Columbia Sportswear, Inc. shares were down in the high single digits overnight Thursday into Friday after the company reported a weak fourth quarter and provided a rather dismal view of the year ahead. Shares came back into balance on Friday, closing essentially flat for the day.

The market was left with a view of a company seeking answers and attempting to right a ship listing to the port side for much of the last year. Company Chairman, President and CEO Tim Boyle ended his quarterly conference call with analysts with real disappointment with what the company is delivering to stakeholders. However, the son of the company founders offered few solutions to the problems they face aside from outreach to younger consumers, continuing to sell off excess inventory built up since the post-pandemic business slowed and introducing cost-saving plans expected to protect the company’s bottom line and appease investors, including sharp staff cuts.

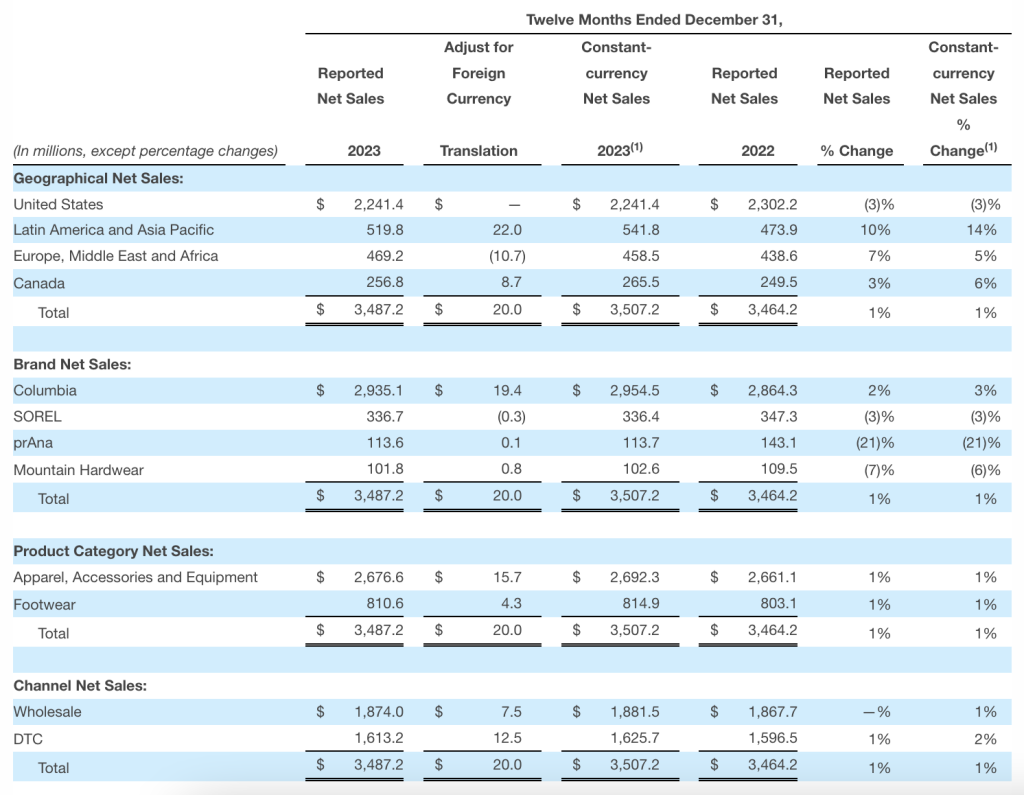

Bright spots for 2023 included a 27 percent reduction in inventory that helped the company generate over $600 million in operating cash flows for the year. International markets were also cited in the plus column for the year, with China generating more than 30 percent growth in constant-currency terms, Japan growing to double digits, and Canada posting mid-single-digit growth for the year. Investments in the direct-to-consumer (DTC) business and operational improvements Boyle cited as catalysts for the DTC business in Europe, also producing double-digit growth for the year. But then there is the U.S. market.

“In the U.S., the marketplace proved more difficult,” Boyle commented in early remarks at the beginning of the conference call. “Consumer demand and traffic tapered off throughout the year. In the fourth quarter, a warm winter impacted cold weather categories. I’d note that the onset of winter weather has recently boosted sell-through; this helps us and our retail partners work through seasonal inventories and mitigate the impact of carryover inventory in future seasons.”

Overall, Columbia Sportswear, Inc. consolidated 2023 net sales increased 1 percent year-over-year to $3.5 billion. Net income decreased 19 percent to $251.4 million, or $4.09 per diluted share, in 2023

“In this muted growth environment, we experienced SG&A deleverage, and our operating margin performance was well short of my personal goal for the business,” said Boyle.

Looking ahead, Boyle said the company expects net sales to decline 2 percent to 4 percent for the full year 2024. Gross margin is expected to expand approximately 100 basis points to 150 basis points to a range of 50.6 percent to 51.1 percent. The improvement in gross margin is said to be “primarily driven by improved inventory health, favorable product costs, and channel mix.” SG&A is expected to grow in 2024, driven by higher DTC incentive compensation and enterprise technology expenses, partially offset by lower supply chain costs and the impact of cost reduction actions.

Boyle said the ocean freight disruptions in the Red Sea impacted some of the flow of Spring 2024 production, but in-window delivery rates to wholesale customers were said to be “still well above 90 percent and cancellation exposure related to the delay is low as of right now.”

“We will continue to monitor the situation closely,” he assured.

Based on the projected decline in net sales and SG&A growth, operating margin for the year is expected to contract between 50 basis points and 130 basis points to 7.6 percent to 8.4 percent. Columbia is forecasting diluted earnings per share to be in the range of $3.45 to $3.85 a share for 2024.

“Despite the earnings decline, we expect strong operating cash flow of at least $300 million in the year,” Boyle explained.

But Boyle spent much of his time at the beginning of the call outlining cost-saving plans and mitigation plans to preserve profitability while dealing with the expected decline in net sales.

“Despite our cost containment actions to date, we expect the net sales decline to result in operating margin contraction,” he said. “To mitigate further erosion in profitability and to improve the efficiency of our operations, we are implementing a multi-year profit improvement program. When the benefits of this program are combined with the cost savings that we anticipated from normalized inventory levels, we believe we can reach $125 million to $150 million in annualized savings by 2026.”

In the company’s initial 2024 financial outlook, Boyle said the company included approximately $75 million to $90 million in realized cost savings, net of severance and related costs of up to $5 million.

He laid out four areas of focus for these savings:

- Operational Cost Savings. “The first area of focus is operational cost savings,” Boyle detailed. “In addition to eliminating expenses associated with carrying excess inventory, we are optimizing our distribution network and driving cost efficiencies throughout our supply chain. We are also optimizing our technology cost structure while increasing the throughput and agility of our digital technology teams.”

- Organizational Cost Savings. “Our overall headcount and personnel expenses have outpaced the growth of our business,” Boyle acknowledged. “We are executing a workforce reduction plan, primarily impacting our U.S. corporate teams; this represents at least a 3 percent to 5 percent reduction in our U.S. corporate personnel cost. This work will be done with respect and thoughtfulness, consistent with our core values while taking the actions required to get back to sustainable growth. We expect the vast majority of these actions to be completed by the end of March.”

- Operating Model Improvements. “We are streamlining decision rights and our ways of working to drive improvements in our operating efficiency and execution of strategic priorities,” Boyle said.

- Indirect or Non-Inventory Spending. “We are focused on driving cost savings in this area, from our strategic sourcing and vendor rationalization outside of our supply chain,” Boyle noted. “It’s important to note that we are not cutting back on demand creation investments. At the same time, we believe there is an opportunity to optimize the efficiency of our marketing spend to drive greater returns. Steps are being taken to amplify the impact of this spending.”

Boyle said the cost savings will ramp up through 2024 and 2025, with the full benefit realized in 2026. “This profit improvement program is an integral component of our goal to restore operating margins to a low teens percent rate. We have achieved this level of operating margin performance before, and we are confident it’s achievable again,” he concluded.

Turning to the business for the last quarter, net sales was said to be at the low end of the company’s guidance range and operating income was below plan, reflecting the “compounding effects of a difficult U.S. environment and a warm winter.”

Overall, net sales decreased 9 percent year-over-year to $1.1 billion. The decline was primarily driven by the company’s Wholesale business, which declined 17 percent. DTC net sales declined 4 percent, with weakness concentrated in the U.S.

On-time Fall 2023 shipments reportedly shifted more sales into the third quarter this year, relative to last year. Boyle said the impact of this timing shift was greater than $100 million in the fourth quarter compared to the fourth quarter of 2022.

Regional Review

U.S. net sales decreased 12 percent in the fourth quarter. U.S. wholesale decreased in the high teens, said to be primarily driven by on-time fall shipments, which shifted sales into the third quarter relative to last year. U.S. DTC net sales decreased in high-single-digits. Across both brick & mortar and e-commerce, Boyle said softer consumer traffic and weather weighed on results.

“Our DTC business performed well during peak sales windows like Black Friday and Cyber Monday but fell off during non-peak periods,” he said.

Brick-and-mortar was said to be relatively flat, driven by the contribution from new stores opened over the last year and incremental sales from temporary clearance locations. U.S. e-commerce net sales were down in the high teens as shifting consumer trends and warm weather impacted demand.

The net sales of Latin America, Asia Pacific (LAAP) region increased 7 percent (CC). China net sales reportedly increased in the high teens, led by strong DTC performance. The team drove e-commerce growth across several platforms during the key holiday periods.

“Transit, our premium China-specific collection, performed well this season, highlighting our continued efforts to create a localized product that resonates with Chinese consumers,” Boyle detailed. “We expect China to again be one of the fastest growing parts of our business in 2024.”

Japan’s net sales increased in mid-single digits, led by wholesale and, to a lesser extent, e-commerce growth. During the quarter, Boyle said they built on the momentum of the Sapland Boot collection by expanding distribution to wholesale and e-commerce.

“The collection celebrates the sister city connection between Sapporo and Portland in a boot that combines style with performance,” Boyle said. “The Sapland was a key pillar of growth in the quarter, and sell-through of the collection was exceptionally strong across all channels.”

Korea net sales declined in the low teens. Columbia continues to reset the business there. “Our team in Korea is focused on building a sustainable growth model with several multi-year initiatives across talent, distribution, marketing, and product. We saw traction on our reset strategy in the fourth quarter through digital commerce expansion and authentic outdoor brand experiences like the Hike Society,” Boyle outlined.

LAAP distributor markets increased low 20s, said to reflect earlier shipment of Spring 2024 orders. “We have phenomenal distribution partners around the world that are operating over 400 full-price Columbia branded stores with many more planned for 2024,” Boyle expressed. “In many of these markets, the Columbia brand is the leader in the outdoor market. Recently, our partners have opened some truly unique stores across Asia and the Americas.”

The net sales of Europe, Middle East, and Africa (EMEA) region decreased 7 percent in the fourth quarter. Europe’s direct net sales reportedly decreased in the low single digits, driven by the on-time Fall 2023 wholesale shipments, which shifted sales into the third quarter relative to last year; this was said to be offset by robust DTC growth.

“Europe Direct was one of our top-performing markets in 2023 and the Columbia brand is well-positioned in the marketplace,” Boyle noted. “As we noted on the last conference call, we expect growth to decelerate in this market in 2024, given economic and geopolitical pressures. Our EMEA distributor business declined low 20 percent, driven by on-time Fall 2023 shipments, which shifted sales into the third quarter relative to last year.”

Canada net sales declined 29 percent, driven by on-time shipments, which reportedly shifted sales into the third quarter relative to 2022, partly offset by DTC growth.

Brand Review

Columbia brand net sales decreased 7 percent during the quarter and increased 2 percent for the year. While fourth-quarter weather proved challenging, particularly in the U.S., Boyle said Columbia’s full-year growth reflects the brand’s strength in international markets.

“This fall, we continue to build momentum around Omni-Heat Infinity with an expanded assortment,” Boyle detailed. “Despite a warm winter, Omni-Heat Infinity showed strong growth on the year.

“As we look ahead, we forecast Columbia brand sales to be about flat in 2024; despite external pressures, we will not pull back on our innovation pipeline nor our demand creation spending rate,” Boyle suggested. “We’re seeking opportunities to maximize sales despite retailer cautiousness. Columbia Brands’ vision is to be the number one outdoor brand in the world. We are embracing this growth mindset as we optimize our product, brand, and marketplace strategies.”

Boyle said that besides serving existing customers with accessible outdoor essentials, the brand is focusing on bringing younger consumers into the brand.

“To reach these new consumers, our chief product officer Woody Blackford is focusing on Reenergizing Columbia’s product line,” Boyle shared. “The foundation of our success is creating iconic products that are differentiated, functional and innovative. In the coming seasons, we will be elevating innovation and style with new collections, as well as updates to our most iconic products.”

He said the company is optimizing its color and style counts to focus efforts on fewer, more powerful collections with a clear purpose. “I’m confident that we can continue delivering exceptional products to our core consumer while introducing new products that appeal to consumers seeking greater performance and style,” he said.

In footwear, Boyle said Columbia is developing product franchises that propel long-term growth. “Our innovation-led process that has fueled our success in apparel can be directly applied to footwear,” he suggested. “We’ve developed classics like the Newton Ridge, which remains a top-selling style today. We’ve expanded our performance offerings with the Facet and Peakfreak collections. We’re introducing product platforms like Omnimax, which can be applied across several product categories, delivering versatility, scale, and unmatched comfort to consumers.”

Boyle said the company is also refreshing its most popular PFG styles and creating new ones to attract younger active consumers.

“PFG is the leading fishing apparel brand in the U.S. with dozens of iconic styles that have stood the test of time. We’re focused on strengthening this position and extending it to reach new anglers around the world,” Boyle said.

“On the marketing front, we’re targeting a more balanced full-funnel approach, emphasizing mid-funnel investments to drive consideration from new consumers,” Boyle outlined. “I believe we can more efficiently deploy our advertising spend to capture additional share and drive growth. We’ve spoken about unlocking the marketplace of the future, a digitally-led omni-channel marketplace that elevates the consumer experience. We want columbia.com to be the best expression of the brand, highlighting our latest products and innovations with enriched brand storytelling.”

Boyle said he believes the brand’s DTC bricks-and-mortar fleet can serve core consumers and strengthen brand perception by delivering the best brand experience possible.

“We are focused on enhancing our assortments and in-store presentations to tell better brand stories and to drive sales,” he said. “From a wholesale marketplace perspective, we are focused on elevating our product assortment and enhancing our in-store retail presentations. We are working closely with our best-in-class strategic partners to bring new consumers to the brand. As we differentiate the marketplace, we will work closely with strategic retail partners to bring new collections to the consumer, led by innovation and style.”

Sorel brand net sales decreased 18 percent in the quarter and 3 percent for the year. In the fourth quarter, shifting consumer trends coupled with weather-impacted demand. Weak sell-through performance this season is said to be weighing on wholesale orders. As a result, Boyle said they expect 2024 to be a challenging year, with net sales forecast to decline approximately 20 percent.

“When we acquired Sorel over 20 years ago, it was a men’s utility boot brand with minimal sales,” Boyle said. “Since then, the brand successfully evolved into a women’s led footwear brand with hundreds of millions in annual sales. The next phase in the brand embraces Sorel’s heritage and the opportunity to serve all consumers globally by bringing the most style in the outdoors and the most outdoors in style. The team is thoughtfully refining the product line and marketing strategies to accelerate growth in 2025 and beyond. I remain confident Sorel has meaningful long-term growth potential.”

Mountain Hardwear’s net sales decreased 11 percent in the fourth quarter and 7 percent for the year. The decline in the quarter was said to be driven by lower Fall 2023 wholesale shipments, partially offset by DTC growth.

“Despite a challenging sales environment, I’m confident Mountain Hardwear’s product line and brand positioning are on track,” Boyle said. “In 2024, we have the opportunity to further elevate its presentation in e-commerce and with strategic wholesale partners. Mountain Hardwear net sales are forecast to increase in the mid-single-digits range in 2024.”

Prana net sales decreased 29 percent in the quarter and 21 percent for the year. “The Prana team remains focused on repositioning the brand and unlocking its growth potential,” the CEO suggested. “They have made great progress reducing excess inventory and strengthening the brand’s product and marketing strategies for future seasons. We anticipate modest growth in 2024, weighted towards the second half of the year, as we stabilize the business and lay the foundation for growth.”

Income Statement

Consolidated gross margin expanded 20 basis points to 50.6 percent of net sales in Q4, compared to 50.4 percent of net sales for the comparable period in 2022 as lower inbound freight costs and favorable channel mix, which were said to more than offset the impact of inventory reduction efforts across the company’s DTC and wholesale businesses.

SG&A expenses were $404.8 million, or 38.2 percent of net sales, compared to $405.1 million, or 34.6 percent of net sales, for the comparable period in 2022. The largest changes in SG&A expenses primarily reflect higher DTC expenses, partially offset by lower variable demand creation and incentive compensation expenses.

Impairment of goodwill and intangible assets included a $25.0 million charge related to Prana, compared to $35.6 million of charges related to Prana for the comparable period in 2022.

Operating income decreased 27 percent to $113.1 million, or 10.7 percent of net sales, compared to $155.4 million, or 13.3 percent of net sales, for the comparable period in 2022.

Interest income, net of $5.0 million, compared to $1.1 million for the comparable period in 2022, reflects higher yields on increased cash, cash equivalents, and investments.

Income tax expense of $26.6 million resulted in an effective income tax rate of 22.2 percent, compared to income tax expense of $34.0 million, or an effective income tax rate of 21.3 percent, for the comparable period in 2022.

Net income decreased 26 percent to $93.3 million, or $1.55 per diluted share, compared to net income of $125.7 million, or $2.02 per diluted share, for the comparable period in 2022. Columbia Sportswear incurred a $25 million non-cash Prana impairment charge during the quarter, which impacted diluted EPS by 31 cents a share.

“Looking ahead, we expect 2024 to be a challenging year,” Boyle said in a statement outlining additional look ahead details. “Retailers are placing orders cautiously, and economic and geopolitical uncertainty remains high. We are working diligently to maximize sales in this environment while optimizing our product, brand marketing, and marketplace strategies to accelerate growth in 2025 and beyond. To mitigate erosion in profitability and to improve the efficiency of our operations, we are implementing a multi-year profit improvement program targeting $125 to $150 million in annual savings by 2026.”

Full Year 2024 Financial Outlook

- Net sales are expected to decrease 4.0 to 2.0 percent, resulting in net sales of $3.35 to $3.42 billion, compared to $3.49 billion in 2023.

- Gross margin is expected to expand 100 to 150 basis points to 50.6 to 51.1 percent of net sales from 49.6 percent of net sales in 2023.

- SG&A expenses, as a percent of net sales, are expected to be 43.2 to 43.5 percent, compared to SG&A expense, as a percent of net sales, of 40.6 percent in 2023.

- Operating income is expected to be $256 to $288 million, resulting in operating margin of 7.6 to 8.4 percent, compared to operating margin of 8.9 percent in 2023.

- Interest income, net, is expected to be approximately $19 million.

- Effective income tax rate is expected to be 24.0 to 25.0 percent.

- Net income is expected to be $207 to $231 million, resulting in diluted earnings per share of $3.45 to $3.85. This diluted earnings per share range is based on an estimated weighted average diluted shares outstanding of 60.1 million.

Foreign Currency

- Foreign currency translation is anticipated to increase 2024 net sales growth by approximately 60 basis points.

- Foreign currency is expected to have an approximately 3 cents positive impact on diluted earnings per share due primarily to favorable foreign currency translational impacts to net sales growth, partially offset by negative foreign currency transactional effects from hedging of inventory production.

Cash Flows

- Operating cash flow is expected to be at least $300 million.

- Capital expenditures are planned to be in the range of $60 to $80 million.

First Half 2024 Financial Outlook

- Net sales are expected to be $1,310 to $1,352 million, representing a decline of 9 to 6 percent from $1,442 million for the comparable period in 2023.

- Operating income is expected to be negative $12 million to positive $8 million, resulting in operating margin of -0.9 percent to +0.6 percent, compared to operating margin of 4.3 percent in the comparable period in 2023.

- Diluted earnings per share is expected to be 1 cent to 26 cents, compared to 88 cents for the comparable period in 2023.

First Quarter 2024 Financial Outlook

- Net sales are expected to be $730 to $753 million, representing a decline of 11 percent to 8 percent from $820.6 million for the comparable period in 2023.

- Operating income is expected to be $16 million to $28 million, resulting in operating margin of 2.2 percent to 3.8 percent, compared to operating margin of 6.9 percent of sales in the comparable period in 2023.

- Diluted earnings per share is expected to be 30 cents to 45 cents, compared to 74 cents for the comparable period in 2023.

Images and data courtesy Columbia Sportswear, Inc.