DSW, Inc.'s fourth quarter profits climbed 38.1% to $18.5 million, or 41 cents a share. Revenues climbed 16.4% to $468.5 million. Comps jumped 14.9% on top of a 12.9% increase last year.

DSW, Inc.'s fourth quarter profits climbed 38.1% to $18.5 million, or 41 cents a share. Revenues climbed 16.4% to $468.5 million. Comps jumped 14.9% on top of a 12.9% increase last year.

“Clearly, our performance reflected some modest economic improvement and a meaningful uptick in the footwear industry generally,” said Mike MacDonald, president and CEO, on a conference call with analysts. “However, I also believe we have and will continue to benefit from the strength of the unique DSW formula of assortment, value and convenience.”

The comp gain was driven by a combination of increased traffic and conversion. Units per transaction contributed over 1 percentage point to the comp, the first gain in over three years. Merchandise margins declined to 41.8% from last year's record high of 44.4% but its SG&A rate decreased 110 basis points due to decreased overhead.

Inventory climbed 16% due to early spring receipts, a significant pre-buy of boots to offset expected increased costs for fall 2011, and inventory to support DSW.com.

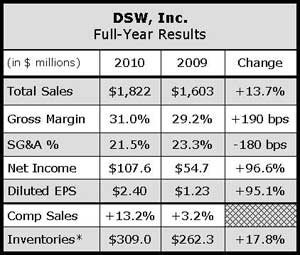

All merchandise categories contributed to the 13.2% full-year comp gain, said MacDonald. Driving comps were increased key item presentations, effective marketing and size replenishment enhancements. For 2011, a focus will continue to be men's, which accounts for 15% of sales; as well as accessories and e-commerce.

Regarding toning, DSW is carrying about half the toning brands it

carried last year and focusing more on “big key items,” said Debbie Ferree, vice chairman and chief merchant, on the call.

But she said athletic assortments overall are shifting away from toning “really more into the lightweight running and technical and that piece of our business is actually doing very well.”

But she said athletic assortments overall are shifting away from toning “really more into the lightweight running and technical and that piece of our business is actually doing very well.”

For the current year, comps are expected to rise in a range between 3% to 5% and EPS between $2.60 to $2.75. EPS was $2.40 in 2010.