Dicks Sporting Goods made the best of a tough quarter as a focus on leaner inventories helped to expand merchandise margins. However, a de-leveraging of occupancy costs following comp store sales declines led to depressed gross margins and a decrease in Q3 net income.

Those declines in turn caused the retailer to lower its guidance for the year.

Looking ahead, Dicks Sporting Goods now expects diluted earnings per share of $1.13 to $1.20, excluding integration costs from Golf Galaxy, of $1.06 to $1.13 including those costs. In reporting second quarter results on Aug. 21, Dick's Sporting Goods said it expected full year earnings ranging from $1.27 and 1.36 excluding costs from the Golf Galaxy integration, and between $1.20 to $1.29, including the integration costs. Comparable store sales, which include Dick's Sporting Goods stores only, are expected to decrease between 5% and 4% for the full year.

For the fourth quarter, the company anticipates reporting consolidated earnings per diluted share of approximately 49 cents to 56 cents a share, excluding costs from the Golf Galaxy integration. The company anticipates reporting earnings per diluted share of approximately 47 cents to 54 cents, including the Golf Galaxy integration costs.

Comparable store sales are expected to decrease approximately 10% to 6%, which compares to a 3.4% increase in the fourth quarter last year, as adjusted for the shifted retail calendar. The comps guidance includes Golf Galaxy, but not Chick's Sporting Goods.

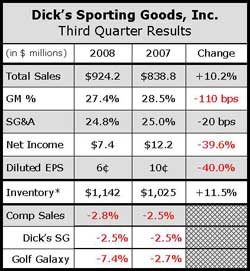

For the third quarter just completed, net sales increased 10.2% due to the opening of new stores and the inclusion of Chick's Sporting Goods. However, overall comps declined 2.8%, with comps sliding 2.5% at Dicks Sporting Goods stores and 7.4% at Golf Galaxy stores.

Chairman, CEO and President Ed Stack said that approximately 40 basis points of the negative 2.5% comp sales decline at the Dicks SG stores were attributable to the discontinuation of Heelys, when discussing the quarterly results on a conference call with analysts. “Golf equipment and exercise also negatively impacted store sales. Athletic apparel, athletic footwear and outdoor business positively impacted sales in the quarter,” said Stack.

Athletic apparel comps were further clarified as “slightly comp positive,” while outdoor hardgoods, including both hunt/fish/camp and specialty, were said to have outperformed softgoods. Management surmised that the incoming Democratic President fueled strong gun sales. Golf was said to be challenging with both the golf business at Dicks Sporting Goods and Golf Galaxy experiencing similar comps.

With fitness continuing to experience declines and difficult sales conditions, management commented that they were having discussions about the future of the business at Dicks Sporting Goods. Not saying that they would move away completely, but simply that they needed to find a way to increase profitability, while also possibly lessening the amount of floor space dedicated in 2009.

Management was upbeat on the pending Under Armour running shoe launch, noting they had “great success” with the cross trainer launch. They reported taking a “pretty aggressive position” with the launch. However any benefit will not be realized until the first quarter as the shoes launch on the last day of fourth quarter.

The overall comp sales decline for the third quarter came from a 2.2% decline in transactions and a 0.3% slip in average ticket. Cannibalization was said to have impacted comps by approximately 1% for the quarter.

Management attributed a large part of the downtick in ticket trend to softness in golf. Purchasing habits were relatively steady, with approximately 76% of sales paid for with plastic.

Looking at store locations, results were said to be pretty even at Dicks SG stores, whether mall, power strip or stand alone locations. New store productivity for new Dicks SG stores was said to be 76%, slightly below average for the company, though improved from the 69% reported after Q2. Management attributed that to tough competition on price as it moves into Texas.

The company opened 43 new Dick's SG stores, relocated one Dick's SG store and converted one Chick's SG store to a Dick's SG store in Q3. The moves mark the completion of planned store openings and relocations for 2008. DKS also opened one new Golf Galaxy store in Jacksonville.

In 2009, the company plans to add approximately 18 new Dick's Sporting Goods stores, relocate one Dick's Sporting Goods store and add one Golf Galaxy store. Roughly 30% of the new Dick's Sporting Goods stores in 2009 are anticipated to be in new markets. More than half of the new stores will open in the first quarter and the remainder thereafter.