Dr. Martens Plc reported that Fiscal 2024 results will align with guidance and consensus expectations. The company saw a pick-up in direct-to-consumer (DTC) revenues in Q4, to high-single-digit year-over-year (YoY) growth, compared with a 3 percent decline in the third quarter when measured in constant currency terms. The company said this resulted from good growth across the EMEA, a flat outcome in the U.S. and a strong result in the APAC, led by Japan. Fourth quarter Group wholesale performed in line with company expectations.

Fiscal 2025 Planning Assumptions

Fiscal 2025 Planning Assumptions

The company’s Board of Directors has reportedly taken a prudent view moving into Fiscal 2025 and shared its planning assumptions for the year ahead.

The company expects U.S. wholesale revenue to be down in double-digits for Fiscal 2025.

“We have recently finalized the Autumn/Winter order book, which makes up the majority of the second half of U.S. wholesale, and this is significantly down YoY,” the company wrote in its assumptions. “If wholesale customers become more optimistic, we could see in-season re-orders; however, these are hard to predict. Given the nature of wholesale orders, the full benefit of any restock always has a lag into the following season. The decline in wholesale has a significant impact on profitability, with a base assumption being in the region of a £20m PBT (profit before tax) impact YoY, assuming no meaningful in-season re-orders.”

Dr. Martens also said it sees single-digit inflation in its cost base and intends to invest in retaining and incentivizing talent throughout the organization.

“Together, these equate to a YoY PBT headwind in the region of £35 million,” the company noted. “As previously communicated, we do not anticipate increasing prices further this year, and, therefore, in FY25, we are unable to offset cost inflation as we have in prior years.”

The company said that given the ongoing challenging performance of its U.S. wholesale business, it expects to continue to require additional inventory storage facilities in the market through Fiscal 2025 and, therefore, the majority of the £15 million of additional costs incurred in FY24 are expected to repeat in the new fiscal year.

“As previously communicated, we have a number of important investment projects underway, incurring operating costs in addition to capital expenditure, including our new Supply and Demand Planning system and Customer Data Platform. These projects are progressing well and will deliver benefits in the outer years. We also continue to invest in brand marketing to drive future growth,” the company said.

“There is a wide range of potential outcomes for FY25 given that we have only recently started the year,” the company summarized.

The company has assumed that revenue will decline in single digits year-over-year and could see a worst-case scenario of profit before tax of around one-third of the Fiscal 2024 level.

The company has assumed that revenue will decline in single digits year-over-year and could see a worst-case scenario of profit before tax of around one-third of the Fiscal 2024 level.

“There are also scenarios where the profit outturn could be significantly better than this, with the key factor being if USA performance is stronger than our planning assumptions as we progress through the year.” the statement continued. “We will also look to drive cost savings wherever possible while protecting our brand and future growth opportunities. Against this backdrop, we are focused on cash generation and have already significantly reduced purchases from the supply chain, which will underpin the strength of the balance sheet.”

Dr. Martens indicated that the business is always second-half weighted, but for Fiscal 2025, given the phasing of U.S. wholesale and costs, “this will particularly be the case.”

Company CEO Kenny Wilson added, “The FY25 outlook is challenging, and the whole organization is focused on our action plan to reignite boots demand, particularly in the USA, our largest market. The nature of USA wholesale is that when customers gain confidence in the market we will see a significant improvement in our business performance, but we are not assuming that this occurs in FY25.

“We have built an operating cost base in anticipation of a larger business; however, with revenues weaker, we are currently seeing significant deleverage through to earnings. Against this backdrop, we will be laser-focused on driving cost efficiencies where possible. We also have a number of ongoing investment projects which will deliver results in outer years. We continue to believe in our DTC-first strategy and the considerable headroom for growth. Our brand remains strong, and we have a compelling product pipeline. These all give us confidence as we look beyond this transition year into future years.”

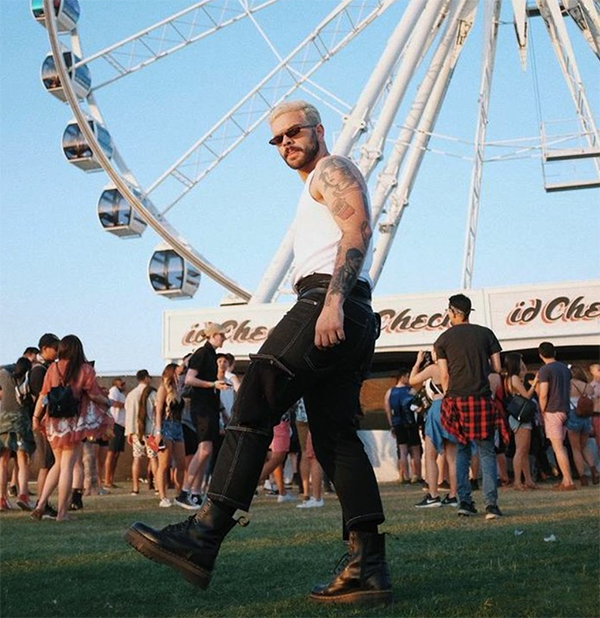

Images courtesy Dr. Martens Plc