Adidas AG has reached an out-of-court settlement with Kanye West two years after the brand ended its Yeezy partnership with the rapper. Under the settlement, both parties have agreed to withdraw all legal claims against each other with no money changing hands.

News of the settlement came from Adidas CEO Bjorn Gulden on a conference call on Tuesday, October 29, while reviewing third-quarter results.

“There aren’t any more open issues, and there is no…money going either way, and we both move on,” Gulden reportedly said on the call. He added, “There were tensions on many issues, and…when you put the claims on the right side and you put the claims on the left side, both parties said we don’t need to fight anymore and withdrew all the claims.”

Gulden declined to provide further details of the settlement.

Adidas has been embroiled in a legal battle over the last two years over its decision to end its partnership with the musician, now known as Ye, in October 2022 after he made a series of antisemitic remarks. The move impacted €1.2 billion in annual sales and €500 million in operating profit.

In early 2023, as Gulden took over as CEO, Adidas had contemplated destroying €1 billion of unsold Yeezy product and writing it off but decided to sell the inventory and donate parts of the proceeds to charity.

With this settlement, Adidas unwound a €100 million provision related to outstanding legal issues over the Yeezy break-up and now plans to also donate that sum to charities. Including the €100 million, total funds earmarked for charity related to the Yeezy inventory sell-off now stand at about €250 million.

In the 2024 third quarter results, the sale of the remaining Yeezy inventory reportedly generated revenue of around €200 million ($215 million) in the quarter, down from around €350 million in the year-ago quarter.

Overall, Adidas AG reported that third quarter currency-neutral sales climbed 10 percent year-over-year, driven by 14 percent growth in the Adidas brand. Strength in Chain helped offset a 7 percent decline in North America. In the Americas, a significantly smaller Yeezy business offset positive growth for the second straight quarter for the Adidas brand.

Third quarter results were said to be in line with a forecast provided on October 15, when Adidas also raised its full-year sales and profit guidance for the third time this year, citing a better-than-expected performance in the third quarter and good brand momentum as it benefits from demand for its retro three-striped Samba and Gazelle shoes.

Major Developments

- Currency-neutral sales up 10 percent, driven by Adidas brand growing 14 percent in Q3

- Underlying Adidas business grows across all markets, channels and product divisions

- Double-digit growth in Lifestyle and Performance reflects breadth of brand momentum

- Gross margin improves 2.0 percentage points to 51.3 percent despite currency headwinds

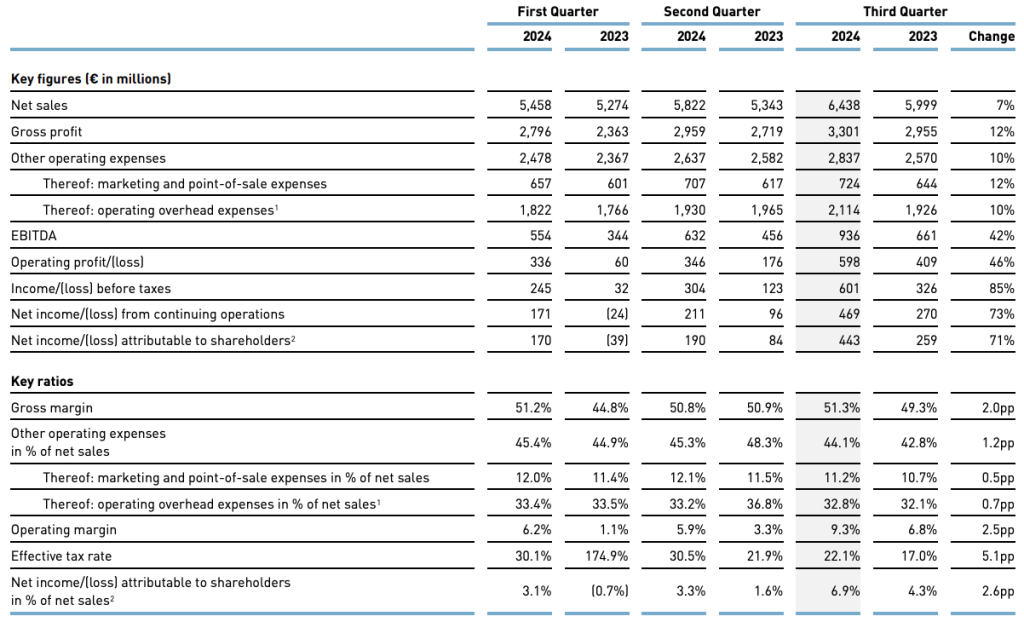

- Operating profit of €598 million compared to €409 million in prior-year period

- Net income from continuing operations improves strongly to €469 million, resulting inbearnings per share of €2.44

- Healthy inventories at €4.5 billion to support continued double-digit top-line growth

- Full-year guidance raised on October 15 to reflect current brand momentum

Adidas CEO Bjørn Gulden said, “The third quarter was a very strong quarter for us and again better than expected. 14 percent underlying growth for the Adidas brand, a very healthy gross margin above 51 percent and an operating profit of €598 million are numbers that we are very happy with and a proof that we are moving in the right direction. I am especially proud that we are growing in all regions, in all channels and now also in all product divisions.

“Double-digit growth in both Lifestyle and Performance shows the currently good ‘balance’ in our business. The strong underlying growth in Greater China and the earlier-than-expected turn to positive numbers for the Adidas brand in North America during the last two quarters strengthens our confidence for the mid-term future.

“This shows the strength of the Adidas brand and is a result of the great job our people are doing in all markets and all functions. With the heat we have again created for the Adidas brand, we have a generational opportunity to connect with a new generation of consumers both in lifestyle and performance – and that in all markets. Our focus is now to continue this momentum and to build a solid platform for future growth and to make Adidas a great company again.”

Third-Quarter Results

Currency-Neutral Revenues up Double-Digits in Q3

Currency-neutral revenues increased 10 percent during the third quarter. The double-digit growth was driven by the strong momentum of the underlying Adidas business, which grew 14 percent. The sale of parts of the remaining Yeezy inventory generated revenues of around €200 million in the quarter, which is significantly below the Yeezy sales in the prior year (2023: ~€350 million in Q3). In euro terms, revenues grew 7 percent to €6.44 billion, compared to €6.00 billion in Q3 2023.

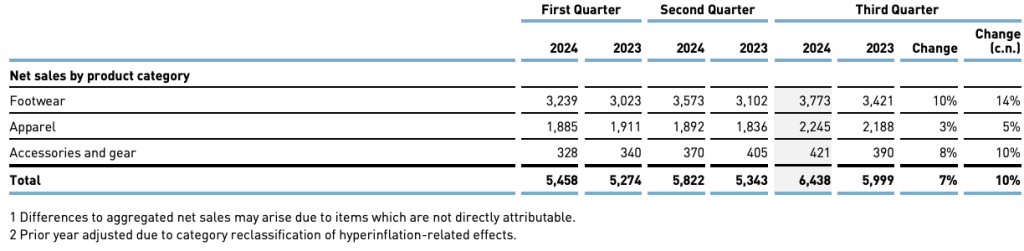

Footwear-led Growth across Product Categories

Footwear revenues increased 14 percent on a currency-neutral basis during the quarter, led by strong double-digit growth in Originals. In addition, double-digit growth in Sportswear as well as increases in Performance categories, including Football, Running, Training, Golf and Specialist Sports, contributed to the broad-based growth in footwear. Apparel sales were up 5 percent, mainly driven by strong double-digit growth in Football. Alongside the new home and away jerseys for the club season, Adidas released retro-inspired third jerseys and a range of other product featuring the iconic Trefoil logo for its major European clubs. This is part of the company’s strategy to create a bigger football lifestyle business. On the Lifestyle side, Originals benefited from the increasing popularity of the Three Stripes through offerings such as Adicolor. The initial launch of completely revamped collections, such as the brand’s innovative Z.N.E. range in Sportswear, sold through well and contributed to the growth. Accessories returned to growth and increased 10 percent during the quarter.

Double-digit Increases in Lifestyle and Performance

On a currency-neutral basis, Lifestyle revenues increased double digits during the quarter. The company continued to drive newness and depth across its popular Samba, Gazelle, Spezial, and Campus franchises. Furthermore, Adidas continued to scale volumes in Retro Running in response to fast-growing demand for its SL72 and started to incubate several franchises in the Low Profile domain, such as Taekwondo. Alongside Originals, growth accelerated in Sportswear as the company met consumer needs across a wider range of price points on the footwear side and introduced new innovative concepts in apparel. Demand for the overall Lifestyle offering continued to be fueled by collaborations with partners such as Bad Bunny, Song for the Mute, Wales Bonner, or Edison Chen. Performance also posted double-digit growth, with increases in almost all Performance categories. In Football, onpitch visibility during the major tournaments in the summer extended into the club season with well-received jersey launches as well as ongoing strength on the footwear side across Predator and F50. Growth in Running continued as Adidas started to leverage the credibility of its record-braking Adizero family into the everyday running space with its recently launched Ultraboost 5, Supernova and Adistar franchises. In addition, Training delivered growth as the Dropset 3 continued to excite consumers, while technical product innovation also drove growth in Outdoor, Specialist Sports, and Golf.

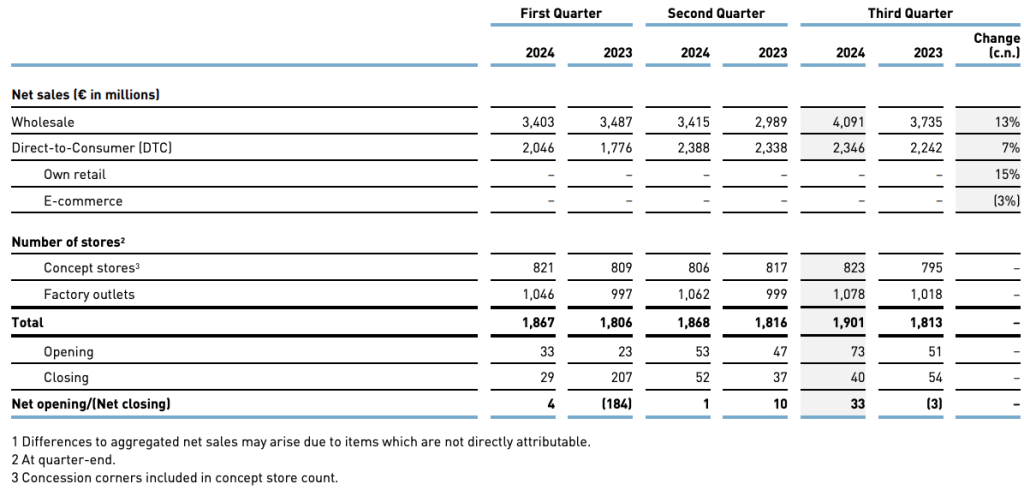

Balanced Growth Across Channels

The company said strong demand for Adidas products was evident across channels.

Wholesale grew 13 percent on a currency-neutral basis during the third quarter.

Direct-to-consumer (DTC) revenues grew 7 percent versus the prior year. Excluding Yeezy in the prior year, the company’s DTC business grew 17 percent. Within DTC, Adidas’ own retail stores posted double-digit growth, driven by the strong sellout in the company’s concept store fleet, which accelerated further compared to the first half of the year. E-commerce revenues declined 3 percent in the quarter because of the significantly smaller Yeezy business. Excluding Yeezy, revenues in e-commerce increased more than 25 percent. As Adidas continues to focus on reducing discounting activity and improving the overall business mix on its own online platforms, the increase in full-price sales was significantly stronger.

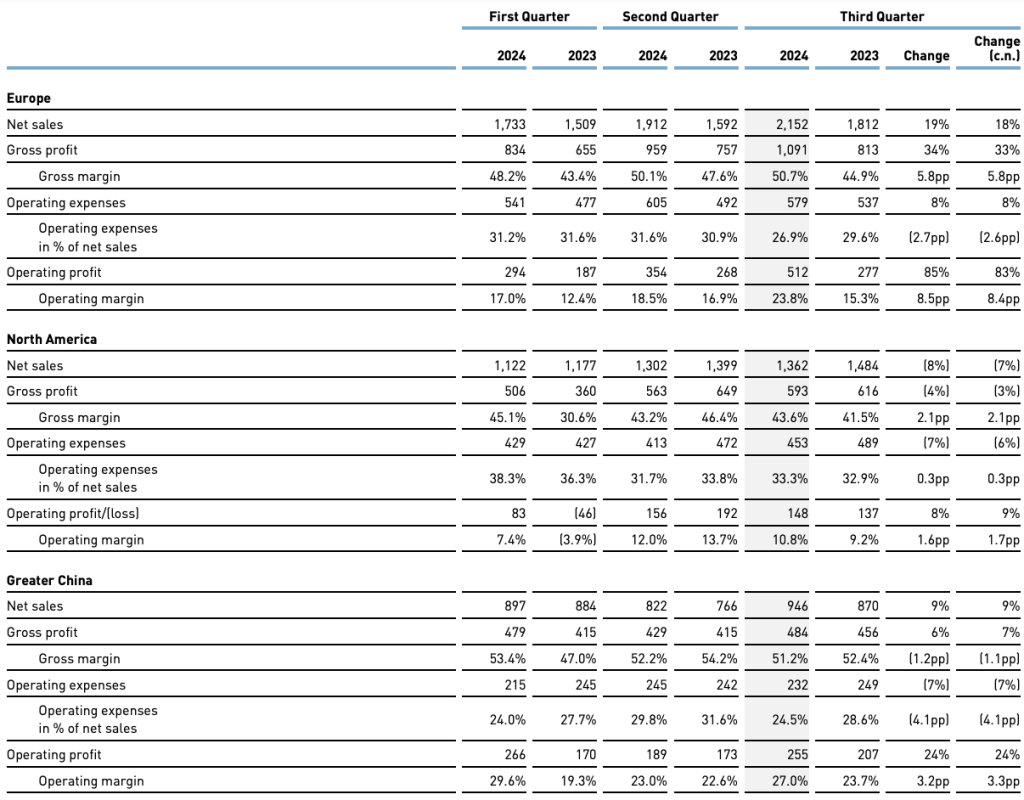

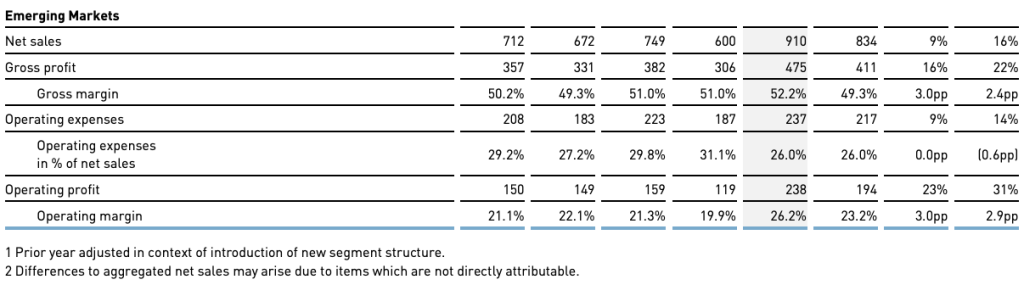

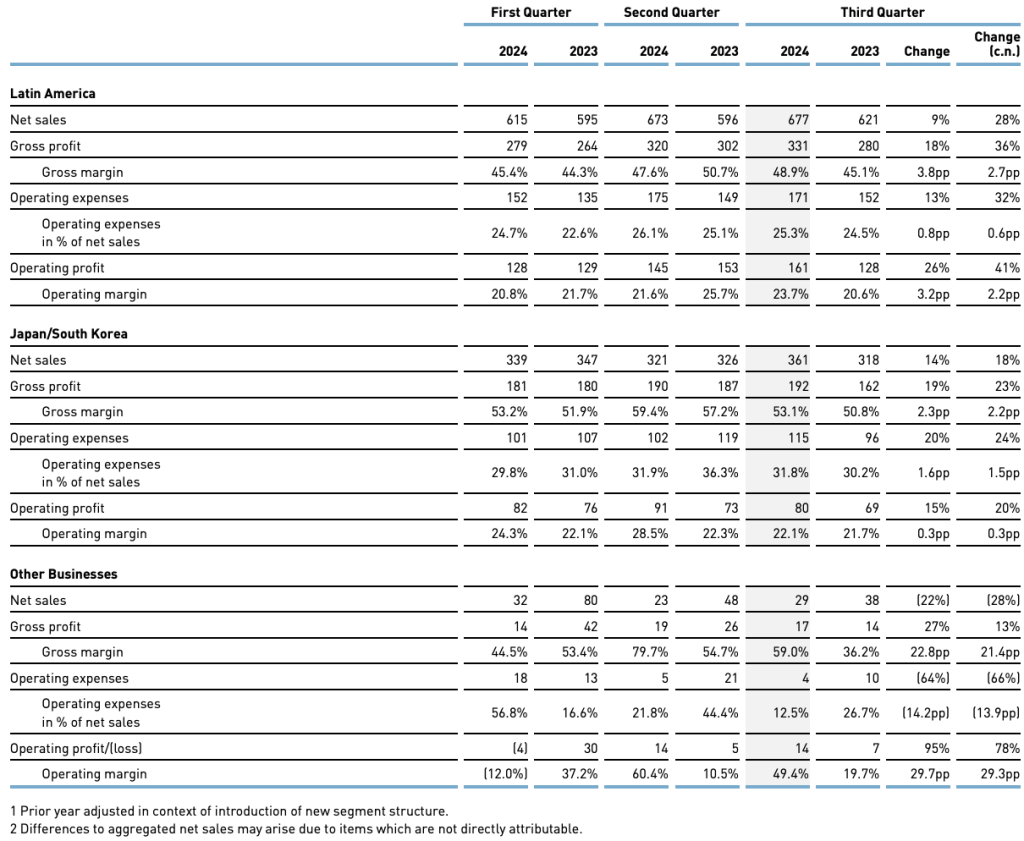

Double-Digit Growth in Europe, Emerging Markets, Latin America, and Japan/South Korea

Currency-neutral sales in Europe increased 18 percent during the quarter. Revenues in Emerging and Latin America were up 16 percent and 28 percent, respectively, while sales in Japan/South Korea increased 18 percent. Revenues in Greater China grew 9 percent. In North America, sales decreased 7 percent. The decline was solely related to the significantly smaller Yeezy business. Excluding Yeezy, revenues in North America increased versus the prior year.

See charts for all regions at bottom.

Gross Margin Improves Significantly to 51.3 percent

The company’s gross margin increased 2.0 percentage points to 51.3 percent during the third quarter (2023: 49.3 percent). This year’s significantly smaller and less profitable Yeezy business had a negative impact on the gross margin. Consequently, the year-over-year increase of the underlying Adidas gross margin was even stronger than 2.0 percentage points. The strong improvement was driven by lower product and freight costs, a more favorable product mix, as well as reduced discounting. In contrast, significant negative currency effects continued to weigh on the gross margin.

Increase in Other Operating Income Neutralized by Further Donations

Other operating income increased to €113 million in the third quarter (2023: €5 million). The increase reflects the release of prior years’ accruals in an amount of around €100 million following the Yeezy settlement. This was offset by provisions for further donations in a similar amount, which were recorded within operating overhead expenses. As a result, these nonrecurring items did not have any material impact on the company’s third-quarter operating profit.

Increase in Expenses amid Continued Brand Investments

Other operating expenses increased by 10 percent to €2.837 billion (2023: €2.570 billion). As a percentage of sales, other operating expenses increased 1.2 percentage points to 44.1 percent (2023: 42.8 percent). Marketing and point-of-sale expenses were up 12 percent to €724 million in the quarter (2023: €644 million). The increase reflects continued investments into the global brand campaign ‘You Got This,’ large-scale activations around the UEFA EURO 2024, the CONMEBOL Copa América, the Olympic and Paralympic Games Paris 2024, as well as support for product launches such as the Z.N.E. apparel range. As a percentage of sales, marketing and point-of-sale expenses were up 0.5 percentage points to 11.2 percent (2023: 10.7 percent). Operating overhead expenses grew 10 percent to €2.114 billion (2023: €1.926 billion), reflecting ongoing investments aimed at strengthening the company’s sales activities. The provisions for further donations in an amount of around €100 million also contributed significantly to the increase. As a percentage of sales, operating overhead expenses increased 0.7 percentage points to 32.8 percent (2023: 32.1 percent).

Operating Profit Increases to €598 Million

The company’s operating profit amounted to €598 million (2023: €409 million), reflecting an operating margin of 9.3 percent (2023: 6.8 percent). The sale of parts of the remaining Yeezy inventory contributed around €50 million to the company’s operating profit in the third quarter. This compares to a profit contribution from Yeezy of around €150 million in the prior-year period. Net income from continuing operations increases to €469 million Net financial income amounted to €4 million (2023: net financial expenses of €84 million). Income taxes amounted to €133 million (2023: €55 million), implying a tax rate of 22.1 percent (2023: 17.0 percent) that reflects the ongoing normalization of profitability levels. The company’s net income from continuing operations amounted to €469 million (2023: €270 million), with basic and diluted EPS from continuing operations increasing to €2.44 (2023: €1.40).

Healthy Inventories to Support Continued Double-Digit Top-Line Growth

Inventories decreased 7 percent to €4.524 billion as at September 30, 2024. This level as well as the composition of inventories allow for continued double-digit top-line growth. On a currency-neutral basis, inventories decreased 3 percent compared to September 30, 2023. Operating working capital was down 12 percent to €4.886 billion (2023: €5.557 billion). On a currency-neutral basis, operating working capital decreased 8 percent. Average operating working capital as a percentage of sales decreased 6.3 percentage points to 20.6 percent (2023: 26.9 percent). This development reflects the decrease in inventories compared to the prior year as well as an increase in payables, partly offset by higher receivables.

Adjusted Net Borrowings decrease €1.0 Billion compared to the Prior Year

Adjusted net borrowings on September 30, 2024, amounted to €4.211 billion (September 30, 2023: €5.235 billion), representing a year-over-year decrease of 20 percent, or €1.0 billion in absolute terms. This development mainly reflects a decline in short-term borrowings due to the repayment of a bond with maturity September 2024 and an increase in cash and cash equivalents due to the company’s strong cash flow generation.

Full-Year Outlook

Currency-Neutral Revenues to Increase at a Rate of Around 10 Percent in 2024

On October 15, Adidas raised its top- and bottom-line guidance as a result of the better-than-expected performance during the third quarter and taking into account the current brand momentum. Adidas now expects currency-neutral revenues to increase at a rate of around 10 percent in 2024 (previously: to increase at a high-single-digit rate). The company’s operating profit is now expected to reach a level of around €1.2 billion (previously: to reach a level of around €1.0 billion).

The company said that within this guidance, Adidas assumes the sale of the remaining Yeezy inventory during the remainder of the year to occur on average at cost. This would result in additional revenues of around €50 million and no further profit contribution in the fourth quarter of 2024.

Image, data and charts courtesy Adidas AG

Regional Details by Quarter