” Pemble noted. “We expect to do so again in 2025. The marine market remains soft, but is stabilized at a level from which we can anticipate recovery and growth. With this in mind, we expect Marine revenue will increase approximately 4 percent for the year.”

Income Statement Summary

Gross margin was 59.3 percent of sales in the quarter, increasing 100 basis points year-over-year, said to be primarily due to lower product cost.

Fourth quarter operating expenses increased by approximately $40 million, or 8 percent, year-over-year. Research and development increased by $22 million, SG&A increased by $19 million. Both increases were said to be primarily due to personnel-related expenses.

Operating income was $516 million in Q4, representing a 52 percent year-over-year increase. Operating margin was 28.3 percent in the quarter, a 540 basis-point increase from the prior-year Q4 period.

Operating income increased 46 percent to nearly $1.6 billion for the full year, with an operating margin at 25 percent of sales.

GAAP EPS was $2.25, Pro-forma EPS was $2.41, a 40 percent increase from prior-year pro forma EPS.

“While we were optimistic at the beginning of 2024, we consistently outperformed even our highest expectations throughout the entire year,” Pemble concluded. We believe our performance is the direct result of our robust product portfolio. Looking ahead, we have many product launches planned for 2025 that will further strengthen our portfolio, with some representing new categories for Garmin.”

Balance Sheet and Cash Flow Summary

Garmin, Ltd. ended the year with cash and marketable securities of approximately $3.7 billion.

Accounts receivable increased sequentially and year-over-year to $983 million due to strong sales in the fourth quarter.

Inventory balance increased year-over-year to approximately $1.5 billion.

“During the fourth quarter 2024, we generated free cash flow of $399 million, $18 million decrease from the prior year quarter,” said Boessen. “For the full year 2024, we generated free cash flow of approximately $1.2 billion, 56 million increase in the prior year due to improved earnings, partially offset by increased working capital needs.”

The CFO said full-year 2024 capital expenditures of $194 million were consistent with the prior year.

“In 2025, we expect free cash flow to be approximately $1.1 billion with approximately $350 million in capital expenditures,” Boessen shared, also adding that the company expects to continue to make investments in platforms to grow, including facilities and IT-related projects.

Outlook

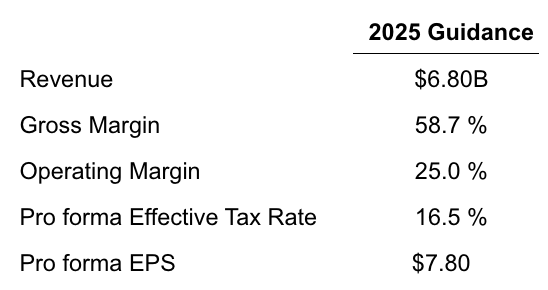

Garmin, Ltd. is estimating revenue of approximately $6.8 billion in full-year 2025, an increase of approximately 8 percent versus 2024.

Garmin, Ltd. is estimating revenue of approximately $6.8 billion in full-year 2025, an increase of approximately 8 percent versus 2024.

“We expect gross margin to be approximately 58.7 percent to consistent with our 2024 gross margin,” Boessen continued. “We expect an operating margin of approximately 25 percent, which is comparable to the 2024 results. The full-year performance effective tax rate is expected to be approximately 16.5 percent as compared to the 2024 tax rate. This results in expected pro forma earnings per share of approximately $7.80, a 6 percent increase over the 2024 pro-forma earnings per share.”

Image courtesy Garmin Ltd.