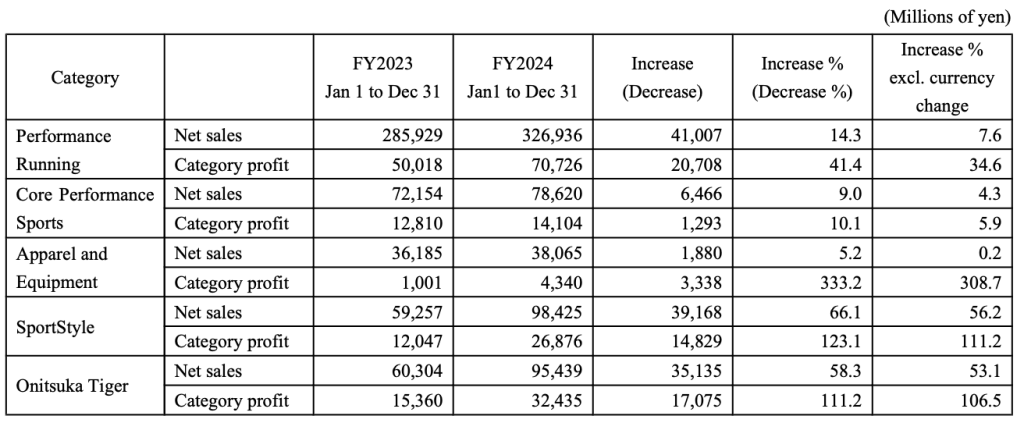

Asics Corporation sees landscape for its brand as the one of the leaders in performance running footwear continues to see outsized growth coming from its sports lifestyle and street lifestyle categories, with the SportStyle and Onitsuka Tiger categories each posting growth in excess of 50 percent year-over-year to nearly ¥100 billion each, while operating profits more than doubled for each category versus 2023.

In Performance Running, the brand’s top category, sales posted solid high-single-digit growth for the year, and operating profits surged by more than a third.

The company pointed to the “abundance of major international sporting events” in 2024, including Kobe 2024 Athletics World Championships, the Paris Olympics and Paralympic Games.

“These sporting events became a good opportunity to communicate the Asics brand through the achievements of many athletes, and we think it likely that they were a catalyst that led to many people learning more about Asics,” thee company said in its annual report.

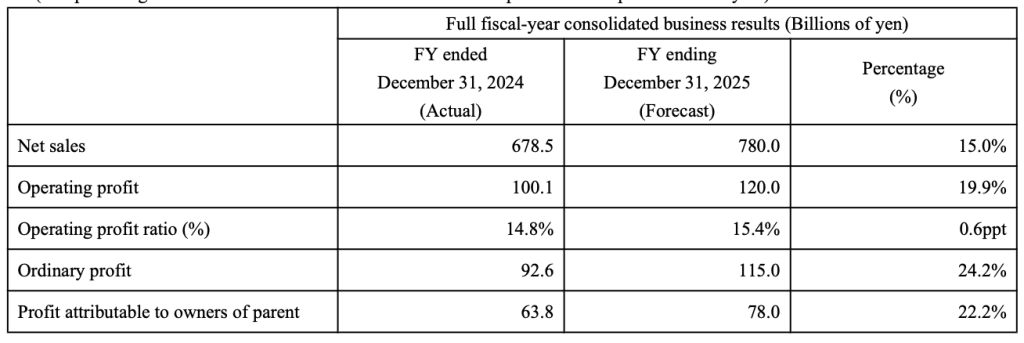

“Viewing 2024 from the perspective of performance, operating profit was ¥100.1 billion, the first time it has reached this milestone,” the company noted. “The operating margin was 14.8 percent, among the highest in the industry, which we believe shows that the Asics brand has arrived at a completely different stage.”

In November 2024, Asics upwardly revised its financial targets for the Mid-Term Plan 2026 (MTP 2026), now pushing for 2026 figures of at least ¥130.0 billion for operating profit (against a previous target of ¥80.0 billion), an operating margin of at least 17 percent (previously around 12 percent), and ROA of around 15 percent (previously around 10 percent).

In the update of Mid-Term Plan 2026 in November 2024, the company announced the establishment of Asics Innovation Campus – a tentative name – as an initiative to further strengthen innovation.

“We will focus on our long-term strategy of performance x footwear, and will continue to prepare with the aim of using it as a collaboration hub for internal and external parties on a global scale,” the company said.

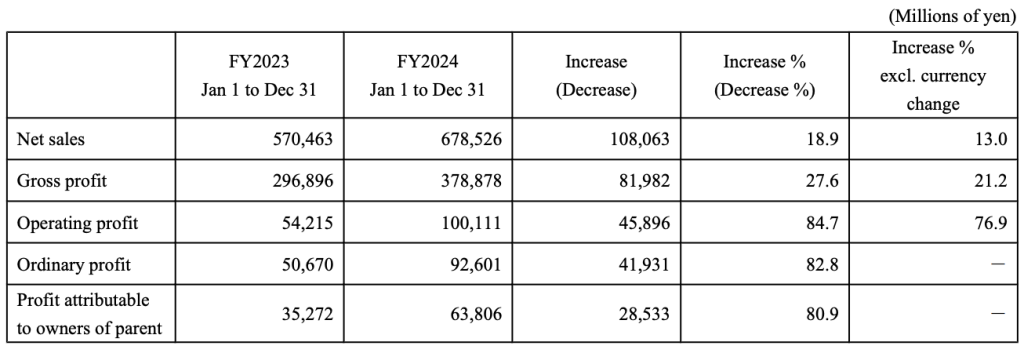

Income Statement Summary

Full-year net sales increased 18.9 percent to ¥678,526 million due to the strong sales in all categories, as well as due to the fluctuation in exchange rates.

Gross profit increased 27.6 percent to ¥378,878 million due to the impact of the increase in net sales.

Operating profit increased 84.7 percent to ¥100,111 million due to the impact of the increase in net sales and gross profit margin in all categories and regions.

Ordinary profit increased 82.8 percent to ¥92,601 million due to the impact of the increase in net sales and profit.

Profit attributable to owners of parent increased 80.9 percent to ¥63,806 million mainly due to the recording of a gain on sale of investment securities following the sale of cross-shareholdings, as well as the impact of the increase in net sales and profit.

Performance Running net sales increased 14.3 percent to ¥326,936 million due to the strong sales in all regions. Sales increased 3.8 percent in currency-neutral (c-n) terms in North America to ¥96.4 billion in 2024, Japan sales rose 9.2 percent to ¥14.1 billion, and Europe grew 3.1 percent c-n to ¥99.8 billion. Greater China growth was pegged at 11.9 percent c-n and Southeast and South Asia jumped 36.1 percent year-over-year off of a low base.

Category profit increased 41.4 percent to ¥70,726 million mainly due to an improvement in gross profit margin, as well as due to the impact of an increase in net sales.

Core Performance Sports net sales increased 9.0 percent to ¥78,620 million due to the strong sales in Europe region and Southeast and South Asia region. Category profit increased 10.1 percent to ¥14,104 million mainly due to an improvement in gross profit margin, as well as due to the impact of an increase in net sales.

Apparel and Equipment net sales increased 5.2 percent to ¥38,065 million mainly due to the strong sales in Europe region. Category profit increased significantly 333.2 percent to ¥4,340 million mainly due to an improvement in gross profit margin.

SportStyle net sales increased 66.1 percent to ¥98,425 million due to the strong sales in all regions, with North America highlighted with 120 percent growth year-over-year. Category profit increased significantly 123.1 percent to ¥26,876 million mainly due to the impact of the increase in net sales. Profit margin was reported at 27.3 percent of sales, up 700 basis points from the prior fiscal year, as the category reportedly continues to grow while improving profitability.

Onitsuka Tiger net sales increased 58.3 percent to ¥95,439 million due to the strong sales in all regions.

Category profit increased significantly 111.2 percent to ¥32,435 million mainly due to an improvement in gross profit margin, as well as due to an increase in net sales. Profit margin was reported at 34.0 percent of sales, up 850 basis points from the previous fiscal year, and boasting the highest profitability of all the categories.

Onitsuka Tiger celebrated its 75th anniversary in 2024, and through the opening of Hotel Onitsuka Tiger on the Champs-Élysées in Paris, participation in Milan Fashion Week, and collaboration with other brands, the company said it has made even greater efforts to communicate the brand at a global scale.

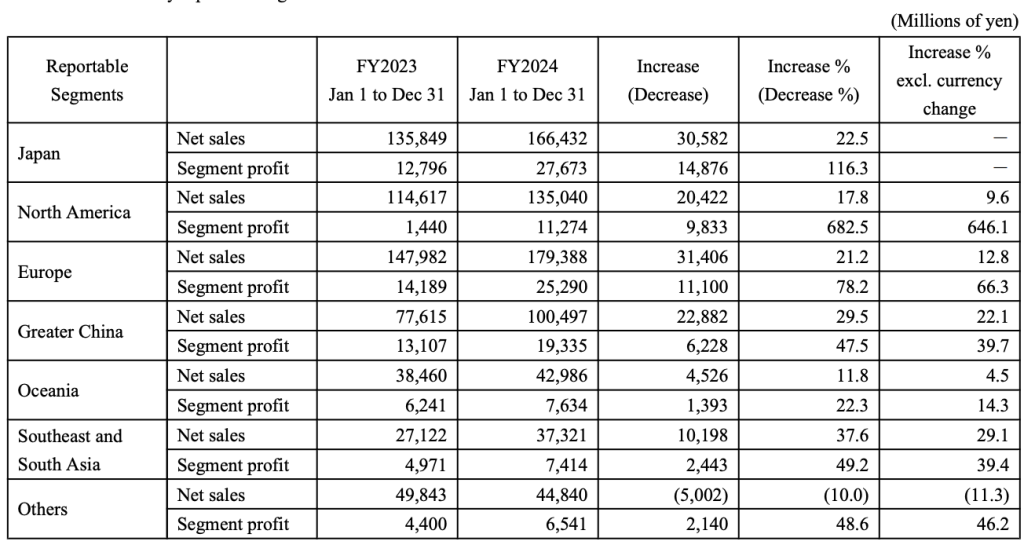

Regional (Segment) Summary

Japan region net sales increased 22.5 percent to ¥166,432 million, reportedly due to the strong sales of the SportStyle category and the Onitsuka Tiger category. Segment profit increased significantly 116.3 percent to ¥27,673 million, said to be mainly due to an improvement in gross margin, as well as due to the impact of the increase in net sales. Operating margin was 23.5 percent for the year, up 12.7 percentage points from the prior fiscal year.

“In addition to the strong sales to inbound visitors, we see these as the fruit of the selection and concentration approach that we have been taking,” the company noted in its annual report.

North America region net sales increased 17.8 percent to ¥135,040 million in 2024, reportedly due to the strong sales of the Performance Running category and the SportStyle category.

Segment profit increased significantly, jumping 682.5 percent to ¥11,274 million, said to be mainly due to an improvement in gross profit margin, as well as due to the impact of the increase in net sales. Operating margin was 8.3 percent of sales, up 7.0 points from the previous fiscal year rose by 7.0 percentage points versus fiscal 2023.

Europe region net sales increased 21.2 percent to ¥179,388 million due to the strong sales in all categories. Segment profit increased 78.2 percent to ¥25,290 million in 2024, said to be mainly due to an improvement in gross profit margin, as well as due to the impact of an increase in net sales.

Greater China region net sales increased 29.5 percent to ¥100,497 million due to the strong sales in all categories. Segment profit increased 47.5 percent to ¥19,335 million mainly due to the impact of an increase in net sales.

Oceania region net sales increased 11.8 percent to ¥42,986 million due to the steady sales in all categories. Segment profit increased 22.3 percent to ¥7,634 million mainly due to the impact of an increase in net sales.

Southeast and South Asia regions net sales increased 37.6 percent to ¥37,321 million due to the strong sales in all categories. In rapidly growing Thailand, Malaysia and Indonesia, net sales rose by more than 30 percent from the prior fiscal year. Vietnam net sales grew significantly, jumping more than 70 percent year-over-year. Segment profit increased 49.2 percent to ¥7,414 million mainly due to the impact of the increase in net sales.

Other regions net sales decreased 10.0 percent to ¥44,840 million due to the impact of the sale of Haglöfs AB in December 2023 and its exclusion from the scope of consolidation. Segment profit increased 48.6 percent to ¥6,541 million in 2024.

Outlook

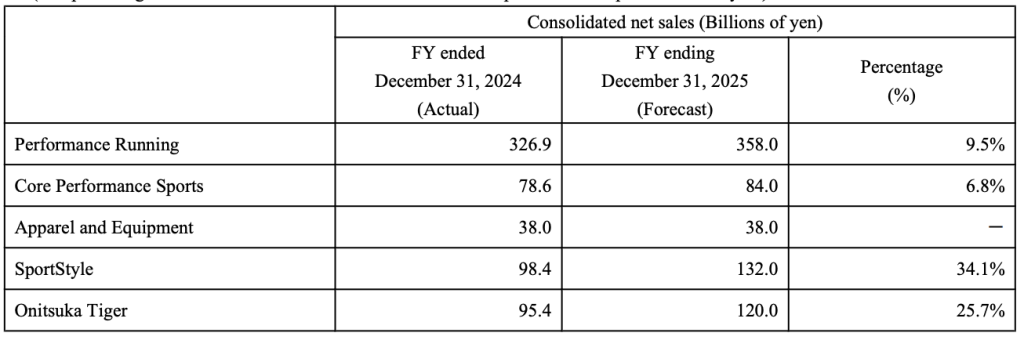

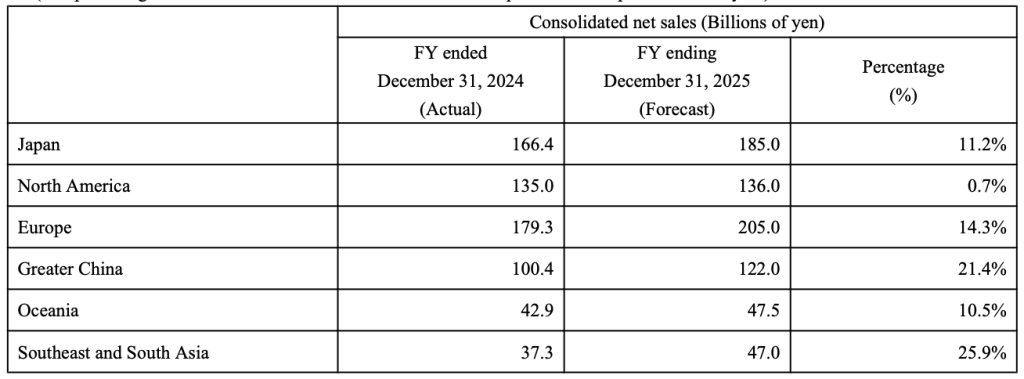

For the fiscal year ending December 2025, Asics Corporation said it expects increased revenue and profit by incorporating further growth in Performance Running, SportStyle, and Onitsuka Tiger, and by striving to improve profitability through disciplined control of selling, general, and administrative expenses.

Forecast of consolidated business results for the fiscal year ending December 31, 2025 is as follows:

Forecast of consolidated net sales by category for the fiscal year ending December 31, 2025 is as follows:

Forecast of consolidated net sales by region for the fiscal year ending December 31, 2025 is as follows: