Designer Brands Inc. lowered its guidance for the year after reporting third-quarter results came in below Wall Street’s targets in part due to warm weather and the impact of tariffs.

Roger Rawlins, chief executive officer, stated, “We continued to make progress on our strategic initiatives and the integration of our acquisitions. At the same time, we faced several meaningful headwinds during the third quarter that impacted our results and will likely continue for the upcoming quarters.

“The near-record warm weather during our largest and most profitable quarter affected every segment of our business. And, while we are extremely proud of the results we’ve achieved, substantially mitigating the very material footwear tariffs that were recently enacted, the mitigation effort itself has had repercussions which have weighed heavy on our results.”

Rawlins continued, “We took proactive actions to protect our topline and delivered positive comps in the third quarter. Our Camuto organization delivered their first positive operating income contribution in the quarter and the incredible Camuto designed and sourced exclusive brand product is being delivered to our warehouses currently and will be customer facing in just a few weeks. And I am excited to see Canada continue to strongly leverage the expertise and infrastructure from our US business as they delivered another stellar quarter.”

“We are continuously seeking ways to increase our market share,” Rawlins concluded, “all while reducing costs across our entire organization and mitigating tariffs. We continue to believe our ability to operate a fully integrated supply chain will yield significant benefit and enable us to better compete across all channels and creates a long runway for growth, and in turn, long-term value for our shareholders.”

Third Quarter Operating Results

- Total revenue increased by 12.4 percent, including $137.5 million in revenue from the Brand Portfolio segment, which includes $25.6 million in intersegment revenue that is eliminated in consolidation. Wall Street’s consensus estimate was $930 million.

Comparable sales increased 0.3 percent for third quarter of fiscal 2019 compared to a 7.3 percent increase in the third - quarter of fiscal 2018. Wall Street’s consensus estimate was a 0.1 percent same-store gain.

- Reported gross profit, as a percent of net sales, decreased by 370 bps primarily driven by lower margins in the U.S. Retail segment due to being more promotional and higher shipping costs in the current year associated with higher digital penetration, partially offset by higher margins in the Canada Retail segment due to lower clearance activity and improved leverage in occupancy costs.

- Reported operating expenses, as a percent of revenue, decreased by 400 bps, driven by lower incentive compensation, the impact of lease exit charges, acquisition-related costs and restructuring charges in the prior year, and lower marketing investments, partially offset by the impact of including Camuto Group in the consolidated results.

- Reported net income was $43.5 million, or $0.60 per diluted share, including pre-tax charges totaling $6.9 million, or $0.07 per diluted share, primarily from impairment charges and integration and restructuring expenses. In the year-ago quarter, EPS was $39.3 million, or 48 cents.

- Adjusted net income was $48.6 million, or $0.67 per diluted share, below the analysts’ consensus forecasts of 74 cents. On an adjusted basis, earnings were down 8.4 percent from $57.9 million, or 70 cents a share.

Nine Months Operating Results

- Total revenue increased by 14.3 percent, including $345.0 million in revenue from the Brand Portfolio segment, which includes $53.8 million in intersegment revenue that is eliminated in consolidation.

- Comparable sales increased 0.8 percent compared to last year’s 6.3 percent increase.

- Reported gross profit, as a percent of net sales, decreased by 190 bps.

- Reported operating expenses, as a percent of revenue, decreased by 30 bps.

- Reported net income was $102.1 million, or $1.36 per diluted share, including pre-tax charges totaling $19.3 million, or $0.21 per diluted share, primarily from impairment charges and integration and restructuring expenses.

- Adjusted net income was $117.9 million, or $1.57 per diluted share.

Balance Sheet Highlights

- Cash and investments totaled $113.8 million compared to $294.3 million at the end of the third quarter last year, and debt totaled $235.0 million compared to no debt outstanding at the end of the third quarter last year, reflecting the funding of the two acquisitions in fiscal 2018 and share repurchase activity.

- The company ended the quarter with inventories of $677.7 million compared to $624.2 million last year. Excluding inventories from the acquisitions, inventories per square foot decreased 5.6 percent to last year.

- During fiscal 2019, the company repurchased 7.1 million shares for a total of $141.6 million with $334.9 million remaining under its share repurchase program.

Regular Dividend

The company’s Board of Directors declared a quarterly cash dividend of $0.25 per share. The dividend will be paid on January 3, 2020 to shareholders of record at the close of business on December 20, 2019.

Fiscal 2019 Annual Outlook

The company lowered its full year outlook for Adjusted EPS in the range of $1.50 to $1.55 per diluted share, compared to its previous range of $1.87 to $1.97 per diluted share.

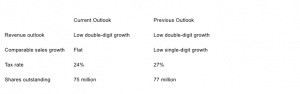

Comparison of Current to Previous Outlook

Designer Brands operates nearly 1,000 locations under the DSW Designer Shoe Warehouse, The Shoe company, and Shoe Warehouse banners and services footwear departments in the U.S. through its Affiliated Business Group (“ABG”). Camuto Group owns licensing rights for the Jessica Simpson footwear business, and footwear and handbag licenses for Lucky Brand and Max Studio. In partnership with a joint venture with Authentic Brands Group, Designer Brands also owns a stake in Vince Camuto, Louise et Cie, Sole Society, CC Corso Como, Enzo Angiolini and others.

Designer Brands operates nearly 1,000 locations under the DSW Designer Shoe Warehouse, The Shoe company, and Shoe Warehouse banners and services footwear departments in the U.S. through its Affiliated Business Group (“ABG”). Camuto Group owns licensing rights for the Jessica Simpson footwear business, and footwear and handbag licenses for Lucky Brand and Max Studio. In partnership with a joint venture with Authentic Brands Group, Designer Brands also owns a stake in Vince Camuto, Louise et Cie, Sole Society, CC Corso Como, Enzo Angiolini and others.