Fila Holdings Corp. is changing its corporate name to Misto Holdings Company. The company, based in South Korea, said the new name reflects the Group’s philosophy, strengthens its global brand portfolio, and provides strategic direction for the future. Misto was taken from the Italian word “misto” meaning “mixed”, or a combination of various elements.”

“Misto embodies our multi-brand DNA and unifies all business operations under a strong corporate identity,” the company proclaimed in its annual report.

Still, the bigger news may be that the company has essentially shuttered the U.S. business and expects to “strategically” sell off Fila USA inventory by the end of 2025 while deciding if the best avenue for re-entry in the market is direct operations, a licensing model or a distribution model.

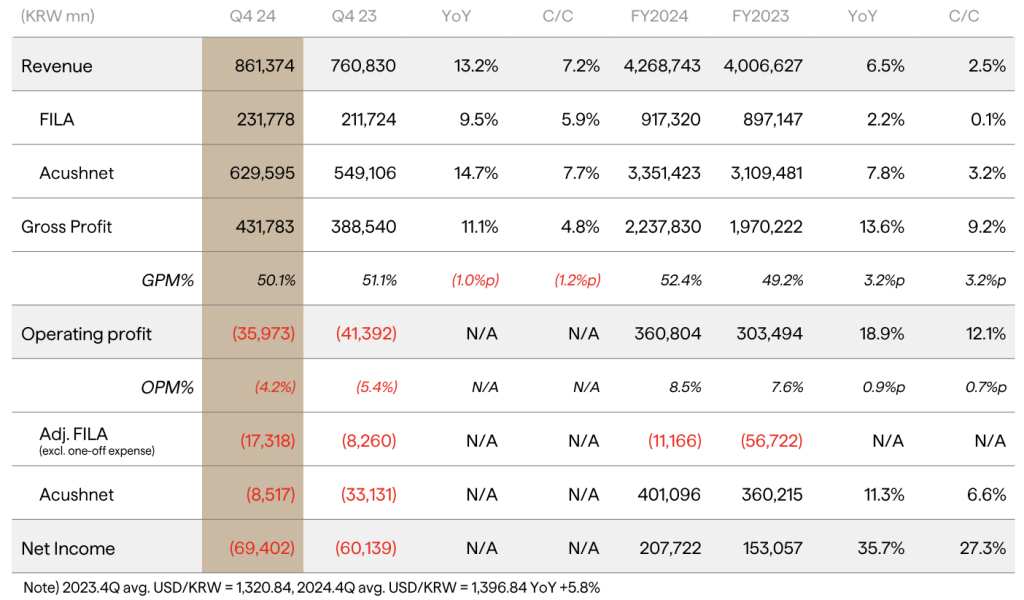

Misto Holdings Corp. reported revenues increased 13.2 percent in the 2024 fourth quarter and 6.5 percent for the 2024 full-year period with strong Q4 reporting from both the Fila and Acushnet (Titleist, Footjoy) segments.

Misto Holdings Corp. trades and reports in the Korean won (₩) currency.

Consolidated full-year 2024 revenue reached ₩4,269 billion ($3.13 billion), a 6.5 percent increase in reported terms, or a 2.5 percent in constant-currency (cc) terms, compared to ₩4,007 billion in full-year 2023. The consolidated figures include the Acushnet (Titleist and Footjoy) business based on Misto’s 51 percent stake in the company. See link to Acushnet’s Q4 and full-year results at bottom.

Net income for the consolidated business in 2024 was ₩207,722 million ($152.3 million), compared to net income of ₩153,057 million in 2023. Profit for the year was impacted by a ₩69,402 million ($49.1 million) net loss in the fourth quarter, owing to operating losses at both Fila and Acushnet.

Fila Holdings Consolidated 2024 Q4 and Full Year Results

Fila Brand

Fila brand revenues were ₩917,320 million ($672.5 mm) in 2024, compared to ₩897,147 million in the prior year, an increase of 2.2 percent on a reported basis, up 0.1 percent on a cc basis. The company said Fila brand’s sales saw strong results in China, offset by a short-term effect of the North America organization.

The Fila brand segment narrowed its operating loss of ₩40,292 million ($29.5 million) in 2024 against a loss of ₩56,722 million in 2023. The improvement was said to due to cost cutting efforts at each entity.

The Fila brand fourth quarter featured revenue growth of 9.5 percent (+5.9 percent cc) to ₩231,778 million ($164.0 million) and an operating loss of ₩17,318 million ($12.3 million), essentially double the Q4 operating loss in the prior year.

Fila USA

Fila USA sales, which covers the U.S., Canada and Mexico, fell 11.6 percent in U.S. dollar terms to $194.9 million in 2024, compared to $220.4 million in 2023.

Revenues were down even more in the fourth quarter, falling 12.6 percent in U.S. dollar terms to $35.8 million in 2024, compared to $40.8 million in Q4 2023. While down in double digits, the Q4 decline in the region was actually an improvement from the 21.7 percent decline in the 2024 Q3 period following a 16.7 percent decline in the second quarter.

“The North America subsidiary, which has endured three consecutive years of losses, has been exposed to a prolonged unfavorable market environment and faces a pressing need for significant cost restructuring, the company said in its annual report.

Management said it has decided to enhance the consolidated Group’s financial structure and realign the long-term brand strategy through the re-organization of its North American Fila entity.

As part of that reorganization plan, the company is currently taking the following actions:

- Managing One-Off Expenses: Most one-off expenses (~$21 million) were recognized in 2024.

- Efficient Inventory Management: Minimize losses and expect full clearance by strategically selling off inventory by the end of 2025.

- Ongoing Cost Reduction: Implement continuous efficiency measures to optimize expenses.

Re-Engagement

The last phase, which has a “TBD” timeline, includes developing and implementing a strategic plan to re-enter the North America market.

- Create a New Model. Determine if best avenue is direct operations, licensing or distribution model.

- Focus on optimizing cost structures and strengthening brand equity for long-term success.

Fila USA’s gross margin was just 12.7 percent of sales for 2024, but it was an improvement from the negative 5.3 percent of sales achieved in 2023. Gross margin in the fourth quarter was negative 27.6 percent, compared to positive 34.3 percent of sales in Q4 2023. Third quarter GM was 32.5 percent of sales, which represented a sharp improvement from the 9.4 percent GM in the second quarter, and up from the 26.1 percent in the 2024 first quarter.

Fila USA posted an operating loss of $78.6 million in 2024, an improvement from the operating loss of $108.8 million in 2023. In the fourth quarter, the Fila USA business posted an operating loss of $30.2 million, compared to a loss of $9.9 million in the Q4 2023.

The company said the strong U.S. dollar against the Korean won further exacerbated the negative impact on Fila USA earnings.

Outlook

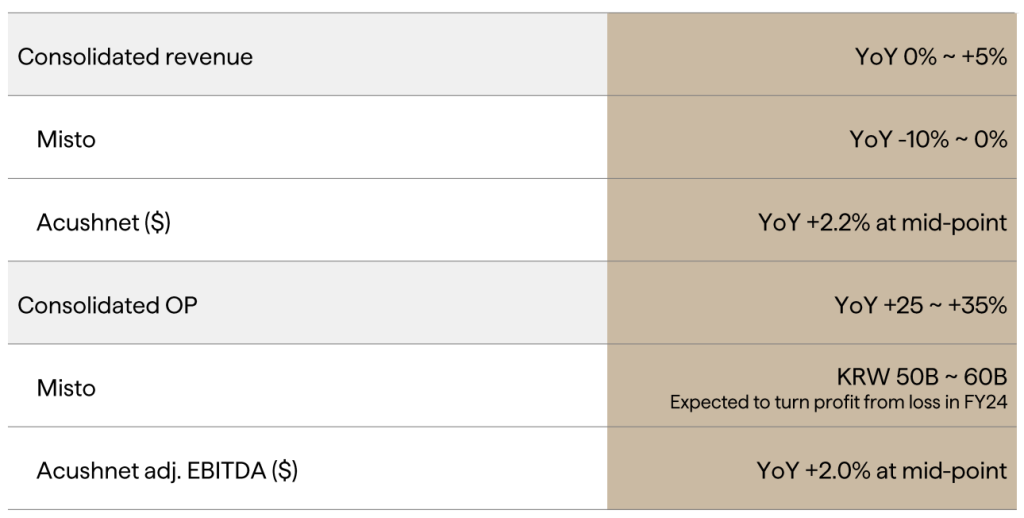

Looking ahead, the company said 2025 revenues are expected to be in a range of flat to a 5 percent increase, primarily driven by Acushnet’s strong performance, macroeconomic trends, and revenue growth in the overall Misto business, excluding Fila North America. Total Misto business is seen flat to down 10 percent for the year.

Consolidated operating profit is expected to grow in double digits, driven by cost sttructure improvements from the Misto North America reorg and brand enhancements in Misto’s direct markets, excluding North America.

Misto Holdings | Full Year 2025 Outlook

Images, data and tables courtesy Misto Holdings Corp.

***

For more SGB Media coverage, see below.

EXEC: Titleist Parent Easily Beats Q4 EPS Estimates as Sales Fall Short