New Wave Group (NWG), the Swedish-based owner of Ahead, Auclair, Craft, Cutter & Buck, and Tenson AB, reported that net sales in the fourth quarter increased 3 percent to SEK 2,827.3 million.

New Wave Group reports are in Swedish krona (SEK) currency.

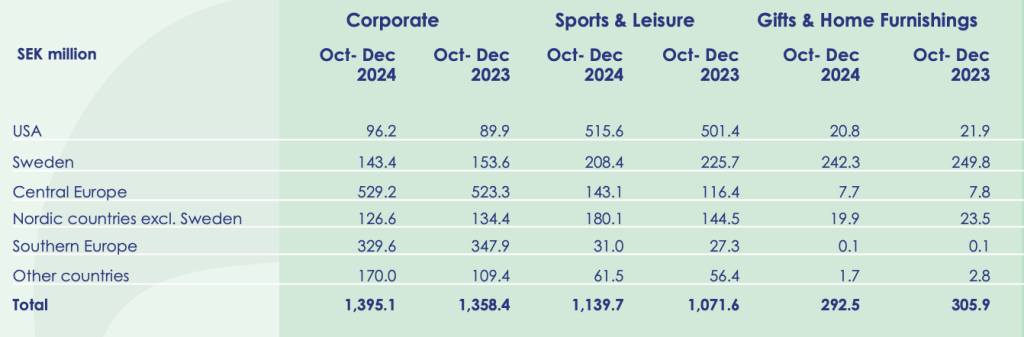

Fourth quarter net sales in the Sports Leisure segment increased by 6 percent and amounted to SEK 1,139.7 million against SEK 1,071.6 million in Q4 2023. All regions except Sweden increased. It was mainly the promo sales channel that increased net sales, but retail also improved compared to last year.

Operating profits in the Sports Leisure segment increased by SEK 11.8 million and amounted to SEK 180.9 against SEK 169.1 million. The improved result is primarily related to the higher net sales, but the segment also has higher costs.

Net sales for the January to December period in the Sports Leisure segment increased by 3 percent and amounted to SEK 3,988.3 million. The acquisition of Tenson AB had an impact of SEK 34.1 million. The segment had higher net sales in Central Europe and the USA but decreased in other regions. The promo sales channel increased while retail was at the same level as last year. Operating income decreased by SEK 73.2 million and amounted to SEK 544.5 million. The decline in profit results from higher costs, both in the form of sales and marketing costs and personnel costs. The acquired unit had an impact of negative SEK 13.2 million.

The Sports Leisure segment includes Cutter & Buck, Craft, Clique, Ahead, KateLord, Sköna Marie, Auclair, Gants Laurentide, Seger, Termo, Tenson, Marstrand and Pax.

Companywide, the Sports & Leisure segment and the promo sales channel saw sales increases in the quarter, but Corporate also had growth. Gifts & Home Furnishings decreased.

By region, net sales in the U.S. increased by 3 percent, related to the Corporate and Sports & Leisure segments. Sweden’s sales decreased by 6 percent and had lower net sales in all segments. Central Europe increased by 5 percent, mainly attributable to Sports & Leisure. The Nordic region, excluding Sweden, increased by 8 percent compared to the previous year. Southern Europe decreased net sales by 4 percent. In other countries, sales jumped 38 percent.

Torsten Jansson, CEO, said, “We managed to increase net sales by 3 percent despite a continued challenging market in all countries — of which Sweden might be the worst; this means that we continue to gain market share. However, there is a significant difference between different countries and regions. Sweden clearly had the largest decrease of 6 percent. Southern Europe also decreased by 4 percent. The USA grew by 3 percent, Central Europe by 5 percent and the Nordics, excluding Sweden, by 8 percent, which is very strong. Other countries generated growth of 38 percent. Other countries include our trading operations in Asia, which are dependent on a few large orders, which means that the sales vary in different quarters.”

He added, “Although I am not satisfied with 3 percent growth, and it is far below our target, I still think it is a statement of strength in today’s market situation. Of our sales channels, promo improved by 5 percent and retail was at the same level as last year. The regions that showed growth have a significantly larger share of net sales in promo than retail. We have continued our investments for future growth, primarily in Germany and the U.S. but also in other markets.”

Consolidated Income Statement Summary

The gross profit margin in the quarter decreased compared to the previous year but remained at a high level and amounted to 50.0 percent against 52.0 percent a year ago. All segments decreased but primarily Corporate and Gifts & Home Furnishings had a lower margin compared to last year.

External costs increased by SEK 13.9 million and amounted to SEK 503.2 million. The increase is largely related to sales and marketing costs. Personnel costs increased by SEK 19.2 million and amounted to SEK 384.3 million because of previously implemented general salary increases and new investments. Exchange rate changes increased the above-mentioned costs by SEK 5.5 million.

Operating earnings fell 10.7 percent to SEK 462.7 million from SEK 518.7 million a year ago. The lower operating result is due to the lower gross profit margin and higher sales and marketing expenses. The operating margin decreased to 16.4 percent against 19.0 percent a year ago.

Net earnings for the fourth quarter decreased 6.0 percent to SEK 344.4 million from SEK 366.4 million in the prior year fourth quarter.

Fourth Quarter Sales by Segment and Region

Consolidated Full Year Summary

In the full year, sales amounted to SEK 9,528.7 million, which was in line with the SEK 9,512.9 million total in 2023. Exchange rate effects negatively impacted sales by SEK 13.5 million.

Operating earnings slid 20.0 percent to SEK 1,262.3 million from SEK 1,577.2 million a year ago. The lower result is related to a lower gross profit margin, higher sales and marketing costs and higher personnel costs. The operating margin decreased 13.2 percent from 16.6 percent.

Net earnings in the year declined to SEK 880.0 million from SEK 1,119.0 million in 2023.

Image courtesy Cutter & Buck