The Asics North America (ANA) region delivered it fifth consecutive quarter of growth within the wholesale channel in the 2025 first quarter as management said it increased demand for products across the Performance Running, SportStyle and Core Performance sport categories.

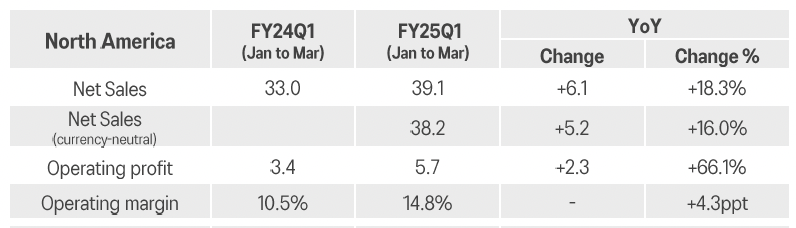

Net sales for the region, which is comprised of the U.S., Canada and Mexico, increased 16.0 percent in local currencies (+18.3 percent reported) to $256.4 million (¥39,133 mm) in Q1, said to be due to strong sales in the Performance Running category and the SportStyle category.

Sales in the U.S. were pegged at $220.0 million (¥33,647 mm) in the first quarter.

The significant growth in net sales in the SportStyle category and improved profitability at company owned-retail stores reportedly contributed to a strong 4.3 percentage points increase in the operating margin to 14.8 percent of net sales.

Asics reported that each country in the region saw double-digit growth (measured in local currency) and overall net sales growth in the first quarter of Q1 2025.

ANA said it saw a profit in all three divisions – Wholesale, Retail and E-Commerce – with Wholesale delivering its fifth consecutive quarter of growth.

“We are very pleased to see the growth across our divisions, fueled by strong response and demand for a number of our products in the various categories,” said Koichiro Kodama, president and CEO, Acics North America. “As the year continues, and even when faced with uncertainties, we remain strongly committed to the success of our industry and supporting and collaborating with our key partners. As a brand we recognize the importance of movement, not only for the body, but also the mind.”

The U.S. Wholesale channel was up 37.6 percent year-over-year in the first quarter. The region’s run specialty and sporting goods channels both saw double-digit growth year-over-year.

The growth across the run specialty trade channel in the first quarter was said to be due to the “significant demand” for the Novablast family of products, along with strong sales of two key legend models: the Gel-Cumulus and Gel-Nimbus. The primary growth drivers for the Sportstyle category, contributing to triple-digit growth this quarter over the previous year, were the Gel-1130 and GT-2160 models.

ANA said the Asics Core Performance Sports category, which includes the brand’s tennis offering, increased 15 percent year-over-year in Q1. This is in contrast to the Asics Corp. global category performance as Core Performance Sports only grew 2.5 percent year-over-year across the consolidated global business. The Gel-Resolution reportedly led the way in sales in the category, posting near 50 percent growth compared to the first quarter last year. The Dedicate family and the Solution Speed models also reportedly contributed to the overall category growth.

ANA said that another notable increase in Q1 was the triple-digit growth of skateboarding sales.

Within the Asics Retail division, Manhattan’s Meatpacking District Store saw growth in Q1 compared to the previous year.

ANA segment profit increased 66.1 percent (+64.9 percent in local currencies) year-over-year to ¥5,772 million ($37.8 mm) primarily due to the impact of an increase in net sales.

North America Outlook

* * * * *

Asics Corporation 2025 First Quarter

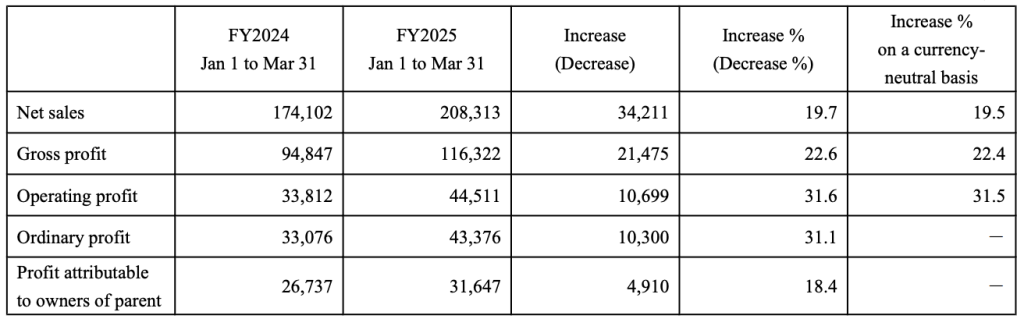

Asics Corporation reported 2025 first quarter net sales amounted to ¥208.3 billion, a 19.7 percent increase year-over-year.

Category Summary

Performance Running

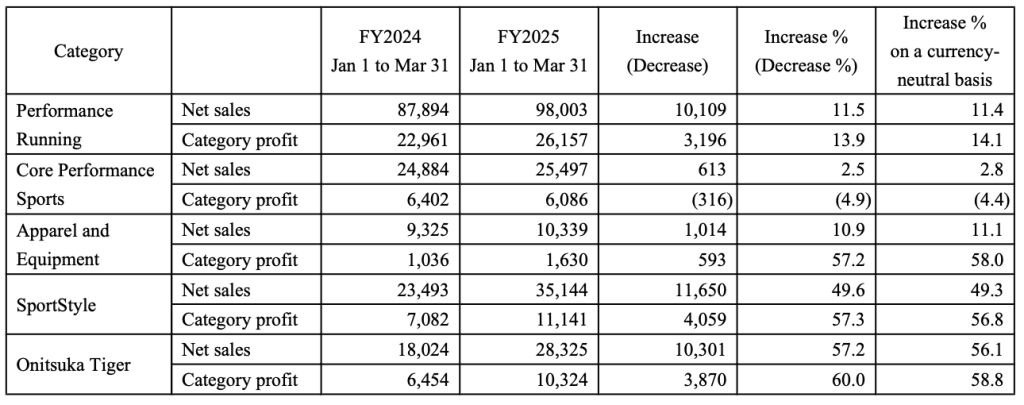

The focus on high-end products in the Performance Running category was said to be successful, resulting in net sales growth of 11.5 percent year-over-year. In particular, Asics Japan, the Europe region, and the Southeast and South Asia regions grew significantly.

SportStyle

In the SportStyle category, net sales “grew significantly” in all regions, posting growth of 49.6 percent year-over-year, reportedly due to continued strong sales of Vintage Tech products. The company said it plans to host an event during Paris Fashion Week in June to further heighten its presence as a premium lifestyle brand.

Onitsuka Tiger

Net sales of the Onitsuka Tiger category increased 57.2 percent year-over-year, continuing its strong growth. Asics Japan reportedly “enjoyed strong inbound demand,” but the Europe region, the Greater China region, the Oceania region, and the Southeast and South Asia regions also saw “significant increases” in net sales.

“We have been taking steps to elevate our brand value globally, with initiatives that include taking part in Milan Fashion Week and opening a flagship store in Barcelona, Spain,” the company said in its Q1 report.

Region Summary

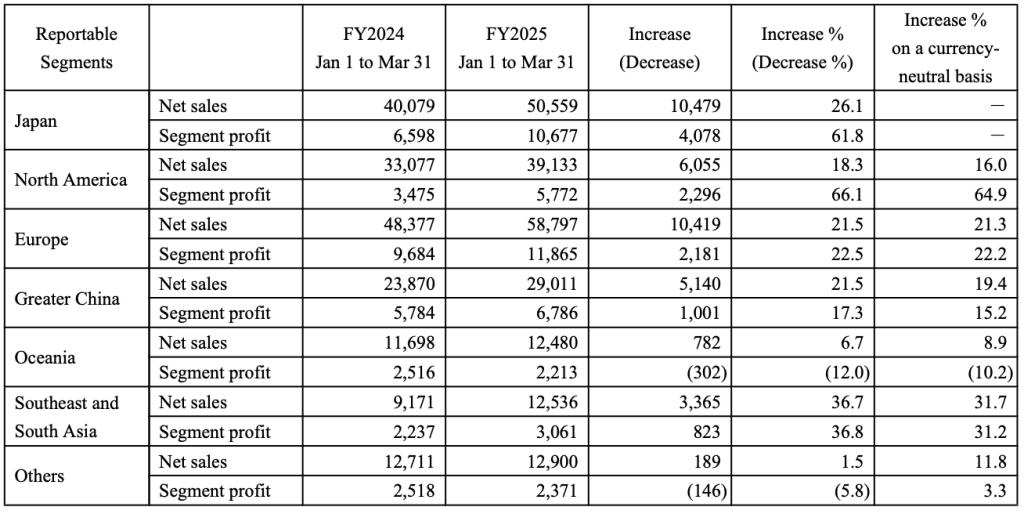

Net sales reportedly increased year-over-year across all regions.

Japan

Net sales increased 26.1 percent to ¥50,559 million due to the strong sales of the Performance Running category and the Onitsuka Tiger category. Sales to inbound tourists reportedly “increased significantly” – up ~150 percent year-over-year – with strong performance continuing not only for the Onitsuka Tiger category but also for Asics.

Due to an improvement in gross margin, the operating margin reached 28.5 percent – up 6.7 percentage point year-over-year. Segment profit increased 61.8 percent to ¥10,677 million mainly due to an improvement in gross profit margin, as well as due to the impact of an increase in net sales.

Europe

Net sales increased 21.5 percent to ¥58,797 million due to the strong sales in all categories. Steady growth in the Performance Running category reportedly served as the core driver, while growth of 48.7 percent in the SportStyle category also contributed to the overall regional growth, resulting in an operating margin of 20.2 percent (+20 basis points).

Segment profit increased 22.5 percent to ¥11,865 million mainly due to the impact of an increase in net sales.

Greater China

Net sales increased 21.5 percent to ¥29,011 million in Q1, reportedly due to the strong sales in all categories. Segment profit increased 17.3 percent to ¥6,786 million mainly due to the impact of an increase in net sales

Oceania

First quarter net sales in the Oceania region increased 6.7 percent to ¥12,480 million, reportedly due to the steady sales in almost all the categories. Segment profit decreased 12.0 percent to ¥2,213 million, said to be due to deterioration of the gross profit margin, despite the increase in net sales and other such factors.

Southeast and South Asia

Net sales increased 36.7 percent to ¥12,536 million in the Southeast and South Asia region in Q1 due to the strong sales in all categories. Segment profit increased 36.8 percent to ¥3,061 million mainly due to the impact of an increase in net sales.

Other regions

Net sales increased 1.5 percent to ¥12,900 million due to the steady sales of the Core Performance Sports category and the SportStyle category. Segment profit decreased 5.8 percent to ¥2,371 million due to the increase in selling, general and administrative expenses.

Global Outlook

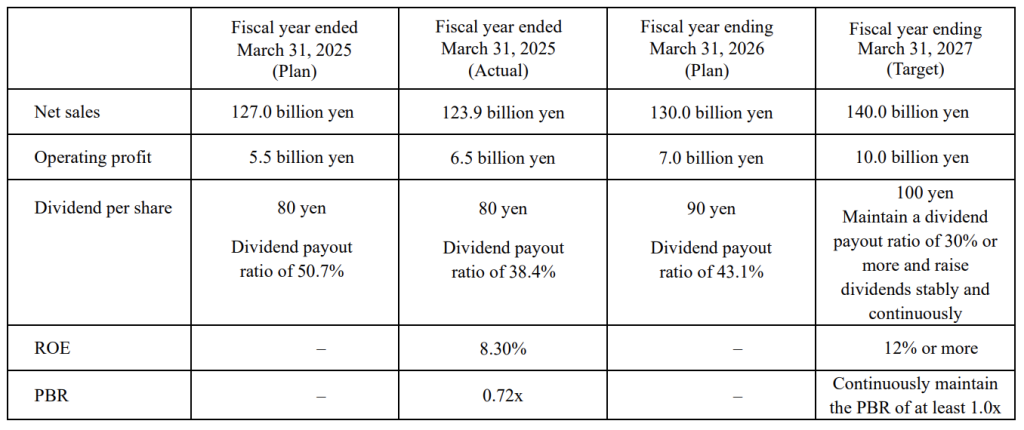

The company said it was maintaining its outlook for the year ahead.

Image/Charts courtesy Asics