Academy Sports and Outdoors, Inc. CEO Steve Lawrence said the bib-box sporting goods retailer’s comp sales results for the third quarter aligned with previous guidance and improved in trend versus the first half of the year. Those comments came at the beginning of his prepared remarks on a conference call on Tuesday, December 10, with analysts to review the quarter that ended on November 2. Lawrence also said on the call that they remain cautious despite outpacing the company’s internal forecasts, starting the holiday strong, and exceeding H1 trendiness.

“We have had a strong start to the holiday season, although as we look at our third quarter in year-to-date performance and the consumer environment, we’re taking a prudent approach to our outlook and have narrowed the guidance for the full year,” Lawrence shared.

One of the biggest drivers for success for the retailer in 2025 will be the addition of an expanded Nike presentation across 140-plus stores, most likely a direct result of Nike getting back to its roots at retail in a bigger way as brands, including Asics, Brooks, New Balance, On, Hoka, and others took share during Nike’s ill-fated digital-first strategy.

Analysts heard the same from Foot Locker on its Q3 call, expecting a bump in business as Nike boosts allocations. It may be too late for Foot Locker as other brands like Adidas have taken hold; however, Academy may be in a prime position to exploit the opportunity.

Digging into the third quarter results, the company’s CFO said sales of $1.34 billion and comparable sales of negative 4.9 percent fell in line with expectations. “Our comp transactions declined by 7.1 percent, while comp tickets increased by 2.4 percent compared to last year,” he noted.

“Despite negative comparable sales in the third quarter, we were pleased to see favorable traffic trends, which drove the sequential improvement in our comp sales trajectory, reflecting the strengthening of our core business as we head into the holiday season,” Ford continued. “We experienced an increase of 250 basis points in-store foot traffic versus the first half of the year. Additionally, foot traffic during key shopping events in the third quarter increased 3.8 percent versus last year. Both of these data points, as well as our start to the holiday season, give us confidence in a stabilizing consumer environment as we enter the fourth quarter.”

Ford said that, in the third quarter-to-date, comparable sales were positive coming out of the Labor Day selling period but were offset in the back half of the quarter. He pointed to the World Series and lapping Texas Rangers World Series sales and a decline in fleece and outerwear sales due to warmer-than-normal weather patterns.

“As a result, these drove approximately 260 basis points of combined impact on the overall comp for the quarter,” Ford noted. “Our comparable sales improvement during the first half of the quarter was attributable to all of our divisions, with outdoor leading the way, primarily driven by strong fishing, camping, and hunting sales,” he detailed. “While overall comp sales for the quarter were negative 4.9 percent, we were encouraged by the performance of our business in August and September, and the October decline in sales was atypical to historical builds.”

Lawrence said the retailer was encouraged by positive comp performance during August, and he told the call participants that the company carried a lot of this momentum deep into the quarter, with comps remaining positive most of the way through September. He said warmer temps were estimated to have impacted seasonal businesses by roughly 140 basis points on comps, and the Ranger’s impact was responsible for 120 basis points of the year-over-year slide.

Looking at the results by division on a shifted calendar basis due to the 53rd week in 2023:

- Outdoor was said to be the best-performing category, posting total sales growth of 4 percent year-over-year, led by continued strength in the camping and hunting businesses.

- Footwear was called out as the second-best performing category, down 2 percent, driven by strength in key brands, including Nike, Brooks, Sketchers, and Crocs.

- Sports & Recreation sales were down 3 percent. Lawrence said Academy saw strength in team sports driven by football and baseball; however, many of the fall seasonal categories in this division (fire pits and patio heaters) saw sluggish sales caused by the aforementioned much warmer-than-average temperatures across the retailer’s geographic footprint.

“These much warmer temps also undoubtedly had a major impact on our apparel business, which ran down 9 percent during the quarter,” Lawrence added. “While we saw solid increases in warm weather categories such as shorts and tees, these businesses are not large enough in Q3 to offset the softness we saw in the key fall seasonal categories such as fleece and outerwear, as well as the Rangers World Series impact.”

The CEO said that when looking at the results across the entire company, the sales performance is not entirely reflective of the strong momentum seen with their most popular brands and non-seasonal businesses.

“These pockets of outperformance within each division are proof of our ability to resonate with consumers by offering a compelling assortment featuring new in-demand products across a wide range of price points,” he indicated.

“We remain focused on leveraging our advantage as the value provider in our space by protecting our everyday value messaging while also offering targeted promotions in key time periods during the year,” the CEO continued. “We remained true to this strategy in Q3, which enabled each division to hold margins versus last year.”

Income Statement Details

Lawrence acknowledged that merchandise margins were down slightly to last year (-30 basis points y/y) during the quarter but said it resulted from the outperformance in the company’s Outdoor division, which tends to carry lower margins. He said gross margin during the quarter declined 50 basis points year-over-year to 34.0 percent of sales.

“The primary reason for the decline in gross margin was driven by some extra supply chain costs associated with the go-live of our warehouse management system and our Georgia distribution facility along with some additional freight costs we incurred as we rerouted key elements of our holiday assortment to come in through the west coast in order to avoid any potential delays from the East Coast port strike,” the CEO explained.

He said margins were down slightly (-10 basis points y/y) through the first three quarters of the year versus the comparable 2023 YTD period, so the company believes it is prudent that for full-year guidance it hold the low end of the range at 34.3 percent, or flat to last year, but narrowing the top end of the guide to 34.5 percent from 34.7 percent previously.

“Furthermore, the decline in margins wwas driven by two key factors during the quarter,” added Ford. “First, headwinds associated with the backlog cleanup of our Georgia Distribution Center, which we discussed on the second quarter call, drove inefficiencies in our productivity as we increased the resources needed to ensure we were prepared for the holiday shopping season, of which the majority of these costs were recognized in the third quarter.”

Additionally, he said costs increased in the international freight associated with accelerating merchandise ahead of the October port strike.

“Second, our merchandise margins were down 30 basis points versus last year. The primary driver of this was our performance in our outdoor division, which was up 7 percent versus last year. We’re now fully caught up in the Georgia Distribution Center in time for the holiday shopping season and will continue to leverage the scale of our supply chain throughout our business, especially as we scale operations in our Georgia facility,” Ford concluded.

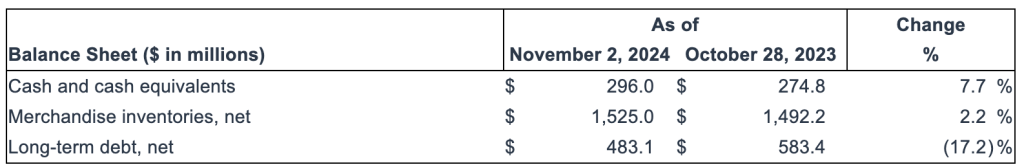

Inventory and Cash Flow Management

Academy generated $97 million and $388 million in GAAP operating cash flow and $34 million and $252 million in adjusted free cash flow during the third quarter and year-to-date in fiscal 2024, respectively, which is an increase of 126 percent and 67 percent versus the third quarter and year-to-date in fiscal 2023, respectively.

“Inventories remain well managed, with units per store down 7 percent and dollars per store down 4 percent, and we have a thoughtful promotional cadence planned to help drive traffic through the Holiday season. We plan to support these promotions with increased marketing investment to highlight Academy’s compelling assortment and market-leading value proposition. We are positioned to deliver strong operating cash flow for the full year, which we are continuing to reinvest into the business through our strategic initiatives while also returning capital directly to shareholders,” said CFO Carl Ford.

Shareholder Returns

During the quarter, Academy repurchased approximately one million shares of its outstanding common stock at a weighted average purchase price of $51.19 per common share for a total cost of $53 million. To date, Academy has repurchased 5.4 million shares of its outstanding common stock under its previous share repurchase programs for approximately $300 million, including $27 million of share repurchases in November 2024.

Subsequent to the end of the third quarter, on December 4, 2024, Academy’s Board of Directors declared a quarterly cash dividend of 11 cents per share of its outstanding common stock. The dividend is payable on January 15, 2025, to stockholders of record as of the close of business on December 18, 2024.

New $700 Million Share-Repurchase Program

With its approval of the dividend, Academy’s Board of Directors approved a new share repurchase program authorizing the company to repurchase up to $700 million of its outstanding common stock.

The new share repurchase program replaces the preceding share repurchase program, of which $423 million remained as of the end of the third quarter and is effective as of December 4, 2024, for a period of three years. Accordingly, as of today, the company has $700 million of capacity available under the new share repurchase program.

Lawrence added, “Our new share repurchase program reflects our strong sustainable cash flow generation, continuing confidence in our business model and growth strategy, and continued commitment to driving value for our shareholders. We view returning capital directly to shareholders through repurchases and our dividend as integral to our capital allocation strategy, along with ongoing investments in the business.”

Fourth Quarter and Holiday View

“Turning to the economy, in the third quarter, we continue to see broad-based consumer backdrop that was characterized by episodic shopping demonstrated by consumers waiting until major events such as back-to-school or holiday, while pulling back spending during the lulls and the calendar,” Lawrence articulated, similar to what other retail execs and researchers are noting. “We continue to see strong results during key event periods as evidenced by our positive comps during the first half of the quarter. This gives us optimism as we head into the fourth quarter, which has one of the largest shopping feeds in the entire year.”

He said customers also continue to gravitate towards the value offerings in the assortment, which was reflected in the strength seen during the promotional back-to-school season.

“Our large private brands, which are one of the best articulations of our everyday value proposition, also continue to perform well during the quarter,” the CEO continued. “To capitalize on the customer’s focus on value during the holiday peak, we’re supplementing our strong slate of everyday values some compelling promotions, which range from $4.99 sleep pants to $39.99 kids bikes, all the way up to $99.99 gas and charcoal grills. Newness continues to resonate with customers as we navigate it through 2024.”

For Q4, Lawrence said the retailer has “dramatically expanded its offering of new “must-have” products with strong statements from brands, including Yeti, Stanley and Owala in drinkware, Koolaburra by Ugg in boots and slippers, and reintroducing Converse back into the footwear assortments in all doors.

“At this point, we’re past the traditional kickoff to the holiday season and we’re pleased with our Thanksgiving weekend results where we had the largest day in the company’s history on Black Friday,” Lawrence shared. “As most of you are aware, we do have a compressed holiday calendar this year with five fewer days between Thanksgiving and Christmas, which means we’ll have to maintain a high level of momentum to help offset this truncated shopping calendar.”

The CEO also highlighted the company’s key growth initiatives to take them into 2025 and beyond.

Opening New Stores

Opening new stores and expanding the company’s footprint remains the largest opportunity for growth and is one of the top priorities as Academy executes against its long-range plan, Lawrence highlighted.

“During 2024, we successfully opened up 16 stores, which equates to roughly 6 percent unit growth, bringing our total count to 39 new stores opened since we began this journey in fiscal 2022 and it takes our total store count to 298,” he said.

Lawrence added that Academy continues to see positive comps out of the 2022 vintage stores and has been very encouraged by the 2024 vintage stores, which have gotten out of the gates with a fast start and are overachieving their plans.

“Our commitment to new store growth remains fundamental to Academy’s long-term success and will continue to refine our approach as we gain additional learnings as we move into new markets,” Lawrence added.

“Our plan is to open up 20 to 25 new stores in 2025, which will increase our unit count by approximately 7.5 percent, with our 300 stores slated to open up in Q1,” he shared. “While our long-term goal of opening up 160 to 180 stores over the next five years remains unchanged, we’re acting thoughtfully and prudently to achieve these goals as we continue to navigate a challenging short-term macroeconomic backdrop.”

To illustrate this point, Lawrence said Academy was moderating the slope of the new store growth curve in the short-term, with the 20 to 25 new stores next year coming in below the original model the company built back in 2022, which called for 30 to 35 stores in 2025.

“We are also excited that in 2025, we are starting to achieve the balanced approach we have discussed on previous calls, with roughly half of these stores currently slated to open in spring, with the remainder opening up in the back half of the year. We’re also on track to open up five new stores in Q1, which is more stores than we’ve ever opened up in the first quarter since we began this journey,” he said. “This is further evidence that we’re improving the execution of our new stores. We’re excited about expanding our store footprint into new markets and states as we start to fill in Ohio and open up our 20th State with Pennsylvania. The remaining stores will help us to fill underserved markets and core geographies such as Texas, Oklahoma, Louisiana, Arkansas, and Tennessee.”

The CEO said Academy expects new stores to generate between $12 million and $16 million in year one sales, depending upon whether it is a new or existing market, as well as other factors such as the size of the market and population demographics.

“Additionally, we hold all of our new stores to positive four-wall EBITDA contribution in year one, leading to returns on investing capital of more than 20 percent over the life of these investments,” he added.

Building a More Powerful Omni-Channel Business

Lawrence said the number one way for Academy to build its DotCom business is through store growth, particularly in new markets.

“The first reason for this is that the new store openings and the associated marketing campaigns help build brand awareness for Academy,” he explained. “Second, roughly 50 percent of our DotCom businesses fill through BOPIS. Customers have consistently demonstrated over time that the preferred method of fulfillment for many of the bulky big-ticket categories we carry, such as kayaks, gun safes, or fitness equipment, is for them to pick it up themselves. The need to have a physical store to act as a distribution hub inexorably links our DotCom growth to our new store expansions.”

Lawrence said the retailer has also seen positive results from its partnership with DoorDash during our first full quarter with this service in place.

“Phase 1 of our DoorDash partnership was fulfillment through their app, and we saw strong growth in unique customers, as well as omni-channel sales from this new service,” he explained. “As we head into holiday, we’ve expanded our partnership to allow for same-day delivery options on academy.com, which is also powered by DoorDash. We expect this to be a big unlock the last four to five days leading up to Christmas.”

Driving Comp Growth in Core Business

Lawrence reiterated his comments that the Academy customer continues to vote for newness in the assortment.

“With that in mind, I’m excited to announce that in Q1 of 2025, we’ll have one of the most meaningful launches in Academy’s history with the addition of an expanded offering of Nike product in 140-plus stores,” he announced. “The plan is to launch in April with full assortment of men’s, women’s, and kids’ across footwear, apparel and accessories along with a strong statement of sporting goods.”

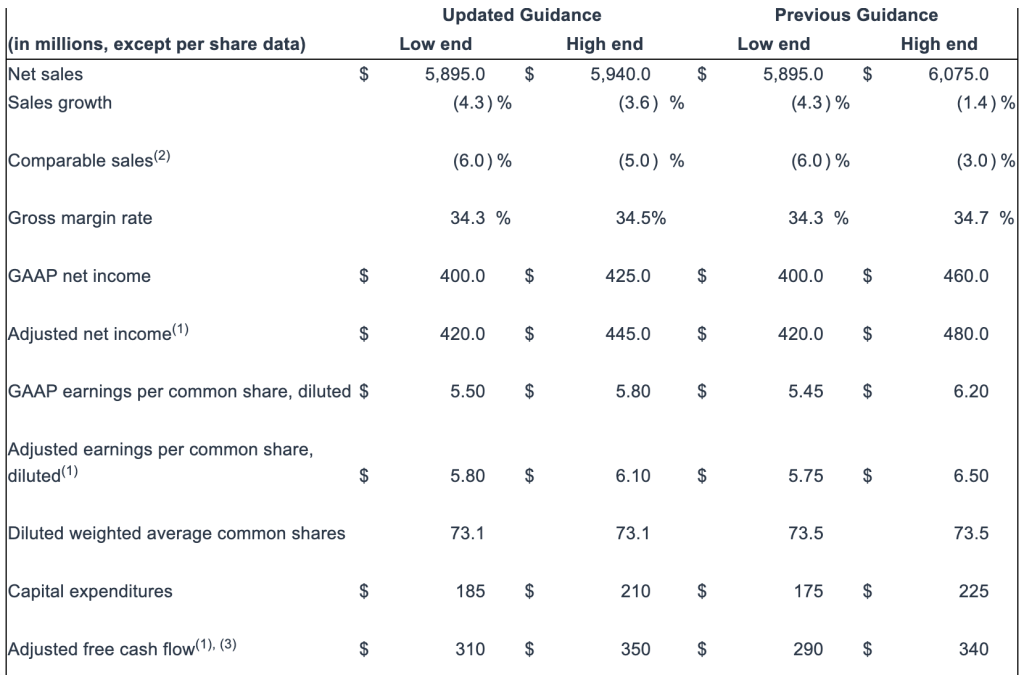

Updated 2024 Outlook

“We are looking forward to a strong fourth quarter and holiday season as our team continues to focus on execution and serving our customers,” said Ford. “Based on our third quarter performance and expectations for the remainder of fiscal 2024, we are narrowing our full-year sales and earnings guidance.”

Academy is updating its previous guidance for fiscal 20242 as follows:

Image courtesy Academy Sports and Outdoors, Inc.