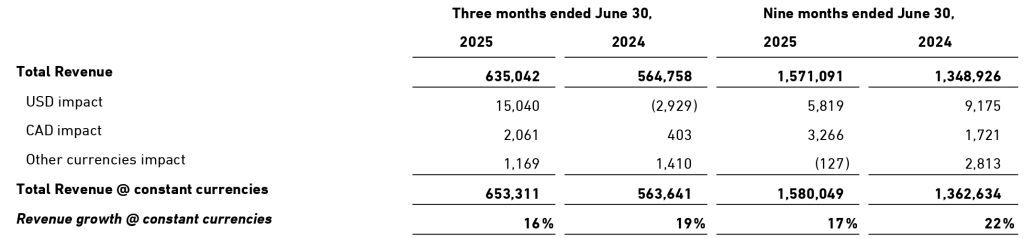

Birkenstock Holding plc reported fiscal third quarter revenue of €635 million for the three-month period ended June 30, a 12 percent increase year-over-year (y/y) on a reported basis. Foreign exchange rate (FX rate) fluctuations with the weaker U.S. dollar had a €15.0 million impact on revenue in the period. The Canadian dollar had a €2.1 million impact on revenue in the 2025 third quarter. Revenue increased 16 percent on a constant-currency (cc) basis.

Reconciliation of Revenue to Constant Currency Revenue

(in € thousands)

Revenue growth was said to be supported by high-single-digit unit growth and mid-single-digit growth in Average Selling Price (ASP). Closed-toe shoes continue to outpace the growth of sandals, contributing to the higher ASP. Closed-toe share of revenue increased 400 basis points year-over-year.

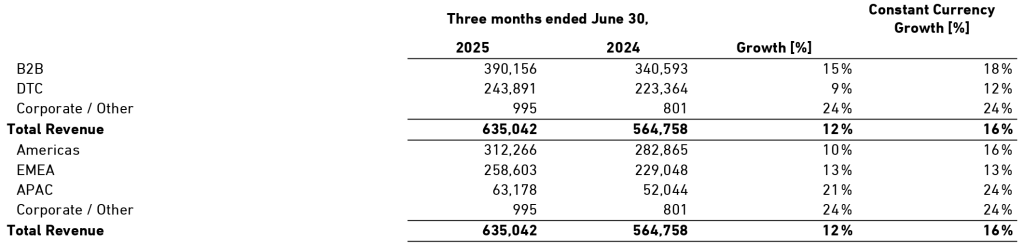

Segment (Region) and Channel Summary

(in € thousands)

B2B (Wholesale) revenue grew 15 percent (+15 percent cc) to €390.2 million in the fiscal third quarter, said to be “supported by strong demand and sell-through at key partners.”

DTC (direct-to-consumer) revenue was up 9 percent (+12 percent cc) to €243.0 million in the period. The company opened 13 new owned stores during the fiscal third quarter of 2025, bringing the total number of owned retail stores to 90 doors.

In the Americas segment, Birkenstock delivered third quarter revenue growth of 10 percent (+16 percent cc) to €312..3 million in the quarter. The company said both B2B and DTC grew at a strong double-digit pace in constant currency. The company opened three new stores in the U.S. (Houston, Deer Park, and Naperville), bringing the total number of own stores in the Americas segment to 13 doors.

Revenue in the EMEA segment grew 13 percent in the third quarter of 2025 to €258.6 million. Both B2B and DTC grew double-digits. The company opened new stores in The Hague and San Sebastian, bringing total stores in the EMEA segment to 39 doors.

In the APAC segment, Birkenstock achieved revenue growth of 21 percent (+24 percent) to €63.2 million in the third quarter of 2025. The company opened eight new own stores in the region, bringing the total in APAC to 38 doors. Additionally, the company grew the number of mono-brand partner stores by over 20 percent in APAC.

Profitability and Cash Flows

“We saw significant margin improvement in the quarter driven by sales price adjustments net of inflation and better absorption,” offered company CEO Oliver Reichert. “This puts us on track to meet our Adjusted EBITDA margin target for the year despite the currency headwinds. We believe we are well-positioned to manage the impact of the current 15 percent U.S./EU tariff agreement through a combination of pricing adjustment, cost discipline and inventory management to protect the long-term health and profitability of the Birkenstock brand.”

Profitability improved with gross profit margin of 60.5 percent, up 100 basis points year-over-year, reportedly due to sales price adjustments (net of input costs) and better absorption of manufacturing capacity, partly offset by unfavorable currency translation and channel mix.

Net profit amounted to €129.2 million in the third quarter, up 73 percent compared to €74.6 million in the prior-year Q3 period. Adjusted net profit was €116 million for the period, up 26 percent from €92 million in Q3 2024.

Basic and diluted EPS were €0.69 per share in Q3, up 75 percent compared to EPS of €0.40 per share in fiscal Q3 2024. Adjusted earnings per share were €0.62, up 27 percent from €0.49 per share in Q3 2024.

Adjusted EBITDA totaled €218 million in Q3, up 17 percent y/y. Adjusted EBITDA margin was 34.4 percent of revenue, up 140 basis points from 33.0 percent in Q3 2024. Adjusted EBITDA margin was 34.4 percent, up 140 basis points year-over-year.

Cash flows from operating activities amount to €261 million in Q3. Operating cash flow was said to be down €21 million year-over-year, primarily due to the timing of tax payments and changes in working capital.

Capital Expenditures

Birkenstock reported that it has invested approximately €22 million in capital expenditures in the third quarter of 2025, primarily to expand production capacity.

Balance Sheet Summary

Birkenstock ended the quarter with cash and cash equivalents of €262 million and net leverage of 1.7x as of June 30, 2025 compared to 1.8x at September 30, 2024.

Without the share buyback, net leverage would have been 1.4x. The company said it remains committed to further deleveraging its balance sheet with free cash flow, targeting approximately 1.5x net leverage by the end of fiscal 2025.

During the quarter, the company used €176 million of cash to repurchase and cancel 3.9 million ordinary shares on May 30, 2025, reducing average shares outstanding for the third quarter by 1.3 million shares. Shares outstanding at June 30, 2025 totaled 183.9 million, down 3.9 million from March 31, 2025

Outlook

Birkenstock is reiterating its previous guidance for fiscal 2025 as follows:

- Revenue growth is expected to be at the high end of 15 percent to 17 percent range in constant currency.

- Adjusted EBITDA margin of 31.3 percent to 31.8 percent, despite the significantly weaker U.S. dollar.

Image courtesy Birkenstock Holding plc