Stella International Holdings Limited, the China-based developer and manufacturer of footwear and leather goods, reported that lower average selling prices of products it shipped in the 2025 first quarter offset an increase in unit volume shipped for the period.

The company reports in U.S. dollar ($) currency terms.

For the three months ended March 31, the Group’s unaudited consolidated revenue decreased ~2.2 percent to $331.0 million, compared to the unaudited consolidated revenue of ~$338.4 million for the corresponding period in 2024 due to a high base effect. Shipment volumes of the manufacturing business increased ~3.4 percent, driven by the Sports segment.

“With our non-sports manufacturing facilities continuing to operate at close to full utilization, we will drive our quality growth through the ramp-up of our new production factories in Bangladesh and Indonesia while continuing to meet the profitability and margin goals outlined in our Three-Year Plan,” commented Group Chairman Lawrence Chen.

The manufacturing business’s average selling prices (ASPs) decreased due to the higher proportion of Sports product orders with a lower ASP.

“In the face of increasing geopolitical and trade uncertainties, we are working with our customers to support their sell-through by delivering differentiated quality products through our diverse production base,” offered Chi Lo-Jen, CEO of Stella International Holdings Limited.

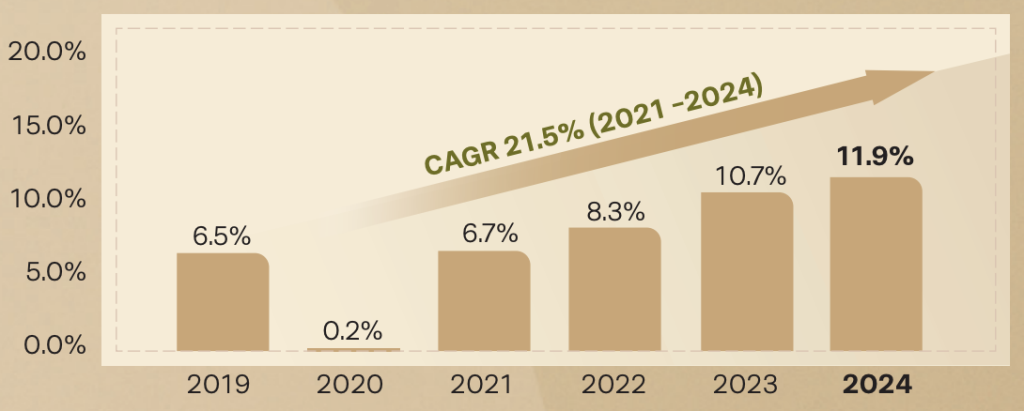

After achieving an operating profit margin of approximately 11.9 percent of sales in 2024, the Group said it is ahead of schedule in meeting the targets of its Three-Year Plan (2023-2025), which calls for an operating margin of 10 percent and a low-teens compounded annualized growth rate (CAGR) on profit after tax by the end of 2025.

“Having recommended payment of additional cash of $60 million as a special dividend in 2024, we also remain committed to returning additional cash up to $60 million per year to shareholders in 2025 and 2026 through a combination of share repurchases and special dividends, on top of paying regular dividends with a payout ratio of approximately 70 percent (comprising final dividends and interim dividends),” the company said in a media statement.

In 2024, the Group’s consolidated revenue increased 3.5 percent to $1.55 billion, compared to $1.49 billion in 2023. Shipment volumes rose 8.2 percent to 53.0 million pairs for the year, compared to 49.0 million pairs in 2023, mainly driven by the Sports and Fashion categories.

The average selling price of footwear products decreased 4.4 percent year-over-year to $28.4 per pair from $29.7 per pair in 2023, said to be due to a higher proportion of Sports products, which have a lower ASP and raw material price deflation.

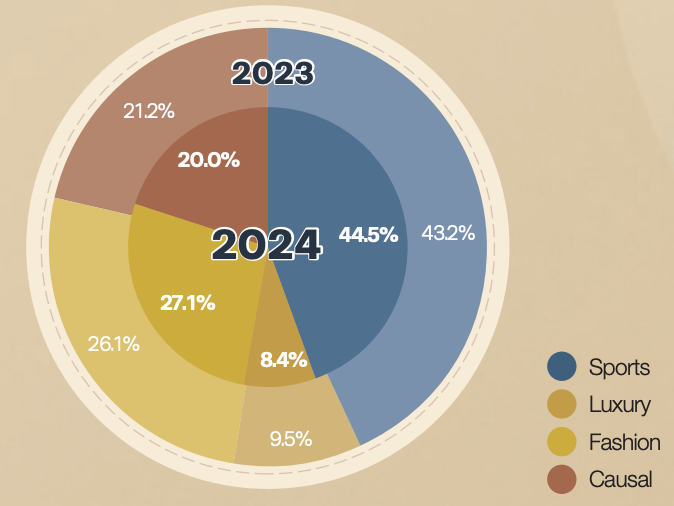

In terms of product category, sales in the Sports category increased by 6.7 percent in 2024, accounting for 44.5 percent of total manufacturing revenue, reportedly driven by the restocking needs of several of the Group’s Sports customers.

Image courtesy Stella International Holdings Limited