Caleres, Inc., the parent company of Famous Footwear and the Naturalizer, Vionic, Allen Edmonds, Blowfish Malibu, and Sam Edelman brands said it reported second quarter sales and earnings that came in below expectations.

“While our brands and our products continue to resonate with consumers and we remain committed to and confident in our long-term vision, our second quarter results fell short in both segments and do not reflect our true potential,” commented company President and CEO Jay Schmidt on a conference call with analysts.

ERP and Execution Issues

Schmidt said an ERP upgrade during the quarter was a significant part of the problem, but not the entire problem.

“Lack of visibility caused execution issues that prevented us from delivering our expected results,” he confirmed.

“As you are aware, we upgraded our SAP enterprise system to the new Cloud-based version,” the CEO explained. “This was a necessary upgrade that our teams have been working on for the past year, resulting in a common platform to leverage across our Brand Portfolio. Mid quarter, we were down for a few days as we planned.”

Schmidt said when the systems came back online, they initially saw signs of a successful implementation with e-commerce and order shipping on track. However, as they progressed through the quarter, several key operational reports were delayed, causing a lack of visibility to the tools the company relies on to drive its business every day. Additionally, he said there were issues related to size reporting that initially made it difficult for them to service drop ship and replenishment orders.

“And finally, we experienced late shipments and carrier failures that, while not related to the ERP implementation, contributed to the sales decline,” he said. “It is important to note that about 45 percent of our Brand Portfolio business is dynamic, including direct-to-consumer replenishment, drop ship and advancing newness. And without the tools and the reports to monitor these areas, we could not see all the issues until it was too late to fully recover.”

In response, the company took several actions.

“First, we immediately replaced one of our integration partners who handled reporting. Second, we pulled experienced order management professionals from elsewhere in our company and enlisted them to help ship out as many orders as possible. Third, we’ve gone function by function to shore up reporting and develop workarounds until the automated solutions are fully online,” the CEO explained.

“Importantly, we are now operational in all areas that cause the ERP disruption and we have addressed the issues that temporarily impacted visibility. That said, we do not expect to recover all the missed sales with respect to seasonal categories, drop ship and other direct-to-consumer purchases,” he noted.

He said the shortfall is factored into the updated guidance that they were sharing.

Schmidt said they have also accelerated cost reduction initiatives to mitigate the impact on profitability.

“To that end, today, we announced a restructuring that will save us approximately $7.5 million on an annualized basis and $2 million in this fiscal year,” he revealed. “These moves will make our teams more efficient and effective. Additionally, we are reducing other SG&A items for the back half to align with our forecast.”

Operating Segments

Brand Portfolio

Brand Portfolio sales declined 5.1 percent to $285.5 million, compared to $300.9 million in the second quarter of 2023, said to be due to the issues related to the SAP upgrade impacting all brands as well as weakness in seasonal categories. Wholesale and drop ship were said to be down and own e-commerce was flat, but below expectations.

“Based on our analysis, we believe the system issue resulted in about $10 million to $15 million of lost sales in the quarter, or as much as 5 percentage points of growth,” said company CFO Jack Calandra on the call.

“We continue to see strong growth in demand for new products and momentum in fashion sneakers, Schmidt shared. “In fact, sneakers and sport represented 28 percent of retail selling for the quarter, up six points versus the prior year. Seasonal products continued to underperform with sandals down high-single digits versus last year. We are well positioned in sneakers going forward and have aligned our inventory with consumer demand for this trending category.”

Higher initial margin rates and a favorable channel mix resulted in a 140 basis point year-over-year improvement in segment gross margin to 42.7 percent of sales.

“This demonstrates the health of our business overall,” the CEO noted. “Our 8.3 percent return on sales for the Brand Portfolio was down to last year due to deleveraging of expenses.”

Schmidt said inventory in the Brand Portfolio was in good shape, “about flat to last year” with a reduction in aged inventory.

“Our four lead brands, which include Sam Edelman, Allen Edmonds, Naturalizer and Vionic, represented more than half of the Brand Portfolio’s sales in the quarter,” he noted. “While sales were down for the lead brands, in total, they outperformed the other brands in our portfolio.”

Schmidt said a few highlights from the quarter demonstrate that the company’s growth vectors are still on track.

On the international front, Schmidt said they are very pleased with Sam Edelman’s momentum. “What we are seeing in Asia is giving us increased conviction in our strategy there.”

Allen Edmonds’ wholesale door count is up 30 percent year-over-year, and they continue to see a strong response at Nordstrom and other strategic specialty accounts.

Schmidt said the company also continues to attract new consumers to brands like Naturalizer.

“There, I hope you noticed that we are moving forward with Deepica Mutyala and Lauren Chan as our first inclusivity ambassadors starting with a campaign centered around our sizing initiatives and wide shaft boots. We are already seeing a strong reaction in early fall to our tall boots, especially in wide shaft,” he detailed

At Vionic, he said the Uptown Moc franchise reportedly continues to introduce the brand to new consumers with more modern and relevant fashion that embodies wearable well-being.

“Overall, the Brand Portfolio had a difficult quarter. However, we have full confidence in our growth vectors. Our retail sell throughs in the quarter were strong. We are well positioned from an inventory perspective in sneakers, and many of our brands have growth and receipt plans for the back half to support our guidance. This was a moment that is not indicative of our future potential,” he concluded.

Famous Footwear

Famous Footwear total sales were up 1.5 percent to $420.3 million in the second quarter, while comp sales declined 2.9 percent. The quarter included a $23 million benefit to Famous Footwear due to the retail calendar shift that pulled a peak back-to-school week into the quarter from August.

“Despite sales that were lower than anticipated, we delivered sequential improvement in each month of the quarter,” Schmidt shared. “We saw our Athletic trend build in July as the back-to-school season began, and we aligned our assortment with trending categories and brands. Notably, our strategically important Kids’ category once again grew in the quarter and Kids’ outpaced the total business.”

Calandra said they saw sequential improvement in each month of the quarter at Famous and that improvement continued with a strong performance in August.

The Kids’ business has now reportedly outperformed the rest of the chain for 14 consecutive quarters. Kids’ penetration of the total Famous Footwear business was 21 percent in the quarter. Schmidt said the retailer gained 0.5 points of market share of the Kids’ business in shoe chains, according to recent market research data.

“Also in the second quarter, Famous Footwear’s market share was flat to the total footwear market overall and gained 0.5 points in shoe chains,” he noted.

“We were also pleased with the performance of our own brands at Famous,” the CEO continued. “Penetration of our Caleres brands was once again up in the quarter. Our own portfolio provides Famous with greater access to fashion products. And at an enterprise level, Caleres captures a higher gross margin on brands sold vertically.”

The Famous.com business was said to be “solid” in the quarter, up 10 percent year-over-year with much of the business fulfilled through the FF stores.

Famous Footwear gross margin slipped 120 basis points year-over-year to 45.0 percent of sales, said to be due to more days on promotion and the pull forward of theBOGO 50 offer as well as higher clearance activity.

“While we utilize the BOGO 50 offer earlier than planned, we believe we maximize gross profit, given the initial tepid response to our buy more, save more promotion,” Calandra added.

“Finally, we continue to further our efforts to enhance the consumer experience at Famous,” Schmidt noted.

“At the end of Q2, we had 31 FLAIR (Famous Localized and Immersive Retail) locations in total,” he said. “We experienced a 5 point sales lift versus the rest of the chain in our fall 2023 and spring 2024 FLAIR stores. Those of you that shop there may notice an expanded assortment of brands like New Balance and Brooks. FLAIR is helping us attract these and other more elevated brands and products, and our Famous consumer is responding. We are on track to remodel 12 additional FLAIR stores in the back half of this year.”

Schmidt said the back-to-school business came late, but it came in strong and he said they are pleased with where the season ended up.

“Early in the year, we saw a stronger Athletic business materializing and worked hard to align our inventory investment with emerging trends for back-to-school,” he explained. “In mid-July, we launched new marketing messages and shifted our marketing mix to channels that were driving the most traffic. We also shifted our promotional strategy to BOGO from buy more, save more, after conducting a test that showed BOGO was margin dollar accretive. In August, we experienced a high-single-digit positive comp store sales gain.”

As a result, through August, he said Famous Footwear comp sales are now about flat for the full year-to-date period.

“The Athletic trend continued to build and turned positive with strength in Nike and Adidas amongst others,” he continued. “Furthermore, we are seeing strength in Men’s and Women’s alongside continued outperformance in Kids’. While we see these trends normalizing now that the back-to-school season is over, our results suggest our product, marketing and promotional messages are resonating with the millennial family.”

Schmidt said the strength of Kids’, the FLAIR results, and the trend in August lead the company to a place of cautious optimism at Famous Footwear.

“We believe Famous’ inherent competitive advantages, namely its leadership position with the millennial family, especially kids, coupled with its clear avenues for growth and support from the Caleres structure position the business to gain additional market share in shoe chains, generate robust levels of cash and increase profitability over the long-term,” he said.

Income Statement Summary

Consolidated gross margin (GM) improved 30 basis points year-over-year (y/y) to 45.5 percent of sales, and was said to be driven by higher margin in the Brand Portfolio, partially offset by the lower margins at Famous Footwear.

Consolidated SG&A, as a percent of net sales, was 39.3 percent, and it was said to reflect planned investment in marketing at certain Lead Brands, international expansion, and the implementation of the integrated SAP platform. The company said restructuring actions will result in $7.5 million in annualized SG&A savings and $2 million in SG&A savings in fiscal 2024.

Consolidated operating earnings were $42.5 million and operating margin was 6.2 percent of sales. Operating margin was 8.2 percent at Brand Portfolio and 8.3 percent at Famous Footwear.

Net interest expense was $3.3 million, down about $2.0 million from last year. The reduction was reportedly driven by lower borrowings as the weighted average borrowing rate was similar to last year.

Consolidated net earnings amounted to $30.0 million, or 85 cents per diluted share, in the second quarter, compared to net earnings of $33.9 million, or 95 cents per diluted share, in the second quarter of 2023, and Adjusted net earnings were calculated at $35.2 million, or Adjusted EPS of 98 cents per diluted share, in the second quarter of 2023.

EBITDA was $57 million, or 8.4 percent of sales, for the quarter.

Balance Sheet Summary

Inventory was flat at quarter-end compared to the end of the second quarter of 2023. Inventory was was said to be “up slightly” at Famous Footwear and “down slightly” at Brand Portfolio.

Borrowings under the asset-based revolving credit facility were $146.5 million at the end of the period, down $98 million from the second quarter of 2023, and included the benefit from a deferred vendor payment of $49 million. The company had no long term debt at quarter-end.

“I would note that one of our vendors had issues receiving payments later in the quarter, which resulted in a planned payment of $49 million being pushed into August,” Calandra added.

Caleres generated generated $80 million in cash flow from operations in the quarter, which reportedly included the favorable impact of the deferred vendor payment.

Capital Allocation Update

During the quarter, Caleres said it continued to invest in value-driving growth opportunities while at the same time returning cash to shareholders through a dividend. In the near term, the company expects to continue to focus on reducing debt and expects borrowings under its asset-based revolving credit facility to be less than $100 million by 2026.

Caleres said it will continue to consider business performance and market conditions as it evaluates all opportunities for free cash flow, including share repurchases, as the year progresses.

Fiscal 2024 Guidance

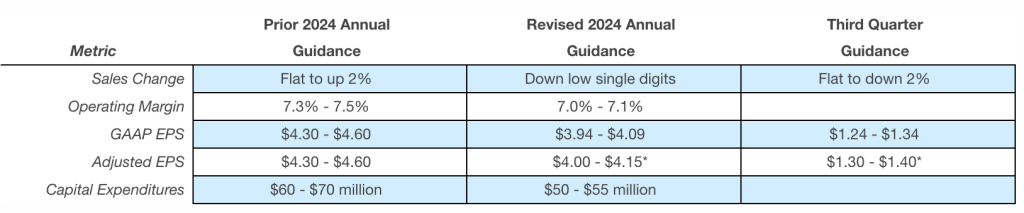

Caleres revised its fiscal 2024 financial outlook to reflect the shortfall experienced in Q2, the strong August results at Famous, and the restructuring actions the company announced in its earnings release and call.

“Specifically, we now expect sales to be down a low-single-digit percent versus last year,” Calandra noted. “This comparison includes the impact of the 53rd week in 2023. Excluding the 53rd week, sales would be flat to down 2 percent.”

He said EPS are estimated at a range of $3.94 to $4.09 per diluted share, and Adjusted EPS are estimated in a range of $4.00 to $4.15 per share, which includes about $2 million of savings and excludes $3 million of one-time costs associated with the restructuring.

“Additionally, we now expect consolidated operating margin of 7.o percent to 7.1 percent and capital expenditures of $50 million to $55 million,” Calandra estimated. “Given the continued strength of e-commerce relative to stores in Famous, we will close an additional 10 stores this year and expect to end the year with 850 stores versus 860 stores last year. And lastly, we still expect an effective tax rate of about 24 percent.”

Third Quarter Guidance

Caleres, Inc. now expects consolidated net sales to be flat to down 2 percent in Q3, a cash restructuring charge of $3 million and earnings per diluted share of $1.24 to $1.34 and Adjusted earnings per diluted share of $1.30 to $1.40.

As previously noted, its fiscal 2024 is a 52-week year and compares to a 53-week year in fiscal 2023. The revised assumptions are summarized as follows:

* Adjusted EPS excludes 6 cents per share ($3 million) expected to occur in the third quarter.associated with restructuring costs.

Image courtesy Famous Footwear/Flair