Boot Barn Holdings, Inc. CEO John Hazen said the Boot Barn team delivered a solid finish to fiscal 2025, highlighted by 15 percent total sales growth for the fiscal year and 23 percent earnings per diluted share growth. He also said the company’s performance underscored the ongoing resilience of the core consumer despite broader market uncertainties.

“Our full year fiscal 2025 revenue increased to a record level of $1.9 billion, which equates to $1 billion of sales growth over the last four fiscal years,” Hazen noted on a conference call with analysts. The company reported that the growth was driven by 186 new stores and strong same-store sales growth.

Hazen highlighted opening 60 new stores in fiscal 2025 and 21 new stores in the fourth quarter, expanding into four new states and achieving a merchandise margin expansion of 130 basis points for the year.

“The continued strength across major merchandise categories, channels, and geographies reaffirms the broad appeal of our brand and the effectiveness of our strategic initiatives,” Hazen offered. “As we look ahead, we remain confident in our ability to navigate the current tariff environment through our diversified sourcing capabilities and established vendor partnerships. The fundamentals of our business remain strong, and we are well-positioned to continue generating value for our shareholders.”

Fourth Quarter Summary

Net sales increased 16.8 percent to $453.7 million in the fiscal fourth quarter ended March 29 (Q4), compared to net sales of $388.5 million in the prior-year Q4 period. The increase in net sales was reportedly the result of incremental sales from new stores and the increase in consolidated same-store sales.

- Consolidated same-store sales increased 6.0 percent;

- Retail store same-store sales increased 5.5 percent; and

- E-Commerce same-store sales increased 9.8 percent for the Q4 period.

Gross profit was $168.6 million, or 37.1 percent of net sales, in Q4, compared to $139.4 million, or 35.9 percent of net sales, in the prior-year Q4 period.

- The increase in gross profit was primarily due to increased sales and merchandise margin, partially offset by the occupancy costs of new stores.

- The 130 basis-point increase in gross margin was reportedly driven primarily by a 210 basis-point increase in merchandise margin rate, partially offset by 80 basis points of deleverage in buying, occupancy and distribution center costs.

- The increase in merchandise margin rate was said to be primarily the result of supply chain efficiencies, lower shrink expense, better buying economies of scale, and growth in exclusive brand penetration.

- The deleverage in buying, occupancy and distribution center costs was reportedly driven by the occupancy costs of new stores.

Selling, general and administrative (SG&A) expenses were $118.9 million, or 26.2 percent of net sales, in Q4, compared to $101.2 million, or 26.1 percent of net sales, in the prior-year Q4 period.

- The increase in SG&A expenses compared to the prior-year Q4 period was primarily the result of higher store payroll and store-related expenses associated with operating more stores and corporate general and administrative expenses in the current-year period.

- SG&A expenses as a percentage of net sales increased by 10 basis points, primarily due to higher legal expenses and store payroll in the current-year period, partially offset by marketing expenses.

Income from operations increased $11.4 million to $49.7 million, or 11.0 percent of net sales, in Q4, compared to $38.2 million, or 9.8 percent of net sales, in the prior-year Q4 period, primarily due to the abovementioned factors.

Income tax expense was $12.4 million, or a 24.8 percent effective tax rate, compared to $9.4 million, or a 24.3 percent effective tax rate, in the prior-year Q4 period. The increase in effective tax rate was primarily due to a decrease in stock-based compensation tax benefits in the current-year period when compared to the prior-year Q4 period.

Net income was $37.5 million, or $1.22 per diluted share, in Q4, compared to $29.4 million, or 96 cents per diluted share, in the prior-year Q4 period.

Fiscal Year Summary

- Net sales increased 14.6 percent to $1.91 billion, compared to $1.67 billion in fiscal 2024;

- Consolidated same-store sales increased 5.5 percent y/y, with Retail store same-store sales increasing 5.0 percent y/y and E-commerce same-store sales increasing 9.7 percent y/y;

- Gross margin was 37.5 percent of net sales in fiscal 2025, compared to 36.9 percent of net sales in fiscal 2024;

- SG&A expenses were $477.7 million, or 25.0 percent of net sales, in fiscal 2025, compared to $416.2 million, or 25.0 percent of net sales, in fiscal 2024. SG&A expenses as a percentage of net sales were flat when compared to fiscal 2024;

- Income from operations increased $41.1 million to $239.4 million, or 12.5 percent of net sales, compared to $198.2 million, or 11.9 percent of net sales, in fiscal 2024;

- Income tax expense was $59.2 million, or a 24.6 percent effective tax rate, compared to $50.4 million, or a 25.4 percent effective tax rate, in fiscal 2024; and

- Net income was $180.9 million, or $5.88 per diluted share, compared to net income of $147.0 million, or $4.80 per diluted share, in fiscal 2024.

Sales by Channel

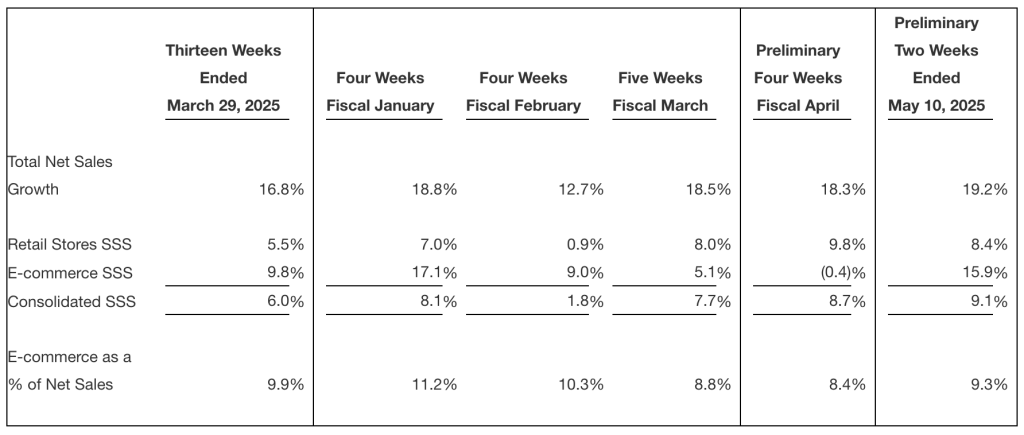

The following table includes total net sales growth, same-store sales (SSS) growth/(decline), and e-commerce as a percentage of net sales for the periods indicated below.

Balance Sheet Summary as of March 29, 2025

- Cash and cash equivalents amounted to $70 million at year-end;

- Zero dollars drawn under the $250 million revolving credit facility;

- Average inventory per store increased approximately 5.7 percent on a same-store basis, compared to March 30, 2024.

- The company opened 60 new stores, bringing its total count to 459 stores as of the fiscal year-end.

Share Repurchase Program

Boot Barn’s Board of Directors has authorized the company to repurchase up to $200 million of its common stock. The company can make repurchases under the Repurchase Program through various methods, which could include open market purchases, which may or may not be pursuant to Rule 10b5-1 trading plans, privately negotiated transactions, block trades, accelerated share repurchase plans, or any combination of the above. The timing and amount of shares repurchased will depend on the stock price, business and market conditions, corporate and regulatory requirements, alternative investment opportunities, acquisition opportunities, and other factors. The company is not obligated to repurchase any specific amount of shares of common stock, and the repurchase authorization does not have an expiration date and may be amended or terminated by the Board of Directors at any time without prior notice.

The Tariff Question

CEO Hazen addressed ongoing tariff uncertainty, expressed confidence in mitigation strategies and highlighted supply chain diversification. He said Boot Barn reduced the proportion of exclusive brand goods sourced from China from 24 percent in fiscal 2025 to an estimated 12 percent in fiscal 2026, suggested that the company will only have 5 percent on order from China in the second half of the year, with China exclusive brand product ~$2.3 million of “tariffable product” for the remainder of fiscal 2026.

Asked about tariff headwinds in the Q&A session, SFO Watkins said that the company had quantified the tariff impact on the year to be around $8 million, and noted the company has historically seen “pretty good pricing power,” but expects “some elasticity of demand and some softening.”

Fiscal Year 2026 Outlook

The company is providing guidance for what it can reasonably expect at this time.

“We are now six weeks into the first quarter of fiscal ’26, and we have continued to see broad-based growth as consolidated same-store sales have increased 9 percent, driven by increased transactions and full price selling,” said Hazen.

For the fiscal year ending March 28, 2026, the company expects:

- To open between 65 to 70 new stores;

- Total sales of $2.07 billion to $2.15 billion, representing growth of 8 percent to 13 percent over fiscal 2025;

- Same-store sales ranging from a decline of 2.0 percent to a growth of approximately 2.0 percent.

- Retail store same-store sales in the range of a decline of 2.5 percent to growth of roughly 1.5 percent.

- E-commerce same-store sales growth of roughly 1.0 percent to 7.5 percent range.

“The low end of guidance assumes total sales of $2.07 billion (8 percent growth) and a full-year same-store sales decline of 2 percent,” added Watkins. “Both scenarios factor in increased tariffs and possible softer consumer demand, with 65–to-70 new stores planned for fiscal 2026.”

- Merchandise margin between $1.03 billion and $1.08 billion, or approximately 49.8 percent to 50.1 percent of sales;

- Gross profit between $747 million and $793 million, or approximately 36.1 percent to 36.9 percent of sales;

- SG&A expenses between $519 million and $527 million, or approximately 25.1 percent to 24.5 percent of sales;

- Income from operations between $228 million and $266 million, or approximately 11.0 percent to 12.4 percent of sales;

- Net income of $169 million to $197 million with deleted diluted EPS of $5.50 to $6.40 per share, based on 30.8 million weighted average diluted shares outstanding;

- Effective tax rate of 26.0 percent; and

- Capital expenditures between $115.0 million and $120.0 million, net of estimated landlord-tenant allowances of $35.5 million.

Fiscal 2026 First Quarter Outlook

(ended June 28, 2025)

- Total sales of $483 million to $491 million, representing growth of 14 percent to 16 percent over the prior-year period;

- Same-store sales growth of approximately 4.0 percent to 6.0 percent;

- Retail store same-store sales growth of roughly 4.0 percent to 6.0 percent;

- E-Commerce same-store sales growth of roughly 4.0 percent to 6.0 percent;

- Merchandise margin between $250 million and $254 million, or roughly 51.7 percent of sales;

- Gross profit between $183 million and $188 million, or roughly 37.9 percent to 38.2 percent of sales;

- SG&A expenses between $122 million and $124 million, or roughly 25.3 percent to 25.2 percent of sales;

- Income from operations between $61 million and $64 million, or roughly 12.6 percent to 13.0 percent of sales; and

- Net income per diluted share of $1.44 to $1.52, based on 30.9 million weighted average diluted shares outstanding.

Image courtesy Boot Barn Holdings, Inc.