DSW reported second-quarter earnings on an adjusted basis slid 24.7 percent but came in ahead of Wall Street's consensus estimate by 5 cents a share. Comps rose 0.8 percent and the footwear chain was “encouraged by the sequential improvement in sales trends as the quarter progressed.” DSW raised its guidance for the year.

Mike MacDonald, President and Chief Executive Officer stated, “In the quarter we accomplished our goal of achieving improvement in the underlying sales trends and eliminating any inventory imbalances. All major categories recorded improved sales performance in the second quarter compared to the first quarter. In addition, we were encouraged by the sequential improvement in sales trends as the quarter progressed. The actions we took to balance inventories created margin pressure but inventories at the end of the quarter were current and below the prior year on a cost per square foot basis.

“We continued to make progress in our omni-channel initiative. The changes we are making are fundamental to the way we serve our customers. They will enable DSW to respond to the rapidly changing customer shopping patterns and maintain our position of strength in the footwear industry,” Mr. MacDonald added.

Second Quarter Operating Results

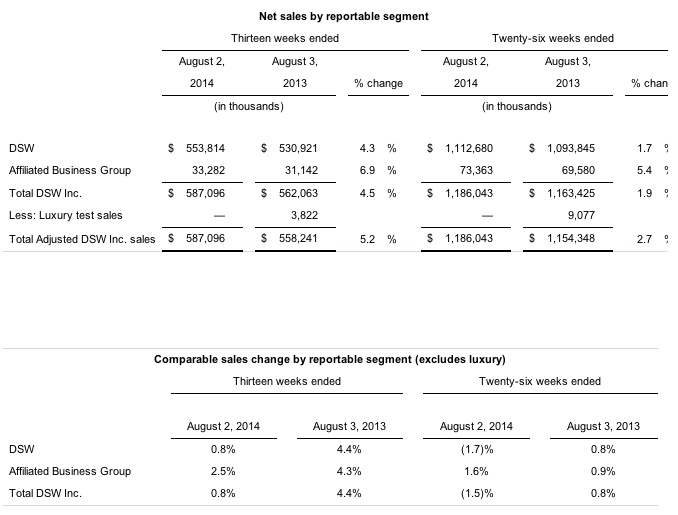

Reported sales increased 4.5 percent to $587 million compared to last year's second quarter sales of $562 million.

Adjusted sales increased 5.2 percent to $587 million compared to last year's second quarter sales of $558 million, which excluded sales from the company's luxury test. For the thirteen week period ended August 2, 2014, comparable sales increased by 0.8 percent. This follows an increase of 4.4 percent during the thirteen week period ended August 3, 2013.

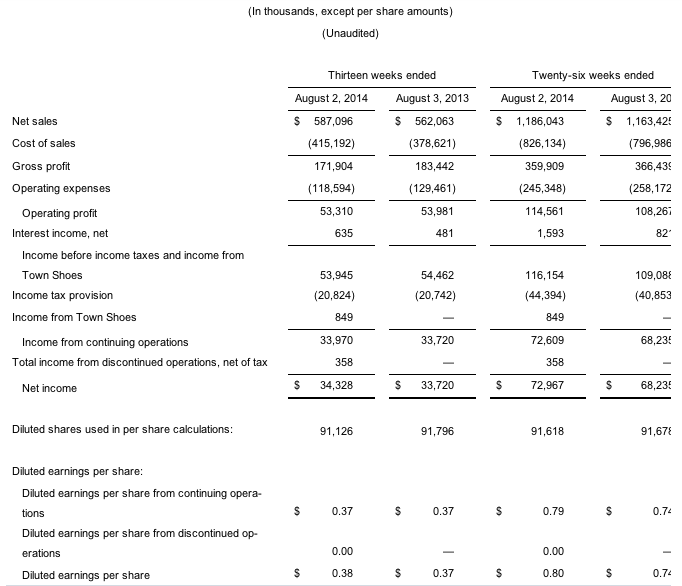

Reported net income was $34.3 million, or $0.38 per diluted share on 91 million weighted average shares outstanding, which includes an after-tax gain related to income for RVI. This compares to Reported net income in the second quarter of 2013 of $33.7 million, or $0.37 per diluted share, which included a net after-tax loss of $1.5 million, or $0.02 per share, from our luxury test, and a net charge of $9.3 million, or $0.10 per share, from the termination of the pension plan assumed in conjunction with the RVI merger.

Adjusted net income was $33.6 million, or 37 cents per diluted share on 91 million weighted average shares outstanding. This compares to net income, adjusted for the results of our luxury test and legacy charges from RVI, for the same period last year of $44.6 million, or 49 cents per diluted share, on 92 million weighted average shares outstanding. Wall Street on average was expecting 32 cents a ahare.

Six Months Ended August 2, 2014 Operating Results

Reported sales increased 1.9 percent to $1.19 billion compared to last year's sales of $1.16 billion.

Adjusted sales increased 2.7 percent to $1.19 billion compared to last year's sales of $1.15 billion, which excluded sales from the company's luxury test.

For the twenty-six week period ended August 2, 2014, comparable sales decreased by 1.5 percent. This follows an increase of 0.8 percent during the twenty-six week period ended August 3, 2013.

Reported net income was $73.0 million, or $0.80 per diluted share, on 92 million weighted average shares outstanding. This compares to Reported net income in the same period last year of $68.2 million, or $0.74 per diluted share, which included a net after-tax loss of $12.9 million, or $0.14 per share, from our luxury test, and a net after-tax charge of $9.3 million, or $0.10 per share, from the termination of the pension plan assumed in conjunction with the RVI merger.

Adjusted net income was $72.2 million, or $0.79 per diluted share, on 92 million weighted average shares outstanding. This also compares to net income, adjusted for the net loss from our luxury test and legacy charges from RVI, for the same period last year of $90.4 million, or $0.99 per diluted share, on 92 million weighted shares outstanding.

Second Quarter Balance Sheet Highlights

Cash, short term and long term investments totaled $465 million at quarter end compared to $500 million at the end of the second quarter last year.

Inventories were at $415 million compared to $405 million during the second quarter last year. On a cost per square foot basis, DSW segment inventories decreased by 3.3 percent at the end of quarter, excluding inventory for our luxury test last year.

The company repurchased approximately 2 million shares for $55 million under its $100 million authorized share buyback plan, with $43 million of its current authorization remaining.

Fiscal 2014 Annual Outlook

For the fifty-two week fiscal year ending January 31, 2015, the company expects Adjusted earnings per share to range from $1.50 to $1.65 per share. This assumes flattish comps and total revenue growth in the mid single digit range. This guidance includes omni-channel related expenses of $10 million, or approximately $0.07 per share, a tax rate of 39 percent and diluted shares outstanding of 91 million.

In reporting first-quarter results on May 28, it had expected earnings for the year in the range of $1.45 to $1.60 per share.