Fenix Outdoor International AG, the parent of Fjällräven, Royal Robbins, Hanwag, and Fenix Outdoor brands, reported a disappointing third quarter but noted that it saw better times ahead.

The company’s Executive Chairman of the Board said the quiet part out loud in his letter to investors regarding the quarter when he remarked that there was not much positive to say from a sales perspective.

“The third quarter continued as the second quarter,” offered Martin Nordin, executive chairman of Fenix Outdoor. “The retail market continued to be driven by price pressure and warm weather. Due to the Middle East situation, there were larger expected delays in the supply chain. This not only created delays in Europe, but the lack of containers also hurt deliveries in the U.S.”

Nordin said this meant that, compared to last year, the company faced challenges in delivering to its Brands and Global sales customers, including Frilufts, while also facing shortages in deliveries from other brands.

“We also saw certain effects of pre-orders that last year were delivered in Q3 and are now delivered in Q4 as our customers are requesting later deliveries due to the late arrival of colder weather,” he continued. “So, from a sales view, there is not much positive to say, even though we have growth in some markets.”

Still, Nordin pointed out that Canada and the company’s joint venture in China were markets that showed growth.

“We still need to improve in some areas, but we also believe that due to some changes in the behavior, a potential need to increase inventory may happen due to an over-caution among retailers when placing pre-orders,” he said.

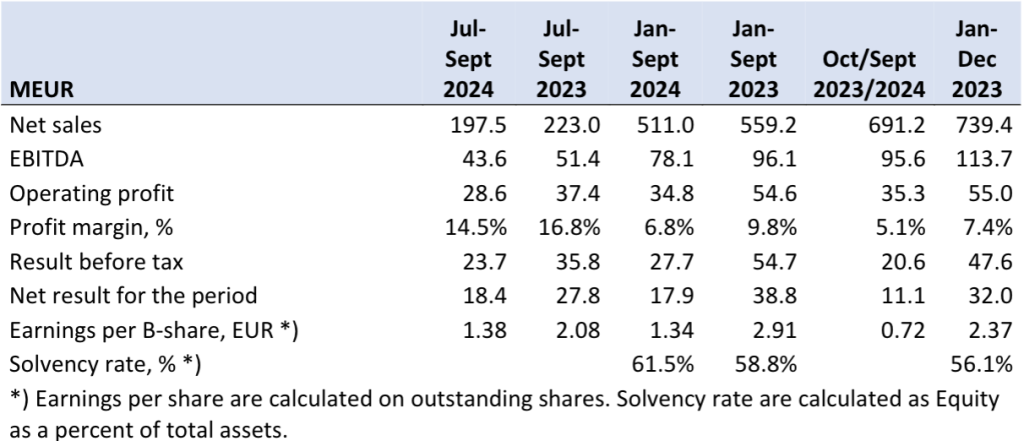

Consolidated Results

The company reported that consolidated third-quarter sales fell 11.4 percent to €197.5 million, compared to €222.9 million in the prior-year comparative quarter, reportedly driven by the high inventory in the retail sector and a slower retail market in general.

Total brick-and-mortar sales were flat at €86.5 million in the quarter, compared to € 86.7 million in the year-ago quarter. Digital sales decreased 13.7 percent to €32.2 million.

“As we look at our brands’ performance in Frilufts and Hanwag, each outperformed their competitors, we believe we outperformed the competition in terms of full-price selling in the market in general,” Nordin noted.

The Group’s operating profit amounted to €28.6 million in the third quarter, compared to €37.4 million in the year-ago quarter.

Fenix posted net income of €18.4 million in the 2024 third quarter, compared to €27.8 million in the 2023 third quarter.

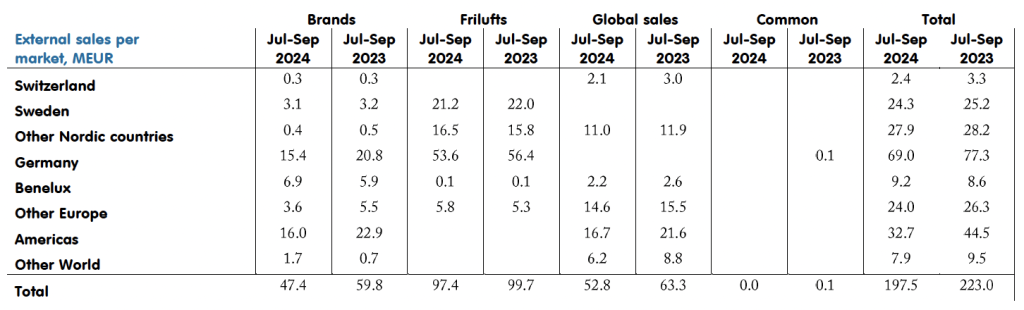

Regional Results

North America

North America reportedly showed a decrease in direct-to-consumer sales and wholesale. Besides a generally slow market, the quarter was also hit by lower Kanken sales. Due to the back-to-school season, the Kanken proportion of sales was larger in the third quarter, and the effect on total sales was larger this quarter.

Frilufts Segment

Net sales for Frilufts decreased 2.3 percent to €97.4 million in the third quarter, compared to €99.7 million in the year-ago comparative period. Nordin said the segment’s decline was driven by a sales decrease in Germany, with almost all of that decline coming from digital sales. Many Frilufts brick-and-mortar shops showed an improvement in the period.

Nordin said the “volatile warm situation” also affected sales in Germany. Frilufts also took a one-time write-off of €1.2 million for software.

Segment operating profit was a loss of €3.5 million in the quarter, down year-over-year from the €4.4 million operating profit in the year-ago period. The improvement was mainly driven by higher sales in Sweden.

Brands Segment

The company’s Brands segment, which includes Fjällräven, Royal Robbins, Hanwag, and Fenix Outdoor, saw sales decrease 20.8 percent year-over-year to €47.4 million. The decline was driven mainly by North American retail sales and the closures of some non-performing stores. Still, Nordin said this would lower costs and improve the bottom line.

Germany also performed below par, while the Nordics outperformed. The gross margin reportedly recovered from earlier quarters due to less need to discount merchandise.

Gross margin reportedly recovered from Q2 2024 and Q3 2023, which were affected by sales of outgoing stock. Operating expenses were reportedly “kept under control.”

Segment operating profit was €19.8 million in the quarter, compared to operating profit of €19.1 million in the prior-year Q3 period.

Global Sales Segment

Within Global Sales, the company saw net sales decrease 16.7 percent to €52.8 million in Q3 2024. North America and Asia primarily drove the decrease, whereas the Rest of the Markets reportedly performed better. Gross margin was said to be lower due to a different product mix. Costs were also reportedly improved here, according to plan.

Segment operating profit was €6.8 million in Q3, compared to €13.8 million in the year-ago Q3 period.

Balance Sheet

The Group’s financial position reportedly remains strong.

- Consolidated cash and cash equivalents amounted to €67.6 million at quarter-end, compared to €41.9 million at the comparative date last year.

- The Group’s interest-bearing liabilities amounted to €38.6 million (2023: €55.3 million).

- Lease liabilities amounted to €128.6 million (2023: €122.5 million).

- Consolidated equity attributable to shareholders was €417.5 million (2023: €419.2 million), corresponding to a solvency rate of 61.5 percent (2023: 58.8 percent).

“In this tough environment, we still managed to decrease our inventory and increase our growth margin. Our net liquidity increased to €29.3 million from negative €10.6 million last year,” Nordin noted. He said this was primarily driven by a decreased inventory level, which is down to a more manageable level.

Outlook

“There are challenges,” Nordin said. “The supply chain and transport remain problematic. This is reinforced by the same larger customers placing pre-orders closer to when they want delivery, thereby increasing our risk of getting higher costs for transport to secure delivery. Internally, we might face higher costs in scaling up our operations in Ludwigslust, as we are using the lower inventory level to speed up that process. However, we must still control costs and become more efficient.”

Nordin said the company is also facing an unpredictable environment due to the ESG and CSR laws. An initial estimate, only counting reporting and administration, looks to increase the costs by around €1 million per year.

Nordin said the company sees a pre-order book for the spring showing an increase compared to last year for Brands and Global sales.

“Generally, the reception of the customers we have met concerning next year’s fall and winter orders is more positive,” he said. “We have started getting our costs sized better. We have a strong balance sheet that can enable us to invest in acquisitions should opportunities occur. In general, we are looking at the development as being positive, as we believe we will see an end to this volatile market and that it will become normalized, at least in a more predictable way.”

From a fourth-quarter perspective, Nording said expectations for the period look good based on the performance during the first couple of weeks. He said this is based on the performance in most of the Frilufts markets and the reorder rate in both Brands and Global sales.

“However, due to the current situation in the market, both politically and economically, nobody knows,” Nordin concluded.

Image courtesy Fjällräven/Fenix Outdoor