Foot Locker, Inc. shares closed down nearly 9 percent on the New York Stock Exchange on Wednesday, December 4 after the athletic footwear retailer reported its third-quarter results and lowered its guidance for the remainder of the fiscal year ending February 1, 2025.

The third quarter fell short of expectations both inside the building and on Wall Street, but analysts and investors also reacted to the cut in sales expectations and non-GAAP EPS for the full year.

“Despite continued and meaningful progress, our third quarter results did not meet our expectations,” offered company President and CEO Mary Dillon on a conference call with analysts. “As we consider this performance and the current promotional environment, we are taking a more cautious approach to our outlook and have revised our sales and earnings guidance for the year. While we are disappointed that we did not see as much sequential improvement in the business that we had anticipated three months ago, we are pleased to continue to demonstrate ongoing progress against our Lace Up Plan as we delivered another quarter of positive comp results and meaningful gross margin improvement in the third quarter.”

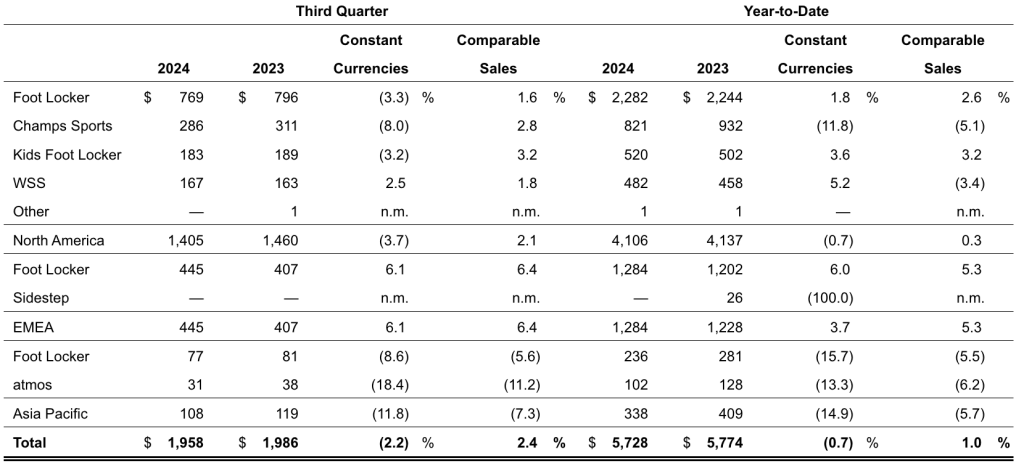

Total sales were down 1.4 percent to $1.96 billion in the third quarter, compared with sales of $1.99 billion in the third quarter of 2023. Excluding foreign exchange rate fluctuations, total sales for the third quarter decreased by 2.2 percent year-over-year (y/y).

Comparable (Comp) Sales

Total comp sales increased 2.4 percent year-over-year in the quarter, reportedly led by share gains from the global Foot Locker and Kids Foot Locker banners, which comped up 2.8 percent in Q3, roughly half the gain in the second quarter. In addition, Champs Sports and WSS banners accelerated back to positive territory, up 2.8 percent and 1.8 percent, respectively, led by strength in the back-to-school period.

“In the quarter, we saw consumers remained cautious with their discretionary dollars. More specifically, this translated to shoppers concentrating spending around the peak back-to-school selling season in August and then pulled back in September and October, which we believe reflected consumers holding off on spending ahead of holiday events,” Dillon noted.

“In terms of cadence, comps peaked in the August back-to-school period as customers consolidated their spending during those key selling moments, followed by softer trends in September and October,” added Foot Locker CFO Mike Baughn. “As a result, August comps of positive high-single-digits slowed to negative low-single-digits in September and October.”

Channel Summary

Comparable sales in the brick-and-mortar store business increased 2.2 percent y/y. Digital comps increased 3.6 percent year-over-year.

“While traffic was down year-on-year and down sequentially compared to the second quarter, we continue to see gains in conversion as well as average ticket, including positive AURs,” said Chief Commercial Officer Frank Bracken, referencing average unit retail pricing. “We continue to deliver higher digital conversion levels as our efforts to improve the customer digital experience continue.”

North America

North America region overall comps were up 2.1 percent y/y, including Foot Locker North America comps up 1.6 percent year-over-year.

“Our Foot Locker banner saw a strong back-to-school season across both men’s and women’s,” Bracken shared. “The team drove excitement and engagement through the quarter with our compelling back-to-school campaign, our 50th Anniversary celebration and our basketball activations, including our Chicago Bulls announcement. With share gains across men’s and women’s in the quarter, we feel well-positioned headed toward the remainder of the holiday season.”

Kids Foot Locker comped up 3.2 percent y/y in the quarter. Bracken said trends accelerated from the second quarter, led by a solid back-to-school season in August, as the retailer could better match product supply with demand.

“Customers responded to our assortments across multiple categories, including basketball, running and seasonal, driving solid increases in our conversion levels. Looking to the fourth quarter, we believe our kid’s banner is well-positioned to continue to take market share,“ Bracken noted.

Champs Sports comps were up 2.8 percent y/y for the quarter, a nearly 7-point improvement from second-quarter results and the first positive banner comp since the repositioning.

“Conversion levels were positive year-over-year as customers responded to the banner’s updated head-to-toe sports style positioning, with differentiated assortments from partners such as New Balance, Adidas, Asics, and our CSG label,“ said Bracken. “Under its new brand platform, Sport for Life, Champs Sports is celebrating the connection between sports and the on-the-go lifestyle of our active consumers.

“Last month, Champs Sports rolled out its holiday campaign featuring Aaron Judge for the Jordan brand and Trea Turner for Adidas, and we are seeing our marketing help Champs gain share with the active athlete and sports style enthusiast consumer segments,” continued Bracken.

WSS reached an inflection point in the quarter and comped positive for the quarter, up 1.8 percent y/y, reportedly led by a strong back-to-school performance in August.

“The banner’s efforts to emphasize value for the full family through its compelling marketing and differentiated assortments, including below $80 footwear, as well as global football and work wear continues,“ Bracken added. “While the overall macro backdrop remains tougher for our WSS customers, our team continues to position the banner with compelling assortments and competitive offers in the peak holiday periods.”

Europe

Europe comps were up 6.4 percent y/y in the third quarter.

“Promotional levels were elevated in the marketplace, especially in digital and the apparel category, and our teams reacted in the quarter to remain competitive,“ Bracken said. “We continue to focus on elevating the consumer experience in our European business as we navigate the choppy environment. We opened our second Foot Locker Reimagined store this quarter near Amsterdam and continue to invest in our store refresh program, which is performing well.“

Asia-Pacific

Asia-Pacific comps were down 7.3 percent y/y in the quarter.

“At our Foot Locker banner, comps fell 5.6 percent, reflecting ongoing headwinds in the Australian marketplace from a challenged consumer. And finally, at Atmos, comps were down 11.2 percent, reflecting our decision to accelerate shifts to our own digital site and away from less profitable third-party digital platforms and partnerships,“ Bracken explained.

Category Summary

Bracken also broke out category performance and highlighted key brands in the quarter.

Footwear comped positive in high single-digits in the third quarter, reportedly led by strong results from Adidas, New Balance, On, Hoka, Ugg, and Asics. Bracken said these brands performed well while Foot Locker is “contending with some more recent softness“ from top partner Nike.

Footwear comped positive in high single-digits in the third quarter, reportedly led by strong results from Adidas, New Balance, On, Hoka, Ugg, and Asics. Bracken said these brands performed well while Foot Locker is “contending with some more recent softness“ from top partner Nike.

“As Nike rebalances their product mix and inventory levels in the near term across the basketball classics franchises, we are seeing some short-term negative impacts on our business,“ Bracken continued. “We are seeing higher promotional levels in the marketplace across both DTC and competition, which is having a cascading impact as we need to react and compete with those dynamics headed into the holiday season.”

Bracken pointed out that Foot Locker returns to growth with Nike on an allocation basis during the holiday season and has a favorable launch calendar.

“Meanwhile, our overall inventory levels with them remain controlled and we are working together closely to optimize new receipt flow, retail sell-through, and prioritize full-price selling as best as possible,“ he continued. “At a strategic level, we are confident in the strength of our partnership with Nike as we continue to engage with its new leadership team. Serving our young multicultural customers through our strategic platforms of basketball, sneaker culture, and kids continues to be the top priority of our partnership.”

Within the overall basketball category, Bracken said Foot Locker continues to see strength within its portfolio of next-gen signature athletes, including Nike’s Ja 2, (shown above right), Sabrina 2, Adidas AE 1, and Puma’s Melo 04, along with retro Nike shoe styles Foamposite and Kobe.

Bracken noted that Foot Locker introduced the Anta brand from China to several doors online in the quarter. He said Foot Locker had been pleased with the customer response to the KAI 1, the offering from Anti tied to Kyrie Irving.

Anta Sports is the retail partner for the Fila and Descente brands in Greater China and is also the majority shareholder of Amer Sports, which owns Arc’teryx, Salomon and Wilson Sports, among others.

“We’ll continue to test and learn with this exciting new partner in the seasons ahead,“ Bracken said.

In the Lifestyle category, Bracken said Adidas continues to lead the global terrace trend, especially within the retailer’s women’s and kids’ segments.

“Our order book and go-to-market plans remain very strong as we approach the holiday season, as we continue to see robust consumer demand across our global banners,“ he suggested. “In Lifestyle Running, New Balance continues to deliver strong momentum through a combination of door expansions as well as like-for-like gains. Franchises like the 9060 (shoe shown right and in lead image) have quickly become new icons with our younger multicultural consumers across men’s, women’s and kids.

“Looking ahead, we continue to see room for growth with this important partner across all our banners and geographies,” continued Bracken.

Foot Locker also highlighted Asics as another brand that is seeing strong global momentum across men’s and women’s as it leverages its authenticity in running.

“We look forward to working closely with Asics leadership team to profitably grow our partnership globally,” Bracken said.

In Performance Running, Bracken said On and Hoka continue bringing new consumers into sneaker culture, especially women and kids.

“We’re pleased to continue to drive strong double-digit gains with these partners as we selectively expand doors to reach new consumers while continuing to see strong like-for-like gains,“ he noted.

“Finally, as we look ahead to the holiday season, the Ugg brand continues to be a large part of our plans,“ Bracken added. “Our go-to-market plans with Ugg include engaging content and elevated in-store presentations, which we believe will capture our customers’ attention.”

Apparel

Bracken said challenges persisted for the retailer in the apparel category in the third quarter, with comp declines deepening to the low 20s.

“As innovation within apparel is lagging compared to our Footwear business, we see this manifest in a more promotional environment as consumers clearly are seeking more newness and innovation in the category,“ he noted. “However, a bright spot continues to be our private-label Apparel business, especially CSG and CSG Active at Champs Sports. We will continue to invest in our private-label capabilities and assortment as it is driving outsized merchandise margins and offering styles and price points that our brand partners do not service.”

Accessories

The Accessories business comped up high-single-digits as Foot Locker continues to build shopper transactions through categories such as socks, headwear and shoe care.

“Here again, the merchandise margins are attractive as we work through both branded partners and private-label to deliver our plans in this category,“ Bracken concluded.

Income Statement Summary

CFO Mike Baughn said the company was pleased to accelerate the year-over-year gross margin rate expansion in the quarter relative to the second-quarter trend while sustaining a positive comp trajectory.

Gross margin for the quarter expanded 230 basis points y/y to 29.6 percent of sales, reportedly highlighting continued progress in recovering from last year’s heightened promotions; however, it fell short of internal expectations.

“While we continued to make sequential improvement in the third quarter, we also ensured we were positioned competitively in the marketplace and did not pull back as far as we had expected,“ Baughn noted.

Merchandise margins were said to drive the improvement in gross margin, increasing 230 basis points y/y, reportedly driven by fewer markdowns year-over-year. Occupancy, as a percent of sales, was approximately flat on a rate basis.

“Approximately $15 million of gross margin savings from our cost optimization programs also flowed through our cost of goods line,“ Baughn added.

The SG&A rate was 24.6 percent of sales in Q3, representing a deleverage of 210 basis points.

“SG&A dollar growth of 8 percent landed below our prior expectation of a low-double-digit dollar increase as we continue to tightly manage expenses in addition to ongoing progress against our cost savings program,“ Baughn explained. “Investments in technology and brand building increases drove the absolute dollar growth year-on-year. These increases were partially offset by $10 million in savings from our cost optimization program. Collectively, our cost optimization program generated total savings of approximately $25 million in the quarter.“

The company posted a net loss in the third quarter in GAAP terms. The net loss was $33 million, or 34 cents per share, in Q3, compared with a net income of $28 million, or EPS of 30 cents per share, in the prior-year Q3 period.

On a non-GAAP basis, net income was $31 million, or EPS of 33 cents per share, for the third quarter, compared to a net income of $28 million, or EPS of 30 cents per share, in the corresponding prior-year period.

Non-GAAP results exclude, among other items, non-cash impairment charges of $25 million related to the Atmos trade name following a strategic review of the Atmos business and a charge of $35 million related to impairment to the carrying value of a minority investment, which the company regularly assessed whenever events or circumstances indicated that the carrying value may not be recoverable.

Balance Sheet Summary

Foot Locker ended the quarter with $211 million in cash and total debt to $445 million. At quarter-end, Merchandise inventories were $1.7 billion or 6.3 percent lower than at the end of last year’s third quarter.

Excluding the effect of foreign currency fluctuations, merchandise inventories decreased 6.9 percent year-over-year.

“Despite the sales shortfall in the quarter, we remain pleased with the composition and quality of our inventory,“ Baughn said. “We’ve operated with reduced inventory for the last four quarters to more normalize our composition and overall levels of inventory, and as we look forward, we continue to expect to end the year with inventories approximately flat to last year.“

Non-Cash Charges

During its early morning release, Baughn also highlighted an update regarding non-cash impairment charges within the quarter. Following a strategic review, Foot Locker took a $25 million non-cash charge against the Atmos trade name, which is excluded from the company’s non-GAAP earnings.

“While the Atmos business continues to perform well, the charge reflects our recent moderation of growth expectations,“ Baughn said. “The second is related to a $35 million non-cash charge on our minority investment portfolio following our routine asset review. This charge flows through our other expense line, but is excluded from our non-GAAP earnings calculation.”

2024 Full Year Outlook

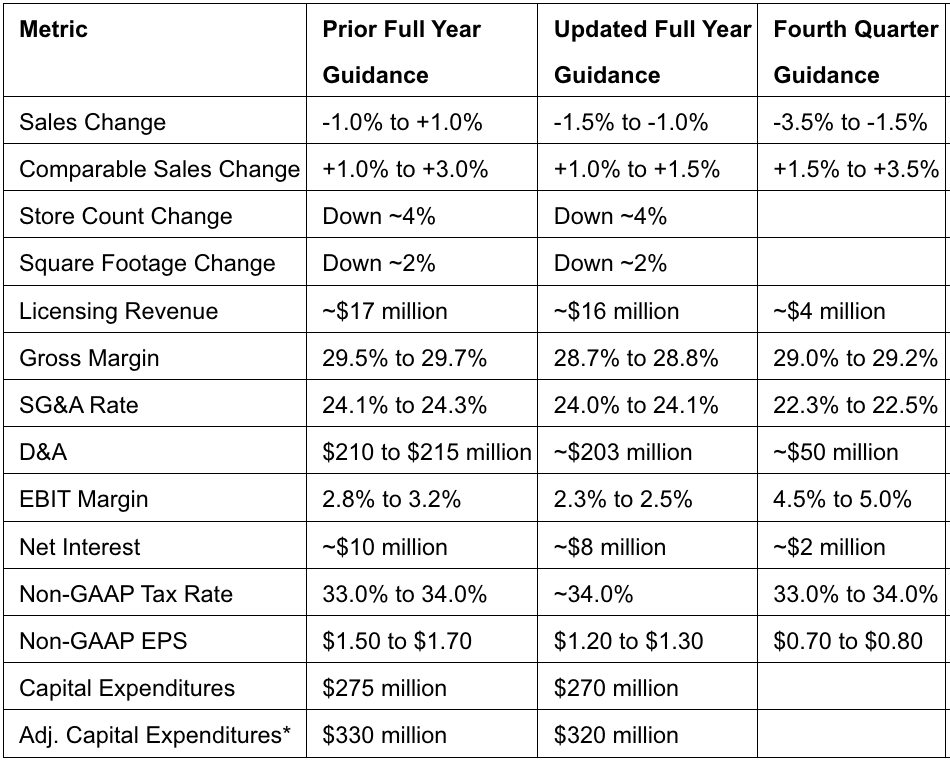

Foot Locker, Inc. reduced its full-year non-GAAP EPS guidance to a range of $1.20 to $1.30 per share from prior guidance of a range of $1.50 to $1.70 per share.

Foot Locker expects full-year comps of +1 percent to +1.5 percent, at the lower end of the prior forecast of +1 percent to +3 percent.

“Overall, our store count will be down approximately 4 percent in 2024 with square footage down approximately 2 percent,“ Baughn noted. “We expect to open 27 new stores in the year and to close approximately 130.”

Including an approximate $100 million drag from lapping the extra week in 2023, Baughn said total sales for 2024 are now expected to be down 1 percent to down 1.5 percent, compared to prior guidance of sales down 1.0 percent to up 1.0 percent.

The company expects Adjusted capital expenditures to be $320 million in 2024, slightly less than previous expectations of $330 million.

Fourth Quarter Outlook

While the first three weeks of November underperformed company expectations, Baughn said Foot Locker did see an improved and “nicely positive“ year-over-year trend during the Thanksgiving and Black Friday like-for-like week.

“We’ve seen consistently solid and improving trends within our stores and are navigating a promotional environment, especially in digital. In other words, the quarter is following the trend we’ve experienced all year where customers are responding in the peak selling moments,“ Baughn explained.

“The combination of the slower start to November, the positive Thanksgiving and Black Friday week, the elevated promotional environment, and the shortened holiday calendar have combined to inform our updated guidance,“ Baughn said.

Baughn also noted that Foot Locker expects fourth-quarter non-GAAP earnings per share to be in the range of 70 cents to 80 cents per share. The outlook assumes a comp of +1.5 percent to +3.5 percent, with the middle end of the range assuming a steady state from the third-quarter comp trend.

On gross margin, Foot Locker is assuming improvement from the third quarter, with margins projected up in a range of 240 basis points to 260 basis points year-over-year to a range of 29.0 percent to 29.2 percent.

“With the backdrop more promotional than we anticipate this holiday, we’re unable to dial back our promotions to the degree we expected 90 days ago,“ Baughn noted. “However, as highlighted by our outlook, we still expect Q4 to be the most meaningful margin improvement year-over-year within 2024 as we don’t anniversary some of the heavy promotional activity that we took last year, especially in the apparel category.”

Baughn said that with margin performance last year benefiting by 40 basis points from occupancy leverage from that extra week, the underlying margin improvement from the third quarter to the fourth quarter is expected to continue.

“On expenses, we expect 10 basis points of deleverage to 10 basis points of leverage range of an SG&A rate of 22.3 percent to 22.5 percent. On an absolute dollar basis, we expect dollars down 2 percent to 3 percent as we continue to manage our expenses carefully, benefit from our ongoing cost savings program, and lap the extra week of expenses from last year,“ the CFO detailed.

“To close, while we are disappointed to be making changes to the full-year outlook, we are also encouraged by our ongoing positive comps and gross margin expansion within the quarter, which we still expect to maintain and accelerate in Q4, supported by the momentum we have in our Lace Up Plan. We remain committed to reaching our longer-term EBIT target of 8.5 percent to 9.0 percent by 2028,“ Baughn concluded.

Full Year and Fourth Quarter 2024 Updated Guidance

Images courtesy New Balance, Nike