Dr. Martens CEO Ije Nwokorie reported the company’s third quarter trading was as expected and the company’s outlook for FY 2025 remains unchanged.

“The global relevance of our iconic brand, the strength of our product line and the passionate commitment of our team give me great confidence for FY25 and beyond,” Nwokorie said in a media statement.

“We have made good progress against our objective of turning around our USA performance, with USA DTC in positive growth in Q3,” the new CEO continued. “We continue to actively manage our costs and are on track to meet our inventory reduction target for FY25. The team and I are squarely focused on returning the business to sustainable and profitable growth.”

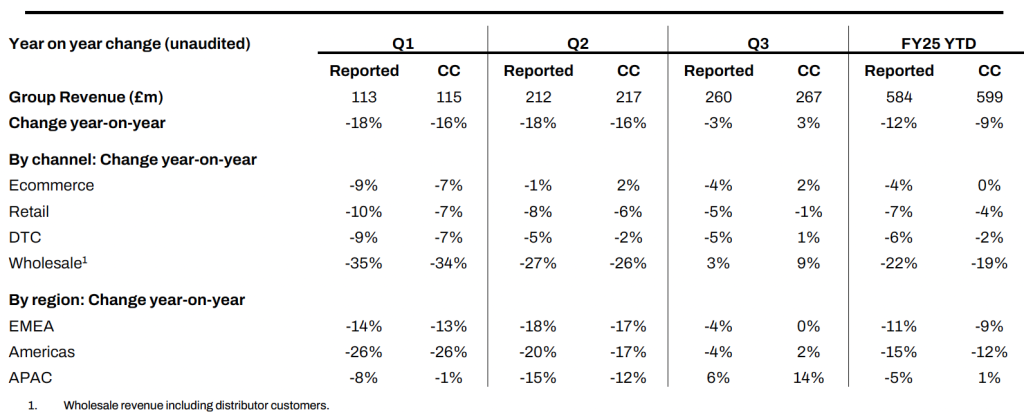

Revenue Performance by Quarter

Third quarter group revenue was reported at £260 million, a 3 percent decline year-over-year. Revenues increased 3 percent on a constant-currency (CC) basis to £267 million.

Group Direct-to-Consumer (DTC) revenue was up 1 percent CC year-over-year, which was reported be the result of e-commerce revenue growing by 2 percent CC and retail revenue declining by 1 percent CC year-over-year.

- Americas DTC revenue was up 4 percent CC. The company went said that one of its key objectives in 2025 is to return Americas DTC revenue to positive growth in the second half, which appears to be on track with the positive Q3 trend.

- EMEA DTC revenue declined by 5 percent CC year-over-year, reported to be impacted by the “deep promotional nature of several markets, especially in December.” The company said it maintained its discipline and only participated in promotional activity in line with its discounting strategy.

- APAC DTC was up 17 percent CC in Q3, driven by e-commerce. “We saw a strong performance across the region, with our largest market Japan continuing to deliver good growth,” the company noted.

Group Wholesale revenue increased 9 percent CC, or 3 percent on a reported basis, reportedly against a weak prior-year comparative.

The wholesale performance by region was reported to align with company expectations, with EMEA and APAC up year-on-year and Americas wholesale down in single-digits in constant-currency terms, as anticipated.

“Our guidance and outlook for FY25 are unchanged and we remain on track to achieve our objectives for the year,” the company reported.

All constant-currency figures were adjusted to align the number of reporting days in the current and prior-year fiscal reporting periods, following the move away from calendar reporting.

Image courtesy Dr. Martens/Nordstrom