Colt CZ Group SE, parent of the Colt, CZ (Česká zbrojovka), Colt Canada, Dan Wesson, Sellier & Bellot, swissAA, Spuhr and 4M Tactical brands, is reporting that Group revenues reached CZK 22.4 billion in 2024, which represents an increase of 50.6 percent year-over-year (y/y), exceeding the company’s full year revenue guidance of CZK 20 billion to CZK 22 billion.

Colt CZ Group SE reports in the Czech Koruna (CZK) currency.

This result is reportedly a combination of both organic growth of the Firearms segment, driven by long firearms sales, and the consolidation of Sellier & Bellot since the acquisition date of May 16, 2024.

“Preliminary results for 2024 are in line with our expectations, particularly regarding the organic growth of our firearms business and the successful contribution of the Sellier & Bellot acquisition,” said Jan Drahota, chairman of the Board of Directors, Colt CZ Group. “Nevertheless, we still see room to further improve our performance, in terms of both revenues and profitability. Our key focus for 2025 and beyond will remain on driving profitable growth, as cost efficiency is essential to the long-term competitiveness of our business.”

Compared to the results achieved in 2023, Group’s revenues in 2024 increased by 50.6 percent to CZK 22.4 billion. The increase in sales was recorded especially in the military and law enforcement segment and also in the commercial segment in all key regions, including the US commercial market. Revenues were also positively affected by the consolidation of the acquisition of Sellier & Bellot from May 16, 2024.

Regional Revenue Summary

Geographically, growth was recorded mainly in Europe, including the Czech Republic and Ukraine, and in the U.S.

- Czech Republic revenues grew 68.9 percent y/y to CZK 4.4 billion in 2024 , driven by Mil/LE deliveries to the Czech Ministry of Defence, including hand grenades to the Czech Army and deliveries related to the aid for Ukraine, also and significantly by the consolidation of the acquisition of Sellier & Bellot.

- United States revenues increased 41.1 percent y/y to CZK 8.8 billion, reportedly due to the consolidation of revenues of the acquisition of Sellier & Bellot from May 16, 2024, and higher sales of firearms conditions on the U.S. commercial market. The U.S. market has not met the company’s expectations in terms of profitability.

- Canada revenues reached CZK 1.1 billion in 2024, down 48.5 percent y/y due to a higher comparable base (one-off delivery to the Canadian government in connection with aid for Ukraine priorr year) and seasonality of deliveries to the Canadian military and law enforcement customers.

- Europe (excluding the Czech Republic) revenues increased 219.7 percent y/y by CZK 6.2 billion in 2024, thanks to the consolidation of revenues of acquisitions in the Ammunition segment, i.e., Sellier & Bellot from May 16, 2024, and swissAA in Switzerland acquired by the Group in 2023.

- Africa revenues declined 4.8 percent y/y to CZK 177.0 million in 2024.

- Asia revenues declined 16.9 percent y/y to CZK 940.3 million in 2024, as large sales to the military and law enforcement customers took place in the prior year.

- Latin America, which is a new Colt CZ reporting region, saw revenues amount to CZK 573.9 million in 2024, which represents a 48.8 percent increase year-over-year.

- Rest of World revenues reached CZK 77.5 million in 2024, down by 18.7 percent year-over-year.

Firearms & Accessories Segment

The Firearms & Accessories segment includes the design, production, assembly and sale of firearms, tactical accessories and optical mounting solutions for the military and law enforcement, personal defense, hunting, sport shooting, and other commercial use.

Revenue from the firearms and accessories segment reached CZK 15.4 billion in 2024, primarily driven by higher sales of long guns and therefore, a favorable sales mix.

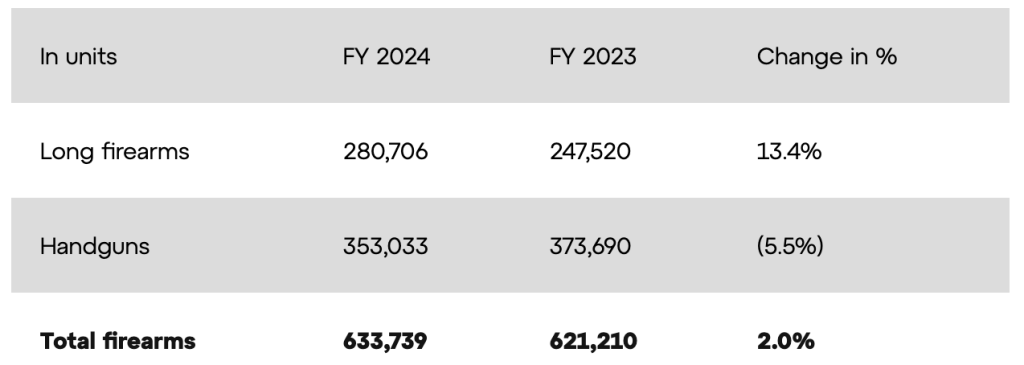

In 2024, there was a year-over-year increase of 2.0 percent in the number of sold firearms, to 633,739 units. Higher sales of long firearms were recorded, which rose 13.4 percent y/y to 280,706 units, while sales of handguns recorded a slight decrease of 5.5 percent y/y. The company is also registering some recovery in the U.S. commercial market but not as strong as expected.

Unit Sales by Firearm Type

Ammunition Segment

The Ammunition segment consists of the design, production and sale of small-caliber ammunition, including pistol and rifle ammunition, together with shotgun shells for hunting, sport shooting, and military and law enforcement, as well as the production and sale of grenades and other military material. It also includes the development and production of ammunition manufacturing machinery and tools.

The ammunition segment includes revenues from subsidiaries Sellier & Bellot (from May 16, 2024), swissAA, and the relevant part of revenues of Colt CZ Defence Solutions. In the newly reported Ammunition segment, the Group achieved revenues of CZK 6.9 billion in 2024.

“I am happy to note that Colt CZ’s full-year financial results for 2024 clearly show that the acquisition of Sellier & Bellot has delivered the expected value to the Group and that the synergies between the Firearms and Ammunition segments are materializing quickly. As the newly appointed CEO of the Group, I am fully committed to achieving the goals set for 2025,” stated Radek Musil, CEO of Colt CZ Group.

Profitability

EBITDA (including extraordinary items) increased by 30.6 percent y/y to CZK 3.5 billion in 2024, said to be primarily due to organic sales growth, recovery of the U.S. commercial market, a better sales mix of products with higher added value (higher share of orders from the military and law enforcement segment), as well as the consolidation of the acquisition of Sellier & Bellot from May 16, 2024.

Adjusted EBITDA amounted to CZK 4.6 billion in 2024, up 50.9 percent year-over-year, said to be in line with company’s guidance. The most significant one-off items were expenses related to the employee stock option plan and one-off expenses connected with the acquisition of Sellier & Bellot, i.e., inventory step-up and commodity hedging. The increase was driven by higher sales, a higher share of orders from the military and law enforcement segment, and especially the consolidation of the Sellier & Bellot acquisition.

Profit (loss) before tax of the Group decreased 45.0 percent y/y to CZK 1.4 billion in 2024, reportedly due to the impact of financial operations, cost associated to share based payment related to the employee stock option plan, the increase in depreciation and amortization related to the acquisition of Sellier & Bellot and the revaluation of inventory also related to this acquisition.

Net Profit decreased 48.9 percent y/y to CZK 1.0 billion in 2024, reportedly due to the impact of financial operations cost associated with share based payment related to the employee stock option plan, the increase in depreciation and amortization related to the acquisition of Sellier & Bellot and the revaluation of inventory also related to this acquisition.

Net Profit Adjusted for Extraordinary Items decreased 5.7 percent year-over-year to CZK 1.9 billion in 2024. The decline in profit was said to be primarily influenced by the result of financial operations, which was affected mainly by higher interest costs associated with acquisition financing.

Balance Sheet and Cash Management Summary

As of December 31, 2024, the net leverage ratio was 2.26x and the company achieved its further reduction compared to the levels during 2024.

The Board of Directors will propose to the General Meeting a distribution of profit for 2024 as follows: approximately CZK 847 million will be distributed as a dividend payment of CZK 15 per share and CZK 847 million will be allocated to a share buy-back program.

“Given the results achieved, the Board of Directors decided to use the profit of approximately CZK 847 million to pay a cash dividend of CZK 15 per share and allocate CZK 847 million to a share buy-back program,” Drahota added.

Investments

The Group’s capital expenditures were up 54.7 percent y/y to CZK 921 million in 2024. This represents a 4.1 percent share of the total revenues which is reportedly less than the company’s 2024 guidance, due to a shift of payments for some investments in Q1 2025. Approximately 63 percent of investments went to the Czech Republic, 24 percent to North America and the rest to subsidiaries in other countries, especially Switzerland.

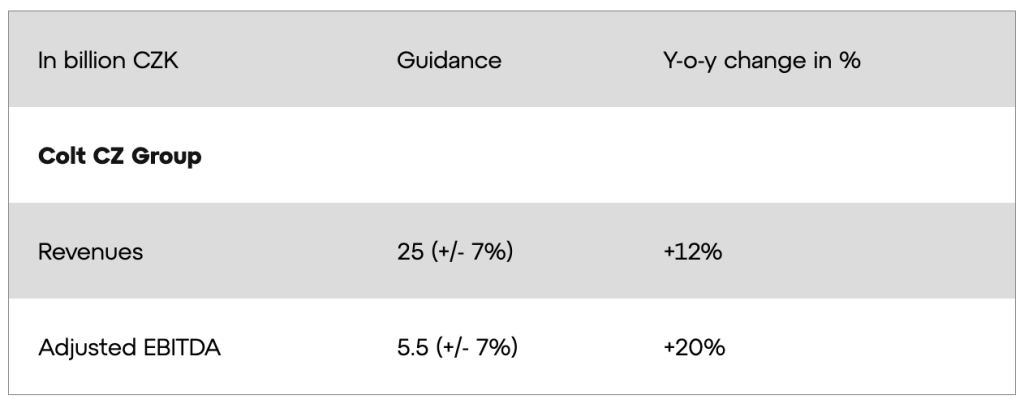

2025 Guidance

With regards to the outlook for 2025, Colt CZ sees major global business opportunities in the military and law enforcement segment. The company said in its report summary that cooperation with NATO and EU member countries and the NATO Support and Procurement Agency (NSPA) remains a top priority, although the Group notices the growing importance of other markets, mainly in Asia. Winning tenders and executing signed contracts on time are other prerequisites for fulfilling the outlook.

Maintaining profitability in the Firearms segment through more effective cost control is one of the company’s goals for 2025, especially in the U.S. market. New CZ and Colt products, which are ready to be launched in the U.S. market, are expected to play a key role for future growth in the U.S. market.

The main risks to achieving the 2025 outlook include: a. worsening of the situation on the commercial market in the U.S. in combination with the global economic outlook; b. delays in the execution of large orders in the military and law enforcement segment; c. delays in the launch of new products on the market; and d. development of FX that affect the conversion to CZK.

Other opportunities in the outlook are: a. potential new large contracts, if they are successfully completed in 2025; and b. the impact of product reselling from other producers.

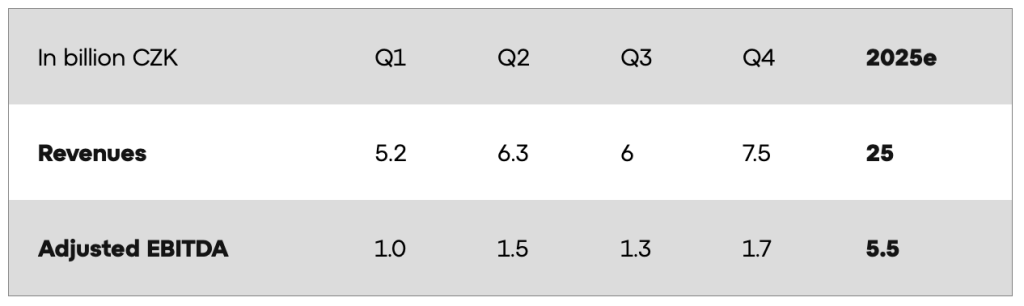

In view of the above, the Group presented the following outlook for 2025:

The capital expenditures of the Group in 2024 could reach CZK 1.1 billion to CZK 1.3 billion, which corresponds to a roughly 5 percent share of the 2025 expected revenues, which was said to be in line with the medium-term target of the company.

Proposed Dividend Payment

The company will propose to the General Meeting a cash dividend of CZK 847 million (CZK 15 per share) for 2024. In addition, the Board of Directors said it also plans to allocate CZK 847 million for a share buyback program (equivalent to 1.15 million shares at the current market price). The proposed profit distribution will be divided equally – 50 percent in the form of a cash dividend and 50 percent through the share buy-back program.

“This approach reflects our commitment to create value for shareholders,” the company said. The company plans to keep the repurchased shares as treasury shares for its future transactions.

The proposed profit distribution is subject to approval by the General Meeting which will be held at the end of the first half of 2025.

Image courtesy Colt CZ Group SE