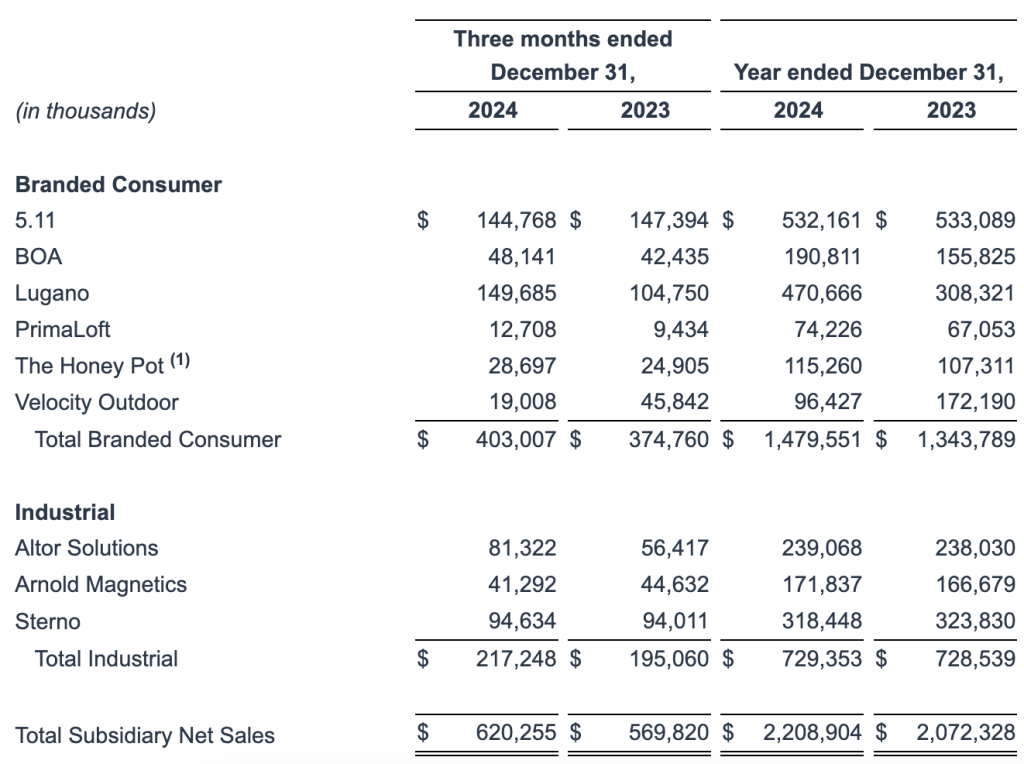

Compass Diversified (CODI) Branded Consumer net sales, which includes 5.11 Tactical, Boa, The Honey Pot, Lugano, Primaloft, and Velocity Outdoor, increased 8 percent in the 2024 fourth quarter to $403.0 million year-over-year. On a pro forma basis, Branded Consumer net sales increased 10 percent to $1.5 billion in the full year 2024.

“For the full year 2024, our consumer vertical saw pro forma revenues grow double digits, and pro forma adjusted EBITDA increased by greater than 27 percent versus prior year,” offered Patrick Maciariello, partner & COO, Compass Diversified, on a conference call with analysts. “This is despite the one-time impact of an approximately $12 million write-down of inventory at 5.11 related to PFAs regulations. Excluding this impact, our pro forma adjusted EBITDA on the consumer segment grew over 30 percent and our adjusted EBITDA margin was greater than 27 percent, representing a more than 400 basis point improvement over 2023.”

5.11 Tactical

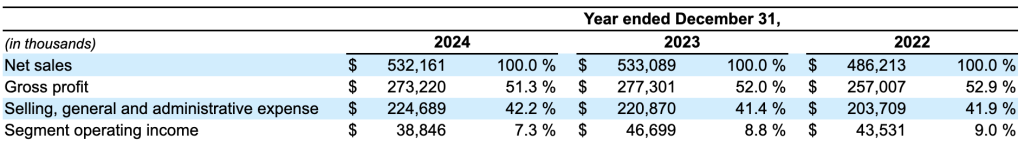

5.11 posted net sales of $532.2 million for 2024, a decrease of 0.2 percent 2023. CODI said the 5.11 sales decrease was driven by a $10.4 million decrease in direct-to-consumer sales due to less promotional sales and lower off-price selling, as well as a $0.5 million decrease in domestic wholesale sales due to inventory availability. These increases were offset by a $9.0 million increase in international sales from strong demand and a $1.5 million increase in direct-to-agency sales due to the fulfillment of large contracts.

Gross margin was 51.3 percent of net sales in 2024, down 70 basis points 52.0 percent in the year ended December 31, 2023. Gross margin was said to be unfavorably impacted by a non-recurring increase in specific inventory reserves for finished goods that include PFAs, which was offset slightly by favorability due to less promotional sales and lower off price selling in the current year versus the prior year.

Selling, general and administrative (SG&A) expenses increased to $224.7 million, or 42.2 percent of net sales, in 2024, compared to $220.9 million, or 41.4 percent of net sales, for the year ended December 31, 2023. The increase in SG&A expense was reportedly due to an increase in payroll costs associated with retail stores, as well as an increase in sales, marketing, travel, bad debt, stock compensation expense and other expenses. These increases were said to be partially offset by decreases in bonus related expenses.

5.11’s operating income for the year was $38.8 million, a decrease of $7.9 million when compared to full-year 2023.

“From an adjusted EBITDA perspective, 5.11 had a challenging year due to PFAs regulations,” noted Maciariello. “These challenges are now behind us, and we believe the company is well positioned for an improved 2025, with a focus both on growth from new product introductions and continued penetration in the direct-to-consumer segment.”

Looking ahead, Maciariello said to focus on three things with 5.11. “We’re sort of reinvigorating the DTC brand marketing, is one, and through sort of more effective execution,” he detailed. “We will have a brand refresh at some point this year that we’re really excited about and we think will drive further sales. And then we also have some — what I believe is some really exciting new product that will come out sort of in Q3 and will further refresh our DTC strategy. So there’s kind of three prongs or three things that I would look for this year at 5.11, and I’m excited about each of them.”

Compass Diversified

Compass Diversified (CODI), parent of the 5.11 Tactical, Boa, Primaloft, and Velocity Outdoor consumer brands, posted net sales of $620.3 million in the 2024 fourth quarter, up 13.8 percent compared to $544.9 million in the fourth quarter of 2023.

For the full year 2024, CODI’s consolidated net sales were $2.2 billion, up 11.9 percent compared to $2.0 billion in 2023.

For the full year 2024, CODI operating income increased 170 percent to $230.1 million compared to $85.2 million a year ago. The increase was reportedly due to an increase in net sales year-over-year, as well as non-cash impairment charges taken in 2023 of $89.4 million.

For the full year 2024, CODI net income was $47.4 million compared to $262.4 million in 2023. The decreases in net income were due primarily to the $179.5 million gain on the sale of Marucci Sports in November 2023 and the $98.0 million gain on the sale of Advanced Circuits in February 2023.

For the full year 2024, CODI income from continuing operations was $42.3 million compared to loss from continuing operations of $44.8 million in 2023. The increases in net income from continuing operations were primarily due to the non-cash impairment expenses associated with PrimaLoft and Velocity Outdoor in 2023.

For the full year 2024, CODI Adjusted Earnings was $161.6 million compared to $101.2 million a year ago.

For the full year 2024, CODI Adjusted EBITDA was $424.8 million, up 30 percent compared to $326.5 million a year ago. The increases were primarily due to strong results at Lugano. Management fees incurred during the fourth quarter and full year were $19.5 million and $74.8 million, respectively.

Image courtesy 5.11/Compass Diversified