JD Sports Fashion Plc, the UK-based parent of the JD, Finish Line, Hibbett, DTLR, and Shoe Pavilion retail brands in the U.S., is reporting its preliminary sales results for the fiscal second quarter ended August 3, which were in line with expectations on a constant-currency basis.

The company completed the acquisition of Hibbett, Inc. on July 25, just before the end of the period. Hibbett is now part of the Complementary Concepts segment in North America and is said to add “material scale and presence” in the U.S. through its 1,179 stores, strengthening further brand relationships in the “world’s largest sportswear market.”

“Hibbett, with its strong community presence, also provides an enhanced platform for the mall-led, nationwide growth of the JD brand in North America through its efficient supply chain and strong back office,” the company said in a media release.

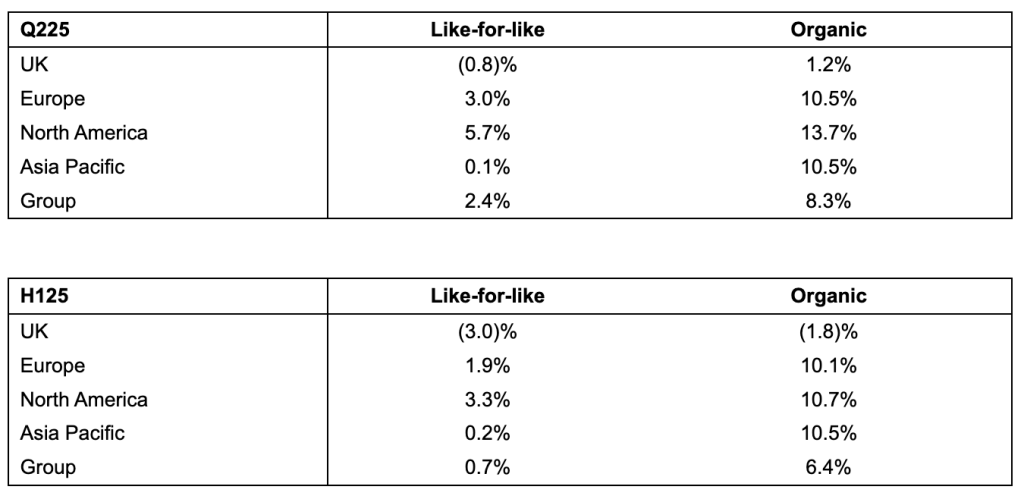

Regional Revenue Performance

Second-quarter comparable store sales were said to be strongest in North America, with 5.7 percent comp sales growth year-over-year. The region also led in organic sales growth, which jumped 13.7 percent year-over-year for the second quarter.

Europe comps were up 3.0 percent for the quarter, while the UK reportedly “improved materially” quarter-over-quarter. The company reported that it achieved Organic growth in all regions.

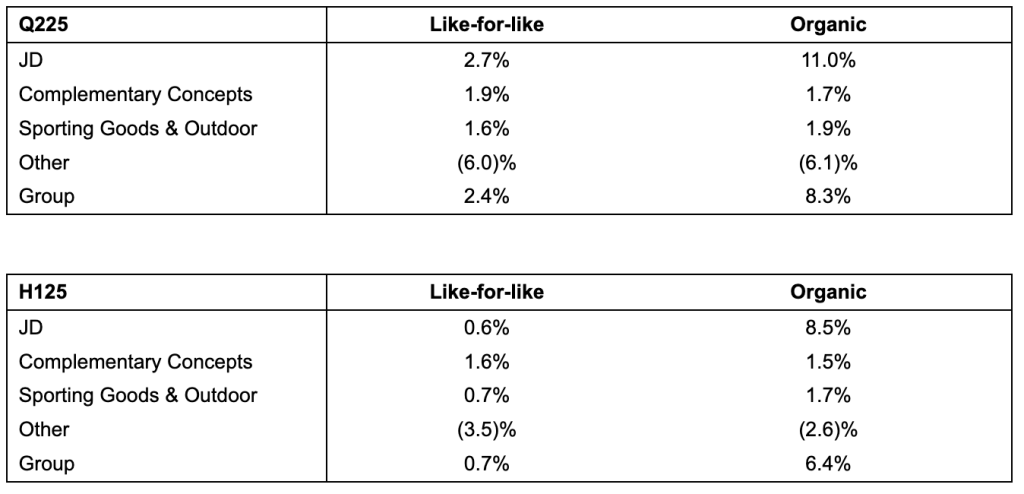

Segment Revenue Performance

All three primary segments—JD, Complementary Concepts and Sporting Goods & Outdoor—achieved comp sales growth. The JD segment benefitted from new store openings, delivering 11 percent organic growth.

Consolidated Results

On a consolidated basis, comp store sales were up 2.4 percent for the quarter, and organic sales were up 8.3 percent. As a consequence, comp sales were up 0.7 percent in the first half, and organic sales were up 6.4 percent.

The quarter-over-quarter sales improvement was reportedly driven primarily by the strength of the company’s multi-brand operating model and softer comparatives with the previous year.

“I am pleased to report like-for-like sales growth of 2.4 percent and organic sales growth of 8.3 percent in the second quarter, demonstrating the strength and agility of our multi-brand model,” commented Régis Schultz, CEO of JD Sports Fashion Plc. “In particular, we saw double-digit organic sales growth in North America and Europe, supported by the continued success of our JD store rollout program. We completed the acquisition of Hibbett, Inc. just before the period end, and we look forward to its contribution to the growth and development of our U.S. business in the coming years. Based on our first half of trading, we remain on track to deliver profit within our full-year guidance.”

For the period, consolidated gross margin was 48.4 percent of sales, down 30 basis points year-over-year. JD Sports said the decline was seen mainly in apparel and online, where its higher penetration resulted in the UK being most impacted.

“While the overall market remains volatile, we showed good promotional discipline and managed inventory proactively to support gross margins in the period,” the company added.

The group’s first-half gross margin was 48.3 percent of sales, ten basis points below H1 last year, and inventory levels at the end of the period were expected to be as expected.

Store Count

During the first half, JD Sports opened 85 new JD stores, which, along with the Hibbett acquisition and the disposal of non-core stores, resulted in 4,506 stores at August 3, up 1,189 doors from the start of the year.

Outlook

The company said the global macro environment remains volatile, so it continues to be cautious about its outlook for the rest of the year.

“Notwithstanding this, based on our first half trading and allowing for an anticipated c.£15m headwind at current exchange rates due to a stronger pound, we are maintaining our guidance range of profit before tax and adjusting items of £955 million to £1,035 million, on a pre-Hibbett basis,” the company concluded.

Image courtesy DTLR/JD Sports Fashion Plc