Foot Locker, Inc. EVP and Chief Commercial Officer Frank Bracken joined the retailer’s second-quarter conference call with analysts to discuss the progress made with brands and products in-store and online.

Nike is on the market’s mind these days after the sharp downturn in shares following a dismal outlook on the company’s fiscal year-end call. Foot Locker CEO Mary Dillon quickly pointed out in her early comments that the retailer expects to return to growth with Nike “starting in the fourth quarter of this year and into 2025.”

Footwear

Bracken noted that, overall, Footwear comped positive high-single-digits in the second quarter.

Basketball

“Within the basketball category, we continue to invest and see the strength within our portfolio of next-gen signature athletes like Nike’s Sabrina Ionescu, Devin Booker and John Moran, along with the Jordan athlete and NBA champion Jayson Tatum,” Bracken detailed. He said FL continues to drive energy and strong sell-through with the Adidas AE1 and the MB.03 from Puma.

Bracken said the company remains confident in the diversity and energy of its signature basketball portfolio and looks forward to delivering more innovation and excitement later this third quarter as the NBA season tips off.

“Importantly, the game of basketball and its influence continues to grow globally, as evidenced by the Olympic Games this past month,” Bracken suggested. “As the U.S. women’s and men’s team both won gold medals, the tournament demonstrated how global, competitive, inclusive, and inspiring the sport has become, and the role it plays in driving both sport and culture across the globe.”

Bracken said that within basketball culture, Nike’s Dunk, Air Force 1 and the Jordan AJ1 remain icons in the sneaker category and among the retailer’s most important franchises with consumers.

“Likewise, our Jordan Retro business continues to be a critical connection point to a new generation of consumers who celebrate basketball culture and streetwear, and we saw strong sell-throughs as we exited the quarter and then the beginning of back-to-school,“ he noted.

Lifestyle

Turning to the lifestyle category, Bracken said Adidas continues to lead FL’s global terrace trend, especially among women and kids. “Our business with Adidas strengthened in the second quarter as we flowed new colors and powerful retail stories through franchises such as the Samba, Campus, and Gazelle,“ he detailed. “Our order book and go-to-market plans remain very strong as we go through the back-to-school time period, and we are encouraged by the robust pipeline of innovation and creativity that Adidas has shared with us looking forward.”

In lifestyle running, Bracken said FL continued its “strong momentum“ with New Balance through door expansions in women’s and kids, as well as like-for-like gains.

“Our partners at New Balance continue to engage our shared consumers with strong product innovation, compelling assets and storytelling, and operational excellence to help scale the business,“ he offered. “With multiple footwear franchises connecting in the marketplace and a commitment to sport, lifestyle and streetwear, we are confident that we will continue to grow with this important partner.”

Bracken called out Asics as another strong brand that is leveraging its authenticity in running. “We are seeing strong global momentum with Asics in multiple footwear franchises across men’s, women’s and kids. Next to that, Champs Sports has partnered with Asics on their performance running line and also executed multiple run club events with consumers this year,“ he commented.

“With our partners at Nike, we continue to revitalize the Max Air business through their innovative platform, Dynamic Air,“ Bracken said. “And in the back half of this year, we will increase door count for Air Max DN across all genders, and we are excited to flow new colors and stories into our business.”

Bracken said FL continues to elevate its exclusive Tuned Air franchise globally, investing in digital content, consumer experiences and elevated in-store merchandising. He said FL also saw momentum with Nike in the second quarter across heritage running franchises, including Vomero, V2K and P-6000. “Our door base and depth in these franchises is improving in our back-to-school selling period, as well as the fourth quarter, and we are pleased to dimensionalize the running business with them,“ he commented.

Performance Running

Within performance running, On and Hoka continue bringing new consumers into sneaker culture, especially women and kids, Bracken suggested. “We grew with both of these brands on both a door and allocation basis in the second quarter, as we also see our retail banners as helping to introduce younger, more multicultural consumers to their brands.

Skate/Vulcanized

Bracken acknowledged that the vulcanized footwear category remains challenged overall, but he also noted that FL is seeing encouraging trends with the Vans brand, primarily through their Knu Skool franchise. “We are building our stock levels in this compelling franchise as we navigate the back half of the year, and we will continue to work with them to connect their classics and innovation to our consumer base,“ he said.

Apparel

In Apparel, Bracken said challenges persisted in the second quarter, with comps down in the mid-teens. “While the promotional environment in apparel remains difficult, we believe we can do more to stabilize the category with greater key item and sneaker connectivity, while also filling in gaps in our assortments with a compelling private label offering,“ he observed. “One of the standouts within our apparel business was our Champ Sports private label performance within CSG. CSG comped positive for the quarter, and we have delivered a compelling assortment for the back-to-school season, including new activewear styles, as well as new assortments in bottoms.”

Accessories

In Accessories, the FL business comped up in mid-single-digits in the quarter as the company focused on the complementary socks, shoe care, and headwear categories, which Bracken said is helping drive UPTs and accretive merchandise margins.

Channel Summary

Comparable sales in the Stores channel increased 2 percent in the quarter. “While traffic was down year-on-year, we continue to see gains in conversion, as well as average ticket, including both positive AURs from greater full-price selling, footwear penetration, and higher UPTs,“ Bracken detailed.

Digital channel comps increased 4 percent year-over-year in Q2. Bracken said they saw growth again in their customer file in the quarter with both new and reactivated customers. He said FL also delivered higher digital conversion levels for the quarter.

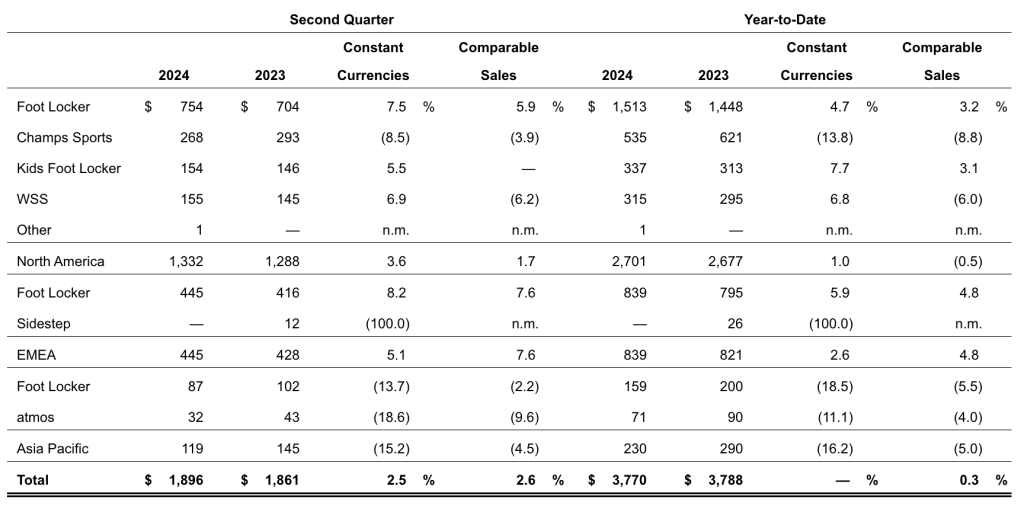

Sales by Region and Banner

(in US$ millions)

North America

North America overall comps were up 1.7 percent for the quarter, led by Foot Locker North America, which delivered a 5.9 percent increase.

“With meaningful store refreshes completed and our inventories well-positioned, customers responded to our assortments and product flows at full price, particularly across women’s, running, and the basketball categories,” Bracken detailed. “Our sustained brand-building presence with our women’s style campaign, our basketball activations with the Clinic and Summer Hoops, and our marketing investments with sneaker season in July kept us top of mind throughout the quarter and headed into the early days of back-to-school.”

Kids Foot Locker comps were said to be flat in the quarter. “Coming off a strong first quarter when we pulled forward receipts to match strong demand, it took some time to rebalance stock levels to fully meet demand here in the second quarter,” Bracken noted. “We were able to partner with our vendors to ensure supply for the third quarter and have seen a nice acceleration in the banner in August as a result and believe we are well positioned for the balance of the year.”

Champs Sports comps were down 3.9 percent, a nearly ten-point sequential improvement from the first quarter results. Bracken said FL sees signs of stabilization at the banner as its repositioning continues to take hold. Champs generated positive footwear comps in the quarter. Bracken said the Top 25 Champs doors comped positive overall in Q2, with strength in July store conversion as assortments reflecting its updated Sportstyle positioning that resonated with customers.

“Additionally, the Champs team has been partnering with Adidas to deliver on the culture of sport and, more specifically, the look of soccer, including jerseys and jersey-inspired shirts, bottoms, and terrace footwear,” Bracken said. “And as I mentioned briefly before, the Champs CSG assortment has helped deliver against consumer-right trends like lifestyle woven bottoms and activewear, which is proving to be a hit with consumers.”

At WSS, the Hispanic consumer-focused chain with its roots in Los Angeles comps declined 6.2 percent year-over-year in the second quarter as inflationary pressures continued to impact the discretionary spending of the retailer’s consumers, as reflected in shopping visits, especially in California. Bracken said the WSS management team continues to focus on delivering compelling value and selection to its core customers.

“However, as we navigate the challenging environment, we believe it’s appropriate in the near term to reduce capital for new store openings at WSS, particularly given the strong returns we are seeing with new store concepts out of our other banners,” he announced. “As a result, our revised plan for 2024 now includes 13 new doors at WSS, down from 20, as we expect to temper our door growth plans in the near term, until we see greater signs of consumer stabilization and recovery. While we are taking this prudent approach in the near term, we still very much believe in opportunities for the banner longer term and serving the fastest growing consumer segment in the U.S.”

Europe Region

In Europe, comps were up a 7.6 percent year-over-year in the second quarter. “The environment in Europe remains dynamic and somewhat promotional, especially within apparel, and we acknowledge there’s more work to do in the region to drive greater levels of full-price sales,” Bracken acknowledged. “However, our teams in the region saw tremendous success in the quarter in engaging consumers through our store refresh program, as well as compelling brand campaigns, including our Summer of Sport campaign, celebrating the Euro Cup, and of course the Olympics in France.”

With optimizing the company’s footprint in the region, Bracken said Foot Locker will continue to focus more resources on the most meaningful European markets where it can drive sustainable and profitable growth.

Asia-Pacific Region

In Asia-Pacific, comps were down 4.5 percent year-over-year in the second quarter. At the Foot Locker banner, comps were down 2.2 percent, reflecting ongoing consumer challenges in the Australian marketplace from higher inflation. Bracken said the company is encouraged by an improving trend it saw as the business moved through the month of July.

At Atmos, comps were down 9.6 percent for the quarter, reflecting the company’s decision to accelerate shifts from less profitable third-party digital platforms to its owned digital site. “We will continue this shift into the back half of the year and come out of this with stronger first-party customer relationships and data,” he said.

“To conclude, we were pleased to deliver a strong second quarter led by our global Foot Locker and Kids Foot Locker banners. Our merchandising and commercial teams are in sync and executing well with the support of our brand partners, leading to a solid back-to-school season thus far and giving us confidence as we look ahead to the holiday season,” Bracken closed.

Image courtesy New Balance

***

See below for additional coverage from SGB Media on Foot Locker’s Q2 performance, the announced HQ move, store closures, and progress against the turnaround plan.

EXEC: Wall Street Reacts as Foot Locker CEO Talks Turnaround Plan and Positive Q2 Comps

EXEC: Foot Locker Exiting New York for Sunnier Environs; Shakes Up Europe and Asia Model

Foot Locker Inc. Sees Core Foot Locker Banner Comps Grow 5.2 Percent in Q2