DSW Inc. reported that athletic shoes helped restore growth in its womens business in the third quarter as the athleisure trend continued to drive fashion.

DSW Inc. reported that athletic shoes helped restore growth in its womens business in the third quarter as the athleisure trend continued to drive fashion.

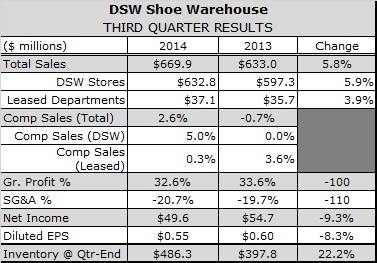

Sales of athletic shoes comped up 7 percent compared with an overall comps increase of 2.6 percent as the Columbus, OH-based retailer chased the athleisure fashion trend. DSW reported net sales grew 5.8 percent to $669.9 million in the third quarter ended Nov. 1.

We saw a shift out of casual footwear into the fashion athletic category, said Debbie Feree, DSW Vice Chairman and Chief Marketing Officer. It’s no secret that customers of all ages are wearing sneakers more often and for more occasions. We recognized this trend early on and shifted inventories accordingly.”

Feree said the fashion piece of the athletic business, both for men and women, saw very large double-digit comp increases.

The iconic brands are actually doing well, things like Converse and Vans. Vulcanized as a category did exceptionally well,” she said.

The trend helped drive a 1 percent comps increase in Womens footwear, where comps had declined the previous two quarters. In addition to Athletic, Womens Boots comped up 6 percent, while Womens Sandal sales comped up 8 percent, reflecting the retailers decision to extend its assortment of sandals in warm weather markets.

Mens footwear posted a 3 percent comps increase during the quarter. Geographically, sales were strongest in the South.

Store traffic declined in the low single-digit range, but continued to improve from Q2 levels. Online traffic increased at a healthy rate. Conversion rates increased both at stores and online. Average unit retails declined in the low single digits, partially offset by an increase in units per transaction in the low single digits.

We believe many customers are using mobile to survey their choices, but ultimately they choose to complete their transaction in-store, said DSWs CFO Mary Meixelsperger.

Gross margin declined 100 bps, reflecting a 40 bps decline in merchandise margins and 55 bps due to asset impairment charges. Lower mark-down rates and better category mix were offset by planned sharper pricing that created pressure on initial mark ups (IMUs). Also driving merchandise margin were shipping costs related to our charge-send or ship-from-store fulfillment, which resulted in 50 basis points of margin contraction.

Occupancy rates increased 60 basis points, which includes 55 basis points for asset impairment charges. SG&A expense dollars increased by 11.9 percent and deleveraged by 90 basis points, due to planned investments in omni-channel and marketing, offset by lower incentive compensation.

DSW President and CEO Mike MacDonald estimated the company now generates about $85 million in omni-channel sales, which includes: sales that originated online, but were fulfilled in store; demand that’s originated in store, but fulfilled through the companys fulfillment center; and demand in one store that’s fulfilled from another store.” The company plans to offer in-store pickup in 2015.

Reported net income was $49.6 million, or 55 cents per diluted share, on 90 million shares, which includes a RVI tax provision adjustment. This compares to reported net income in the third quarter of 2013 of $55.0 million, or 60 cents per diluted share, on 92 million shares, which included a net after-tax income of $1.4 million, or a penny per share, from the company’s luxury test.

Adjusted net income was $50.4 million, or 56 cents per diluted share, on 90 million shares, which includes a one-time charge of 3 cents per share from asset impairment. This compares to adjusted net income for the same period last year of $53.6 million, or $0.58 per diluted share, on 92 million shares. Wall Street’s consensus estimate had been 51 cents a share.

DSW ended the period with 431 stores in operation, up 9.6 percent in units and 7.1 percent in square footage. Performance at seven new, smaller format stores was mixed. Inventory was up 7.4 percent on a square-foot basis, reflecting the companys decision to increase opportunistic buying. Excluding those pre-buys, inventory-per-square-foot was up 3.7 percent.

DSW expects full-year comparable sales to be slightly positive and full-year total sales to increase in the mid-single-digit range. Its still calling for disappointing spring results, IMU compression associated with selective sharper pricing, and higher shipping costs to push down full-year merchandise margins by 100-150 bps compared with the prior year.

MacDonald noted that DSW hired a buyer in October in a bid to bump close-out sales back up to about 10 percent of sales after letting them fall below the level in the last year. DSW will emphasize those values in its holiday marketing, but does not expect to increase the general level of promotions.

Feree sees the athleisure trend continuing into spring 2015.

That excites me, she said, because the casualization of apparel and footwear plays very, very well into what’s happening in the athletic area.