Designer Brands, Inc. (DBI), the parent of the DSW, The Shoe Co., and Rubino retail brands, and Topo Athletic, Keds, Le Tigre, Hush Puppies, and other footwear brands, pointed to three consecutive quarters of sequential comp improvement, coupled with consistent improvement in the company’s top-line performance throughout the second quarter, as evidence that the company is making continued progress against its plan to return Designer Brands to growth.

But the company also had to come to terms with the impact of the economy on their customers and cut guidance for the full year That action helped push DBI shares down in the low- to mid-teens for most of the day on Wednesday, September 11, closing down 11.5 percent for the day.

“However, with consumers being increasingly mindful of their discretionary spend, that improvement has been more muted than anticipated,” commented company CEO Doug Howe on a conference call with analysts after releasing second quarter results. “In spite of this, as expected, our comps have now turned positive as we’ve moved into the back half of the year and reached our anticipated inflection point.”

Howe said the company expects positive comps to continue in the back half, supported by its strategic initiatives.

“We’ve been particularly pleased with our back-to-school business, which has carried its momentum into the third quarter, supported by our expanded Athletic and Athleisure offerings.

Consolidated sales in the second quarter ended August 3 were down approximately 2.6 percent to $771.9 million, compared to $792.2 million in the 2023 second quarter ended July 29, 2023.

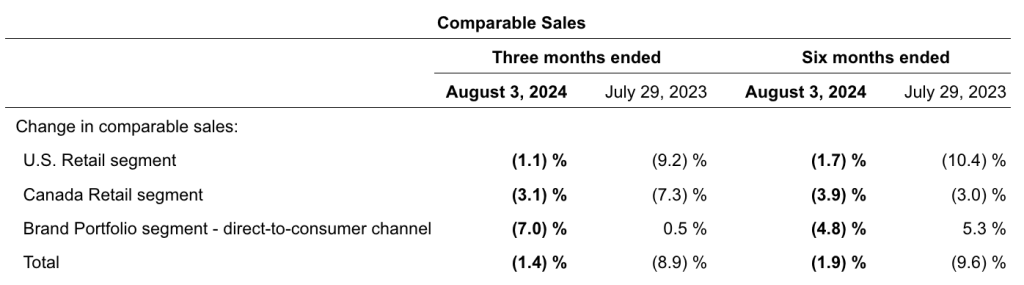

“We saw a roughly 1 percent decline in comparable sales versus last year, a sequential improvement as our efforts to reinforce and grow relationships with our key national partners are paying dividends,” Howe said. “Our top eight brands, all in the Athletic and Athleisure categories, continued to generate outsized growth in the second quarter, up over 30 percent, which was in line with the growth that we saw from them in Q1 and showcases the benefits of developing deeper relationships with key brand partners.”

He shared that the penetration from the Top 8 partners climbed to 39 percent of sales in the quarter, which he said was a “significant increase” over the prior-year penetration of 30 percent.

“While our assortment pivot is gaining traction, our over-penetration in Dress and Seasonal once again pressured results,” Howe noted. “We remain committed to reducing our reliance on these categories and we’re encouraged by the continued comp improvement as we exited the second quarter stronger than we started. As I mentioned earlier, we’ve seen that momentum continue quarter to date primarily driven by strength in the back-to-school season.”

Segment Reporting

U.S. Retail

In total, DBI’s U.S. retail sales reportedly declined 2.6 percent year-over-year to $641.7 million, or 79 percent of total company revenue, compared to $658.5 million, or 81.0 percent of total revenue in the 2023 second quarter. The segment reportedly posted a 1.1 percent decline in comparable sales as the company saw increasing pressure on Seasonal volume in the spring. Howe said thanks to efforts to increase Athletic offerings, they had a powerful tailwind with total Athletic sales increasing 16 percent for the second quarter.

The Q2 comp cycled against a 9.2 percent decline in Q2 last year. Comps down 2.3 percent in the 2024 first quarter, down 7.4 percent in Q4 of last year, and down 9.8 percent in Q3 of last year.

Howe said that, according to Circana, DSW outpaced the overall footwear market by one percentage point in the second quarter. Company Jared Poff CFO added on the call that Athleisure grew 4 percent in the second quarteryear-over-year in the footwear market, while Fashion declined by 6 percent year-over-year.

“As mentioned, our performance was led by strong double-digit comps in both our Athletic and Kids categories, which was offset by negative comps in our Dress and Seasonal categories,” offered Poff.

Howe provided an update on the progress the company is seeing across DSW’s three strategic pillars: Reinvigorating the Assortment, Elevating the Marketing, and Enhancing the Omni-Channel Shopping Experience.

Reinvigorating the Assortment

“Beginning with our assortment, since the pandemic, the footwear market has undergone a structural shift to footwear more appropriate for everyday use, and we’ve made an effort to capture that shift by pivoting our assortment,” Howe offered. “Prior to the pandemic, our penetration of Dress and Seasonal went as high as 60 percent in 2017 compared to roughly 49 percent today. Conversely, Athletic and Casual was only 32 percent of DSW’s assortment in 2017 versus 42 percent today, a key driver in the improving overall performance. Being able to offer a robust selection from Nike, the largest kids athletic brand, is also a notable tailwind for us.”

The CEO said strength in Athletic the second quarter was robust with Adult athletic comps up 15 percent versus Q2 last year, along with Kids’ Athletic growing over 25 percent versus the prior-year Q2 period. “At this time, we expect Kids’ and Athletic comparable results to continue to strengthen in the third quarter, bolstered by the majority of our back-to-school efforts falling during this time period,” Howe suggested.

“Driven by our strategic assortment changes, DWS drove Athleisure sales growth of 8 percent to last year, outpacing the Athleisure market by over four percentage points and thus grabbing share in this important and growing category,” added CFO Howee. “This helped us deliver another quarter of sequential improvement in our retail comp sales, and while comps sequentially improved for the third consecutive quarter, the level of improvement was below what we were anticipating as the consumer further pulled back on discretionary spend in Dress and Seasonal footwear which, in spite of our pivot towards athletic and casual, still weighed heavy on our overall results.”

Howe went on to say that as a result of the success in Athleisure, DSW is also taking a new look at its strategy in adjacent categories.

“One new initiative we implemented was an increase of inventory in Athletic Socks,” How shared. “As we leaned into this newer area, we saw a 52 percent increase in Athletic Socks sales in the quarter and expect socks growth trajectory to climb further in the back half of the year as we continue to lean into this offering.”

He said that although it is a relatively smaller part of the assortment, affordable luxury offerings provide a bit of differentiation in our assortment while also having the potential to enhance margins. He said that the recent reinvestment into this space has promoted the differentiated value that DSW can provide to both new and long time customers who enjoy the treasure hunt that comes with close-out buys, and DSW has seen strong growth as a result.

“As we reduced our reliance on Seasonal and Dress, we have taken substantial actions in planning our fall assortment, Howe shared. “Notably, we are planning Boots to be down in the double digits versus last year. As we continue to re-balance our assortment to Athletic and Athleisure, we anticipate Seasonal and Dress penetration to continue to further contract over time.”

Elevating the Marketing

Turning to DSW’s marketing, he pointed to the appointment of new Chief Marketing Officer Sarah Crockett during the quarter. See said she brings extensive experience in consumer marketing, having led marketing efforts at Dickies, Backcountry, Vans, and Burton, amongst others.

“Sarah’s work going forward will augment our efforts to evolve our assortment and enhance our omni-channel experience, which we expect will drive further momentum with new and existing customers,” He suggested.

“In the near term, our teams are executing our ongoing DSW brand equity building through top of funnel initiatives, leaning in heavily to the back-to-school season,” he continued. “We have created a digital and physical back-to-school destination by integration our marketing message with opportunities in stores such as leveraging influencers and using a digital look book to drive engagement. We are also capitalizing on the presence of Nike in our marketing, given its stature as a cornerstone of the back-to-school season.”

Howe said they are also increasing DSW’s presence on social media in new and different ways.

“This includes a renewed content strategy, the expansion of our influencer program, and specific targeted enhancements,” he said. “These marketing strategy changes are already driving an improvement in social media performance where we are seeing a 2X lift in performance in recent campaigns. On Tiktok alone, we’ve seen our engagement rate increase over 450 basis points, outpacing the retail industry benchmark by over 100 basis points. We’ve grown video views and organic engagements by over 100 percent each and are consistently gaining new followers. Finally, we continue to invest in personalization to further refine and improve our customers’ experience with DSW and to more effectively engage last or about to last customers. As part of this, we are piloting new strategies in our loyalty program.”

Enhancing the Omni-Channel Shopping Experience

In the third strategic pillar, Enhancing the Shopping Experience across DSW’s sales channels, Howe said they were encouraged by the success of their Digital platform, which continues to lead the business, sustaining mid-single-digit growth for the third consecutive quarter.

“In Stores, we are actively upgrading aesthetics with enhanced visual merchandising and promotional signage which goes hand-in-hand with our refreshed assortment and omni-channel marketing strategy,” he noted.

Canada Retail

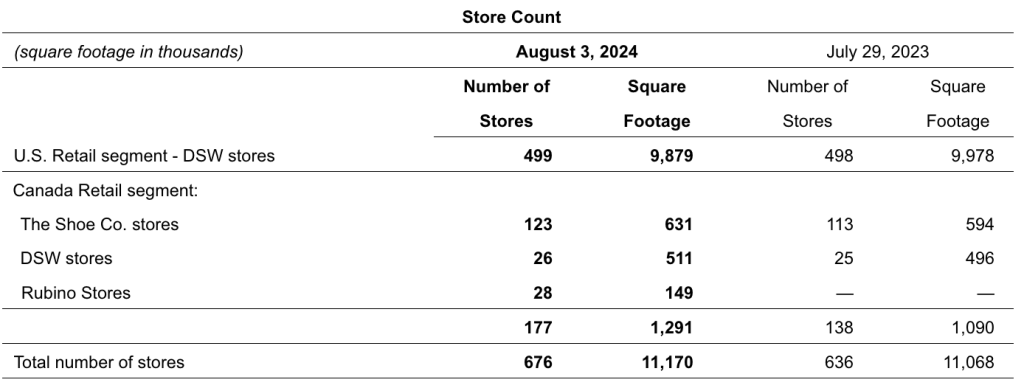

The Canadian Retail segment saw sales increase 6.4 percent to $74.8 million, or 9.2 percent of total revenue, in the second quarter, compared to $70.3 million, or 8.6 percent of total revenue, in the 2023 Q2 period, said to be driven by the acquisition of Rubino, while comps contracted by roughly 3 percent as the Canadian market experienced similar pressures to the U.S. market.

Canada Retail segment comps were down 3.1 percent in the second quarter, said to be driven by continued macro challenges that have led to a reduction in overall consumer discretionary spending activity.

“In Canada, we continue to invest in branding as well as explore opportunities to expand our geographic footprint, and we anticipate these will help drive an improvement in results,” Poff noted.

Howe reminded the call participants that the company last quarter entered into the previously untapped Canadian territory of Quebec following its acquisition of Rubino.

“Quebec is a new territory for Designer Brands and we are excited to compete here and extend our reach to another corner of Canada’s population. As discussed, we intend to continue operating the 28 storefronts under Rubino’s legacy banner, given their established brand in the region. As a result, we continue to anticipate no material expenses associated with integrating the Rubino business within our portfolio,” he explained.

Howe said the company opened one new Shoe Company store and one new DSW store in Canada in the quarter, bringing the total to net six new stores year-to-date on top of the 28 Rubino stores. He said they expect to further expand the Shoe Company store count by two more stores in the third quarter.

Brands Portfolio

In the Brands Portfolio segment, the company has implemented new programs and reviews that have supported reducing costs, right-sizing the organization, increasing margins, streamlining and simplifying the way people work, and defining the role, purpose and potential of the brands in its portfolio.

Brands Portfolio segment sales were up 14.0 percent year-over-year to $96.0 million, or 11.8 percent of total company revenue in the second quarter, compared to $84.2 million, or 10.4 percent of total revenue, in Q2 last year.

“As a reminder, starting this fiscal year, we have harmonized our approach to how we transact business between our brand portfolio segment and our retail segments. This change resulted in approximately $22 million of year-over-year additional sales for our brand segment in the quarter that gets eliminated in consolidation,” Poff noted.

He also said the company saw notable strength in their DTC sites, where it has been investing.

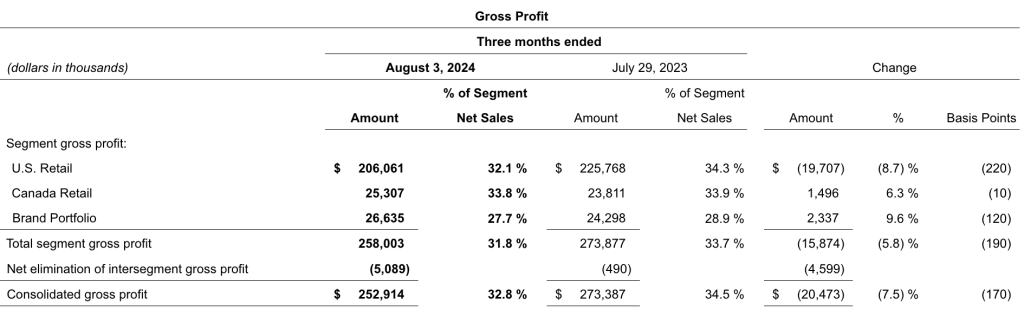

“In particular, Topo.com delivered a positive comp of 20.3 percent and VinceCamuto.com reported positive comps of 4.0 percent,” the CFO detailed. “Consolidated gross margin of 32.8 percent in the second quarter decreased 170 basis points versus the prior year, primarily driven by slightly lower IMU as we prioritized growing our penetration of national athletic brands, as well as absorbing the impact of elevated promotions that were prevalent across the entire market.”

Howe said they continue to be excited about the growth they are seeing in the Brands Portfolio with Topo Athletic and Jessica Simpson cited as two examples of success they are recognizing.

“Topo continued to gain momentum as we grow its recognition with the dedicated running community,” Howe explained. “We are constantly engaging premier fitness and outdoor channels to further expand Topo’s accessibility nationwide.”

He said those efforts drove a 109 percent year-over-year growth for Topo Athletic in the Wholesale channel in the second quarter.

Jessica Simpson also sustained the momentum it saw in the first quarter with high double-digit sales increases as Howe said the brand continues to appeal to customers for its colorful and unique style.

“We’re embracing the Jessica Simpson brand momentum and have capitalized on this excitement with expanded wholesale distribution up 70 percent in the quarter,” he commented.

“I want to reinforce our message from last quarter that this year is all about execution and discipline within our brands business, and we’ve right-sized our inventories and are implementing new ways of working amongst our teams,” he offered. “Looking to the future, both Jared [Poff] and I are working closely with our Brand Portfolio team to identify and pursue prudent investments where we can deliver the highest returns.”

Income Statement Summary

Consolidated gross margin contracted by 170 basis points to 32.8 percent of net sales, which Howe said was influenced primarily by lower IMU (initial mark up) on Athletic and Athleisure products as the company prioritized growing penetration in those categories, as well as pressure from promotions needed to clear through seasonal inventory.

“As we head into the fall season, we are maintaining our disciplined inventory allocations, which we believe will enable us to be less reliant on promotions to sell through inventory and capitalize on any momentum shifts we may see, though we still expect IMU to be a continued headwind as our Athletic inventory expands,” he continued.

Adjusted SG&A was 28.9 percent of sales in Q2, compared to 26.9 percent in the second quarter of last year.

“This deleveraging was largely a result of a declining top line coupled with the increases of underlying fixed expenses and increased investment in talent and IT, specifically our e-commerce teams and back-to-school marketing, partially offset by the cost reductions we implemented at the beginning of the second quarter,” Poff noted.

He said the company has kicked off a formalized expense efficiency initiative with the help of an outside consultant. “We will be working to put a multi-year execution plan together that will help us to more meaningfully and sustainably optimize our cost structure moving forward.”

Adjusted operating income was $32.5 million for the second quarter, compared to $62.6 million in the prior-year quarter.

“In the second quarter of 2024, we had $11 million of net interest expense compared to $6.9 million last year,” the CFO shared. “Higher interest expense is a direct result of our term loan we installed last year, as well as higher interest rates on our ABL.”

Poff said the effective tax rate in the second quarter on our adjusted results was 20.6 percent compared to 29.3 percent last year.

Adjusted net income was $17.1 million, or 29 cents per diluted share, compared to $39.4 million, or 59 cents per diluted share, in the 2023 Q2 period last year. Poff said higher operating expenses and interest expense weighed on this quarter’s results.

Balance Sheet and Cash Management Summary

Designer Brands, Inc. ended the second quarter with inventories up 5.9 percent versus the prior-year second quarter-end, said to be “mostly driven by athletic as we brought in more receipts earlier this year to support our back-to-school campaign in our retail segments,” according to Poff.

“For the second quarter, we generated $28 million of free cash flow, defined as cash provided by operating activities less cash paid for property and equipment, reflecting the receipt of our IRS tax refund,” Poff outlined. “We believe our healthy liquidity position, including availability under our ABL, supports our ability to navigate further potential uncertainty, and we do anticipate that we will be free cash flow positive in the back half of the year.”

DBI ended the second quarter with $38.8 million of cash and the company’s total liquidity, which includes cash and availability under the ABL revolver, was $193.9 million.

Total debt outstanding was $465.8 million second quarter-end.

“With our CARES Act tax refund, our teams immediately paid down outstanding balances on our ABL revolver,” Poff noted.

Store Openings and Closings

During the second quarter of 2024, the company closed one store in the U.S. and opened two stores in Canada, resulting in a total of 499 stores in the U.S. and 177 stores in Canada as of August 3, 2024.

Share Repurchase Program

“Additionally in the second quarter, our team and the board deemed it prudent to re-engage our share repurchase activity,” he continued. “To that end, we repurchased $18 million worth of DBI shares at an average price of $6.74 in Q2. We will continue to evaluate all opportunities to bolster shareholder value, and we believe this recent repurchase activity is evidence of our conviction in our long term strategy.”

Outlook

“As I’ve discussed already and as Jared will elaborate upon further in just a moment, we are seeing the turnaround we have been steering beginning to come to fruition, and I am energized by the return of our U.S. retail business to positive comps,” Howe exclaimed. “It has been a significant effort to get to this point, and I am grateful to all of our team members for diligently pursuing our current strategic initiatives to get us to this place.”

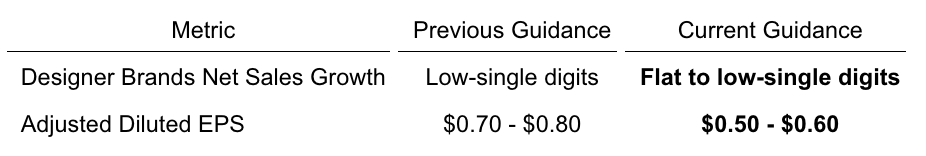

Howe said that even with this turnaround gaining traction and transitioning the business back to growth, the ongoing macro uncertainty and the challenges the company saw as a result of a pressured consumer in the second quarter specifically related to sandals and dress have muted the overall level of these improvements below what the company was expecting at the start of the year.

“Accordingly, we are repositioning our full-year earnings guidance at 50 cents to 60 cents,” Howe said. “As we shared last quarter, we continue to expect comp sales from the fall to be materially stronger than in the spring and in fact remain positive. Notably, as mentioned earlier, we have already seen positive comps to start the third quarter as our assortment evolution continues to take hold. We expect this to produce an improved EPS in the back half of 2024 versus the back half of 2023, while helping forge a recovery from last year’s lackluster boot season.

Digger deeper into the look ahead for the company, CFO Jared Poff said, “We have always expected comps to improve as we worked through spring, inflecting to positive in Q3, and our bottom line to turn to growth over last year for the fall, and this is exactly what we’ve seen year-to-date and are seeing currently as we start the back half. As of the first month of the third quarter, we have inflected to positive comps and expect those to continue. As a reminder, this includes the lapping of Nike’s return, which we enjoyed during the entire fourth quarter last year.

“We remain confident in the calendarization of the trajectory of our comp trend and expect continued sequential improvement through the balance of the year; however, as we’ve discussed, the overall pace and level of recovery has been more muted than expected as a result of a pressured consumer, macro pressures on the overall footwear market, and a lackluster spring seasonal business at DSW. As such, we are revising our full-year guidance accordingly,” he continued.

He shared that the company is adjusting its net sales growth guidance for the full year to be flat to up slightly versus prior guidance of a low-single-digit increase (as outlined above).

“As a reminder, this does include the headwinds of the sales recorded in the 53rd week of fiscal 2023,” Poff continued. “We continue to project our third quarter as our strongest sales growth quarter and I want to remind you that while we also expect positive comp sales growth in the fourth quarter, our year-over-year total sales will be negatively impacted by the loss of the 53rd week from the prior year.

“We do believe our assortment and marketing strategies are being rewarded as customers have embraced the updated selection and promotional strategies that we are championing, and we have moved even more decisively to position ourselves for success in the back half with the most notable adjustment to our seasonal assortment yet. We now anticipate external sales in our brand portfolio segment will be flattish as strong growth from Jessica Simpson and Topo are offset by declines in our DTC businesses overall,” he said.

“Turning to factors impacting our profitability, while continuing to see the investments over last year in people and IT that we’ve discussed previously, the expense savings from the reorganization we executed early in the second quarter have started to materialize. With these puts and takes coupled with a more muted top line, we now expect to see flat to slight deleverage in SG&A for the full year,” he detailed.

He said weighted average diluted shares outstanding are anticipated to be approximately 57.8 million for the third quarter and approximately 58.3 million for the year, given the share repurchase activity that has occurred thus far throughout the year.

Poff also re-affirmed DBI’s expectations for capital expenditures to be in the range of $65 million to $75 million for this year.

“I remain energized by our plans to return Designer Brands to earnings growth in the back half of the year, including what is implied with this revised guidance of meaningful growth in EPS over last year,” Poff said as he wrapped his prepared remarks. “Importantly, the third quarter will mark the first quarter of positive comps since the third quarter of 2022, a testament to the fact that our strategies are working.”

Image courtesy DSW