Escalade Inc.’s profits doubled in the fourth quarter as sales jumped 58.9 percent. For the year, sales ran up 51.6 percent.

“We completed our fiscal year with a record fourth-quarter performance fueled by continued consumer demand for our innovative and dynamic portfolio of brands and product categories. Our fourth consecutive record quarterly performance demonstrates that we’ve built a sustainable business model, which drives profitable growth, invests in our team and key growth enablers, and delivers exceptional value and returns to our shareholders,” said Scott Sincerbeaux, President and CEO of Escalade, Inc.

“We took important steps in fiscal 2020 to strengthen Escalade’s competitive position over the long-term, including the acceleration of our product and asset creation pipeline and the acquisition of American Heritage Billiards and RAVE Sports, as well as key investments in our digital business and capabilities,” continued Sincerbeaux. “I would like to share my heartfelt thanks to the entire Escalade family, who have demonstrated incredible resilience throughout unprecedented times. Their dedication to serving customers and consumers, while balancing the health and wellbeing of friends, family and our community, is inspiring. Our team is what makes Escalade a truly special organization.”

“We had an excellent finish to the year, including record earnings on revenue growth,” said Stephen Wawrin, Escalade’s Chief Financial Officer. “For the full year, we delivered shareholder value through an increase in our dividend and the repurchase of 405,924 shares of stock at an average price of $16.60 per share. In addition, we enhanced our strong balance sheet and increased our financial flexibility for further strategic investments.”

Fourth Quarter Results

Net sales for the fourth quarter of 2020 were $74.8 million compared to net sales of $47.0 million for the same quarter in 2019, an increase of $27.8 million, or 58.9 percent. The company recognized increased sales across all product categories during the quarter due to increased product placement and continued high demand, most notably in our outdoor and fitness categories.

Gross margin ratio for the fourth quarter of 2020 was 23.9 percent, compared to 23.1 percent for the same period in the prior year. Gross profit for the fourth quarter of 2020 was $17.9 million compared to gross profit of $10.9 million for the same quarter in 2019, an increase of $7.0 million, or 64.0 percent.

Selling, general and administrative expenses (SG&A) were $10.5 million for the quarter compared to $7.0 million for the same period in the prior year, an increase of $3.5 million, or 50.0 percent. SG&A, as a percent of sales, for the fourth quarter of 2020 decreased to 14.1 percent from 15.0 percent reported for the same period in the prior year.

Operating income for the fourth quarter of 2020 was $6.9 million compared to operating income of $3.5 million for the same period in the prior year, an increase of $3.4 million, or 97.1 percent.

Net income for the fourth quarter of 2020 was $5.1 million, or $0.36 diluted earnings per share compared to net income of $2.6 million, or $0.18 diluted earnings per share for the same quarter in 2019.

Full Year Results

Full-year net sales for 2020 were $273.6 million compared to $180.5 million in 2019, an increase of $93.1 million, or 51.6 percent.

Gross margin ratio for full-year 2020 increased to 27.3 percent from 23.5 percent. Margins were favorably impacted by factory utilization, change in sales mix and supply chain improvements made throughout the year. Gross profit for 2020 was $74.8 million compared to gross profit of $42.4 million in 2019, an increase of $32.4 million, or 76.6 percent.

SG&A expenses for full-year 2020 were $40.3 million compared to $31.6 million in 2019, an increase of $8.7 million, or 27.5 percent. As a percent of sales, SG&A decreased to 14.7 percent from 17.5 percent in 2019.

Operating income for full-year 2020 was $33.0 million compared to $9.2 million in 2019, an increase of $23.8 million, or 256.1 percent. During 2019, the company experienced challenges with the integration of two of the latest acquisitions. The company implemented changes during the second half of 2019 which enhanced the profitability of these acquisitions during 2020.

Full-year net income for 2020 was $25.9 million, or $1.82 diluted earnings per share compared to net income of $7.3 million, or $0.50 diluted earnings per share for 2019.

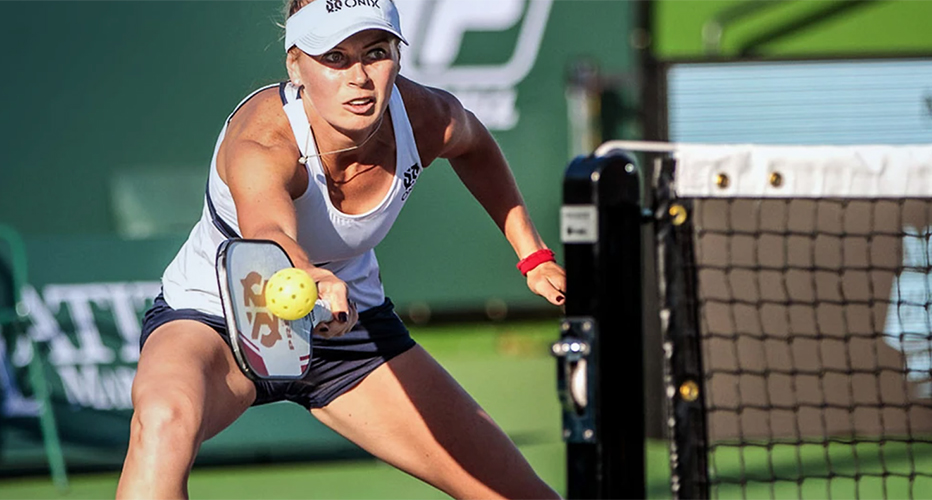

Escalade Sports’ brands include Bear Archery, Bear X, Trophy Ridge, Rocket, SIK, and Cajun Bowfishing Archery Equipment; STIGA and Ping-Pong Table Tennis; Accudart and Unicorn Darting; Rave Sports water recreation products; Atomic, Victory Tailgate, Triumph Sports, Viva Sol, Zume Games recreational games; Dura and Onix pickleball equipment; Goalrilla, Goalsetter residential in-ground basketball systems, Goaliath and Silverback residential in-ground and portable basketball goals; Lifeline and Step fitness products; Woodplay playsets; American Heritage Billiards billiards and game room assortment; and Cue&Case specialty billiard accessories.

Photo courtesy Escalade Sports