Amer Sports CEO James Zheng confirmed on a conference call with analysts Tuesday what many in the market expected – that Arc’teryx is a breakout growth story with unprecedented growth and profitability for the outdoor industry, and is charting new territory with its disruptive DTC model and strong competitive position.

That about wraps up the story for Amer’s Technical Apparel segment in the 2024 second quarter.

In truth, Amer’s Technical Apparel segment was just getting started, increasing revenues 34 percent (+38 percent constant-currency) year-over-year to $407 million in the second quarter, led by the Arc’teryx brand and strong double-digit growth in omni-comp performance in the quarter, a unique metric utilized by Amer Sports that the company’s CFO Andrew Page defined for the audience.

“Our omni-comp metric incorporates growth from both owned retail stores and e-commerce sites that have been open at least 13 months. Arc’teryx DTC momentum was fueled by both new and existing consumers, and both strong traffic and conversion trends in stores and on-line,” he explained.

The segment also includes the Peak Performance brand.

Page said segment growth was fueled by 39 percent DTC expansion, including a 26 percent omni-comp result, which he called “a great result” considering it had to comp against an 80 percent omni-comp last year in the second quarter.

“The Arc’teryx brand continues to experience broad-based strength, and is outperforming across every region, channel, and category. DTC remains the core growth engine, but we also experienced strength in the Wholesale channel, which grew 24 percent for the segment,” Page added.

“Arc’teryx delivered another very strong quarter with healthy growth across all regions, channels, and categories, especially footwear, women’s, and hardshell jackets,” Zheng shared. “Arc’teryx’s world-class products, plus the authentic and deep connection with consumers is allowing us to have strong success in large new categories, such as footwear and women’s. And also incredible momentum across all major geographies.”

Regionally, Page said Technical Apparel growth was led by Asia Pacific, followed by Greater China, and the Americas, which were partially offset by declines in EMEA.

“Arc’teryx is generating strong results in Europe, especially new store openings, but this is off a small base, and was offset by a decline in Peak Performance, which continues to go through a brand reset to focus on greater full-price selling,” Page added.

Zheng said that globally, Arc’teryx is executing that retail expansion plan well, opening 17 net new brand stores in the first half, including 13 net new locations in the second quarter, bringing the total owned brand store count to 125.

Key new locations in the most recent quarter included Bloor Street in Toronto, as well as Le Marais and La Madeleine in Paris, which have “emerged as standout locations with high engagement” from local consumers in France.

“We also opened three stores in Greater China, and one Los Angeles store in Brentwood. All of these new stores have performed exceptionally well,” Zheng said. “We are also excited to open our NYC Soho flagship this week with [the] grand opening set for early September.”

He said this new “Alpha store” will feature our most pinnacle expression of ReBIRD yet, including shoppable REGEAR in-store for the first time, a large ReBIRD Service Center facility for care and repair, and much more. ReBird is product design for circularity – and is the home for all the brand’s initiatives in care and repair, resale and upcycling.

In May, Arc’teryx also recently opened a cutting edge creation center in Tokyo. This design space will serve as an innovation hub reflecting local creativity, culture and the outdoor community.

Zheng noted that Arc’teryx recently launched its first footwear line that was designed, developed, and sourced by the brand’s in-house footwear team. He said they continue to be extremely pleased with the reception to what they believe is the best line of technical performance footwear designed for the mountain athlete.

“Since the launch, penetration of footwear to Arc’teryx total revenues has jumped from 6 percent to 10 percent, often selling out of our most popular styles, especially the Kragg,” Zheng shared. “Because of the unique position of Arc’teryx footwear in the market, the strong sales in our DTC channel, and enthusiastic interest from key wholesale accounts, our confidence is growing that footwear will become a very sizeable and profitable growth avenue for the brand both in own stores and brand-relevant wholesale accounts.”

He also said the women’s business continues to perform extremely well, growing faster than the brand overall.

“Women’s outperformance is driven by Softshell and Windshell, particularly the Gamma and Squamish franchises,” he detailed. “Women’s share of sales is already more than 20 percent of the business, and we see great upside in the category as we add more colorways, models and style options that resonate with her.”

Zheng also had a quick update on the call about the brand’s new ePE product, which complies with the ban on PFAs “forever” chemicals traditionally used in waterproof materials.

“Sales of our iconic Beta Jacket have accelerated since switching to compliant materials. Our customers love the look, feel and performance of the new material,” he said.

Segment Operating Margin

The Technical Apparel segment adjusted operating margin expanded 110 basis points to 14.2 percent, driven primarily by gross margin from favorable channel and geographic mix. The Technical Apparel segment margin also benefited from modest SG&A leverage on Arc’teryx’s strong sales growth, while continuing key growth investments.

Segment Outlook

Looking ahead, Amer sees the Technical Apparel segment posting greater than 30 percent revenue growth for the 2024 full year with segment operating margin slightly above 20 percent.

“Arc’teryx is a breakout growth story with unprecedented growth and profitability for the outdoor industry, and is charting new territory with its disruptive DTC model and strong competitive position,” added Zheng. “Arc’teryx’s world-class products plus the authentic and deep connection with consumers is allowing us to have strong success in large new categories, such as footwear and women’s. And also incredible momentum across all major geographies.”

Consolidated Amer Sports Results

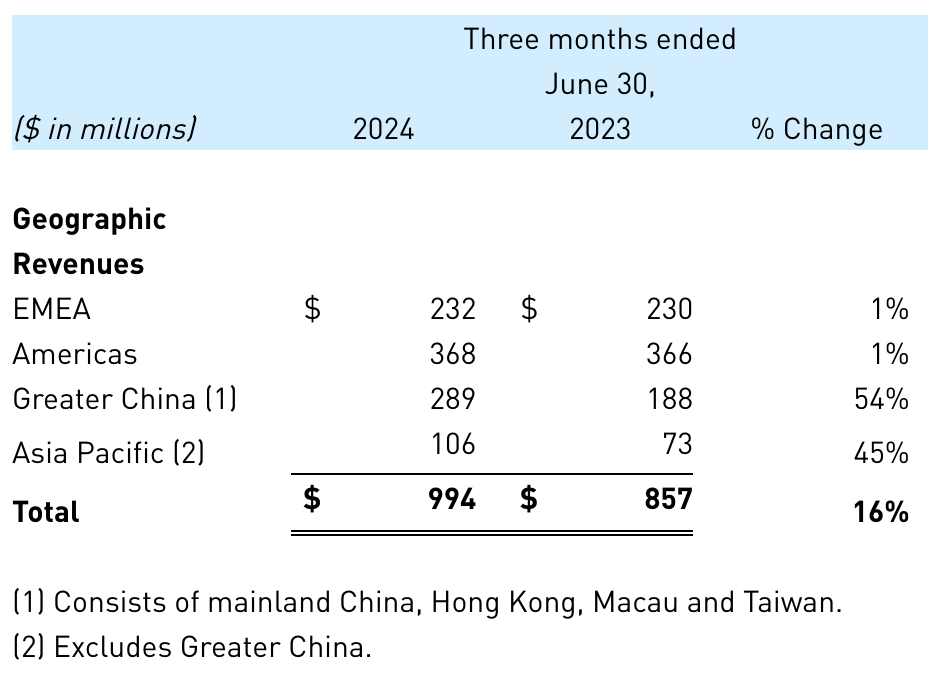

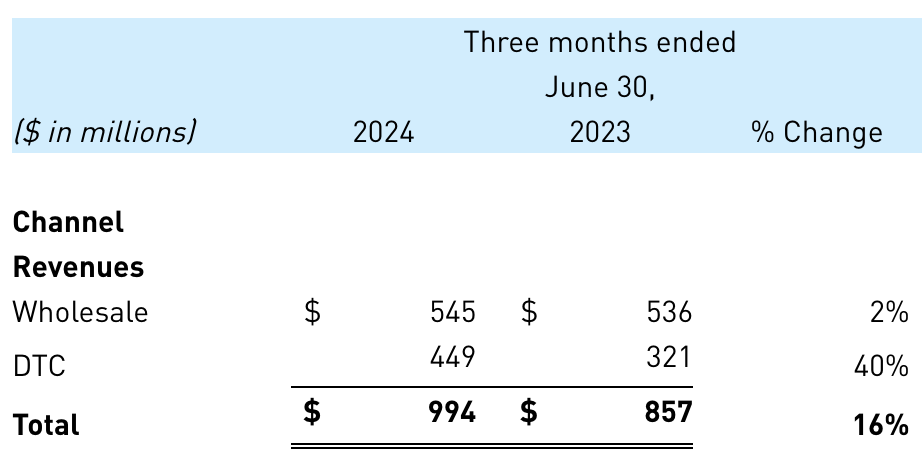

On a consolidated basis, Amer Sports Inc. reported that second quarter revenue increased 16 percent to $994 million, and increased 18 percent year-over-year on a constant currency (cc) basis.

“We generated 16.0 percent sales growth in Q2, or plus-18 percent on a constant currency basis led by our flagship brand, Arc’teryx,” concluded CEO Zheng. “Although we benefited from a 2-point shift of wholesale shipments from 3Q into 2Q, our underlying growth momentum is clear. We achieved nearly a 3 percent adjusted operating margin, also well above our expectations, as we continue to enjoy strong gross margin expansion driven by the pricing power of our brands and a healthy mix-shift toward our highest-margin franchise, Arc’teryx.”

Region Summary

Segment Summary

Outdoor Performance, which is primarily comprised of Salomon brand sales with 66 percent of total sales, increased 11 percent (+13 percent cc) to $304 million. Outdoor Performance operating margins increased 380 basis points to negative 2.1 percent of sales in the quarter.

Go Here for more details on Salomon’s second quarter.

Ball & Racquet Sports, primarily comprised of the Wilson Sports business, increased 1 percent (+2 percent cc) to $283 million. Segment operating margin decreased 160 basis points to 1.1 percent of sales in the Q2 period.

Go Here for more details on Wilson’s second quarter.

Channel Summary

Income Statement Summary

Gross margin increased 220 basis points to 55.5 percent; Adjusted gross margin increased 200 basis points to 55.8 percent.

Selling, general and administrative (SG&A) expenses increased 26 percent to $560 million in Q2, with Adjusted SG&A expenses increased 21 percent to $526 million for the period.

Operating loss was for the quarter was $9 million compared to operating profit of $8 million for the second quarter 2023. Adjusted operating profit increased 40 percent to $29 million for the Q2 period.

Operating margin decreased 180 basis points to negative 0.9 percent, with expansion un the Arc’teryx business offsetting weakness in the Salomon and Wilson Sports businesses. Adjusted operating margin increased 50 basis points to 2.9 percent of sales for the quarter.

The company’s net loss decreased 98 percent to $4 million, or a loss of one cent per diluted share, in the quarter. Adjusted net income increased 129 percent to $25 million, or 5 cents diluted earnings per share, in Q2, compared to a net loss in Q2 2023.

In the second quarter, Amer Sports recognized an incremental tax benefit of $20 million related primarily to the resolution of uncertain tax positions, which benefited Q2 diluted EPS by approximately 4 cents per share. Additionally, approximately $20 million of wholesale orders shipped earlier than anticipated, which benefited Q2 sales growth by approximately 2 percent and diluted EPS by 1 cent per share. These timing shifts do not impact the full year guidance.

Balance Sheet Summary

Inventories increased 2 percent year-over-year, below the 16 percent revenue growth for the quarter and are said to be in a healthy position.

“Our focus on inventory discipline is paying off as inventories finished Q2 in healthy condition, up only 2 percent year-over-year vs. 16 percent sales growth. Within our target to grow inventories in-line with, or slower than, sales,” Page noted.

Net debt was $1.820 billion at quarter-end, and Cash and equivalents totaled $256 million at June 30, 2024.

“Using the midpoint of our 2024 implied adjusted operating profit guidance, our net-debt-to-adjusted-non-IFRS-EBITDA ratio is already approximately 2.6x,” Page explained. “Deleveraging our balance sheet remains a priority, and our goal is to reduce our leverage ratio to 1.5x or better over the next few years through both EBITDA expansion AND debt pay down.”

Outlook

Digging into the outlook, CFO Page said, “Our strong financial performance in Q2 reinforces my confidence in our near- and long-term path forward. Organic revenue growth in the high-teens and significant gross- and operating-margin expansion reflects the combination of great brands, strong management execution, and a disciplined approach to expenses and working capital. These outstanding results give us the confidence to raise our full-year sales and earnings guidance.”

Zheng is confident in the company’s forecast in part because of its focus on China growth, a concern for some analysts that fear the slow-down in that market could have negative implications for Amer, and Arc’teryx in particular, due to its reliance on that market. But the CEO tackled that question head on.

“While other consumer companies are having challenges in Greater China, we generated more than 50 percent growth there as we continue to well outperform the market. Importantly, we are seeing strong momentum across all of our Big 3 brands,” Zheng noted.

“A few reasons I would like to highlight, why we are doing so well in China:

“Number one: Our brands compete in one the healthiest and fastest-growing consumer segments in China: the premium sports and outdoor market. The outdoor trend in China is very strong. Even beyond the traditional male consumer, the outdoor category is attracting younger consumers, female consumers, and we also see more luxury shoppers spending in our categories.

“Second: The China consumer landscape today has evolved into a market of winners & losers, with some brands doing extremely well, and others underperforming. Our still small, specialized brands with deep expertise and high quality and performance resonate strongly with Chinese shoppers.

“Thirdly and most important: We believe we have the best team in China. Our deep expertise and unique, scalable operating platform gives us a significant competitive advantage across the portfolio,” he concluded.

Full-Year 2024

For the full year, Amer Sports now expects revenue growth of 15 percent to 17 percent which incorporates greater than 30 percent growth in Technical Apparel, mid- to high-single-digit revenue growth in Outdoor Performance, and low- to mid single-digit growth in Ball & Racquet Sports.

“We are increasing our adjusted gross profit margin guidance from approximately 54.0 percent to approximately 54.5 percent,” Page said. “We also are raising our guidance for our full-year operating margin, and now expect adjusted operating margin toward the high-end of our previous 10.5-11.0 percent range.”

On an adjusted basis, Amer Sports sees Full Year 2024:

- Reported revenue growth: 15 percent to 17 percent

- Gross margin: approximately 54.5 percent

- Operating margin: toward high-end of 10.5 percent to 11.0 percent

- D&A: approximately $250 million, including approximately $110 million of ROU depreciation

- Net finance cost: $200 – $220 million, including approximately $15 million of finance costs in the first quarter 2024 that will not be recurring

- Effective tax rate: approximately 38 percent

- Fully diluted share count: 500 million

- Fully diluted EPS: 40 cents to 44 cents per share

Third Quarter 2024

Amer Sports expects third quarter consolidated revenue to grow 12 percent to 13 percent, led by Technical Apparel.

“A reminder that in Q3, we will face our most challenging growth comparison of the year,” Page noted. “We expect Q3 adjusted gross margin to be approximately 54 percent driven primarily by the mix shift towards Technical Apparel, and an adjusted operating margin between 11.0 and 12.0 percent.”

On an adjusted basis, Amer Sports sees Third Quarter 2024:

- Reported revenue growth: 12 percent to 13 percent

- Gross margin: approximately 54.0 percent

- Operating margin: 11.0 percent to 12.0 percent

- Net finance cost: $45 million to $50 million

- Effective tax rate: 50 percent to 55 percent

- Fully diluted share count: 510 million

- Fully diluted EPS: 8 cents to 10 cents per share

Image courtesy Arc’teryx

See below for additional SGB Media coverage of Arc’teryx sister brands Salomon and Wilson:

EXEC: Salomon Sees North America Q2 Wholesale Cut into 55 Percent Jump in Global DTC

EXEC: Wilson Sports Returns to Growth in Q2, but Sees Bigger Gains Ahead