Emerald Expositions, the parent company of Outdoor Retailer, reported a net loss of $90 million in the fourth quarter as it took $104.3 million in impairment charges related to certain trade names and customer-related intangible assets.

Fourth Quarter 2018 Highlights

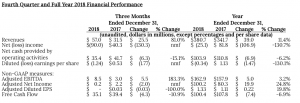

- Revenues increased 81.0 percent to $57.0 million, compared to $31.5 million for fourth quarter 2017

- Net loss of $90.0 million, compared to net income of $40.3 million for fourth quarter 2017

2018 fourth-quarter net loss included a non-cash charge of $104.3 million related to the impairment of certain intangible assets - Net cash provided by operating activities decreased 15.1 percent to $35.4 million, compared to $41.7 million for the fourth quarter of 2017

- Adjusted EBITDA, a non-GAAP measure, increased 183.3 percent to $8.5 million, compared to $3.0 million for fourth quarter 2017

- Adjusted Net Income, a non-GAAP measure, decreased to $0.2 million, compared to $2.2 million for fourth quarter 2017

- Free Cash Flow, a non-GAAP measure, decreased 10.9 percent to $35.1 million, compared to $39.4 million for fourth quarter 2017

Full Year 2018 Highlights

- Revenues increased 11.4 percent to $380.7 million, compared to $341.7 million for the full year 2017

Net loss of $25.1 million, compared to net income of $81.8 million for the full year 2017 - As noted above, 2018 net loss included a non-cash charge of $104.3 million related to the impairment of certain intangible assets

- Net cash provided by operating activities decreased 6.2 percent to $103.9 million, compared to $110.8 million for the full year 2017

- Adjusted EBITDA, a non-GAAP measure, increased 3.2 percent to $162.9 million, compared to $157.9 million for the full year 2017

- Adjusted Net Income, a non-GAAP measure, increased 24.8 percent to $100.2 million, compared to $80.3 million for the full year 2017

- Free Cash Flow, a non-GAAP measure, decreased 6.9 percent to $100.4 million, compared to $107.8 million for the full year 2017

“We delivered strong growth in revenues and Adjusted EBITDA in the fourth quarter of 2018,” reported Phil Evans, interim Chief Executive Officer and Chief Financial Officer of Emerald Expositions. “This growth partly reflected the benefit of several successful launches, including our new Outdoor Retailer Winter Market show in November. We also experienced a strong contribution from our two acquisitions in the second half of 2018, including Boutique Design New York which staged in November and grew revenues by a low double-digit percentage over the prior year’s show, in line with our expectations. Beyond our portfolio, we also worked to maximize shareholder value through our capital allocation strategy as we repurchased approximately 1.6 million common shares at an average cost of $11.94 per share given the persistent discount to intrinsic value at which our shares traded during the fourth quarter.”

Evans added, “Looking to 2019, our guidance reflects the bold actions that we are taking to reposition our NY Now Shows and to enhance our event experiences broadly across the portfolio for both attendees and exhibitors. We are confident that these actions and incremental investments will be rewarded with improved performance in the future. In fact, we are optimistic that we have successfully turned around the perception of NY NOW for many in the marketplace as there was genuine excitement on the show floor for our recent Winter edition. There were numerous new exhibitors and show features, while show attendance volume and quality improved noticeably over the prior year, which bodes well for future editions. Overall, we have a strong portfolio of market-leading brands and, as we stabilize NY NOW and ASD, we expect the portfolio to return to solid organic growth. Looking forward, we remain committed to delivering strong cash flows and shareholder returns over the long term.”

Financial And Operational Results

For the fourth quarter of 2018, Emerald reported revenues of $57.0 million compared to revenues of $31.5 million for the fourth quarter of 2017, an increase of $25.5 million, or 81.0 percent. The increase included incremental revenue in 2018 of $17.1 million from acquisitions and $2.8 million from a show scheduling difference for an event that staged in the fourth quarter of 2018 and in the third quarter of 2017, partly offset by a net $0.7 million reduction in revenues due to several small discontinued events. Organic revenue growth for the quarter of $6.3 million, or approximately 19.1 percent, was mainly driven by several show launches, most notably Outdoor Retailer Winter Market.

Cost of Revenues of $20.4 million for the fourth quarter of 2018 increased by 112.5 percent, or $10.8 million, from $9.6 million for the fourth quarter of 2017. This increase reflected $7.3 million of incremental costs related to acquisitions and $0.8 million due to the show scheduling difference noted above, with $0.5 million of net savings on discontinued events. Additional costs associated with organic revenue growth, including show launches, were $3.2 million for the fourth quarter of 2018.

Selling, General & Administrative Expense (“SG&A”) of $31.8 million for the fourth quarter of 2018 increased by 22.3 percent, or $5.8 million, from $26.0 million for the fourth quarter of 2017. SG&A for the fourth quarter of 2018 included incremental costs attributable to acquisitions of $4.8 million, and an increase in stock-based compensation of $1.1 million, offset by a reduction of $3.1 million in non-recurring other items.

Net loss of $90.0 million for the fourth quarter of 2018 represented a decrease compared to net income of $40.3 million for the fourth quarter of 2017. In the fourth quarter of 2018, in connection with the company’s annual October 31 testing of intangibles for impairment, the company recorded a $104.3 million non-cash charge related to certain trade names and customer-related intangible assets. In the fourth quarter of 2017, net income included the benefit of a $52.1 million deferred tax credit related to the re-measurement of the company’s deferred tax liabilities at the reduced federal corporate tax rate that became effective January 1, 2018.

For the fourth quarter of 2018, Adjusted EBITDA was $8.5 million, compared to $3.0 million for the fourth quarter of 2017, which reflects an adjustment for the impact of the show scheduling difference noted earlier. The increase of $5.5 million was driven predominantly by acquisitions and fourth quarter launches.

For a discussion of the company’s presentation of Adjusted EBITDA, which is a non-GAAP measure, see below under the heading “Non-GAAP Financial Information.” For a reconciliation of Adjusted EBITDA to net income see Appendix I attached hereto.

Cash Flow

Net cash provided by operating activities decreased by $6.3 million to $35.4 million in the fourth quarter of 2018, compared to $41.7 million in the fourth quarter of 2017. The key items affecting the quarter’s cash flow were lower cash receipts for future shows in the fourth quarter of 2018 than in the fourth quarter of 2017, $0.7 million in higher interest payments and $0.4 million in higher cash taxes, partly offset by a $3.1 million reduction in the cash outflows related to non-recurring other items.

Capital expenditures were $0.3 million for the fourth quarter of 2018, compared to $2.3 million for the fourth quarter of 2017.

Free Cash Flow, which we define as net cash provided by operating activities less capital expenditures, was $35.1 million for the fourth quarter of 2018, compared to $39.4 million in the fourth quarter of 2017.

Liquidity and Financial Position

As of December 31, 2018, Emerald’s cash and cash equivalents were $20.5 million and gross debt was $576.5 million, resulting in net debt (gross debt less cash and cash equivalents) of $556.0 million. As a result, Emerald’s net debt leverage ratio at the end of the fiscal year was 3.4 times Adjusted EBITDA, calculated in accordance with the company’s credit agreement.

Dividend

On February 5, 2019, the Board of Directors approved the payment of a cash dividend of $0.0725 per share for the quarter ending March 31, 2019, to holders of the company’s common stock. The dividend is expected to be paid on or about March 5, 2019, to stockholders of record on February 19, 2019.

In the second quarter of 2019, management intends to propose and expects the Board of Directors will approve, a 3.4 percent increase in the quarterly cash dividend rate, to $0.075 per share effective for the second quarter 2019 dividend. The incremental quarterly cash payment of the proposed increase would be approximately $0.2 million.

Outlook (Forward-Looking Statements), Variances From 2018 And Key Assumptions

For the year ending December 3, 2019, Emerald management expects the following

- Total revenue decline of 0.7 percent to growth of 2.5 percent, or revenue in a range of approximately $378 million to $390 million

- Solid revenue growth in many of our brands; slight revenue growth in our three-show Outdoor Retailer franchise and a modest decline in our ASD shows

- Expected revenue decline for the two NY NOW shows of between $5 million and $8 million in aggregate, partly reflecting our deliberate decision to more tightly curate the show and reposition the brand up-market

- Combined incremental revenue in 2019 for the two acquisitions closed in the second half of 2018 in the range of $11 million to $13 million, offset by a revenue loss of approximately $6 million relating to events that took place in 2018 and will not repeat in 2019, most notably our Interbike show

- Organic revenue decline of 1.7 percent to growth of 1.1 percent

- Adjusted EBITDA in the range of $140 million to $150 million, representing a decrease in the range of 7.9 percent to 14.1 percent compared to 2018

- High flow-through of the revenue decline at NY NOW to consolidated Adjusted EBITDA

- New investments that are incremental to 2018 levels in our show experiences and in marketing and sales resources totaling approximately $9 million

- Incremental contribution in 2019 for the two acquisitions closed in the second half of 2018 of approximately $1 million to $3 million, reflecting the fact that a high proportion of their annual results were reported in 2018 as the principal events staged after our acquisition, offset by the lost contributions related to discontinued events, notably Interbike

- Adjusted Net Income in the range of $76 million to $88 million, representing a decrease in the range of 12.2 percent to 24.2 percent compared to 2018

- Adjusted Diluted EPS in the range of $1.02 to $1.20, representing a decrease of 9.8 percent to 23.3 percent compared to 2018

- Free Cash Flow in the range of $80 million to $90 million

Emerald is a leading operator of business-to-business trade shows in the United States. We currently operate more than 55 trade shows, as well as numerous other face-to-face events. In 2018, Emerald’s events connected over 500,000 global attendees and exhibitors and occupied more than 7.0 million net square feet of exhibition space. Photo courtesy Emerald Expositions