Dick’s Sporting Goods saw first quarter sales come in below plan due to heavy rains in key parts of the country, but strong cost controls and higher merchandising margins helped the sporting goods giant beat EPS guidance.

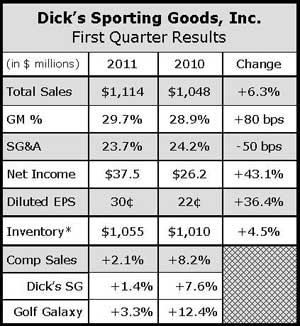

First quarter net income jumped 43.1 percent to $37.5 million, or 30 cents a share, exceeding the prior forecasted range between 26 cents to 28 cents. The above-plan earnings were helped by modifying its variable spending, primarily around marketing and payroll, and leveraging its SG&A down 50 basis points.

Total net revenues grew 6.3 percent to $1.11 billion for the quarter. Same-store sales increased 2.1 percent. At the Dick’s Sporting Goods (DSG) chain, comps increased 1.4 percent, driven by a 0.8 percent increase in transactions and a 0.6 percent increase in sales per transaction. Comps rose 3.3 percent at Golf Galaxy. E-commerce comps increased 25.2 percent.

Gross margins “meaningfully improved” year-over-year, confirmed company Chairman and CEO Ed Stack on a conference call with analysts, expanding by 80 basis points to 29.7% of sales. Merchandise margins increased due to a change in mix, with relative increases in athletic apparel and footwear at DSG stores, and continued effective inventory management. Systemic inventory controls implemented over the past 18 months reduced clearance inventory, leading to fewer markdowns. Occupancy margins were flat.

“Our apparel and footwear business did very well, and we continued our tight control over inventory by once again keeping inventory growth significantly below our comp store sales growth,” added Stack. Inventory per square foot was up 0.6 percent.

Stack said overall comps came in well short of their previous 4-5 percent guidance due to weather-related delays in spring sport seasons. In the first two-thirds of the quarter, comps were tracking in line with guidance. But in April, the start of many high school, junior high school, and community baseball, soccer and lacrosse seasons were delayed due to unplayable field conditions.

Stack said golf courses in important parts of the country likewise opened late or saw significantly reduced play due to the wet and cold conditions. Finally, outdoor activities, such as fishing, camping, and boating, were impacted by rain and flooding.

“In areas of the country where we did not see these weather patterns, our sales met or exceeded our original expectations,” said Stack. “Now that the spring season is in full swing around most of the country, we have seen a return to our expected sales performance.”

Driving the top-line growth was footwear and apparel although Stack also highlighted “the innovation that’s going on in the golf business right now.”

Stack said the roll out of Dick’s SG’s shared-service footwear departments continue to do well, and the company is “working with the brands to kind of take the presentation of the shared-service footwear up significantly.”

Stack is also “extremely enthusiastic” about the Nike Fieldhouse in-store shops. It currently has 38 Evo Plus shops and nine Pinnacle shops, and expects to have between 90 and 100 in total by the end of the year.

“The performance of these stores have been terrific compared to the balance of the chain,” said Stack.

The sales shortfall in the quarter, he believes, was largely weather-related not only because of the solid performance of regions unaffected by weather, but because consumers arent trading down unlike a few years ago.

“Weve seen in strength in the consumer is some higher-end running shoes,” noted Stack. He sees this as an indication that the consumer is willing to pay for true performance product.

“The TaylorMade R11 driver is the perfect example,” adds Stack. “It’s a $399 driver. And if it’s not our best-selling driver, it’s our second-best-selling driver. That driver has just been off the charts. And it’s been a long time since weve had one of our best-selling drivers be a $400 driver. So we think the consumer is willing to step out and buy if they perceive that what theyre buying is truly going to help their performance.”

The retailer has not seen any notable vendor price increases so far although Stack expects “a little bit more” in the second half of the year and a “a bit more than that” in the first half of 2012.

New store productivity was 106 percent in the quarter, up from 82 percent in the year-ago quarter. The improvement partly reflects the fact that new stores are opening in areas “less hit” by economy versus the prior year, when stores opened in Arizona, Southern California and Florida. Regionalization efforts also helped.

Looking ahead, DKS raised full-year EPS guidance from previous estimates of $1.89 to 1.91 per share to a range of $1.91 to $1.93 per share. An increase in the gross profit rate is expected to drive earnings growth as improved merchandise margins — driven by inventory management, private brands, regionalization efforts, store enhancements like its shared service model, and partnering with vendors – offset any sourcing costs pressures. Comps are expected to increase 3 percent for the year.

For the second quarter, DKS expects EPS in the range of 47 to 49 cents, up from 43 cents in Q2 last year. Comps are expected to increase 3 percent for the quarter.

Asked during Q&A why the Q2 guidance was lower than the 4 to 5 percent original Q1 forecast, Stack said it was largely due to tough comparisons. He said the 2010 second quarter was boosted by the Blackhawks winning the Stanley Cup as well as the 2010 World Cup, with the benefit of two events estimated at 4 cents a share.

Asked about the Canadian Tire/Forzani acquisition, Stack said, “What Canadian Tire and Forzani are doing may make sense for them, but we dont see that having any impact on us.”

Although Dick’s SG will continue to explore opportunistic purchases in the marketplace, Stack said he doesnt see signs of expansion accelerating across the sporting goods channel.

“Weve taken a look at the number of stores that our competitors are opening up and theyre not opening up very many,” said Stack. “I think Sports Authority is opening up roughly six; Academy is opening up a few more than that. But Golfsmith is opening three. We dont see a big rush for real estate and this getting irrationally competitive by any means.”