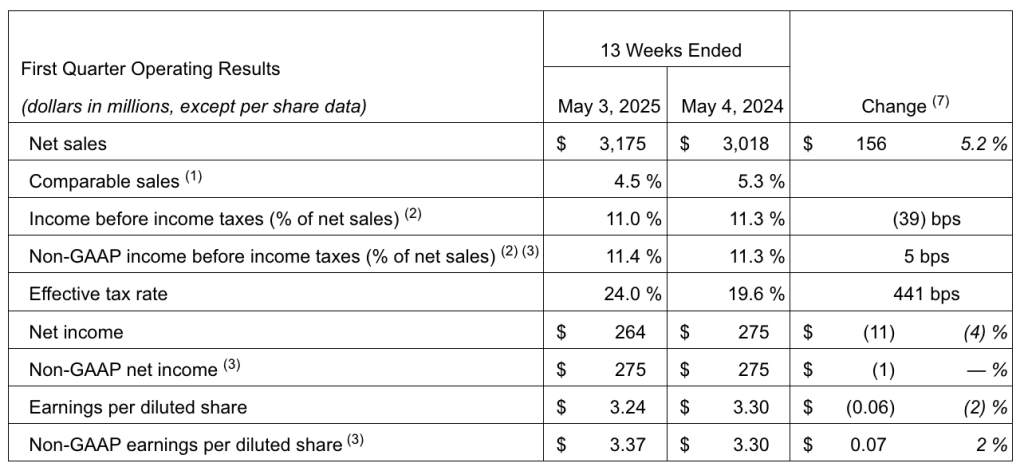

Dick’s Sporting Goods, Inc. achieved net sales of $3.18 billion in the fiscal first quarter ended May 3, a 5.2 percent increase compared to net sales of $3.02 billion in the prior-year Q1 period. Comparable store sales were up 4.5 percent in the first quarter, cycling against a 5.5 percent increase in the year-ago Q1 period.

Company and president Lauren Hobart noted that Q1 was the fifth straight quarter where the DKS team has delivered over 4 percent comp growth.

CFO Navdeep Gupta said that the comp sales increase for the quarter represents a 9.8 percent two-year comp stack and a 13.4 percent three-year comp stack.

“These strong comps were driven by a 3.7 percent increase in average ticket and a 0.8 percent increase in transactions,” Gupta detailed. “We saw strength across key categories and our vertical brands led by DSG, CALIA and VRST, which all continue to resonate very well with our athletes.” Hobart said that compared to the Q1 period last year, more athletes purchased from them, they purchased more frequently, and they spent more each trip.

Hobart reported that Dick’s saw growth across “so many areas of our business,” detailing that growth came from footwear, apparel, and team sports. She said from a cadence standpoint, “like the rest of the world,” the beginning of February was a little cold and wet, but it continued to improve and they had strength across the quarter in each month.

When hit with a question on the impact of tariffs on the consumer and pricing, Hobart pointed to a very resilient customer (athlete) that appears to be in good shape regardless of their economic strata.

“Our consumer has held up very well,” said Hobart. “And this has been a trend for some time and it continues to be a trend where people are prioritizing activities, healthy, active lifestyle, team sports, running, walking, being outside with their kids.”

She said that for Q1 Dick’s saw no trade down from “best” to “better” or “better” to “good.” She said they saw growth across all income demographics.

“As we reflect on our strong results and look to the rest of the year, I want to acknowledge that we’re operating in an increasingly complex macroeconomic environment, one shaped by shifting trade policies and a more cautious consumer mindset,” Hobart offered. “However, despite this uncertainty, we continue to operate from a position of strength.”

Hobart dug into the focus on accelerating the company’s highly profitable e-commerce business, one of the key strategic pillars for growth. She said they see significant opportunity to grow online presence and gain market share from online only and omni-channel retailers alike.

“To capture this opportunity, we’re investing aggressively in technology and marketing to enhance the omni-channel athlete experience and drive greater consideration for dicks.com.

As part of a broader digital strategy, the company reportedly remains “very enthusiastic” about two long-term growth opportunities, GameChanger and Dick’s Media Network, both of which are delivering strong profitable growth as they scale.

“Looking more closely at the GameChanger business, we had over 6.5 million unique active users during the first quarter, with an average of approximately 2.2 million daily active users, a nearly 28 percent year-over-year increase,” Hobart shared.

Profitability & Expenses

Gross profit for the first quarter reportedly remained strong at $1.17 billion, or 36.7 percent of net sales and increased 41 basis points from last year, said to be driven by higher merchandise margin.

Asked by an analysts what drives the acceleration from the 41 basis points growth in Q1 to the forecasted 75 basis points gain for the full year, Gupta said the Q1 improvement came from merchandise margin expansion while the full-year improvement is based on a variety of factors.

“The gross margin and the merch margin expansion continues to come from the differentiated product, the work that our team has been doing on the pricing and promotion optimization, as well as the strong performance that we saw in our vertical brands, which carry the 700 to 900 basis points of higher margin,” he noted.

“And as we look to the future and the balance of this year, our expectation is, these will be the same three drivers of the gross margin expansion, in addition to the two new drivers which we believe will continue to drive higher levels of margin improvement as we go into the balance of the year between GameChanger, as well as the Dick’s Media Network,” Gupta reported in an answer to another gross margin question.

On a non-GAAP basis, SG&A expenses increased 7 percent to $791.2 million and deleveraged 42 basis points compared to last year’s non-GAAP results.

“As we previewed during last quarter’s call, this year-over-year deleverage was expected and driven by strategic investments digitally, in-store and in marketing to better position ourselves over the long-term, this was partially offset by lower incentive compensation expense compared to the prior year,” the CFO said.

Pre-opening expenses were $13.4 million a decrease of $7.7 million compared to the prior-year Q1 period and said to be in-line with expectations.

Non-GAAP operating income was $360.4 million, or 11.4 percent of net sales, up from non-GAAP operating income of $334.5 million, or 11.1 percent of net sales, in Q1 of 2024.

On a non-GAAP basis, other income, which is primarily comprised of interest income was $13.3 million, down $8.3 million from the prior-year Q1 period. This decline reportedly resulted from lower cash on hand and an expected lower interest rate environment.

Non-GAAP EBT (earnings before taxes) was $361.6 million or 11.4 percent of net sales, up from EBT of $342.4 million, or 11.3 percent of net sales, in Q1 of 2024.

As expected, the Q1 tax rate grew from 19.6 percent last year to approximately 24 percent this year. This approximate 440 basis point increase reportedly reflects the higher tax reduction from greater number of employee equity awards being exercised in the prior year, which favorably impacted Q1 2024 earnings by approximately 19 cents compared to the current-year quarter.

Net income dipped 4 percent year-over-year to $264 million, compared to $275 in the prior-year first quarter. Non-GAAP net income was said to be flat.

In total, DKS delivered non-GAAP earnings per diluted share of $3.37, an increase of 2.1 percent compared to the earnings per diluted share of $3.30 last year. On a GAAP basis, earnings per diluted share were $3.24, which includes non-cash losses from non-operating investment in Foot Locker stock.

The retailer delivered earnings per diluted share of $3.24 and non-GAAP earnings per diluted share of $3.37 in the quarter, compared to $3.30 during the prior-year quarter, a period in which there were no non-GAAP adjustments.

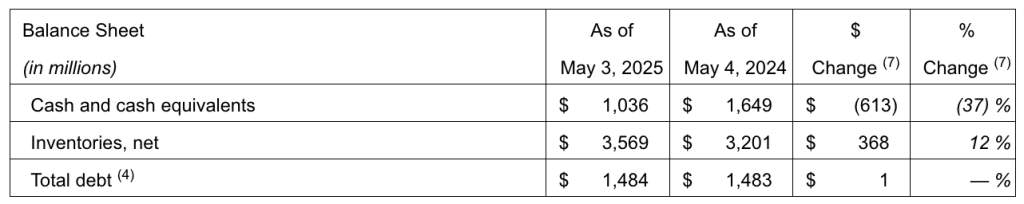

Balance Sheet Summary

Dick’s Sporting Goods ended the first quarter with approximately $1 billion of cash and cash equivalents and no borrowings on its $1.6 billion unsecured credit facility.

Quarter-end inventory levels increased 12 percent compared to Q1 quarter-end last year.

“We believe our inventory is well-positioned,” Gupta stated. “As we have discussed, our deliberate investment in key items and categories continue to fuel our sales momentum.” He said that one thing they have said consistently is that this is differentiated inventory that is allowing Dick’s to drive differentiated top-line results.

Gupta said the focused investments made at the end of Q4 bringing spring products earlier actually worked really well. “And that’s what you saw was the outsized comp that we were able to deliver,” he noted.

“In terms of the inventory growth and the impact from tariffs, we expect that the inventory growth will moderate even with some of the tariff headwinds that we have anticipated in that as we start to lap the investments that were made in the second half of 2024,” the CFO detailed.

Another participant asked if Dick’s had received any tariff items into inventory and if they had taken any prices yet on that product.

“We have no impact from tariffs in Q1, and we are working very closely with each of the brand partners on the right cadence and how best do we flow it,” Gupta offered. “So we’ll share much more on these things start to actualize. As we called out in our guidance, we have contemplated some of the timings associated with it, in our guidance, and we still feel great about the 75 basis points of the margin expansion that we guided for the full year.”

Net capital expenditures were $242 million in the first quarter, and DKS paid $100 million in quarterly dividends. The company also repurchased 1.4 million shares of its own stock for $298.7 million at an average price of $218.65 per share.

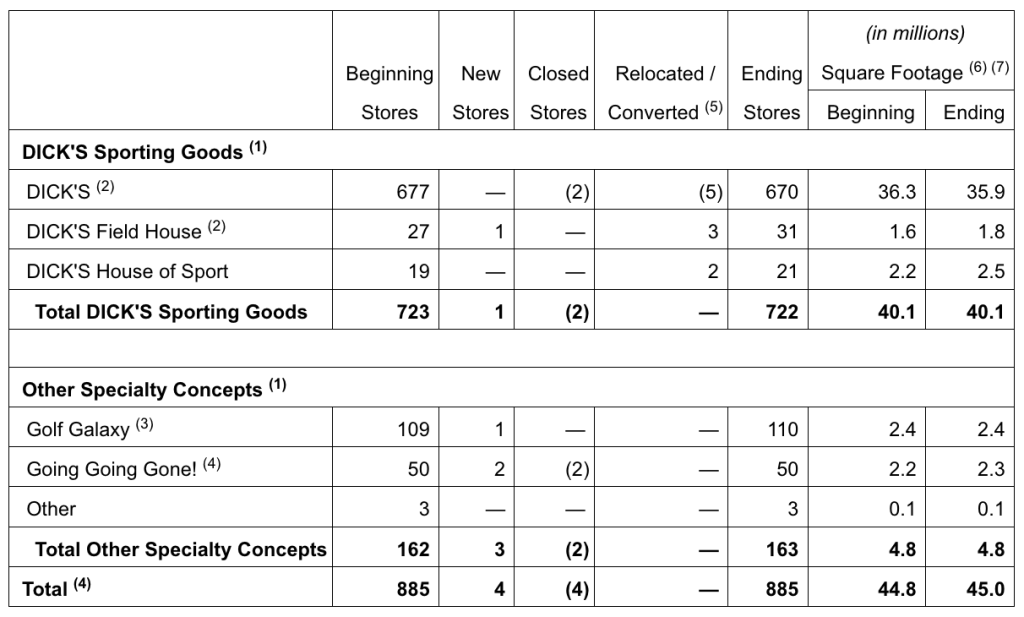

Stores

During the first quarter the company opened two new House of Sport locations and four new Dick’s Field House locations.

An analyst speculated a range of store opening numbers for Field House stores and House of Sport doors by the end of the year and asked about the overall square footage growth of the total business at year-end. “It looks like it was up about 5 percent year-over-year in Q1,” he asked.

Gupta said they continue to expect the House of Sport to be in the range of 75 to 100 doors as they look to the near future and there will be about 35 House of Sport locations – adding about 20 House of Sport locations in 2026 – and just over 40 Field House locations by the end of the year. The company continues to use the Field House model as a way of “reimagining what a Dick’s 50K would look like.”

“The way I would characterize the square footage growth would be in that same 2 percent or slightly north of that, depending on the number of new store openings,” the CFO estimated.

Fiscal 2025 Store Count and Square Footage

Quarterly Dividend

On May 27, 2025, the company’s Board of Directors authorized and declared a quarterly dividend in the amount of $1.2125 per share on the company’s common stock and Class B common stock. The dividend is payable in cash on June 27, 2025 to stockholders of record at the close of business on June 13, 2025.

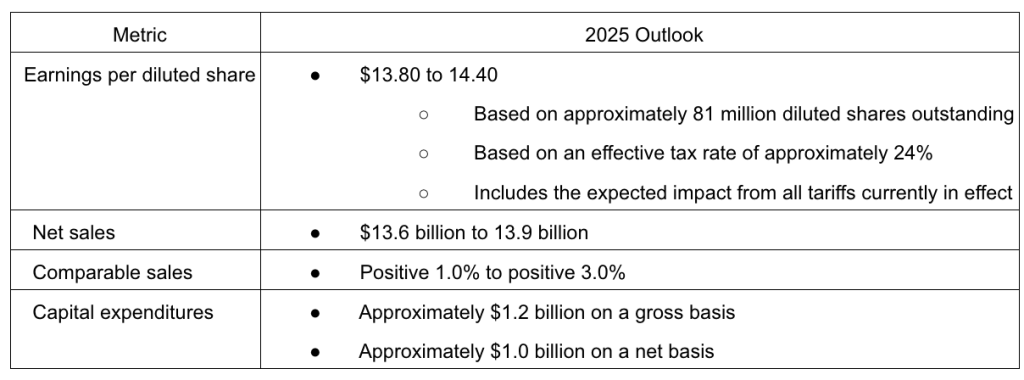

Full Year 2025 Outlook

DKS said it continues to expect full year 2025 comparable sales growth to be in the range of 1.0 percent to 3.0 percent and full year 2025 earnings per diluted share to be in the range of $13.80 to $14.40 per share.

The company’s Full Year Outlook for 2025 below does not include acquisition-related costs, investment losses or results from the recently announced plan to acquire Foot Locker:

Image and charts courtesy Dick’s Sporting Goods, Inc.

See below for additional coverage and details on forward guidance, the Foot Locker acquisition and the expected tariff impact:

EXEC: Dick’s SG Senior Execs Talk Foot Locker Deal, Tariffs and Guidance