Descente, Ltd said it has been implementing various strategies in its major business segments since the start of the fiscal year in an effort to achieve a new medium-term management plan, “D-Summit 2026”.

In Japan, the company said it is increasing the direct-to-consumer (DTC) sales ratio of the Descente brand, while in South Korea, it is investing in growth brands and promoting rebranding with a view to further business expansion. In China, the company said it is rebranding brands developed by consolidated subsidiaries to build a solid revenue base while maintaining the expansion trend of the Descente brand.

In the fiscal first quarter ended June 30, consolidated net sales increased by 1.2 percent year-over-year (YoY) to ¥27,482 million, due to the positive effect of the yen’s depreciation, strong sales of the Descente brand, and Umbro growth in South Korea.

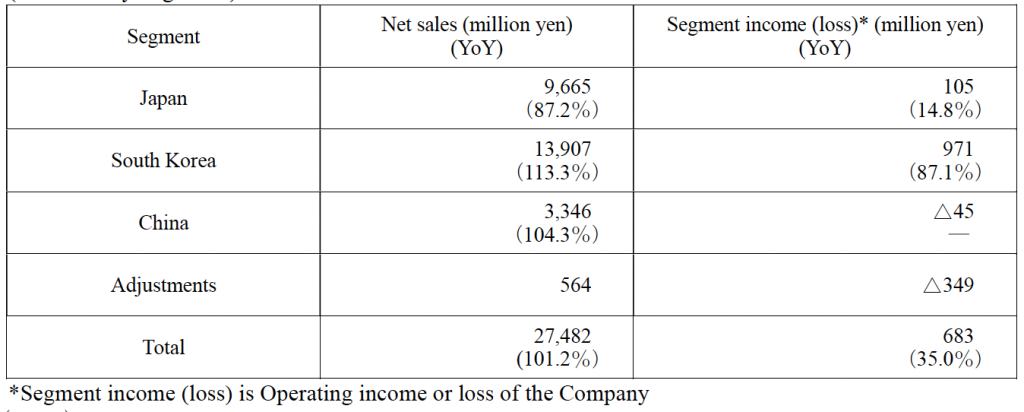

Segment Sales and Income

Japan Segment

While sales of high-value-added products such as shell jacket CREAS and the PRO series reportedly sold well at directly managed Descente brand stores, the company said sales at Le Coq Sportif and Movesport, the mainstays of the wholesale business, declined from the same period of the previous fiscal year. Although the gross profit margin rose 2.2 percentage points due to an increase in the DTC sales composition ratio, gross profit declined year-over-year due to the decrease in sales.

Japan segment income fell 85.2 percent YoY to ¥105 million due to the decrease in gross profit as well as an increase in personnel expenses resulting from an increase in employee basic wages.

South Korea

Segment sales increased by 13.3 percent YoY to ¥13,907 million, reportedly due to strong sales of Descente brand lifestyle shoes Chron series, continued growth in sales of Umbro products commemorating the brand’s 100th anniversary, and the impact of foreign exchange rates.

South Korea segment income decreased by 12.9 percent YoY to ¥971 million, said to be due to the opening cost of the global flagship store Descente Seoul for the Descente brand and an increase in SG&A expenses associated with branding for Umbro pop-up stores and other activities.

China Segment

Segment sales increased by 4.3 percent YoY to ¥3,346 million, reportedly due to foreign exchange impacts, despite a reaction to the reopening demand in the post-pandemic that occurred in the same quarter of the previous year.

While gross profit margin improved due to curbing price discounts, segment loss amounted to ¥45 million, reportedly due to increased expenses associated with rebranding at Le Coq Sportif (NINGBO) CO., LTD., including store remodeling and revision of distribution strategy.

Although not included in segment income/loss, DCH, an equity-method affiliate that develops the Descente brand, continued to perform well.

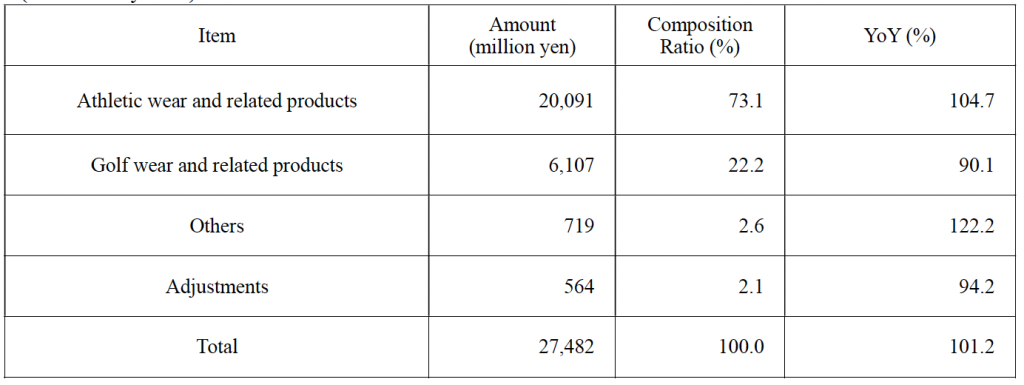

Net Sales by Category

Gross profit increased by 3.6 percent YoY to ¥17,110 million, driven by the sales increase. The gross profit margin increased by 150 basis points to 62.3 percent of sale in Q1, reportedly due to an increase in DTC sales composition ratio, strengthened full-price sales and the implementation of discount restraint.

SG&A expenses increased by ¥1,866 million to ¥16,427 million, or up 12.8 percent YoY, due to aggressive upfront investments in global promotions, store remodeling, and a review of distribution strategies.

Operating income decreased by 65.0 percent YoY to ¥683 million in the quarter. Ordinary income decreased by 23.0 percent YoY to ¥3,455 million, said to be due to a decrease in operating income, despite an increase in equity in earnings of affiliated companies because of the growth in performance of Descente China Holding Ltd. (DCH).

Net income attributable to owners of the parent decreased by 14.2 percent y/y to ¥2,739 million in the first quarter. The business results of the reportable segment are as follows. The fiscal year end of major overseas subsidiaries is December, and the business results for each segment do not include figures for equity method affiliates.

Image courtesy Umbro