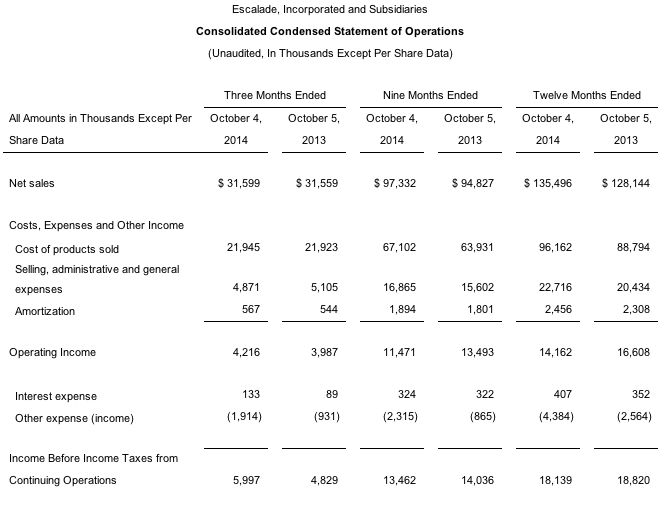

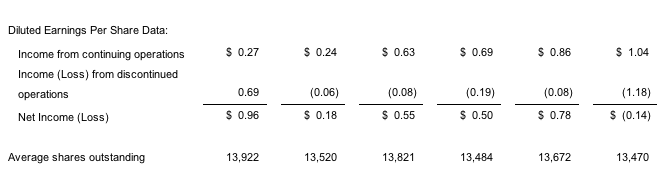

Escalade, Inc. reported net income from continuing operations for the third quarter of 2014 was $3.8 million, or 27 cents a share, compared to net income of $3.4 million or 24 cents, for the same quarter in 2013.

As a result of tax benefits recognized on the divestiture of its Information Security business and reclassification of accumulated other comprehensive income related to the disposition, total net income increased significantly during the quarter. Total net income for the third quarter of 2014 was $13.6 million or $0.96 diluted earnings per share.

Revenue from the Sporting Goods business was flat for the third quarter of 2014 and up 3 percent for the first nine months of 2014, compared with the same periods in the prior year. During the first nine months of 2013, the company experienced exceptional sales growth in certain categories that was not equaled during the first nine months of 2014. The company expects sales growth trends for the remainder of the year to exceed those experienced in the first nine months of 2014, not including the effect of the previously announced acquisition of Cue & Case Sales.

The Sporting Goods gross margin ratio for the first nine months of 2014 was 31.1 percent compared to 32.6 percent for the same period last year. Decreased gross margin resulted from lower sales in certain higher margin categories and increased product development investments.

The company is solely focused on growing its Sporting Goods segment through organic growth of existing categories, strategic acquisitions, and new product development now that the businesses comprising the Information Security and Print Finishing segment have been divested. The Sporting Goods segment competes in a variety of categories including archery, team and individual sports and games. Strong brands and on-going investment in product development provide a solid foundation for building customer loyalty and continued growth.

Loss from discontinuing operations includes loss from operations of $0.4 million, loss on disposal of assets of $9.4 million, income from reclassification of accumulated other comprehensive income of $2.6 million and a tax benefit of $6.1 million. The company was able to utilize previously reserved net operating loss and capital loss carryovers to realize a tax benefit on the disposal of $6.1 million. Net loss from discontinued operations is $1.1 million or $0.08 diluted earnings per share.

“In spite of facing exceptionally strong sales comparisons to last year, we have grown our sporting goods business through the first nine months of 2014,” noted Robert J. Keller, President and Chief Executive Officer of Escalade, Inc. “We anticipate improved growth in the fourth quarter from our base business including revenue from our recent acquisition of Cue & Case Sales.” Commenting on Escalade’s sole focus on the Sporting Goods segment, Keller stated, “Our team of sports and outdoor enthusiasts has a passion for innovation and a close connection to our brands and the active lifestyles they inspire. We are fully focused on building Escalade into a premier Sporting Goods company.”

Escalade’s Board of Directors declared a quarterly dividend on the company’s common stock of $0.10 per share, to be paid to all shareholders of record on December 12, 2014 and disbursed on December 19, 2014. Escalade’s Board of Directors will evaluate its dividend policy on an ongoing basis, giving careful consideration to the company’s financial condition, outlook, and potential cash flow requirements.

In a separate statement, Escalade said it was consolidating its finance and accounting department effective at the end of its fiscal year on December 27, 2014. At that time, Stephen R. Wawrin will assume the additional duties as Escalade’s Vice President, Finance and Chief Financial Officer. Since 2008, Mr. Wawrin has served as Vice President Finance and Administration for Escalade’s Sporting Goods business. He joined Escalade in 2005, and previously served as Corporate Controller for Escalade, Inc. Mr. Wawrin will succeed Deborah J. Meinert, Escalade’s current Vice President Finance, Chief Financial Officer, and Secretary, who will be leaving Escalade at that time.

The decision to restructure Escalade’s finance and accounting department results from Escalade’s strategic decision to focus on its Sporting Goods business. With the divestiture of its Information Security and Print Finishing business, Escalade’s executive management and board of directors determined that certain functions could be consolidated. This management change does not impact or in any way relate to the financial statements or reporting of Escalade or its subsidiaries.

Robert J. Keller, Escalade’s President and Chief Executive Officer, said, “We thank Deborah for her service over the last seven years. Deborah has made many contributions to the success of Escalade, and we wish her the best in the future.” Mr. Keller continued, “Stephen is an integral part of our Sporting Goods team and we look forward to his continued leadership as we seek to grow our Sporting Goods business. We anticipate a smooth transition in the company’s business and financial operations as Stephen assumes his expanded role.”

The largest division, Escalade Sports, is a leading manufacturer and distributor of sporting goods and outdoor products. Leaders in their respective categories, Escalade Sports brands include STIGA and Ping-Pong table tennis, Accudart and Unicorn darting; Goalrilla, Goaliath and Silverback sports training equipment and basketball goal systems; and Bear Archery, Trophy Ridge and Cajun Bowfishing hunting products.