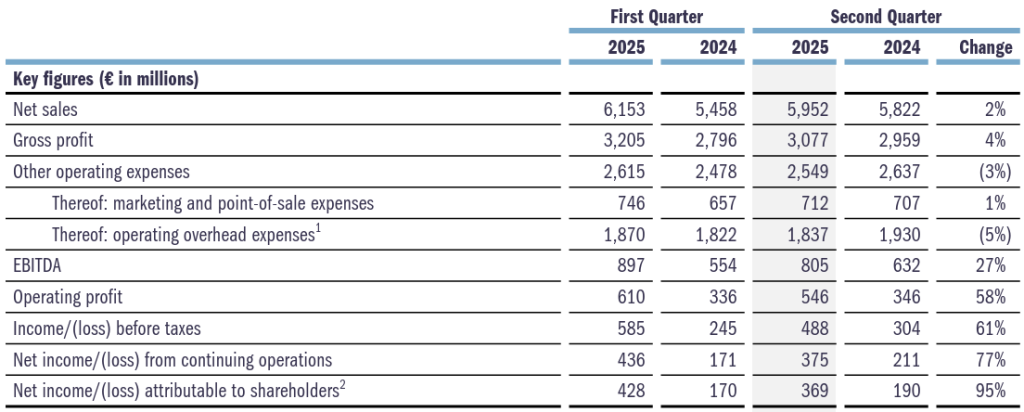

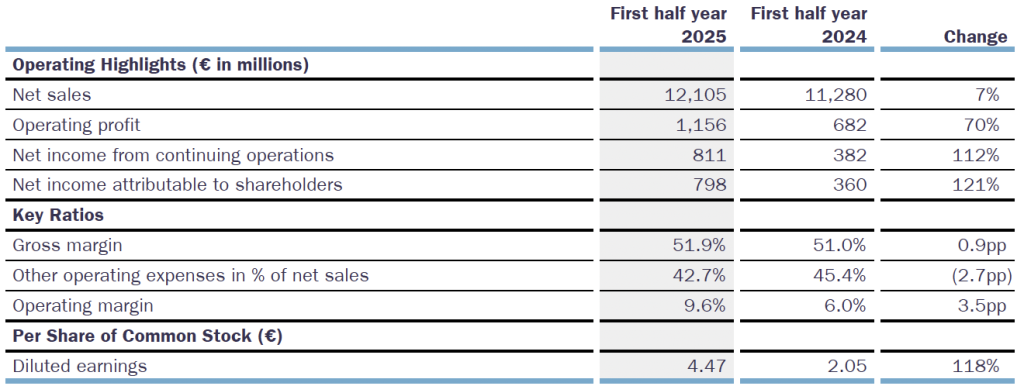

Adidas CEO Bjørn Gulden reported 2025 second quarter (Q2) and first half (H1) financial results on Wednesday morning, July 30. He indicated that the double-digit growth for the Adidas brand in Q2 and H1 has created enough leverage to nearly deliver its mid-term EBIT margin target. Still, the market seemed to disagree with his sentiments as the company’s shares closed down 11 percent on Wednesday in Frankfurt. When the impact of Yeezy sales from last year and foreign exchange fluctuations are factored in, reported sales grew by only 2 percent year-over-year.

Net income on a continuing basis increased by 77 percent year-over-year.

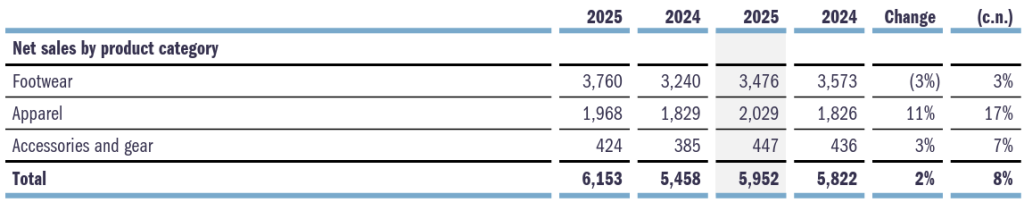

Adidas reported currency-neutral (cn) revenues for the Adidas brand increased 12 percent year-over-year (y/y) in the second quarter, “reflecting ongoing momentum.” Having completed the sale of the remaining Yeezy inventory at the end of last year, the company’s results for the second quarter do not include any Yeezy revenues. By contrast, the 2024 Q2 period had ~ €200 million. Including Yeezy sales from the 2024 Q2 period, Adidas brand currency-neutral revenues increased 8 percent y/y in currency-neutral terms. The company also noted that the strengthening of the euro against several currencies resulted in an unfavorable translation impact of approximately €300 million in the quarter. In reported euro terms, revenues grew 2 percent y/y to €5.95 billion.

- Footwear revenues for the Adidas brand increased 9 percent y/y for the quarter on a currency-neutral basis, or plus 3 percent including the Yeezy business year-over-year. Several categories reportedly posted double-digit footwear growth, most notably Running, Training, Sportswear, and Performance Basketball. Strong growth in Originals, Outdoor, and Specialist Sports also reportedly contributed to the increase.

- Apparel sales grew 17 percent in Q2, as the strong product offering in Originals, Training, Running, Golf, and Specialist Sports drove double-digit increases in those categories. Sportswear, Football, and Outdoor further added to the growth, reflecting a broadening of the brand’s momentum in Apparel as well.

- Accessories grew 7 percent during the quarter.

Performance Segment

Performance revenues increased 12 percent year-over-year on a currency-neutral basis during the second quarter, driven by strong double-digit growth in the Running, Training, and Performance Basketball categories.

- In Running, Adidas said it introduced the second generation of its record-breaking Adios Pro Evo ahead of London Marathon, where Adidas athletes delivered a double victory. The brand also launched the Boston 13, the pinnacle training shoe in the Adizero franchise, ahead of the Boston Marathon weekend. Together with the Adios Pro 4 lightweight racing shoe, these launches were said to complete the strong footwear offering for ambitious runners. Driven by the strong global credibility of the Adizero franchise as well as higher supply and an increasing number of colorways on offer, the Evo SL, said to be the most comfortable choice in the Adizero family, contributed significantly to an increase of almost 30 percent across the brand’s running footwear business.

- Growth in Training benefited from the increasing popularity of the brand’s head-to-toe offerings, including the Dropset and Rapidmove franchises in Footwear and the Essentials and Power collections in Apparel.

- The increase in Performance Basketball was driven by continued success of Anthony Edwards’ AE 1, the Harden Vol. 9, and Damian Lillard’s Dame 9, with frequent iterations across the brand’s portfolio of basketball signature models.

- Football managed to maintain the prior-year revenue level, which included the company’s highly successful business related to last year’s UEFA EURO and Conmebol Copa América tournaments. The F50 football boot remained a standout in terms of growth and awareness, with F50 Sparkfusion launching ahead of the UEFA Women’s Euro as a boot specifically designed for female football players. Activations with Aitana Bonmatí, Leo Messi, and Mo Salah were said to further authenticated the F50 franchise. This also led to positive halo effects on the brand’s growing football lifestyle offering which continues to drive and benefit from the strong soccer culture trend.

On the back of technical product innovation as well as retro-inspired collections with the iconic Trefoil logo, other categories, including Golf, Outdoor, Specialist Sports, and Motorsport also contributed to the broad-based growth.

Lifestyle Segment

Lifestyle revenues for the Adidas brand increased 13 percent y/y in currency-neutral terms during the second quarter, driven by double-digit growth in both Originals and Sportswear. “Fresh and relevant” makeovers reportedly continued to fuel healthy growth for the brand’s popular Terrace offering and Retro Running franchises. Those included restocks of sought-after animal print and metallic versions or a football-themed Samba pack featuring seven of the company’s biggest clubs in the world. Demand and supply for the brand’s Low Profile offering including Tokyo, Japan, Adiracer, and Rasant continued to scale, with ballerina versions such as the Taekwondo Mei being particularly popular. Local activations of the Superstar gained traction across several markets, with the global campaign featuring icons like Samuel L. Jackson, Missy Elliott, and Anthony Edwards kicking off the next phase of the franchise relaunch in July. To round off its offering with modern footwear silhouettes, the brand also continued to incubate Goukana as well as the Adistar Cushion platform, building on the popularity of Pharrell Wiliam’s Adistar Jellyfish, and revealed the F50 Megaride silhouette during Paris Fashion Week Men’s.

The strong momentum of Originals continued to expand into Apparel, with classics such as Firebird scaling across channels and contributing to double-digit growth. Collaborations with Edison Chen, Sporty & Rich, and exclusive collections with several retail partners further supported the growth in Originals apparel.

In Sportswear, double-digit growth continued in the quarter as Adidas said it is successfully leveraging its strong brand and product momentum in Originals and other major categories into franchises tailored to commercial price points. Additionally, innovative launches such as Climacool, a shoe with a unique lattice structure engineered entirely through 3D printing technology, or Soft Lux in apparel, featuring soft knitted fabrics for enhanced comfort, were well received by sportswear consumers.

Regional Summary

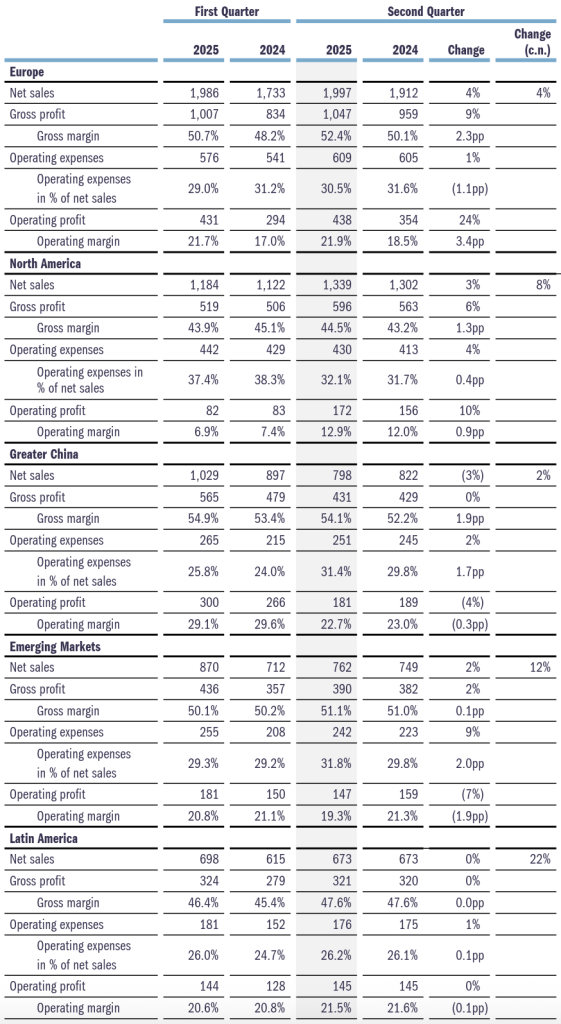

Region North America

Adidas brand currency-neutral net sales continued to grow at double-digit rates in North America (+15 percent; +8 percent incl. Yeezy). On a reported basis, North America sales improved 3 percent y/y to €1.34 billion.

First half sales for the Adidas brand in North America increased 14 percent (cn). Growth was reportedly driven by strong double-digit increases in Lifestyle, including both Originals and Sportswear. Performance revenues grew at a high-single-digit rate, including strong double-digit growth in Performance Basketball, Running, and Training. Including Yeezy sales in H1 2024, currency-neutral revenues grew 6 percent y/y. In reported euro terms, sales were up 4 percent to €2,52 billion.

Gross margin in North America remained stable at 44.2 percent in the first half. The positive effects of lower sourcing costs and reduced discounting were largely offset by an unfavorable business mix. Operating expenses increased 4 percent to €873 million, driven by an increase in marketing expenditure, while operating overhead costs declined. Operating expenses as a percentage of sales were down 0.2 percentage points to 34.6 percent of sales.

First half operating profit in North America increased 6 percent to €254 million. As a result, the operating margin increased 20 basis points to 10.1 percent of sales.

Region Europe

Adidas brand revenues in Europe grew 7 percent (+4 percent incl. Yeezy) in the second quarter, despite the non-recurrence of the strong commercial success related to last year’s UEFA Euro, which had generated revenues of ~ €100 million in the prior-year quarter.

Sales for the Adidas brand in Europe increased 11 percent on a currency-neutral basis in the first half of 2025. The increase was reportedly driven by double-digit growth in Lifestyle, featuring double-digit increases in both Originals and Sportswear. Performance revenues increased at a mid-single-digit rate, despite the non-recurrence of the strong commercial success related to last year’s UEFA Euro, driven by strong double-digit growth in Running, Training, and Performance Basketball alongside increases in several other categories. Including Yeezy sales in the prior year, currency-neutral revenues grew by 9 percent in the first half. In euro terms, H1 sales also increased 9 percent to €3,98 billion. Gross margin in Europe was up 240 basis points y/y to 51.6 percent of sales in H1, said to be mainly reflecting lower sourcing costs and favorable currency developments. Operating expenses increased 3 percent to €1.19 billion, said to be primarily due to higher operating overhead costs. As a percentage of sales, operating expenses were down 1.7 percentage points y/y to 29.8 percent of sales.

First half operating profit in Europe increased 34 percent to €869 million. The operating margin increased 410 basis points to 21.8 percent of sales in the period.

Region Greater China

Adidas brand revenues increased 11 percent in Greater China in the second quarter, or or growth of 2 percent incl. Yeezy. Reports euro sales were down 3 percent y/y to €798 million.

First half sales for the Adidas brand in Greater China increased 13 percent on a currency-neutral basis. Growth was led by strong double-digit gains in Lifestyle, driven by both Sportswear and Originals. Performance revenues also increased, driven by double-digit growth in Training and Outdoor, alongside increases in Running. Including Yeezy sales in the prior year, currency-neutral revenues grew by 8 percent. In euro terms, sales were up 6 percent to €1,827 million. Gross margin in Greater China was up 1.7 percentage points to 54.5 percent of sales in the first half as the positive effects of reduced discounting and lower sourcing costs more than offset unfavorable currency developments. Operating expenses were up 12 percent to €516 million, reflecting increases in both marketing expenditure and operating overhead costs. Operating expenses as a percentage of sales grew 1.5 percentage points to 28.2 percent.

First half operating profit in Greater China increased 6 percent to €481 million. The operating margin remained stable at 26.3 percent of sales.

Other Regions

Latin America (+23 percent; +22 percent incl. Yeezy), Emerging Markets (+14 percent; +12 percent incl. Yeezy) and Japan/South Korea (+15 percent; +13 percent incl. Yeezy) also recorded double-digit increases. In these markets, growth was broad-based as reflected in double-digit improvements in both the wholesale and DTC business.

Regional Performance

(n € millions)

Channel Summary

- Strong sell-through rates and increased shelf space allocations for the Adidas brand continued to drive Wholesale revenues, which increased 14 percent on a currency-neutral basis (+11 percent incl. Yeezy).

- DTC (direct-to-consumer) sales grew 9 percent (+3 percent incl. Yeezy).

- Owned-Retail revenues were up 9 percent (+8 percent incl. Yeezy) year-over-year, driven by like-for-like (comp-store) growth in the company’s global fleet of owned stores.

- E‑commerce sales also increased 9 percent (-3 percent incl. Yeezy) amid an ongoing focus on full-price propositions and on top of more than 30 percent growth in the prior-year quarter.

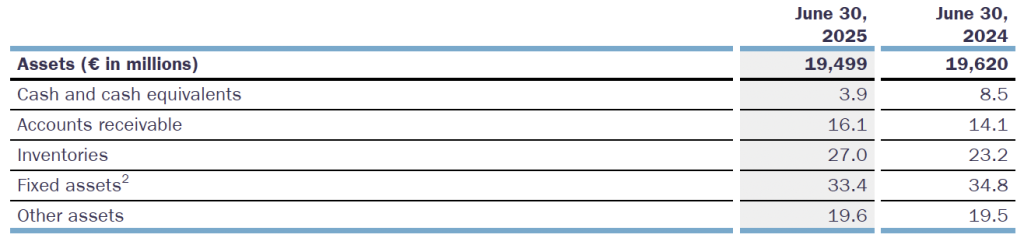

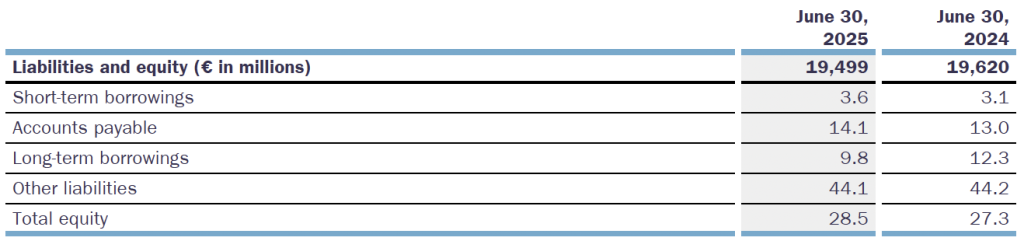

Balance Sheet Summary

Full-Year Outlook

Adidas is confirming it outlook for the full year, reflecting uncertainty due to U.S. tariffs and macroeconomic risks.

The company said external volatility and macroeconomic risks have been increasing significantly since Adidas first issued its full-year outlook at the beginning of March. While the company confirms its outlook, the range of possible outcomes remains increased.

The company continues to see upside potential based on the strong results for the first half of the year, continued brand momentum, and the strong order book for the remainder of 2025. At the same time, the increased uncertainty around the possible direct and indirect impacts from higher U.S. tariffs persists.

Adidas expects to gain further market share and grow the company’s currency-neutral sales at a high-single-digit rate in 2025. This reflects continued double-digit growth for the Adidas brand. A significantly better, broader, and deeper product range combined with an increased focus on local consumer preferences as well as much improved retailer relationships will be the main drivers of the projected top-line increase. In addition, impactful marketing initiatives will further add to the company’s brand momentum and fuel the expected top-line growth.

While Adidas will continue to increase marketing and sales investments, operating overhead efficiencies will allow the company to leverage its strong top-line growth. In combination with continued gross margin expansion, this is expected to lead to further significant bottom-line improvements in 2025. As a result, the company still projects operating profit to increase to a level of between €1.7 billion and €1.8 billion in 2025.

Having completed the sale of the remaining Yeezy inventory in 2024, the company’s outlook does not include any Yeezy revenues (2024: around €650 million) or profits (2024: around €200 million) in 2025.

Image courtesy Adidas