DSW Inc. reported second-quarter earnings slid 33.4 percent on a modest comp decline but adjusted earnings came in ahead of Wall Street’s consensus target and the off-pricer affirmed its outlook for the year.

“We are on track to deliver our outlook for the full year and we’ve made progress on a number of initiatives to drive sales and improve our financial trajectory,” said Roger Rawlins, CEO, DSW Inc. “We’ve positioned fall inventories conservatively to chase the trend of the business and after conducting a comprehensive assessment of DSW’s cost structure, we’ve identified actions, most of which will benefit 2017, with approximately $25 million in annualized cost savings. We are committed to getting back to sustained earnings growth while planting the seeds for long term success.”

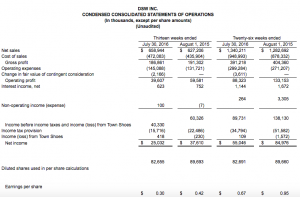

Second Quarter Operating Results

- Sales increased 5.1 percent to $659 million, including $19.6 million from Ebuys.

Comparable sales decreased by 1.2 percent compared to last year’s increase of 1.8 percent. - Reported and adjusted gross profit decreased by 210 bps due to lower initial markup, higher markdowns and the addition of Ebuys.

- Reported operating expense rate increased by 100 bps, which includes charges from purchase accounting and transaction costs related to the Ebuys acquisition. Separately, the percent recorded an expense of $2.2 million for the change in fair market value of the contingent consideration related to Ebuys.

- Adjusted operating expense rate increased by 40 bps primarily due to higher marketing and technology investments.

- Reported tax rate increased by 120 bps due to favorable discrete tax items last year.

- Reported net income was $25.0 million, or $0.30 per diluted share, including pre-tax charges of $3.9 million, or $0.03 per share, from purchase accounting, transaction costs and fair market value accounting charges related to the acquisition of Ebuys, and $2.7 million, or $0.02 per share, from restructuring costs.

- Adjusted net income was $29.1 million, or $0.35 per diluted share, excluding costs related to the Ebuys acquisition and restructuring.

Six Months Ended July 30, 2016 Operating Results

- Sales increased 4.5 percent to $1.3 billion, including $34.7 million from Ebuys.

- Comparable sales decreased by 1.4 percent compared to last year’s increase of 3.5 percent.

- Reported net income was $55.0 million, or $0.67 per diluted share, including pre-tax charges of $8.4 million, or $0.06 per share, from purchase accounting, transaction costs and fair market value accounting charges related to the Ebuys acquisition, and $2.7 million, or $0.02 per share, from restructuring costs.

- Adjusted net income was $61.9 million, or $0.75 per diluted share, excluding costs related to the Ebuys acquisition and the company’s restructuring costs.

Expense Management Review

The company completed a comprehensive expense review and identified approximately $25 million of annualized savings resulting from organization realignment and improvements in procurement and other business processes. Approximately 30 percent of these benefits, or $7 million, will be realized in 2016 and is included in the company’s full year guidance.

Second Quarter Balance Sheet Highlights

Cash, short-term and long-term investments totaled $244 million compared to $471 million in the second quarter last year. The lower cash balance reflects the company’s share repurchase activity totaling $180 million in 2015, the funding of its acquisition of Ebuys totaling $60.4 million and capital spending totaling $102 million in the last twelve month period.

Inventories were $556 million compared to $505 million at the end of the second quarter last year. Excluding Ebuys inventory of $28 million, total inventories increased by 4.5 percent. On a cost per square foot basis, DSW inventories were flat.

Regular Dividend

DSW Inc.’s Board of Directors declared a quarterly cash dividend payment of $0.20 per share. The dividend will be paid on September 30, 2016 to shareholders of record at the close of business on September 16, 2016.

Fiscal 2016 Annual Outlook

The company maintained its full year earnings guidance of $1.32 to $1.42 per share. Guidance excludes the impact of purchase price accounting, transaction costs and the fair market value accounting related to the acquisition of Ebuys and current and future charges related to its expense management review.

Photo courtesy of Annapolis Harbour Center