Dick’s Sporting Goods Executive Chairman Ed Stack joined the company’s first-quarter conference call with analysts on Wednesday, May 28, something he has not done since the company released its 2021 Q4 and full-year results. His appearance was anticipated by many after the company recently announced its planned acquisition of Foot Locker. Although Stack joined the call following that announcement, there were still expectations for considerable questions from the investor community regarding the deal.

The Board chair and Dick’s SG architect was clearly aware of the talk, questions and rumblings in the market about the deal and how it did or did not make sense for Dick’s to take on the heavy weight of a weaker competitor in the athletic footwear space.

“While we spoke to our strategic rationale and the significant benefits of this acquisition on our most recent investor call, I wanted to take a moment to reiterate why we’re so excited about this combination and why it makes sense for Dick’s at this time,” Stack said. “The convergence of sport and culture has never been stronger, and we’re seeing tremendous momentum and opportunity across our industry.”

Stack said the company has admired the Foot Locker brand and the powerful community it has ave built in sneaker culture, and he saw an opportunity to create a global leader in the sports retail industry by bringing the two brands together.

“This combination positions us to participate in a $300 billion global sports retail market and expand our reach to over 3,200 stores worldwide,” he explained.

However, the real crux of the deal rationale may come down to operational excellence, as he also discussed conversations with brands that saw an upside in bringing Dick’s discipline to the Foot Locker business.

“By applying the operational expertise we’ve built over the years, we will help unlock the next chapter of growth for Foot Locker,” he suggested. “We believe this makes us an even more important partner to the world’s leading sports brands, giving them a larger, more connected platform to reach athletes across geographies, channels and banners.” Stack said they see a clear path to unlocking meaningful cost synergies over the medium term.

During the Q&A portion of the call, Stack was asked first if there was anything he thought the market was missing on the potential for the Foot Locker transaction, given the talk on the Street and the lower DKS share price since the acquisition was announced.

Stack said he understands that there is a group of shareholders who would prefer the company continue its current course of action. After all, company shares value fell in the mid-teens on the day of the acquisition announcement, and shares continued a decline over the last two weeks.

“We’ve got a lot of momentum around what’s going on from a House of Sport standpoint, what’s going on from a Field House, and we’ve got these projects firmly under control, and people would just be wishing we just continue to do what we’re doing,” he replied. “We don’t think that’s right long-term for the business.”

Stack said that with the Foot Locker transaction, the company sees several opportunities.

“It really gives us a unique opportunity to strengthen our brand relationships through a global presence, gives us the ability to service a portion of the market that we can’t service today with our Dick’s Sporting Goods stores,” Stack noted.

“We do believe one of the strong tenets of this acquisition is that we will be acquiring a different customer,” added company President and CEO Lauren Hobart. “We’ll have access, even within the U.S., to urban locations that we don’t have access to before with the large format stores, and we are hoping that this will be incremental to our customer base.”

Stack said they believe Dick’s can bring greater operational efficiency to the Foot Locker business and increase its profitability.

He mentioned that the company has already discussed capturing $100 million to $125 million of synergies over the medium term. And he reiterated that Dick’s expects the transaction to be accretive to the company’s EPS in the first full fiscal year post-close.

“As we take a look at why we did this, we believe sport and culture have intersected around the globe, and it’s only going to get stronger over time. This gives us an opportunity to compete for that market share and not just abdicate it to other retailers around the globe,” Stack said. “We just don’t feel that we should do that. And I think what the Street needs to understand is that, like it or not, we don’t make investments or decisions for a quarter or two, we make these decisions and investments for a lifetime.”

Stack said they know that it’s up to them to prove to the Street and to everyone that this was the right decision to make. “We’re confident that we’ll be able to do that,” he concluded.

One analyst inquired about a “relatively low divestiture threshold” based on their reading of the agreement. The analyst stated that the value appears to be around $100 million, and Dick’s could potentially walk away from the deal if required to divest more than that.

Stack reminded the participants that one of the main reasons for the acquisition is to serve a consumer that they are currently unable to serve. “And if we have to divest a lot, then it kind of makes it inconsistent with what our strategy and the tactics are that we want to employ. So that’s why we’ve got that $100 million number there,” he explained.

Stack reiterated that Dick’s is excited about this acquisition.

“We think it’s going to be very good for our shareholders,“ he expressed. “It’s very good for the Foot Locker shareholders. It will be good for the consumer out there. And the momentum we have with our Dick’s business, we do not expect to be interrupted. So we’re pretty excited about this.”

Foot Locker Integration

Hobart added that while the company has so much momentum with the Dick’s business, they will keep the Dick’s team fully focused on maintaining that momentum. At the same time, she said they are going to put a small group of people working for Ed to work with the Foot Locker team to unlock all of that “gross margin improvement that we know is available.”

And she described Ed Stack as — “obviously“ — an incredible retail expert. “He’s got operational excellence — incredibly strong brand relationships. Real estate development relationships,“ she continued. “I mean it’s such a wonderful thing that he’s going to be able to bring all that expertise and partner with the Foot Locker leadership team to drive both businesses. We are confident that we’ll be able to execute the heck out of this and really drive that gross margin improvement that will drive profitability.

2025 Full-Year Outlook

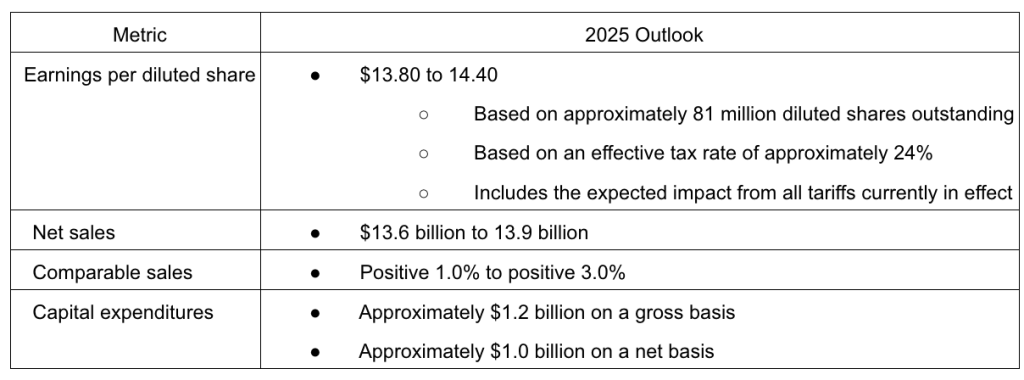

Hobart noted that the company was reaffirming the guidance provided for 2025, which includes the expected impact from all tariffs currently in effect.

“We continue to expect our comp sales to be in the range of 1 percent to 3 percent, which at the midpoint represents nearly a 10 percent three-year comp stack,“ she said. “We continue to expect our EPS to be in the range of $13.80 to $14.40.”

Company CFO Navdeep Gupta said the outlook for 2025 does not include acquisition-related costs, investment losses or results from the Foot Locker acquisition. He said that they continue to expect comps closer to the high end of the 1 to 3 percent guidance through the third quarter.

Consolidated sales are expected to remain in the range of $13.6 billion to $13.9 billion.

“As a reminder, this does not include the acquisition-related costs, investment losses,or results from the recently announced Foot Locker acquisition,” noted Gupta. “From a pacing perspective, we continue to expect EPS to decline year-over-year in the first half and increase year-over-year in the second half.”

Gupta stated that earnings guidance is based on approximately 81 million average diluted shares outstanding, compared to the prior expectation of 82 million, and an effective tax rate of approximately 24 percent.

“As we have discussed from this position of strength, we plan to make strategic investments digitally, in-store and in marketing to better position ourselves over the long term,” he said.

He noted that the company anticipates gross margin expansion to be offset by SG&A deleverage.

“Driven by the quality of our assortment, we also continue to expect gross margins to improve by approximately 75 basis points at the midpoint,” Gupta added.

“From a pacing standpoint, we continue to expect greater SG&A expense deleverage in the first half, this moderation in the second half as we lap the higher investment levels from the second half of the last year,” he continued.

Pre-opening expenses are expected in the range of $65 million to $75 million, with approximately one-third incurred in the first half of the year and the remaining two-thirds in the second half.

“We continue to expect operating margin to be approximately 11.1 percent [of net sales] at the midpoint,” Gupta said. “At the high end of our expectations, we continue to expect to drive approximately 10 basis points of operating margin expansion.”

He said they continue to expect net capital expenditures of approximately $1 billion for the year.

“As Lauren mentioned, our guidance includes the expected impact from all tariffs currently in account,” the CFO said. “We are working closely with our manufacturing and brand partners to mitigate potential impact and we are making continued progress in diversifying our direct source and corporate.”

Tariffs & Pricing

When approached with a question about the impact of tariffs on consumers and pricing, Hobart pointed to a very resilient customer, an athlete, who appears to be in good shape regardless of their economic stratum.

“Our consumer has held up very well,” said Hobart. “And this has been a trend for some time. and it continues to be a trend where people are prioritizing activities, healthy, active lifestyle, team sports, running, walking, being outside with their kids.”

She said that for Q1, Dick’s saw no trade down from “best” to “better” or “better” to “good.” She said they saw growth across all income demographics. She noted they also saw growth in tickets and transactions.

“I say all that because as we look to tariffs, we have now factored in all of the known tariffs into our guidance,” she noted. “We are able to affirm our guidance going forward, both top line and bottom line, and 75 basis points of gross margin improvement. And we will continue to work incredibly closely with our brand partners and our manufacturing partners to navigate.”

Hobart said they have an incredibly dynamic pricing ability.

“We have a very advanced pricing capability, much more advanced than we used to have and much more enabled to make real-time and quick decisions,” Hobart said. “This is something we do. This is a core strength of ours. We will continue to navigate.”

An analyst attempted to hone in on a price increase number to apply to her model, estimating a low- to mid-single-digit price increase to offset the 30 percent China and 10 percent elsewhere tariff increases that are known today. “The price increases needed are not terribly daunting, I would say, maybe,” the analyst pondered.

“That’s why we were able to just confirm our guidance is we believe with the tariffs that are known to date, we can manage, and we are continuing to do that,” Hobart responded. “We are constantly assessing our pricing down to the item level, SKU level. And we do that based on consumer demand and the profitability of the business.”

An analyst asked when the tariffs or the costs start to come through the P&L and how Dick’s is thinking about units versus dollars at the end the quarter and start of the fall season, an analyst asked regarding inventory.

“Let me start with where we finished in Q1,” responded Gupta. “Our inventory growth was 12 percent. But one of the important things that we have said consistently is the fact that this is the differentiated inventory that is allowing us to drive this differentiated top-line results.”

Gupta said the focused investments made at the end of Q4, bringing the spring products earlier, actually worked really well. “And what you saw was the outsized comp that we were able to deliver,” he noted.

“In terms of the inventory growth and the impact from tariffs, we expect that the inventory growth will moderate even with some of the tariff headwinds that we have anticipated in that as we start to lap the investments that were made in the second half of 2024,” the CFO detailed.

Another participant asked if Dick’s had received any tariff items into inventory and if they had taken any prices yet on that product.

“We have no impact from tariffs in Q1, and we are working very closely with each of the brand partners on the right cadence and how best we flow it,” Gupta offered. “So we’ll share much more on these things start to actualize. As we called out in our guidance, we have contemplated some of the timings associated with it, in our guidance, and we still feel great about the 75 basis points of the margin expansion that we guided for the full year.”

Image courtesy Dick’s Sporting Goods, Inc.

***

See below for additional coverage of the Dick’s SG Q1 conference call for discussions on categories, inventory, gross margin expansion and more.

EXEC: Dick’s Sporting Goods CEO and CFO Unwind Q1 Analysts’ Questions