Dick’s Sporting Goods, Inc. saw DKS shares take a dip on Tuesday, March 11 after reporting the retailer’s fiscal fourth quarter and full-year results. DKS shares were down in mid-single-digit in midday trading.

While the company’s results looked to be particularly strong in the fourth quarter and solid for the full year, investors and analysts were apparently concerned over the weaker outlook for fiscal 2025, which called for comparable sales growth in the range of 1.0 percent to 3.0 percent for the year ahead. Many believe that the retail sector in general is playing it conservative given the unknowns in the market surrounding tariffs and trade wars while fears of inflation and recession give consumers pause as the stock market slumps.

Company CFO Navdeep Gupta, told a group of analysts on the company’s quarterly conference call that, “given the evolving nature of the discussion and number of unknowns,” the company’s guidance does not contemplate changes in tariffs at this time.

“We successfully managed through tariffs in the prior cycle,” he noted. “Along with our brand partners, we have been diversifying our vertical brand sourcing for several years and will continue to do that going forward. We will remain flexible and nimble to adapt to the changing environment.”

Fourth Quarter Summary

Total sales for the fourth quarter increased 0.5 percent to $3.89 billion in the 13-week period ended February 1, compared to $3.89 billion in the 14-week period ended February 3, 2024, representing the largest sales quarter in the history of the company.

Fourth quarter comps came in at a healthy 6.4 percent growth level for the biggest quarter in the retailer’s history, cycling against 2.9 percent comp sales growth in the prior-year Q4 period. The strong comps were said to be driven by a 4.4 percent increase in average ticket and a 2 percent increase in transactions.

Gupta reminded the participants on the conference call that the strong quarter represented a nearly 15 percent three-year comp stack. He also noted that net sales comparisons for Q4 were unfavorably impacted by approximately $200 million, including the extra week in 2023, which added $170 million in sales in Q4 2023, as well as the impact of the calendar shift, which was neutral for the full year but unfavorably impacted Q4 sales by $30 million.

Gross profit for the fourth quarter remained strong at $1.36 billion, or 35.0 percent of net sales, and increased 39 basis points from last year’s non-GAAP results. Gupta said the increase was driven by lower shipping costs and higher merchandise margin, which was partially offset by expected deleverage on the occupancy cost due to the 53rd week in 2023.

On a non-GAAP basis, SG&A expenses for the quarter increased 4.8 percent to $957.6 million and deleveraged 101 basis points compared to 2023’s non-GAAP results.

“This year-over-year deleverage was expected and due to the strategic investments in our technology, talent and marketing based on the strength of our business, and also included higher incentive compensation,” the CFO noted.

Fourth quarter pre-opening expenses were $10.7 million, an increase of $5.3 million compared to the prior-year Q4 period. This expected increase was said to be driven by the timing of new store openings.

EBIT in the fourth quarter was $397.3 million, or 10.2 percent of net sales. This compares to a non-GAAP EBIT of $427.7 million, or 11.0 percent of net sales in Q4 2023. Gupta said EBIT margin comparisons were unfavorably impacted by approximately 27 basis points due to the extra week in 2023, plus the impact of the calendar shift.

The company had fourth-quarter earnings of $3.62 per diluted share, versus $3.57 per share in Q4 2023 and non-GAAP earnings of $3.85 in 2023 per diluted share; 2023 results included approximately 19 cents for the 14th week.

The CFO said EPS comparisons for Q4 were unfavorably impacted by approximately 29 cents per diluted share due to the extra week in 2023, which added approximately 19 cents per diluted share in Q4 2023 plus the impact of the calendar shift, which was neutral for the full year but unfavorably impacted Q4 EPS by approximately 10 cents per diluted share.

Full Year Summary

Total sales for the 52-week fiscal 2024 year increased 3.5 percent to $13.4 billion, compared to $13.0 billion in the 53-week fiscal 2023 full-year period. Full-year 2023 sales were positively impacted by $170 million from the 53rd week.

“On a 52-week comparable basis, our consolidated net sales increased 4.9 percent,” added Gupta.

The company posted a 5.2 percent comp store sales increase for the 2024 fiscal year, cycling against a 2.6 percent comp sales gain in the 2023 fiscal year. These strong comps were said to be driven by a 40 percent increase in average ticket and a 1.2 percent increase in transactions.

DKS delivered full-year 2024 earnings per diluted share of $14.05, up 15 percent versus $12.18 per share in 2023 and up 9 percent versus non-GAAP earnings per diluted share of $12.91 in 2023. The 2023 results were said to include ~ 19 cents for the 53rd week. On a 52-week comparable basis, this represents a year-over-year increase of 10.5 percent.

Driven by strong sales and gross margin expansion, EBIT was $1.52 billion, or 11.3 percent of net sales, and increased $116 million, or 49 basis points, from 2003’s non-GAAP results, Gupta noted.

Balance Sheet and Capital Allocation Summary

Dick’s Sporting Goods, Inc. ended the year with approximately $1.7 billion of cash and cash equivalents and no borrowings on its $1.6 billion unsecured credit facility.

Year-end inventory levels increased 18 percent year-over-year.

“We believe our inventory is well positioned with clearance levels at historic lows,” Gupta said. “As we have discussed, to maximize the benefit of our differentiated assortment, we have made a deliberate decision to lean into key items and categories. We also invested in earlier spring receipts to more effectively transition seasons in warmer climate markets. These investments play a vital role in driving our continued strong sales momentum, which we expect to carry into 2025.”

For fourth quarter capital allocation, net capital expenditures were $215 million and the company paid $89 million in quarterly dividends. DKS also repurchased 428,000 shares of its stock for $98 million at an average price of $228.17 per share.

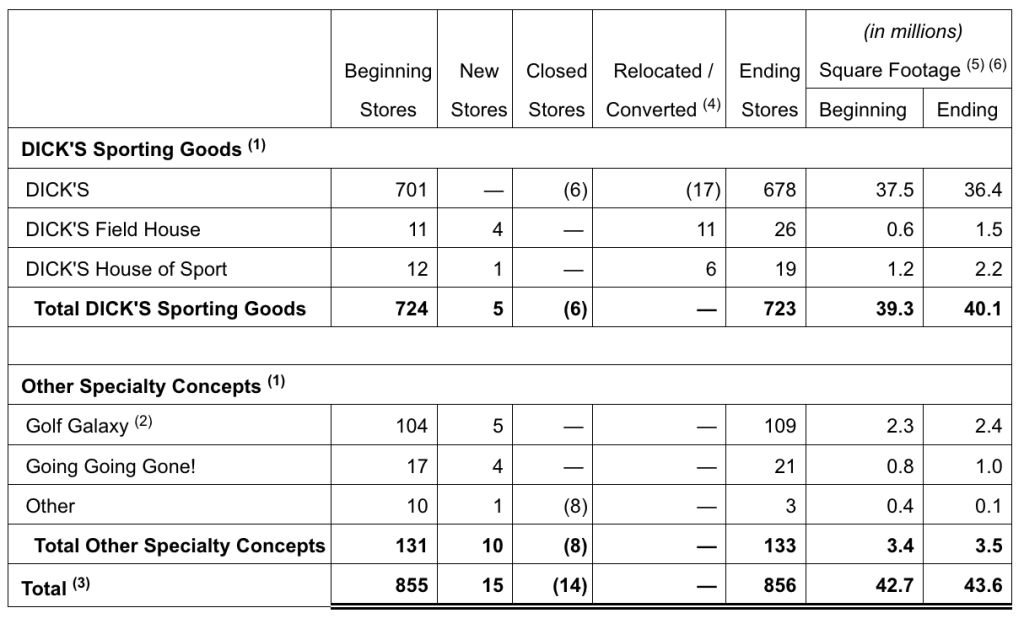

Store Count and Square Footage

DKS opened seven House of Sport locations and 15 Dick’s Field House locations in 2024 and plans to open roughly 16 additional House of Sport locations and approximately 18 additional Dick’s Field House locations in 2025.

“After opening seven more House of Sport locations during 2024, we ended the year with 19 total locations and we look forward to adding approximately 16 more in 2025,” commented company president and CEO Lauren Hobart. “By the end of 2027, we expect to have between 75 to 100 House of Sport locations across the country.”

DKS finished the year with a total of 26 Dick’s Field House locations and expects to add approximately 18 more this year.

“As we’ve said previously, this one-two punch of House of Sport and Field House is the future of our Dick’s stores,” Hobart added.

Full Year 2025 Outlook

Dick’s Sporting Goods expects full-year comparable sales growth in the range of 1.0 percent to 3.0 percent, which at the midpoint represents nearly a 10 percent three-year comp stack, according to Gupta’s comments.

“We expect comps to be closer to the high end of our guidance through the third quarter, though in Q4 we’ll be lapping very strong results from 2024,” the CFO shared.

Consolidated sales are expected to be in the range of $13.6 billion to $13.9 billion.

“Driven by the quality of our assortment, we expect gross margins to again expand year-over-year, which at midpoint we expect to improve approximately 75 basis points,” Gupta detailed. “This brings total expected gross margin expansion over the three-year period from 2022 to 2025 to approximately 200 basis points.”

Gupta said the company expects gross margin expansion to be offset by SG&A deleverage due to investments in the company’s three pillar strategy.

From a pacing standpoint, DKS expects greater SG&A expense deleverage in the first half with moderation in the second half as it laps the higher investment levels from the second half of last year. Pre-opening expenses are expected to be in the range of $65 million to $75 million with approximately one-third incurred in the first half of the year and the remaining two-thirds in the second half.

“We expect both EBIT and EBIT margins to be approximately 11.1 percent at the midpoint,” Gupta noted. “At the high end of our expectations, we expect to drive approximately 10 basis points of EBIT margin expansion on a non-GAAP basis.”

He said DKS expects interest expense to remain roughly flat year-over-year while it is modeling other income, which is comprised primarily of interest income, to decline due to the lower interest rate environment compared to the prior year.

DKS expects full year earnings per diluted share to be in the range of $13.80 to $14.40 per share, based on ~ 82 million average diluted shares outstanding and effective tax rate of approximately 24 percent.

“From a pacing perspective, we expect EPS to decline year-over-year in the first half and increase year-over-year in the second half,” Gupta detailed.

The DKS Board of Directors authorized a 10 percent increase in quarterly dividend and a new five-year share repurchase program of up to $3 billion.

Image courtesy Dick’s Sporting Goods, Inc.