The whipsaw effects of Trump Administration tariff moves on April 2 that continued into the following week were felt far and wide, from small retailers and nascent brands to larger retailers, Asian manufacturing giants and publicly-traded companies with large brands with high exposure to the tariff increases. At issue for many executives working on a reaction and strategy is the uncertainty of what could actually happen over the next 90 days.

As anyone with a TV or and Internet connection knows, Trump’s Independence Day turned much higher tariff rates for all countries that trade with the U.S. into a 90-day pause in increases above a new 10 percent baseline tariff except for China, which saw tariffs climb to 145 percent as the President kept playing tit-for-tat on tariffs with Chinese President Xi Jinping. There are also several other side deals (such as the exclusion of product from Mexico and Canada covered under the USMCA deal negotiated during Trump 1.0 and adding 25 percent tariffs on automobiles, steel and aluminum products) negotiated or imposed as the Trump Administration assessed the domestic impact of its actions, including reciprocal tariffs from many of the nation’s largest and longest-running trading partners, and all before Trump provided relief for a new buddy, Apple CEO Tim Cook, as he excluded cell phones and other electronics from the tariff impact.

The news has not been filled with companies pulling the trigger on reactions related to the higher tariffs, except for a few isolated events, including Rip Curl, Oboz, and Passenger, re-routing product deliveries, or suspending activity in the U.S. market. Some Asian footwear manufacturers are assessing the impact, with at least one factory group’s Q1 profit warning that gross margins will come up short for the quarter. It remains to be seen whether the sharp increase in goods coming out of China in February and the softening of shipments in March was a reaction to tariffs or a shift in the Easter holiday week. A full read of the combined March/April retail report will be important to assess.

For the most part, Wall Street has held its powder as uncertainty has frozen many from making early moves and offering direction to clients. The landscape on April 21 differs significantly from initial impressions on April 3. However, analysts have been hard at work interviewing retailers and brands, conducting store checks and assessing the ongoing transition in the tariff policies. Some have come out with strong positions on the market effect.

“We are lowering estimates and price targets across our coverage, reflecting an average reduction of the P/E multiple by 20.4 percent. We are also downgrading DKS [Dick’s SG] & SCVL [Shoe Carnival] from Buy to Hold, SHOO [Steve Madden] from Hold to Sell, and upgrading GOOS [Canada Goose] from Sell to Hold, and lowering estimates and price targets on all companies in our coverage,” was the message from Williams Trading on April 21 as the firm’s research team, led by Sam Poser, put its cards on the table.

“The uncertainty around the impact of tariffs on margins, pricing and, most importantly, demand has led us to these changes,” said Poser. “Further, we would not be surprised if all the companies in our coverage either do not provide forward guidance or withdraw forward guidance,” he added in an underlined note.

Uncertainty

Poser said that based on Williams Trading’s research team’s checks, it appears that the additional 145 percent tariff on goods from China has frozen product shipments to the U.S., challenging sales and margin opportunities for those brands that rely on China for its products and conduct a large percent of sales in the U.S., calling out Crocs, Inc. (CROX) and Steve Madden (SHOO).

“We also expect that inventory levels in mid-2025 will be very high as companies rush to bring goods into the U.S. ahead of a potential tariff increase after the 90-day reprieve ends for product from countries other than China,” the Williams Trading team noted.

While the Williams note to investors seems limited, the actions on April 21 impacted all companies covered by the firm.

Dick’s SG was downgraded from BUY to HOLD, while Williams Trading reduced the retailer’s Price Target (PT) to $200 from $243 previously.

The firm also downgraded Shoe Carnival to HOLD from BUY and cut its PT to $17 from $30. It also cut Madden to SELL from HOLD and reduced its PT to $16 from $35 previously.

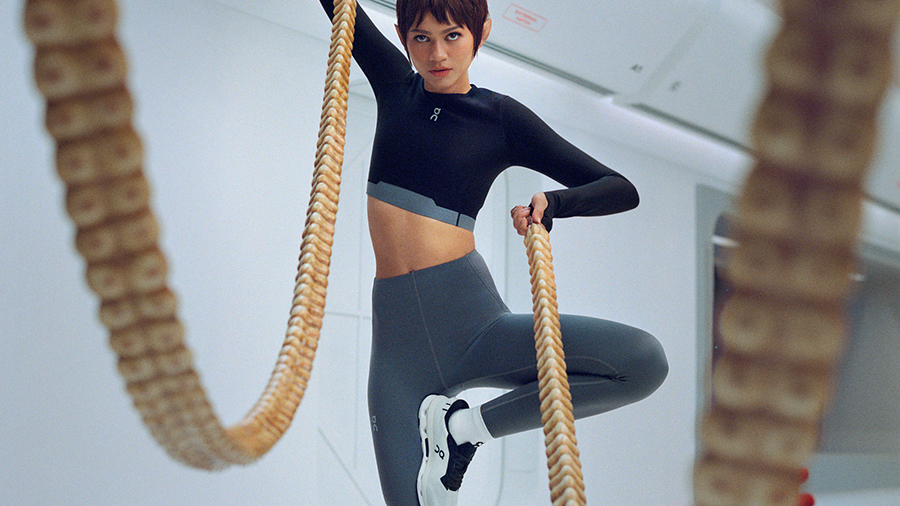

Those experiencing PT cuts included Birkenstock (BIRK), CROX, Foot Locker (FL), Nike (NKE), On Holding (ONON), Skechers (SKX), VF Corp. (VFC), and Wolverine World Wide, Inc. (WWW). Some of those hit hardest included Boot Barn (BOOT), Deckers (DECK) and Under Armour (UA). Williams sees DECK’s PT at $140 per share, while CNBC’s Jim Cramer suggested investors buy it at $120. DECK shares closed down on April 21 to $103.55.

Williams based its assessment partly on China’s sourcing exposure, not lost on the market or the players.

On April 21, it was reported that Xi Jinping spent the weekend visiting Southeast Asian countries, including leading footwear manufacturer Vietnam. The New York Times reported in the early morning of April 21 that China warned countries not to team up against it to gain a Trump tariff relief. This comes as Vietnam and other Southeast Asia manufacturing nations are coming to Washington DC, or have already made the trip, to negotiate total reciprocal trade deals. Reports have circulated that China may be working through details to transship goods through other countries to circumvent the Trump tariff impact.

Smelling Opportunity

Baird upgraded Adidas AG (ADI.F) and Wolverine Worldwide on April 21 to OUTPERFORM, suggesting in an investor note that it sees an improved risk/reward after stock pullbacks. It also reported growing confidence in brand momentum, conservative forecasts and manageable tariff exposure.

Baird reported that the recent pullback presents an attractive entry point, particularly for quality names with visible fundamental drivers and limited earnings risk.

Estimates of the declines that active lifestyle market stocks have seen since Independence Day range from 20 percent to 30 percent, while global apparel and footwear brands have dropped 31 percent year-to-date and are said to be underperforming the overall market.

After a 25 percent decline from recent highs, Baird upgraded Adidas, noting that its company meetings reinforced confidence in the brand’s broadening strength across lifestyle and performance segments. The firm also noted improving wholesale relationships, limited U.S. tariff exposure and “conservative” 2025 earnings guidance.

Wolverine World Wide stock fell 55 percent from peak levels despite minimal direct China-to-U.S. sourcing and low expectations for growth at Saucony, its performance and lifestyle footwear brand, according to Baird’s note.

Baird maintained OUTPERFORM ratings on Planet Fitness Inc. (PLNT), On Holding AG (ONON), DECK, BOOT, Amer Sports (AS), CROX, and NKE.

Changing Landscape

Exemplifying what others are waiting to adjust outlooks on brands and retailers, Citibank’s Citi Research team downgraded VFC and lowered its PT on Columbia (COLM) before the worst of the tariffs were announced.

In a research note on April 7, Citi downgraded VFC from BUY to NEUTRAL to reflect the firm’s forecast decreases and its increasing concern about the company’s ability to turn Vans around in the current macro. In addition, Citi said that although the company has significantly improved its balance sheet following the sale of Supreme, it remains relatively highly leveraged. Based on the forecast decrease, the firm also lowered its TP from $30 to $12.

Citi lowered COLM’s TP to $68 but did not change its NEUTRAL rating. “We are lowering our F25/26E from $3.97/$4.49 to $3.09/$2.31 based on lower sales and higher product costs (driven by tariffs), partially offset by lower SG&A than previously forecast.” The firm is modeling fiscal 2025 sales as “flat” to fiscal 2024.

While there may be little alignment on where these companies will go, it does look like at least one company in the market where many suggest investors put their money — Costco (COST). While it was down nearly 5 percent on April 21, it remains up 4.5 percent over the last 30 days.

Other big guys, including Target, Walmart, Home Depot, and Lowes were at the White House on Monday, pleading their case for a change in strategy. Many don’t expect clarity for another four to five weeks.

Image courtesy On Running