In EY Parthenon’s latest recap of its semi-annual CEO survey, the firm found a slight rise in CEO confidence that could signal cautious optimism for transformation and growth agendas in 2025.

Based on the survey output, deal appetite is high, as EY suggests the most confident CEOs see M&A as a driving force of transformation, and the firm believes they are ready to act.

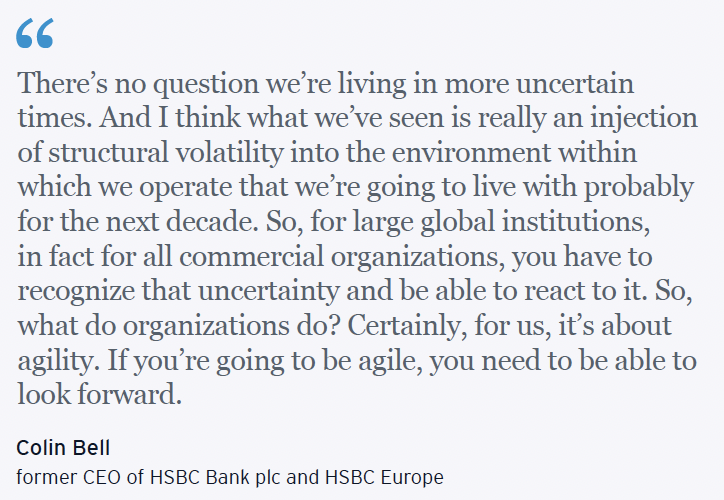

EY said decoding disruption is the key to accelerating sustainable growth, but geopolitical uncertainty casts a concerning shadow, and those observations came before the daily headlines warned of the effects of rising tariffs, the Trump effect on wars in Ukraine and the Middle East and the potential for conflict over Taiwan. The current issues involving illegal immigration may seem trivial compared to the other problems that confront CEOs running global businesses.

EY sees business model innovation and transformation as strategic imperatives in today’s fast-changing landscape.

“The most confident CEOs are adopting a dynamic mindset viewing change as a core capability,” the company wrote in its survey report. “They understand transformation isn’t a one-time initiative but an ongoing reimagination of behaviors and potential, rooted in continuous learning and adaptation.”

EY believes market leaders prioritize holistic, long-term transformation over quick fixes, but that may minimize the effects of the public markets on running a business measured today in 90-day increments. The firm states that success requires persistence, strategic vision and investment in one of businesses’ most critical assets: people. By re-skilling and new-skilling employees, leaders unlock the key competitive edge of human potential.

But these measures take time and patience.

As the market watched recently, one analyst felt impatient about Nike, Inc.’s gigantic moves to turn around its business and downgraded NKE shares. Others were more forgiving, possibly due to a better understanding of product timelines or understanding that it is still early in the game for a new CEO appointed 90 days ago. On the other hand, Wolverine Worldwide has been transparent and diligent in its process and set clear, achievable metrics that provided the market with enough to consume as the process unfolded. But this past week was an example of patience running out in the midst of the 90-day calendar as WWW shares fell because the 2025 forecast was not aggressive enough.

The pressure can come from the Board, the street and the consumer. CEOs with the ability and capability to adapt need to build expectations for each constituency, including employees.

“Adaptability is the ultimate advantage,” EY wrote. “Organizations that embrace a transformational mindset turn disruption into opportunity – continuously learning, pivoting and growing, to shape their future with confidence.”

Follow along here for Part 1 of a summation from SGB Media of EY’s January 2025 survey, and ask yourself how you might respond to the questions.

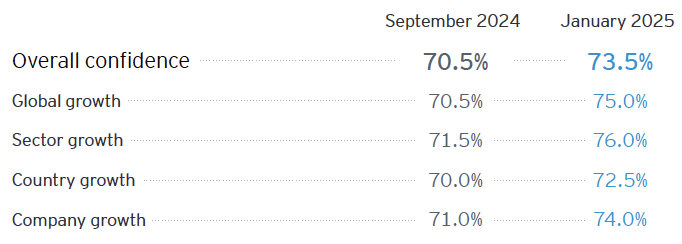

CEO confidence steadily increasing across all aspects of the organization

The latest Global CEO Confidence Index shows a modest three-point increase since September 2024, which indicates strengthening CEO optimism about the next 12 months.

EY believes that CEO confidence influences how CEOs approach transformation. The firm’s September 2024 survey highlighted that the most confident CEOs can overcome resistance and embrace transformation with stronger processes to manage portfolios and strategic investments.

This latest survey reveals that confident CEOs take a long-term approach to transformation, focusing on enhancing customer and employee engagement amid macroeconomic, geopolitical and technological shifts to drive long-term sustainable value creation. In contrast, the less confident CEOs concentrate on short-term improvements in top- and bottom-line performance.

Global economic forecasts see 2025 having levels of growth similar to 2024 levels, with the inflation rate declines in 2024 across most economies expected to continue, albeit more slowly. However, the risk of global inflation spikes could begin tilting to the upside, given the prospect of increased protectionism.

CEO confidence in sector growth is driving more positivity about company earnings. Companies find it easier to manage their talent strategy given the rebalanced labor market conditions. There is also a continued focus across transformation levers, including technology investment and organic and portfolio transformation.

EY indicated notable differences in CEO confidence at the country level. Scores have improved in Europe, the UK, Italy, and the Nordic region, while France has declined; this may reflect political stability in these countries.

In North America, the U.S. score increased while Mexico’s and Canada’s scores declined, potentially reflecting the result of the U.S. election. In Asia, Singapore’s score declined, potentially reflecting fears that an increase in global trade tensions could impact its growth; however, China saw an increase, reflecting the government’s announcement of support for the economy.

Geopolitical risks are playing an increasingly important role in corporate decision-making. On everything from trade and tariff tensions, industrial sovereignty initiatives, and tax policy to more serious regional wars and disputes, CEOs are having to carefully consider their global footprint, supply chains, ecosystem partners, and addressable markets.

Understanding the global geopolitical landscape and emerging risks has never been higher on the C-suite agenda.

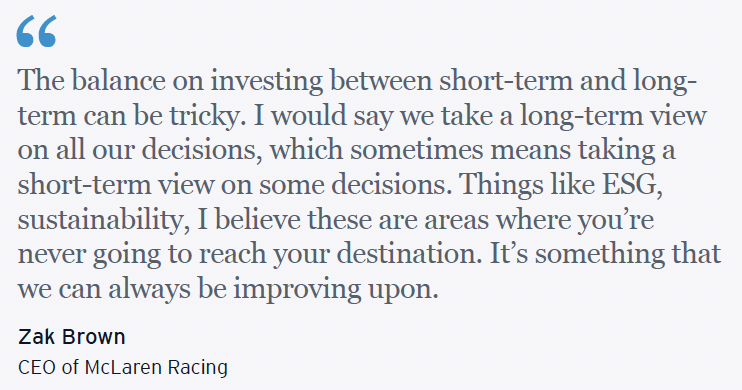

Focusing on short-term financial metrics may please the stock market, but it does not necessarily determine the long-term success of transformation initiatives. Taking a longer-term view, even at the cost of short-term financial measures, is a more reliable path to sustainable value creation.

Part 1

Broader vision for transformation unlocks a clear path to long-term value.

EY suggests confident CEOs are building disruption-resilient and customer-centric business models to better position themselves for the future.

Companies view critical trends and disruptions as either threats to their existence or opportunities, and this difference separates industry leaders from laggards.

“Today’s business landscape is shaped by disruptive forces: rapid technological advancements, including artificial intelligence (AI), climate change-driven sustainability agendas, and geopolitical tensions affecting supply chains and global operations,” EY wrote. “Digital ecosystems expose new threats and opportunities, while remote work reshapes organizations. Rising cybersecurity risks, shifting consumer expectations, economic volatility and complex regulations demand agility. Meanwhile, emerging markets create new competitive dynamics and growth potential.”

The most confident CEOs view all trends as a driving force to transform their businesses.

Question: How important is it to rethink your organization’s approach to transformation to adapt to the following trends?

Note: The surveyed respondents were asked to select one option for each statement.

EY said the CEOs’ responses highlight the critical impact of trends driving transformation in this time of elevated uncertainty. The top quartile of confident CEOs are twice as likely to see all trends as critical to reshaping transformation. Effectively recalibrating their risk radar to include all potential headwinds reveals the path forward, although fixating on existing risks could lead to paralysis.

***

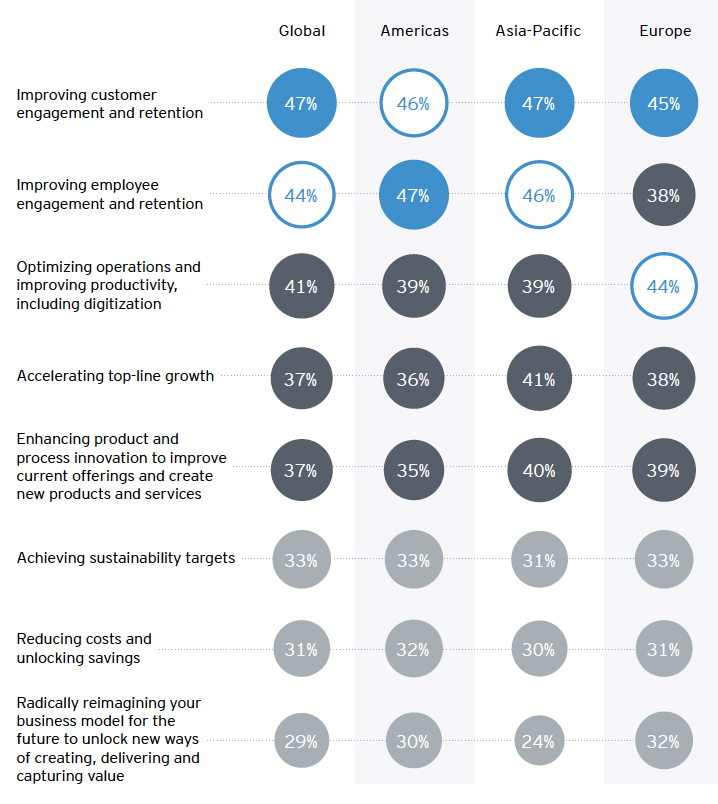

CEOs prioritize enhancing customer and employee engagement and retention, while also optimizing operations, as the most important outcomes of the transformation.

Question: What are the most important outcomes that your transformation initiatives are trying to achieve in the next 12 months?

Note: The surveyed respondents were asked to select up to three responses and rank them in order of priority.

CEOs prioritize elevating the customer and employee experiences to bring sustainable business growth.

EY said CEOs prefer improving customer and employee engagement and retention while optimizing operations and enhancing productivity. Putting people at the center of the transformation can enhance productivity gains by a factor of 2.6.

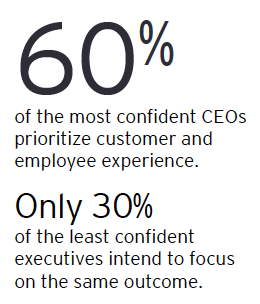

The most confident CEOs will likely aim for better employee and customer experiences through transformation (60 percent vs. 30 percent of the least confident CEOs). In comparison, a plurality of the least confident CEOs focus on improving top-line growth and margin expansion (40 percent vs. 20 percent of the most confident CEOs).

This stark contrast may reflect a divergence in ambition horizons. Top-line growth and margin expansion may be unsustainable short-term indicators. Improving customer and employee engagement will likely create a stronger foundation for longer-term sustainable growth.

In today’s hyper-competitive market landscape, customer engagement has emerged as a critical differentiator for sustainable business growth. Companies can unlock substantial long-term value by cultivating meaningful, personalized interactions that transcend transactional relationships.

Strategic engagement initiatives that leverage data-driven insights, omni-channel communication, and responsive customer experience design enable companies to retain relationships and transform loyal customers into brand advocates. Moreover, companies prioritizing genuine value-added engagement are better positioned to adapt to evolving market dynamics and build resilient customer-centric business models that generate consistent competitive advantage.

Similarly, in navigating transformation, employees represent the critical catalyst for sustainable change. Successful transformation programs depend on workforce alignment, engagement, and psychological safety to drive meaningful strategic shifts.

By empowering employees as active change agents rather than passive recipients, companies can unlock intrinsic motivation, reduce resistance and accelerate transformation. Effective change management necessitates transparent communication, robust skill development and the creation of a culture that values innovation and adaptability. When employees feel genuinely invested in the transformation journey, they become the primary architects of organizational reimagination, translating strategic vision into operational excellence.

* * *

CEOs seem bullish in their ability to achieve transformational outcomes despite heightened uncertainties.

Question: How confident are you in your transformation initiatives’ ability to achieve the outcomes you have identified as most important?

Question: How confident are you in your transformation initiatives’ ability to achieve the outcomes you have identified as most important?

Note: The surveyed respondents were asked to rate their confidence levels in the Top 3 transformation outcomes they had identified. Between 1 percent and 4 percent answered “Not confident enough.”

By empowering employees as active change agents rather than passive recipients, companies can unlock intrinsic motivation, reduce resistance and accelerate transformation. Effective change management necessitates transparent communication, robust skill development, and creating a culture that values innovation and adaptability. When employees feel genuinely invested in the transformation journey, they become the primary architects of organizational reimagination, translating strategic vision into operational excellence.

Where the survey sees the outlook of the most and least confident CEOs converging is their belief in achieving their most important targeted transformation ambitions. However, only a little over half of CEOs (57 percent) are “very confident” they can reimagine their business model for the future. The ability to get this right will increasingly define leaders and laggards.

Business model innovation, or identifying, developing and commercializing new business models to retain competitive advantage and transformation, will be a defining characteristic of successful companies navigating an increasingly complex environment.

SGB Media will publish Part 2 of this study report on Monday, February 24, in the SGB Update Morning Newsletter

Go here to download or view the complete EY Parthenon CEO Survey for January 2025. Images, graphics and quotes courtesy EY-Parthenon