Designer Brands, Inc. shares were down more than 20 percent trading on June 4 after the parent of DSW, Topo Athletic, Keds, Le Tigre, Hush Puppies, and other footwear brands reported that fiscal first-quarter net sales increased 0.6 percent year-over-year to $746.6 million.

Total comparable sales decreased by 2.5 percent in the first quarter on top of a 10.4 percent decline in the year-ago Q1 period.

- U.S. Retail segment net sales increased 1.4 percent in Q1 to $621.4 million, with comparable store sales down 2.3 percent on top of an 11.6 percent decline in the prior-year Q1 period.

- Canada Retail net sales grew 2.9 percent to $55.5 million in the quarter. Comps in Canada were down 4.9 percent for the Q1 period, cycling a 2.9 percent comp sales increase in Q1 last year.

- Brand Portfolio segment net sales, including Keds, Hush Puppies, Keds, Topo Athletic, and Le Tigre, increased 12.0 percent to $104.1 million in Q1. Segment direct-to-consumer (DTC) comps were down 1.7 percent in Q1, cycling an 8.3 percent comp in the year-ago Q1 period.

Total segment net sales, which includes inter-segment net sales, were up 2.8 percent for the quarter to $781.0 million.

DTC sales decreased 10.2 percent year-over-year to $127.3 million.

Gross profit increased to $245.1 million versus $237.7 million in Q1 last year, and gross margin was 32.8 percent of net sales in Q1 compared to 32.0 percent for the Q1 period last year.

The retailer’s Reported Net Income attributable to Designer Brands, Inc. was $0.8 million, or one cent earnings per diluted share, including net after-tax charges of 7 cents per diluted share from adjusted items, primarily related to restructuring and integration costs; this compares to net income attributable to Designer Brands, Inc. of 11.4 million, or 17 cents per diluted share, in the year-ago Q1 period.

- Adjusted net income was $4.8 million, or adjusted diluted EPS of 8 cents per share.

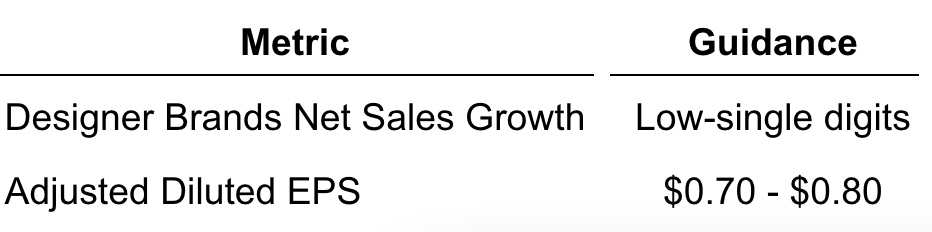

Reaffirming 2024 Financial Outlook

The company reaffirmed the following guidance for the full year 2024:

Chart and data courtesy Designer Brands Inc.

See below for additional SGB Media coverage of DBI’s first quarter, including new hires, new acquisitions, details by brand and segment and CEO commentary on progress:

EXEC: DBI Gets Q1 Lift from Topo and Keds While Dress and Seasonal Drag on Retail