New Wave Group (Group), the Swedish-based owner of Ahead, Auclair, Craft, Cutter & Buck, and Tenson AB, reported that the second quarter of 2025 was marked by macroeconomic concerns regarding the introduction of new U.S. tariffs and the potential impact on international trade. During the quarter, the Group said it incurred minor additional costs due to the implemented tariffs. Despite these concerns, and the effect of currency fluctuations on the company’s reported numbers as the Swedish krona strengthened against other currencies, sales in local currencies increased compared to the year-ago Q2 period.

“The market was generally weak during the second quarter,” offered company CEO Torsten Jansson in his quarterly letter to investors. “However, we see signs that a turnaround may be coming, although the timing is difficult to predict. Uncertainties around tariffs in the U.S. and the global situation need to stabilize before a broader recovery can occur.”

New Wave Group reports in the Swedish krona (SEK) currency. Conversions in the report were translated at approximately 1 krona per 10 cents U.S.

The big news for the quarter was the agreement inked in June for New Wave Group to acquire 100 percent of the shares in the Austrian textile wholesaler Cotton Classics Handels GmbH. The acquisition is subject to approval by the relevant competition authorities.

The big news for the quarter was the agreement inked in June for New Wave Group to acquire 100 percent of the shares in the Austrian textile wholesaler Cotton Classics Handels GmbH. The acquisition is subject to approval by the relevant competition authorities.

“A significant part of the quarter was dedicated to our strategic acquisition of Cotton Classics – the second largest in the group’s history,” Jansson commented. “The acquisition is an important step in our long-term growth strategy and further strengthens our market position.”

The Group also noted that the U.S. Department of Justice has initiated a review of PPP loans received by the its U.S. subsidiary during the COVID-19 pandemic, questioning the company’s eligibility for the loans. Although the loans, amounting to approximately $5.4 million, have been forgiven, there is a risk that repayment may be required, in whole or in part, and that damages may be imposed. The subsidiary is cooperating with the authorities and evaluating possible actions. The obligation is considered possible but uncertain in scope.

The obligation was considered as possible. However, due to current uncertainty regarding both probability and scope, a reliable assessment could be made at the time of the Q2 report. Accordingly, the reported the full amount as a contingent liability as of June 30, 2025.

Second Quarter

Jansson reported that the second quarter continued to deliver organic growth in local currencies of 1.3 percent, which was below Group expectations. In reported Swedish krona terms, sales decreased 4.1 percent year-over-year (y/y) to SEK 2.30 billion (~$230 mm), said to be mainly due to 5.4 percent of negative currency effects. He said this year’s move of Easter (to March) caused a negative calendar effect during the quarter, which instead had a positive effect to the first quarter.

“Despite a generally weaker market, we continue to gain market share – a clear sign of strength,” he stated.

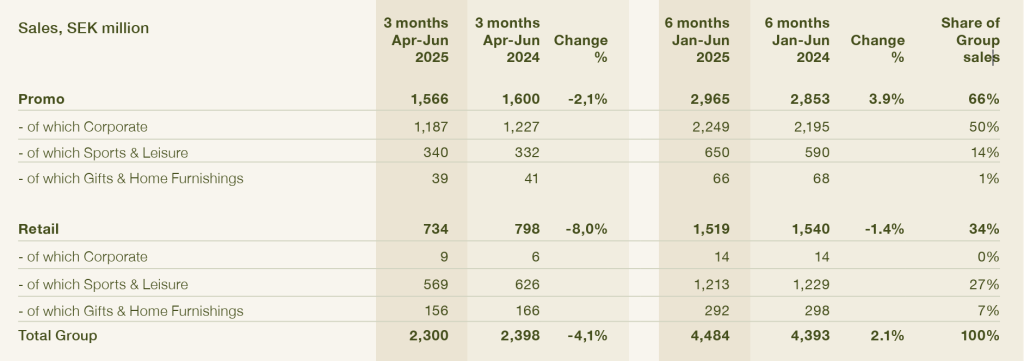

Sales by Operating Segment and Sales Channel

The Group’s products are distributed through two sales channels, promo and retail, across three operating segments: Corporate, Sports & Leisure, and Gifts & Home Furnishings. Most brands are offered in both channels.

In the second quarter, sales through the Promo channel decreased 2.1 percent y/y to SEK 1.57 billion (~$157 mm), and the Retail channel declined 8.0 percent y/y to SEK 734 million (~$73 mm). For the first half of the year, approximately two-thirds of total sales were generated through the Promo channel, with the remaining one-third coming from the Retail channel. Both sales channels were negatively impacted by currency fluctuations during the quarter, with a total 5.4 percent negative effect. Additionally, the early timing of the Easter holiday was said to have had an adverse effect on sales.

The Corporate channel was also affected by a temporary decline in revenue at the Group’s Dutch subsidiary, New Wave Sportswear, due to the implementation of a new ERP system and a new warehouse automation system. The company is the first within the Group to adopt both systems, which has led to certain transitional challenges during the period.

Segments Summary

The Corporate segment accounts for 50 percent of the Group’s revenue, Sports & Leisure for 42 percent, and Gifts & Home Furnishings for the remaining 8 percent.

The Corporate segment generated SEK 1.20 billion (~$120 mm) in Q2 revenues, compared to SEK 1.23 billion in Q2 2024. Within the Corporate segment, growth was said to be primarily driven by the trading business and the promo operations for giveaways and tech products.

The Sports & Leisure segment’s revenues amounted to SEK 910 million (~$91 mm) in Q2, compared to SEK 959 million in Q2 2024. Within the Sports & Leisure segment, Craft was the primary driver of sales growth, while Tenson also shows comparatively strong growth.

The Gifts & Home Furnishings segment delivered SEK 195 million (~$20 mm) in Q2 revenue, down from the SEK 207 million produced in Q2 2024.

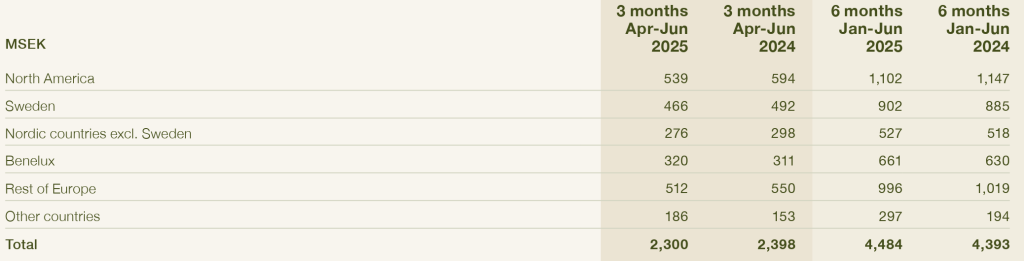

Sales by Region

New Wave Group operates in 25 countries, with sales primarily in Europe and North America. As of 2025, Benelux (the Netherlands and Belgium) is reported as a separate region in the segment reporting. These countries were previously included in regions referred to as Central Europe and Southern Europe, which are now reported as Rest of Europe and include England, France, Ireland, Italy, Poland, Switzerland, Spain, Germany, and Austria. Canada and the USA have been included as North America starting from 2025.

As reported above, sales for the quarter were said to be negatively affected by currency translation effects, with North America negatively impacted the most at approximately 10 percent. Adjusted for currency, Asia, Benelux, and North America showed growth, while Sweden and the rest of the Nordic countries and Europe had lower sales compared to the same quarter in 2024, largely due to the timing of Easter.

Other Operating Income and Expenses

Other operating income and other operating expenses primarily relate to foreign exchange gains and losses. At the end of the period, the Swedish krona’s closing rate was slightly lower than at the end of March 2025, resulting in a minor positive translation effect. Net foreign exchange effects within other income and expenses for the quarter amounted to SEK 6 million (−3). The net total of other operating income and other operating expenses for the quarter was SEK 9 million (8).

“What has been essential and what brings me the most joy during this quarter is that we continue to gain market share and that the agreement to acquire Cotton Classics has now been finalized. These are two important milestones for our future development,” the CEO said.

Gross Profit and Gross Margin

The gross profit and gross profit margin were said to be the result of many factors, both internal and external, and are primarily influenced by the decisions made by the Group based on the strategy to achieve the best combination of quality, price, service level, and sustainability.

Gross profit for the second quarter was approximately 6 percent lower compared to the second quarter last year and amounted to SEK 1.1 billion, corresponding to a gross profit margin of 48.0 percent of revenue in translated currency, compared to 49.0 percent of revenue in the year-ago quarter.

The gross profit is mainly driven by increased sales, where Sports & Leisure improved its gross margin by 0.1 percentage points compared to the previous year, reaching a gross profit margin of nearly 56 percent, flat to Q2 last year. The gross profit margin for Corporate was down approximately 70 basis points year-over-year, amounting to 44 percent of revenue, while Gifts & Home Furnishings reached 46 percent compared to 48 percent the prior-year Q2 period.

Selling and Administrative Expenses

Selling and Administrative Expenses

During the second quarter, external costs decreased by SEK 15 million, or 3.3 percent, and amounted to SEK 427 million. The decrease was said to be mainly due to currency translation effects.

Excluding currency effects, costs increased slightly, with sales and marketing expenses said to be “somewhat higher” in the second quarter due to targeted one-time campaigns.

Personnel costs increased by SEK 9 million y/y. Adjusted for currency translation, the increase is approximately SEK 25 million and is a result of general salary increases and new initiatives, amounting to SEK 372 million in Q2, compared to SEK 363 million in the year-ago Q2 period. The average number of full-time employees was 61 more in the second quarter than in the Q2 period last year, totaling 2,500 as of June 30. The increase was said to be mainly related to recruitment within sales-oriented functions and IT.

Due to investments in new warehouses, the number of warehouse employees has also increased again. Of the total number of employees, 517 work in production. The production within New Wave Group is attributable to Ahead (embroidery), Cutter & Buck (embroidery), Kosta Boda, Orrefors, Seger, Termo and Toppoint.

Currency fluctuations reduced the above-mentioned costs by a total of SEK 44 million.

Depreciation and amortization were higher compared to the same quarter last year and amounted to SEK 80 million. The increase is related to depreciation of right-of-use assets linked to leasing and investments made in automation within the Group’s warehouse operations.

Operating Profit and Operating Margin

The Group said it aims to achieve an operating margin of 20 percent annually over a business cycle.

Operating profit for the second quarter amounted to SEK 241 million, or 10.5 percent of revenue, compared to SEK 301 million, or 12.6 percent of revenue, in the 2024 quarter. Currency translation effects had a negative impact on the operating margin, as the portion of the Group’s cost base denominated in SEK does not decrease as a result of the krona’s appreciation.

Operating profit (EBIT) decreased from SEK 301 million in Q2 2024 to SEK 241 million in Q2 2025, which was said to be “unsatisfactory” but still demonstrated “good stability and strong earning capacity” in a challenging market.

Profit after tax amounted to SEK 167 million in Q2, compared to SEK 210 million in Q2 last year.

Seasonal effects for New Wave were said to be primarily tied to holidays and seasons. Within Gifts & Home Furnishings, sales and results are typically strongest in the fourth quarter due to Christmas shopping. For winter sports products, Q4 and partly Q1 are the most important, while Q2-Q4 matters most for retail. Generally, the second and third quarters are evenly distributed, while Q4 is usually the Group’s strongest period, and Q1 bears the most costs in relation to sales.

Finance Net and Taxes

Finance Net and Taxes

The finance net during the quarter decreased and amounted to negative SEK 24 million from negative 33 million in Q2 last year, resulting from a lower average net debt to credit institutions and lower interest rates. The effective tax rate was 23.1 percent for both the quarter versus 21.5 percent in Q2 last year. The higher tax rate is due to a changed mix of countries with taxable income.

Net Profit

Profit for the quarter amounted to SEK 167 million, or SEK 1.26 per share, compared to SEK 210 million, or SEK 1.59 per share in the 2024 second quarter.

Balance Sheet and Cash Flow Summary

The Group’s liquidity reportedly remains strong.

As of June 30, 2025, cash and cash equivalents amounted to SEK 435 million, compared to SEK 546 million at the previous year-end and SEK 492 million at end of Q2 last year. In addition, the Group had unused credit facilities of SEK 787 million, to be compared with SEK 860 million at the same time last year. The total liquidity buffer amounted to SEK 1.22 billion.

Net debt increased since the beginning of the year and amounted to SEK 2.09 billion. The increase was said to be primarily related to higher borrowing from credit institutions due to ongoing investments.

The net debt-to-equity ratio and net debt-to-working capital ratio amounted to 32 percent and 42 percent, respectively.

The currency translation issue also negatively affected the translation of the Group’s equity by a total of SEK 513 million, reducing the equity ratio by 1.8 percentage points. The equity ratio amounted to 59.3 percent, compared to 60.2 percent at the same time last year.

As of June 30, the Group’s credit facility amounted to SEK 2.64 billion, of which SEK 2.15 billion matures in December 2026, SEK 98 million in August 2027, and SEK 138 million in December 2030. The remaining SEK 250 million has maturities ranging from three months to four years. The credit limit is restricted in amount and depends on the value of certain underlying assets. The financing agreement stipulates that key financial ratios (covenants) must be met to maintain the credit limit. As of 30 June 2025, the group’s financial ratios (covenants) were fulfilled.

Adjusted for currency, inventory decreased by 1.8 percent, or SEK 94 million, since the beginning of the year and amounted to SEK 5,031 million. Currency effects exceeded the decrease, as exchange rate changes reduced the inventory value by SEK 262 million. In local currency, inventory increased 3.1 percent. Inventory turnover was said to be in line with the Q2 period last year and amounted to 1.0x, which aligns with the Group’s investments in new establishments, including in Canada and the U.S. The inventory compositions was assessed as “good.”

Adjusted for currency, inventory decreased by 1.8 percent, or SEK 94 million, since the beginning of the year and amounted to SEK 5,031 million. Currency effects exceeded the decrease, as exchange rate changes reduced the inventory value by SEK 262 million. In local currency, inventory increased 3.1 percent. Inventory turnover was said to be in line with the Q2 period last year and amounted to 1.0x, which aligns with the Group’s investments in new establishments, including in Canada and the U.S. The inventory compositions was assessed as “good.”

As of June 30, 2025, total obsolescence deductions, representing the difference between the lower of acquisition cost and fair value, for inventory amounted to SEK 168 million, and the obsolescence reserve in relation to finished goods inventory was 3.2 percent versus 3.3 percent last year. Investments in the development of warehouses and initiatives within the existing business areas continue.

Cash flow from operating activities during the six-month period amounted to SEK 368 million, compared to SEK 541 million in 2024. The lower cash flow compared to the same period last year was reportedly attributable to higher inventory purchases during 2025.

Cash flow from investing activities increased and amounted to negative SEK 223 million, compared to SEK 125 million last year. The increase was said to be primarily related to investments in automation and warehouse development.

Working capital amounted to SEK 5.0 billion and was reportedly “in line with the previous year,” taking currency effects into account.

Dividends

During the quarter, the first of two dividend payments to shareholders was executed, amounting to SEK 464 million.

Outlook

Jannson concluded his letter suggesting that the Group is “very well positioned” for the future and is confident that it will outperform its competitors.

“Once the market turns, we will greatly benefit from our increased market share and strategic acquisitions,” he continued. “We will continue to focus on the development of our existing brands such as Craft, Clique, and Cutter & Buck while we also continue pursuing strategic acquisitions, such as the recent purchase of Cotton Classics, which presents strong growth opportunities. We will also maintain our investments in marketing, warehouse automation, and actively explore further acquisition opportunities. It is in times like these that we can lay the foundation for a future New Wave Group, one that is even larger, stronger, and more profitable!”

Images courtesy Cutter & Buck and New Wave/Oy Trexet Finland Ab