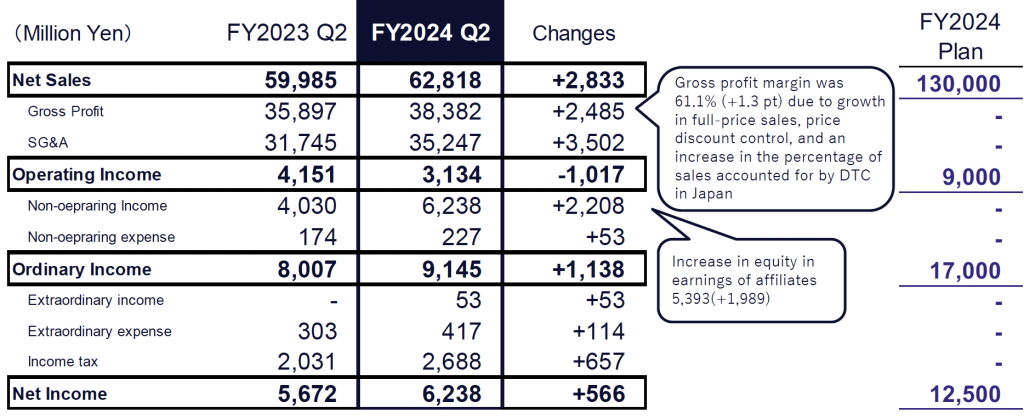

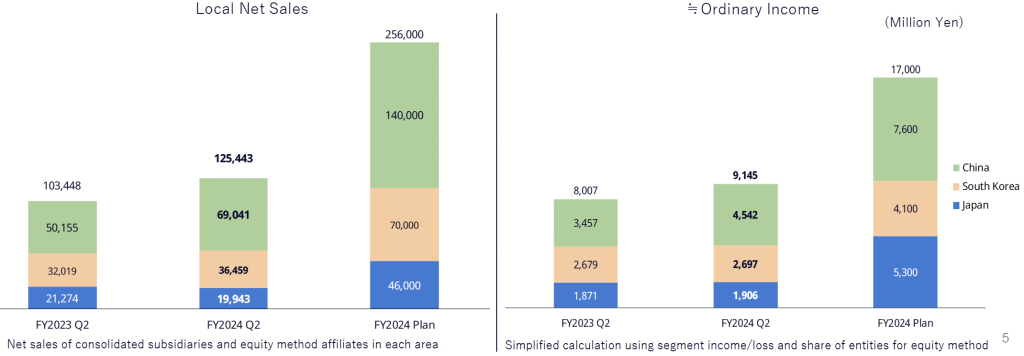

Descente Ltd. reported that net sales for the fiscal second quarter ended September 30 increased 4.7 percent to ¥62,818 million, reportedly due to foreign exchange effects and growth of the Descente and Uumbro brands in Japan and South Korea

Second quarter operating income decreased due to an increase in SG&A expenses for global promotions, etc.

The company posted record-high ordinary income and net income in the quarter for the third consecutive year due to an increase in equity in earnings of affiliates

Second Quarter Reportable Segments Summary

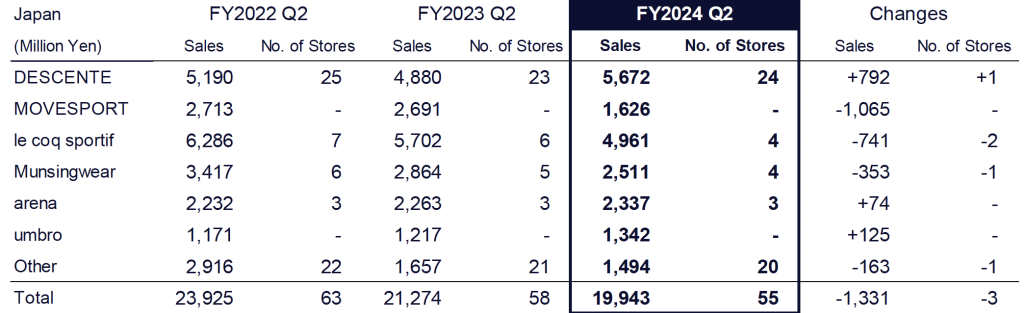

Japan Segment

In Japan, the company saw a slight decrease in sales in the second quarter, but an increase in actual income due to increase in gross profit from higher DTC ratio.

Second quarter sales of the Descente brand in Japan, as a premium sports brand, increased due to strong sales of high-functional products while sales of Le Coq Sportif and Movesport, etc., which are distributed through wholesale channels, declined.

The DTC ratio in Japan increased to 48 percent in the second quarter, compared to 42 percent in the year-ago Q2 period, reportedly due to growth in directly managed stores and e-commerce combined with a decrease in wholesale sales.

The DTC ratio for the Descente brand in Japan was said to be 54 percent in Q2, compared to 47 percent in Q2 last year. The company said sales of high-functional products, led by shell jackets Creas, were strong, and the directly managed store business grew 38 percent year-over-year. E-commerce sales grew as limited-edition products featuring volleyball player Yuki Ishikawa sold out.

Japan department store sales grew mainly in the golf category due to increased exposure of Xander Schauffele, who won a major championship this season, and the effect of increased inbound sales.

Gross profit margin ratio in the Japan segment increased by 1.0 percentage point year-over-year due to higher DTC ratio.

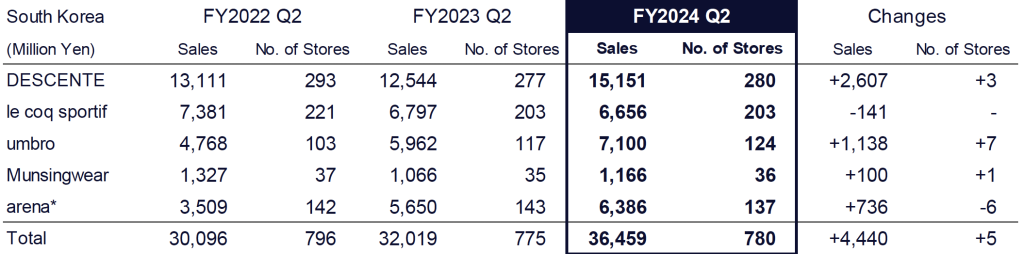

South Korea Segment

In South Korea, sales and income increased due to strong full-price sales mainly driven by Descente and Umbro.

South Korea sales increased due to sustained growth of the Descente and Umbro brands and the impact of foreign exchange effects. Sales of the Arena brand, which is developed by an equity-method affiliate, also increased.

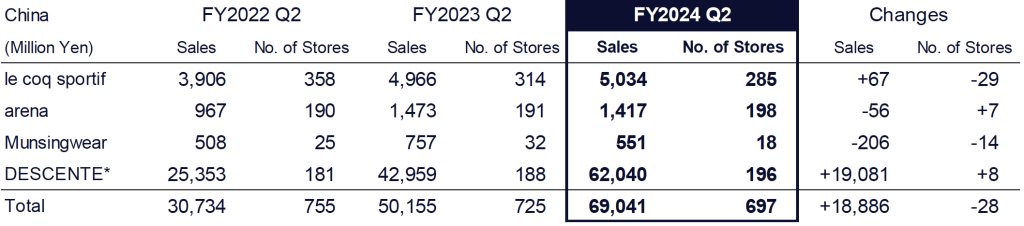

China Segment

In China, despite continued upfront investment in rebranding expenses for Le Coq Sportif, both sales and income increased due to growth of equity-method affiliates.

Sales of the Descente brand in China, which is developed by an equity-method affiliate, increased due to an increase in the number of customers, and due to an increase in the number of stores. The company had a slight increase in Le Coq Sportif due to the impact of foreign exchange effects.

First Half Summary

Descente Ltd. said that ordinary income and net income attributable to owners of the parent for the fiscal first half ended September 30 (H1, first half) reached record highs for the third consecutive year. First half net sales increased 4.7 percent year-over-year to ¥62,818 million, reportedly due largely to the positive effect of yen’s depreciation, as well as growth in sales of the Descente and Umbro brands in Japan and South Korea.

First half gross profit increased by 6.9 percent year-over-year to ¥38,382 million because of the revenue growth. The gross profit margin increased by 130 basis points year-over-year to 61.1 percent of revenue, said to be due to the strengthening of full-price sales, the implementation of a discount restraint, and an increase in the percentage of DTC sales in Japan.

SG&A expenses increased by 11.0 percent year-over-year to ¥35,247 million due to the yen’s depreciation in addition to higher advertising and promotional expenses for global promotions and branding.

Operating income decreased 24.5 percent year-over-year to ¥3,134 million as the increase in SG&A expenses exceeded the increase in gross profit.

Ordinary income increased 14.2 percent year-over-year to ¥9,145 million because of an increase in equity in earnings of affiliates due to the growing performance of Descente China Holding Ltd. (DCH)

Resulting net income attributable to owners of the parent increased 10.0 percent year-over-year to ¥6,238 million.

First Half Reportable Segments Summary

The fiscal year end of major overseas subsidiaries is December, and the business results for each segment do not include figures for equity method affiliates.

Japan

While sales of high-functional products such as shell jacket Creas were strong at directly managed Descente stores, sales of Le Coq Sportif and Movesport, both of which are mainstream wholesale businesses, declined year-over-year. Net sales decreased by 1.4 percent year-over-year to ¥23,633 million.

Segment gross profit increased year-over-year due to an increase in the ratio of DTC sales, and the gross profit margin improved by 100 basis points. As a result, segment profit increased by 0.2 percent year-over-year to ¥2,059 million.

South Korea

South Korea segment net sales increased by 12.1 percent year-over-year to 31,102 million due to the strong performance of Descente’s line of products featuring designs from the British Triathlon Team and “Umbro”’s Classic Collection, as well as the positive effect of yen’s depreciation.

Segment gross profit increased because of the higher sales, and the gross profit margin improved by 0.5 percentage points year-over-year. Segment income increased by 21.2 percent year-over-year to ¥2,110 million, as the increase in gross profit exceeded the increase in SG&A expenses due to promotional costs for Descente Seoul, the global flagship store of the Descente brand.

China

Segment sales decreased 1.7 percent year-over-year to ¥6,978 million.

While the gross profit margin improved by 4.2 percentage points year-over-year due to the strengthening of full-price sales following the rebranding of “Le Coq Sportif”, the segment loss amounted to 446 million due to an increase in SG&A expenses from store remodeling and a review of distribution strategies for the above mentioned brand. Although not included in segment income loss, DCH, an equity-method affiliate that develops Descente, continued to perform well.

Balance Sheet Summary

At the end of the consolidated interim accounting period under review, total assets were ¥158,520 million, an increase of ¥8,216 million from the end of the previous fiscal year ended March 31, 2024.

Current assets increased by ¥2,508 million from the end of the previous fiscal year to ¥89,667 million. This was mainly due to a ¥3,243 million decrease in cash and deposits, a ¥1,596 million increase in notes and accounts receivable-trade, a ¥1,803 million increase in merchandise and finished goods, and a ¥2,283 million increase in accounts receivable-other included in other current assets.

Non-current assets increased ¥5,707 million from the end of previous fiscal year to ¥68,852 million. This was said to be mainly due to an increase of ¥4,437 million in investment securities included in investments and other assets.

Total liabilities increased ¥5 million from the end of the previous fiscal year to ¥36,576 million. This was mainly due to a decrease in notes and accounts payable – trade of ¥1,698 million and an increase in short-term borrowing of ¥1,553 million and an increase in deferred tax assets included in other of non-current assets of ¥817 million.

Net assets increased ¥8,210 million from the end of the previous fiscal year to ¥121,943 million. This was said to be mainly due to an increase in retained earnings of 2,612 million and an increase in foreign currency translation adjustment of ¥6,292 million.

As a result, the equity ratio increased 1.3 points from the end of the previous fiscal year to 76.6 percent.

Cash Flows

Cash and cash equivalents at the end of the consolidated interim accounting period under review decreased by ¥2,755 million from the end of the previous fiscal year to ¥26,487 million.

Cash flows from operating activities recorded a net-cash-inflow of ¥2,294 million (a net-cash-inflow of ¥237 million for the previous interim period). This was mainly due to the increase by income before income taxes of ¥8,782 million, interest and dividend income of ¥2,208 million and a decrease by payments of income taxes, etc. of ¥2,362 million, decrease of notes and accounts payable trade of ¥2,142 million.

Cash flows from investing activities recorded a net-cash-outflow of ¥1,882 million (a net-cash-outflow of ¥6,078 million for the previous interim period). This was mainly due to the acquisition of PP&E assets of ¥2,063 million.

Cash flows from financing activities recorded a net-cash-outflow of ¥3,278 million (a net-cash-outflow of ¥4,204 million for the previous interim period). This was mainly due to cash dividends paid of ¥3,625 million.

Explanation of Forecasts and Forward-looking Statements

As announced in the “Notice Concerning the Revision of Dividend Forecast for the Fiscal Year Ending March, 2025 (No Dividend) and Abolition of Shareholder Benefit Plan” released on August 5, 2024, the Board of Directors, at a meeting held on the same day, resolved that, subject to the completion of a tender offer for the company’s common stock by a subsidiary of Itochi Corporation, the company will not pay a year-end dividend, as announced on May 13, 2024. The Board of Directors has resolved not to distribute a year-end dividend, as revised from the announcement of May 13, 2024, on the condition that the tender offer for the Company’s common stock by a subsidiary of Itochi Corporation is completed.

Outlook

At this time, the company has not changed its earnings forecast announced on May 13, 2024.

Images, data and tables courtesy Descente Ltd.