Designer Brands, Inc. said its fiscal first-quarter results were in line with internal expectations, but that does not appear to be the case for external expectations as same-store sales missed by a fairly wide margin, EPS missed analysts’ expectations, and the company’s full-year earnings guidance was also below Wall Street’s estimates.

The result was that DBI shares lost 20.4 percent of their value for the day to close at $8.80 per share on June 4.

The top-line revenue results exceeded market estimates, but the comps miss that hit home. On a conference call with analysts after the earnings release, company CEO Doug Howe said the company anticipated that comps would continue to improve throughout fiscal 2024 as new strategic initiatives are further implemented.

“As noted last quarter, we are confident that we have the right people and processes in place and believe that 2024 will continue to be a time of transition for Designer Brands as our refreshed leadership team implements thoughtful, strategic and operational improvements,” Howe expressed. “We are seeing early signs that this refreshed focus is benefiting our organization.”

Howe continued with his positioning, saying that everything was going as planned. “Turning to this quarter’s results, in the first quarter, sales were up almost 1 percent versus last year, and we saw a 2.5 percent decline in comparable sales,” he shared from the earlier report. “These results were in line with our expectations and demonstrated sequential improvement from the fourth quarter of fiscal 2023.”

First-quarter net sales increased just 0.6 percent year-over-year to $746.6 million, but those numbers also include a few lines of business and new stores that were not in the portfolio in Q1 2023. Total comparable sales decreased by 2.5 percent in the first quarter on top of a 10.4 percent decline in the year-ago Q1 period.

“In our U.S. retail business, we performed in line with the overall industry as our improving assortment featuring trend-right styles and brands engaged existing customers and reached new audiences, despite seeing continued broad base weakness and seasonal footwear,” Howe noted. “As we continue to leverage consumer insights to evolve our assortment, we believe that the benefits of a strong athletic and casual assortment are evident.”

U.S. Retail

U.S. Retail segment net sales increased 1.4 percent in Q1 to $621.4 million, with comparable store sales down 2.3 percent on top of an 11.6 percent decline in the prior-year Q1 period.

“We’re pleased with the progress we’ve made on our strategic initiatives to fuel U.S. retail growth,” Howe continued. “Our efforts to reinvigorate the assortment, optimize our marketing investments, and enhance our omni-channel shopping experience are already beginning to contribute to our results.”

Howe said the company was pleased with its performance in Athletic and Casual footwear in the quarter, which outperformed the balance of categories at DSW, with Athletic, in particular, of 15 percent.

“According to Circana, for Q1 DSW dollar sales in both of these categories, Performance and Leisure footwear, outpaced the balance of the footwear market,” the CEO shared. “Keds significantly benefited from the heat in these categories as well, with sales dollars outpacing the balance of the footwear market in Q1, according to Circana.”

Howe continued to say that athletic penetration of total DSW overall sales grew by over 460 basis points year-over-year to 30 percent.

“Furthermore, nearly all of the leading national athleisure brands that we carry are seeing impressive growth within DSW that often outpaces their own growth in the market, which has facilitated constructive dialogue with our top partners,” Howe asserted.

Howe also said the company has seen exceptional growth from its top national brands.

“Specifically, in the first quarter, our eight hottest brands alone, which include a number of the most sought-after trending athletic brands in the market today, grew 27 percent year-over-year,” he detailed. “We spoke last quarter about [DSW President] Laura [Denk]’s focus on strategically building stronger relationships with our brand partners; this will help to ensure we always have the right top brands on hand, based on consumer insights, regardless of category.”

Howe said that Denk and her team have also been executing select strategic closeout buys in the affordable luxury market.

“These exciting finds carry a perceived value in product differentiation that extends well beyond the size of the buys themselves. Although relatively small compared to our other offerings, this affordable luxury category significantly outperformed the balance of our assortment. Additionally, we’ve gotten incredibly positive customer feedback,” he said.

“Many of our most ardent customers have been attracted to the excitement of the treasure hunt phenomenon at our physical locations,” Howe explained. “And we want to continue to be a destination of choice for shoppers eager to find exciting and unexpected selections. We believe that these buzzworthy offerings are paying off by enhancing assortment relevance and customer excitement, complementing our existing product, and driving sales in ancillary categories.”

Howe acknowledged that amidst the successes, they are aware of the categories that do not resonate as strongly with the customer, prompting the company to enact prudent inventory controls.

“The seasonal category got off to a slower start as inconsistent weather impacted this category in the first quarter. The industry continues to see broad weakness in the seasonal footwear space,” he shared. “Likewise, dress continued to experience softness in the quarter, posting a comp of negative 7 percent year-over-year. We will continue to closely monitor these trends and manage our inventory levels and assortment planning accordingly.”

The CEO also said the company continues to find new avenues to enhance its omni-channel experiences.

“This quarter, digital demand achieved strong mid-single-digit growth versus last year, and conversion continued to improve as we evolved our digital customer experience,” he shared. “At our physical locations, new layouts continue to be piloted, and we have seen a positive reception to store refreshes we are doing, which include fresh paint, new lights, and updated flooring.”

Stepping outside the U.S., Howe talked about Canadian retail operations, which he said were also representative of the company’s efforts to improve the shopping experience for its customers.

Canada Retail

Canada Retail net sales grew 2.9 percent to $55.5 million in the quarter, due in part to a new acquisition. Comps in Canada were down 4.9 percent for the Q1 period, cycling against a 2.9 percent comp sales increase in Q1 last year. Still, Howe saw it as a sequential improvement from the fourth quarter in line with expectations. Howe said this was primarily driven by Kids and Athletic categories, which posted strong positive comps for the quarter.

“As we noted last quarter, Mary Turner has begun fully rebranding The Shoe Company, both digitally and in new storefronts,” he shared. “This quarter, we opened five new The Shoe Company stores, and we expect to add an additional four net new stores to our portfolio by the end of 2024.”

Howe added a small nugget not previously discussed when he announced that to expand reach and grow market share, DBI acquired Rubino, a profitable Canadian footwear retailer operating nearly 30 stores, specifically serving the Province of Quebec. Howe said Quebec represents nearly a quarter of Canada’s population, but DBI had no existing presence.

“Rubino currently operates stores that offer nearly identical atmospheres and assortments to that of our The Shoe Company stores,” he said. “Rubino already makes sufficient use of its working capital and is expected to contribute to DBI’s operating income at about the same rate as our overall Canadian retail segment, and we expect the acquisition to be immediately accretive.”

Howe said Rubino’s customers are loyal to the brand, and DBI intends to continue operating these storefronts under the Rubino banner.

“We also believe there’s an opportunity to add value by offering our own brands in their stores,” he suggested.

Company CFO Jared Poff said that Rubino generated CN$47 million in Canadian dollars in 2023. DBI will register sales for three quarters of the current year.

“So, we are expecting, as we mentioned, similar operating income contribution from Rubino as our entire Canadian segment,” the CFO said. “They look, feel, smell, taste just like our Shoe Company stores, and they basically are the Shoe Company just rebadged as Rubino serving Quebec.”

Brand Portfolio

Brand Portfolio segment net sales, including Keds, Hush Puppies, Topo Athletic, and Le Tigre, increased 12.0 percent to $104.1 million in the first quarter. Segment direct-to-consumer (DTC) comps were down 1.7 percent in Q1, cycling against an 8.3 percent positive comp in the year-ago Q1 period.

Andrea O’Donnell, president of the Brand Portfolio segment, said that Designer Brands first attracted her because of its unique combination of retail and brand.

“Since I joined the team, I have become even more excited by the opportunity, not least of which is because of the progress we are already making this year. As a veteran in this industry, I understand footwear brands’ competitive advantages very well,” she said. “My job here is to build and execute a portfolio strategy that focuses our resources and efforts over the next few years toward the strongest brands and the biggest ideas.”

O’Donnell said the Brand Portfolio presents an incredible opportunity to increase the profitability of DBI, stressing that for the immediate term, the focus is on reducing costs, right-sizing the organization, increasing margins, streamlining and simplifying the way they work, and defining the role, purpose, and potential of the brands in the portfolio.

“We already have in place key competencies in design, sourcing, and logistics,” O’Donnell noted. “So once we have re-engineered the operating model and built the foundations for profitable growth, I believe we will be well-positioned to invest and scale fast.”

O’Donnell said the goal is to build their foundation and refine core competencies early, professionalizing the product strategy so they could easily grow and integrate further in the future.

“From next year, we will be executing on a strategy that aims to deliver growth in a number of ways,” O’Donnell said. “DSW-exclusive brands already have strength in key women’s categories, and we will leverage these strengths to grow sales and become margin maximizers for the business.”

O’Donnell said the company is in the process of redefining the brand and product strategies for its licensed brands, with Jessica Simpson already evidencing potential based on its current competitive positioning.

“In addition, we will be investing in accelerating growth in Keds and Topo Athletic, she said. “They are uniquely well positioned within the portfolio, have compelling heritages, and are situated in growing categories. They already have access to great distribution and are achieving upper quartile growth margins.”

In the first quarter, O’Donnell said the company saw a solid performance from Keds and overall DTC growth. Hush Puppies, which was added to the portfolio in the third quarter of last year, was incremental to sales, and Jessica Simpson posted a double-digit comp.

“Topo Athletic continues to be a brand with increasing momentum,” she noted. “This quarter, we saw strong consumer demand as we partnered with premier fitness and outdoor channels such as REI to develop distribution nationwide.”

O’Donnell said she and her team have developed a strategy and a three-year plan. 2024 is about reducing waste and driving efficiency. 2025 is leveraging strengths to grow both growth margin and sales. And 2026 is really about “scaling and scaling fast.”

Income Statement

Gross profit increased to $245.1 million versus $237.7 million in Q1 last year, and gross margin was 32.8 percent of net sales in Q1 compared to 32.0 percent for the Q1 period last year.

“Our strategic changes also enabled us to expand gross margins in the first quarter by 80 basis points to 32.8 percent,” Howe said. “This improvement was driven by strong inventory management, reduction in closeouts, and direct-to-consumer, or DTC growth. During this turnaround year, we are continuing to look for ways to rationalize and size our cost based appropriately, streamline our operations and improve our efficiency.

The retailer’s Reported Net Income attributable to Designer Brands, Inc. was $0.8 million, or one cent earnings per diluted share, including net after-tax charges of 7 cents per diluted share from adjusted items, primarily related to restructuring and integration costs; this compares to net income attributable to Designer Brands, Inc. of 11.4 million, or 17 cents per diluted share, in the year-ago Q1 period.

Adjusted net income was $4.8 million, or adjusted diluted EPS of 8 cents per share.

Liquidity

Cash and cash equivalents totaled $43.4 million at the end of the first quarter of 2024, compared to $50.6 million at the end of the Q1 period last year, with $187.8 million available for borrowings under a senior secured asset-based revolving credit facility, as amended.

Debt totaled $476.1 million at the end of the first quarter of 2024 compared to $390.3 million at the end of the same period last year.

The company ended the first quarter with inventories of $620.5 million compared to $637.4 million at the end of the Q1 period last year.

Dividend

On May 15, 2024, the company’s Board of Directors declared a quarterly cash dividend of 5 cents per share of Class A and Class B common shares. The dividend will be paid on June 18, 2024, to shareholders of record at the close of business on June 5, 2024.

Store Openings and Closings

During the first quarter of 2024, in the U.S., DBI opened one store, and in Canada, the company acquired 28 Rubino stores, opened five stores and closed one store, resulting in a total of 500 stores in the U.S. and 175 stores in Canada as of May 4, 2024.

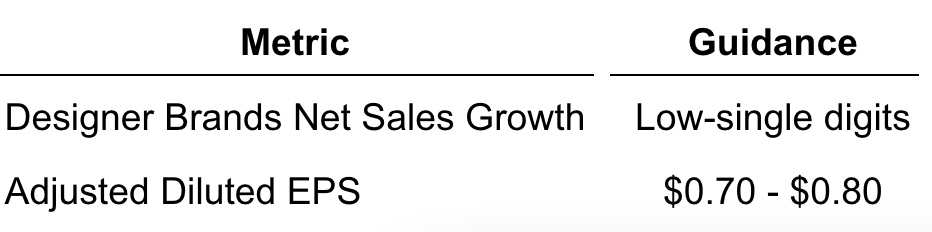

Reaffirming 2024 Financial Outlook

The company reaffirmed the following guidance for the full year 2024:

Image courtesy Topo Athletic

In other DSW news, the retailer appointed a new chief marketing officer to drive messaging, see below.