Adidas’ surprise profit warning for 2023 last week signaled to analysts that the fallout from the Yeezy break-up would be worse than expected and the sales recovery under new CEO Bjorn Gulden would take longer than forecast.

According to a company statement issued last Thursday, Adidas said if it decided not to sell excess Yeezy inventory as currently intended, operating profits would be reduced by €500 million, and sales would be negatively impacted by €1.2 billion.

Under this scenario, currency-neutral sales could decline at a high-single-digit rate in 2023, below Wall Street’s consensus estimate that called for a 4 percent growth.

Adidas also said it expected one-off restructuring costs of up to €200 million in 2023 as part of a “strategic review the company is currently conducting aimed at reigniting profitable growth as of 2024.”

With the restructuring charge and write-offs from not selling Yeezy product, underlying operating profit for 2023 is projected to be around break-even versus Wall Street’s consensus estimate that had called for an operating profit of $1.02 billion.

“The numbers speak for themselves. We are currently not performing the way we should,” said Gulden, who joined Adidas as CEO from rival Puma on January 1. “2023 will be a year of transition to set the base to again be a growing and profitable company.”

The update marked Adidas’ fourth profit warning in less than six months.

Adidas also reported preliminary results for 2022 that were in line with updated guidance issued in November 2022. Revenue reached €22.5 billion, up one percent on a currency-neutral basis and compared with guidance in the low-single-digits. Net income came in at €254 million, in line with consensus targets.

Gulden said, “Adidas has all the ingredients to be successful—a great brand, great people, fantastic partners, and a global infrastructure second to none. We need to put the pieces back together again, but I am convinced that over time we will make Adidas shine again, but we need some time.”

Shares of Adidas on the Frankfurt Stock Exchange fell €17, or 10.9 percent, to €139.26, representing a loss of half its value since mid-2021. Shares had rallied 66 percent since Gulden’s appointment as CEO.

Analysts roundly slashed their guidance for 2023 in line with or more than Adidas’ guidance and downwardly adjusted estimates for 2024. Many also reduced their price targets for Adidas.

Baird lowered its price target to €125 from €145 while pointing to “very low visibility” given the surprising nature of the release just before earnings come out.

Baird analyst Jonathan Komp said Adidas faces balance sheet concerns as Moody’s in early November cut the outlook for Adidas’ credit ratings to negative and Baird’s expectation that Adidas would likely continue to show negative free cash flow in the near term. Komp wrote, “We think Adidas may face credit downgrades and potential questions about current liquidity (dividend at risk?), balance sheet concerns and competitive pressures from Nike.”

More broadly, Komp wrote the commentary from Adidas, with the recent cautious update last week from Under Armour and others, “highlights a highly challenging current environment tied to uncertain demand, elevated channel inventory, and lower wholesale expectations. We suspect NKE’s brand strength and own clearance actions may also be placing added pressure on secondary brands in the marketplace.”

DZ Bank downgraded Adidas from “Buy” to “Hold” and lowered its price target to from €155 to €138.

Analyst Thomas Maul wrote that it’s likely that Adidas’ return to healthy growth would take longer than previously assumed, with challenges in China also impacting results beyond the Yeezy situation. He still noted that cautious guidance was expected under the new CEO. He stated, “The fact that a new CEO clears the air and starts in office with conservative targets is basically no surprise.”

Bernstein kept its “Market-Perform” rating and its price target of €135.

“We expected a kitchen sinking… just not so soon,” wrote Aneesha Sherman. “This is the main reason we have been cautious about upgrading Adidas over the last few months despite liking the LT growth story and the price. We expected another reset by the new CEO, either at Q4 results or perhaps even Q1, but certainly not one month into his tenure.”

Sherman said the guide calling for high-single negative growth on a currency-neutral basis for 2023 hinted that Adidas faces problems well beyond Yeezy. Sherman wrote, “We are concerned about the underlying health of the business that would drive such a drastic guide-down, even after stripping out the Yeezy impact. The sales guide suggests negative YoY growth ex-Yeezy, stemming from structural issues that may last longer than this reset year, e.g., lack of innovation, poor execution, e.g., the long-delayed basketball launch, too much inventory clearance hurting the brand, and hundreds of China store closures.”

Credit Suisse’s Simon Irwin maintained his “Underperform” rating and his €103 price target. He wrote, “In our opinion, this guidance confirms our view that the brand is very weak and the Adidas recovery will be slower than the market expects, and that the EBIT margin structure has been more damaged by the loss Yeezy (negative 190 basis points) and the normalization of margins in China ( negative 350 basis points).”

Irwin assumed the profit downgrade resulted from weaker gross margins and more operating de-leverage. He believes cost leverage or cost cutting will be necessary to drive EBIT margin improvement in the near term, but restructuring activities will challenge that. He wrote, “CEO Bjorn Gulden faces a tricky challenge of rebuilding the brand while simultaneously engaging in some quite significant restructuring.”

At Hauck & Aufhäuser, analyst Christian Salis reiterated his “Sell” rating and lowered its price target to €70 from €78. He said, “The release fully underpins our view that the company continues to struggle with multiple company-specific issues, which should be hard to overcome.”

Salis said the update confirmed that a rebranding of the Yeezy line was unlikely under Gulden following indications by former management that a rebranding was being explored to liquidate product.

Salis said that beyond the Yeezy exit challenges, Adidas continues to be held back by a lack of innovation. He wrote, “Having relied on its Originals business, especially since 2014, Adidas failed to initiate a new innovation cycle, leading to market share losses against Nike. At the same time, Adidas’ aggressive DTC shift led to frustration among retailers, enabling rivals such as Puma to fill the gap. Furthermore, Adidas’ organizational structures seem to lack efficiency, explaining why the company is seen to book €200 million one-off expenses in FY 23E.”

In China, Salis believes Adidas’ struggles are “disproportionally” due to an inefficient distribution network, including e-commerce, and the brand is losing market share there to Nike and local brands such as Anta. He also cited recessionary conditions in Europe as another hurdle for Adidas to overcome this year. Wrote Salis, “Against this backdrop, it remains questionable whether new CEO Gulden will be able to restore Adidas’ glory.”

Deutsche Bank’s Adam Cochrane retained his “Buy” rating on Adidas while lowering his price target to €160 from €170. He wrote, “In November, there was an expectation that much of the impact from not selling Yeezy could be mitigated in 2023, including a €300m saving from less royalties and direct marketing, but this is no longer the case.”

Cochrane suspects investors will focus on what a sustainable margin for Adidas looks like in the future without the profitable Yeezy or Russian businesses and a smaller business in China. Cochrane wrote, “The new Adidas CEO is making his mark. Investors will likely sit up and take notice as he has now rebased the earnings expectations and has a clean slate to start a new chapter for Adidas.”

Guggenheim kept its “Neutral” rating and does not have a price target.

Guggenheim’s Robert Drbul expects 2023 will be a year of transition for Adidas as it sets itself for profitable growth in 2024. He wrote, “We remain Neutral on Adidas as we await more visibility on an updated strategy from recently appointed CEO Bjørn Gulden as well as traction on its product innovation initiatives in the highly competitive and increasingly promotional athletic industry. While we do not anticipate any long-term strategy update on the March call, we look forward to hearing his initial thoughts on the company.”

RBC Capital Markets kept its “Perform” rating on the stock and reduced its price target to €110 from €130.

Analyst Piral Dadhania wrote in a note, “We were largely expecting ADS to book all one-off costs in FY23E including ‘CEO investment’ given Bjorn Gulden’s new tenure (see note). What has caught us by surprise is lower underlying guide and less apparent add-back contribution resulting in materially worse FY23E financial outlook than expected. There is a lot of work to be done across corporate culture, product, lower sell-through rate, excess inventory and digesting Yeezy exit, all of which can be done but will take time.”

Warburg Research maintained its “Buy” rating and slightly lowered its price target to €175 from €185.

Warburg’s Jörg-Philipp Frey wrote, “This guidance reflects, in our view, kitchen-sinking at its best by incoming CEO Björn Gulden. We follow the guidance in assuming a EUR 1.2bn sales hit from Yeezy and include the mentioned EUR 500m profit impact in our model as well as the EUR 200m in one-time expenses. However, to our understanding, this guidance is based on very cautious assumptions regarding EMEA and the Americas while stressing the lack of visibility on as regards the reopening in Chinese. We therefore do not follow this guidance, but rather subtract EUR 1.2bn from our current sales estimates and lower our earnings estimates by some EUR 700m to reflect the one-time/Yeezy impact. This release should finally mark the trough of the news cycle and we expect adidas to surprise positively in light of this undemanding guidance. We therefore reiterate our Buy rating and would use this setback to increase positions.”

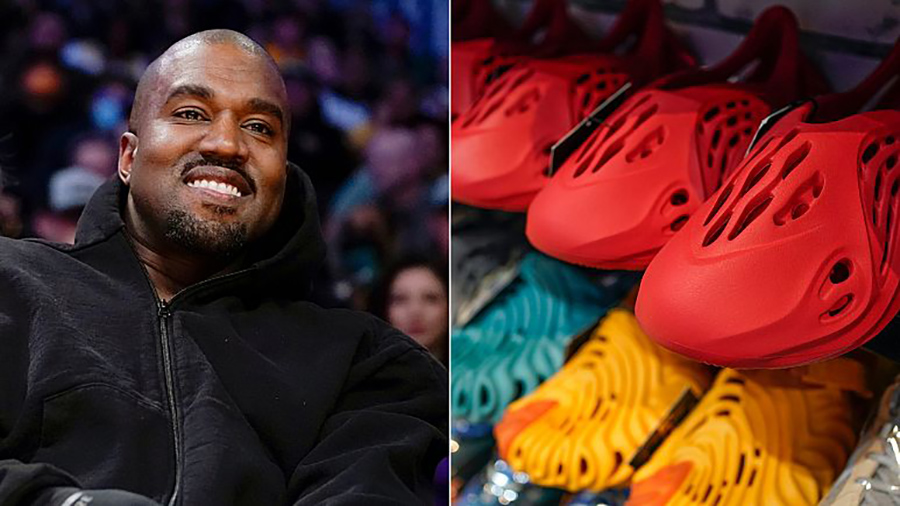

Photo courtesy AP