Prague-based Colt CZ Group SE reported that sales jumped 50.3 percent year-over-year (y/y) in the first quarter while announcing it reached an agreement to acquire Valley Steel Stamp Inc., a components supplier based in Greenfield, MA.

Revenues in the quarter reached CZK 5.51 billion ($250 mm), exceeding previous guidance of CZK 5.2 billion. The strong gain was reportedly driven by both organic growth in the firearms segment and growth in the ammunition segment as well as the consolidation of Sellier & Bellot, a Czech ammunition manufacturer acquired in May 2024.

Colt CZ Group reports in the Czech koruna (CZK) currency.

“The first quarter of 2025 was the most successful first quarter in the Group’s history. We slightly exceeded our guidance presented in March in terms of both revenues and profitability. We are very pleased with the successful integration of Sellier & Bellot into our Group. To meet our full-year guidance, it will be crucial to successfully close key business opportunities, particularly in the firearms segment, while maintaining strict focus on operational efficiency across all our subsidiaries,” said Jan Drahota, chairman of the Board of Directors, Colt CZ Group.

Adjusted EBITDA excluding extraordinary items reached CZK 1.21 billion, up 148.1 percent y/y and also above quarterly guidance. The increase was mainly supported by higher sales in the military and law enforcement segment and higher margins in the ammunition segment as a result of the consolidation of Sellier & Bellot.

Adjusted net profit after tax for Q1 2025 reached CZK 546.5 million, an increase of 51.8 percent compared to the same period in 2024. The slightly lower net profit growth rate was influenced by the negative result of financial operations, primarily due to higher interest costs.

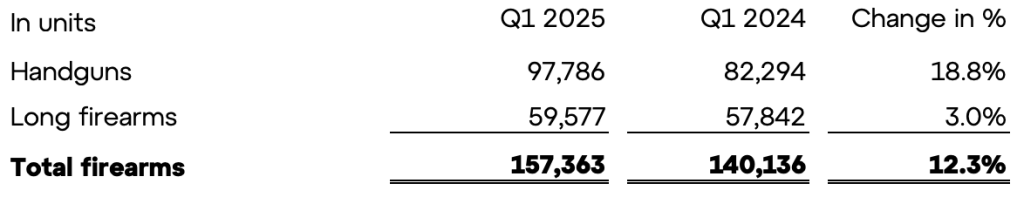

The number of firearms sold in Q1 2025 rose by 12.3 percent y/y, reaching 157,363 units sold, driven by strong demand for both short and long firearms.

Firearms Unit Sales by Type

Valley Steel Stamp Inc. Acquisition

Colt CZ also reported that on May 9, 2025, Colt CZ Group North America, Inc. reached an agreement to acquire a 100 percent stake in New England Expert Technologies Corp., which owns all the capital stock of Valley Steel Stamp Inc. The acquired company is a producer of firearm parts and long-term supplier to Colt CZ Group. The purchase price was not disclosed. The transaction is expected to close in June.

“I am pleased to announce the planned acquisition of the U.S.-based company Valley Steel Stamp Inc., our long-standing supplier of firearm components known for its manufacturing excellence. The strategy behind this transaction is vertical integration within specific product groups and further strengthening our position in the North American market. We expect to close in June this year,” stated Radek Musil, CEO, Colt CZ Group.

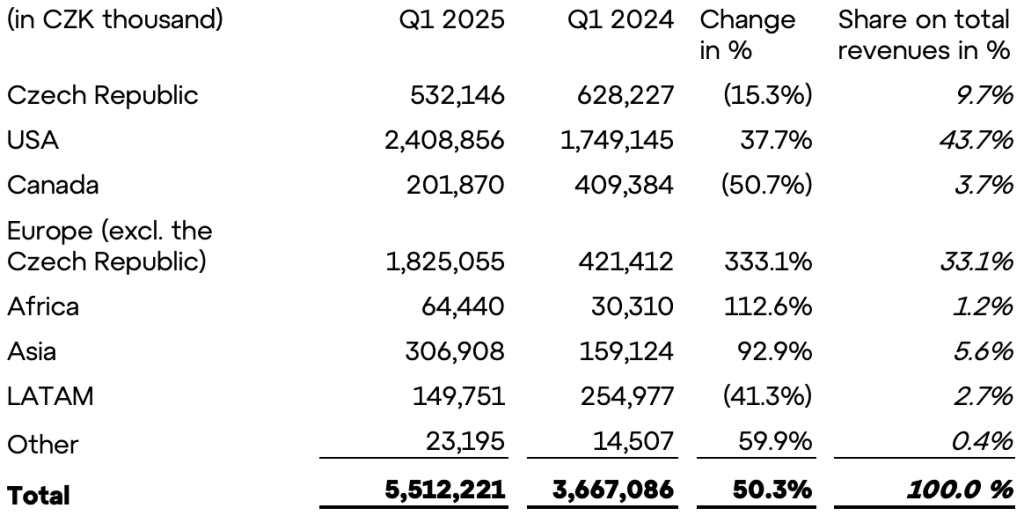

Revenues

The Group’s revenues for the first three months of 2025 increased 50.3 percent y/y to CZK 5.5 billion. The strong performance was reportedly driven by organic growth in the firearms segment and ammunition segment, with the latter benefiting from the consolidation of Sellier & Bellot, which affected the annual revenue comparison. The increase in sales was attributed mainly to the military and law enforcement segment.

Regional Summary

Czech Republic revenues declined slightly by 15.3 percent y/y to CZK 532.1 million in Q1 yet represented almost 10 percent of total Group sales. This decline reportedly reflects a high comparison base due to significant deliveries to the Czech Ministry of Defence last year.

U.S. revenues increased 37.7 percent y/y to CZK 2.4 billion, said to be due to the consolidation of revenues of the acquisition of Sellier & Bellot from May 16, 2024, and higher sales of firearms on the U.S. commercial market.

Canada revenues reached CZK 201.9 million in the first quarter of 2025, down 50.7 percent y/y due to a higher comparable base (one-off delivery to the Canadian government in connection with aid for Ukraine previous year) and seasonality of deliveries to the Canadian military and law enforcement customers.

Europe revenues (excluding the Czech Republic) increased 333.1 percent y/y to CZK 1.8 billion in the first quarter, thanks to the consolidation of Sellier & Bellot from May 16, 2024, and strong performance of both segments in the European market

Africa revenues increased 112.6 percent y/y to CZK 64.4 million in the first quarter, reportedly due to new orders from both firearms and ammunition segments.

Asia revenues increased 92.9 percent y/y to CZK 306.9 million in the first three months of 2025, primarily due to the consolidation of Sellier & Bellot and also due to delivery of delayed orders from the end of 2024.

Latin America region revenues to CZK 149.8 million in Q1, a 41.3 percent decline y/y.

Other regions revenues reached CZK 23.2 million in Q1 2025, up 59.9 percent year-over-year.

Segment Performance

In the first three months of 2025, there was an increase of 12.3 percent y-o-y in the number of sold firearms, to 157,363 units. Higher sales of handguns were recorded, driven by sales of CZ branded products in all key markets. With respect to long firearms, the sales were evenly distributed between CZ and Colt branded products.

Revenue from the Firearms & Accessories segment reached CZK 2.8 billion in the first three months of 2025, primarily driven by a higher number of sold pieces and a favorable sales mix

The Ammunition segment includes revenues from its subsidiaries Sellier & Bellot (from May 16, 2024), swissAA, and the relevant part of revenues of Colt CZ Defence Solutions. In the ammunition segment, the Group achieved revenues of CZK 2.7 billion in the first three months of 2025.

Profitability Summary

In the first three months of 2025, EBITDA (including extraordinary items) increased by 186.4 percent y/y to CZK 1.20 billion, thanks to the ammunition segment which generated higher margins and a better sales mix of products with higher added value (higher share of orders from the military and law enforcement segment).

Adjusted EBITDA amounted to CZK 1.21 billion for Q1, up 148.1 percent y/y. The most significant one-off items were expenses related to the employee stock option plan, one-off expenses connected with the commodity hedging of Sellier & Bellot and cost of unrealized M&A.

Profit (loss) before tax of the Group increased for the first three months of 2025 by 84.6 percent y-o-y to CZK 691.4 million, due to the strong operating profitability.

Net profit jumped 72.8 percent to CZK 523.9 million in Q1, compared with the Q1 period of last year, reportedly driven by strong profitability and partially impacted on higher interest costs. In the first three months of 2025, net profit adjusted for extraordinary items increased by 51.8 percent to CZK 546.5 million compared with the same period in 2024.

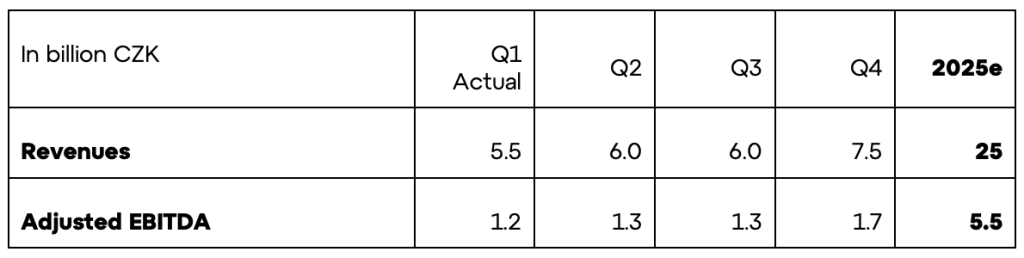

2025 Guidance

Colt CZ continues to see major global business opportunities in the military and law enforcement segment. Cooperation with NATO and EU member countries, along with the NATO Support and Procurement Agency (NSPA), remains a top priority. At the same time, the Group acknowledges the growing importance of other markets, mainly in Asia. Winning tenders and timely executing signed contracts are other prerequisites for fulfilling the outlook.

Maintaining profitability in the firearms segment through more effective cost control, especially in the US market, is one of the company’s goals for 2025. New CZ and Colt products set to be launched in the US market will play a key role in supporting future growth.

The main risks to achieving the 2025 outlook include: a. potential deterioration in the US commercial market, in combination with the global economic slowdown, b. delays in executing major orders in the military and law enforcement segment, c. delays in launching new products on the market, and d. adverse FX developments affecting the conversion to CZK.

The company is carefully monitoring the situation regarding the introduction of U.S. tariffs on European goods. The Group anticipates that impact would primarily affect subsidiaries in both the firearms and ammunition segments that export part of their production to the U.S., namely Česká zbrojovka and Sellier & Bellot. While no major impact on total planned revenues is expected, operating profitability, especially EBITDA, may be affected. The Group has been able to increase the prices of the affected exports by 10 percent, resulting in zero impact on financial results as of today. Therefore, no adjustments of the tariff introduction impact have been included in the 2025 guidance.

On the other hand, potential upside factors for the outlook include:

- Successful award and completion of new large contracts in 2025; and

- The impact of product reselling from other manufacturers.

The Group confirms its outlook for 2025 calling for revenues of CZK 25 billion (+/- 10 percent) and Adjusted EBITDA of CZK 5.5 billion (+/- 10 percent).

Company 2025 Guidance by Quarter

Image courtesy Colt CZ