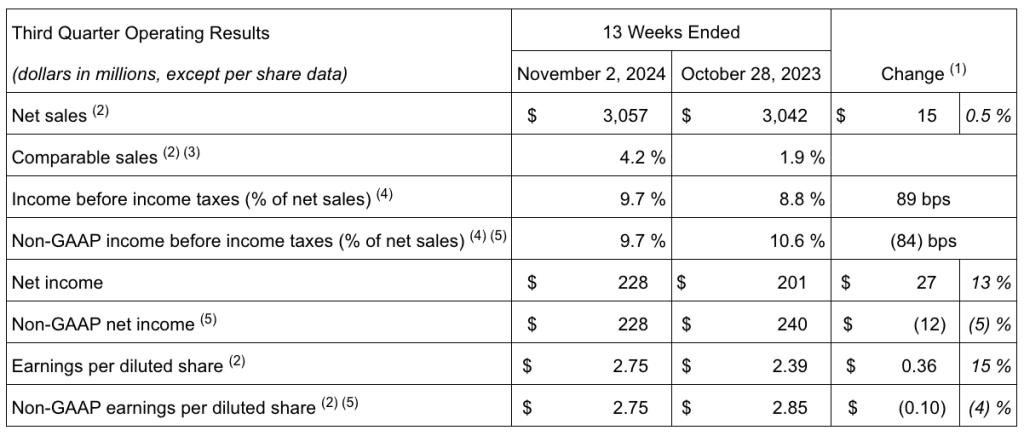

Dick’s Sporting Goods, Inc. delivered third-quarter net sales of $3.06 billion and earnings per diluted share of $2.75 in the third quarter ended November 2. Comparable store sales for fiscal 2024 third quarter, calculated by shifting the prior-year period by one week to compare similar calendar weeks, were up 4.2 percent year-over-year.

The comps increase was said to be driven by a 4.8 percent increase in average ticket and partially offset by a modest 0.6 percent decline in transactions.

“These results show how well our long-term strategies are working and the great execution from our team,” said Laureen Hobart, president and CEO, Dick’s Sporting Goods, Inc., on a conference call with analysts. “Our Q3 comps increased 4.2 percent driven by our four strategic pillars of omni-channel athlete experience, differentiated product assortment, deep engagement with the Dick’s brand, and our knowledgeable and passionate teammates who are integral to our success. We had an excellent back-to-school season and continue to gain market share.”

The company noted that, due to the 53rd week in fiscal 2023, there is a one-week shift in the fiscal 2024 calendar compared to the prior year, which unfavorably impacted net sales comparisons for the third quarter by approximately $105 million, or approximately 35 cents per diluted share on the EPS line, and favorably impacted the year-to-date period by approximately $35 million, or approximately 10 cents per diluted share.

“Our strong third-quarter results demonstrate the significant momentum we have in our business,” offered Ed Stack, executive chairman, Dick’s Sporting Goods, Inc. “We continue to make strategic investments such as our House of Sport and Dick’s Field House concepts, where we are redefining sports retail and creating strong engagement with our athletes, brand partners and communities that will fuel our long-term growth. Sport continues to have a strong influence on culture, and culture on sport, and our House of Sport concept is uniquely positioned to meet the needs of athletes as they look for the best of performance as well as the lifestyle of sport.”

Gross profit for the third quarter remained strong at $1.09 billion, or 35.8 percent of net sales, a 67 basis-point improvement over last year’s Q3 non-GAAP results. The increase was said to be driven by higher merchandise margin of 84 basis points due to favorable sales mix and the quality of the assortment. This was partially offset by expected deleverage on occupancy costs driven by unfavorable impact to our total sales from the calendar shift.

Hobart believes the continued growth and margin expansion is a testament to the retailer’s investment across its digital and store experiences, particularly a great about the strong performance in the House of Sport stores.

“We are redefining sports retail and creating strong engagement with our athletes, brand partners, and communities,” she said. “We continue to see sport having a strong influence on culture and culture on sport, and our House of Sport concept is uniquely positioned to meet the needs of all athletes across both performance and lifestyle.”

The company opened three House of Sport locations in Q3, followed by two more earlier in November, bringing the total to 19 HoS stores open ahead of the holiday season.

“In 2025, we expect to open approximately 15 House of Sport locations, and we remain on track to have 75 to 100 locations open by 2027,” Hobart shared. “Inspired by House of Sport, we continue to revolutionize our 50,000 square foot Dick’s stores with a next generation format, which we refer to internally as our Field House concept. These stores continue to do very well in both sales and profitability.”

DKS opened 5 Field House locations in Q3, followed by another four in November, bringing the total to 26 smaller format doors now open.

“In 2025, we expect to open approximately 20 Field House locations,” Hobart noted.

“The Texas market is an exciting growth opportunity for us, and it’s one of the areas where we are investing in new House of Sports locations, in marketing, and in our infrastructure to enhance the omni-channel experience for our athletes and capture this potential,” Hobart added. “This quarter, we broke ground on the new distribution center we’ve been planning in Fort Worth, Texas, which is expected to open in early 2026.”

On a non-GAAP basis, SG&A expenses increased 7.2 percent to $787.1 million in Q3 and deleveraged 162 basis points compared to last year’s Q3 non-GAAP results. This year-over-year deleverage was reportedly expected with approximately 65 basis points of the increase due to unfavorable impact to the company’s reported total sales from the calendar shift. The remaining increase was said to be driven by strategic investments, primarily across marketing, technology and talent based on the strength of the business, as well as higher incentive compensation.

Pre-opening expenses were $16.8 million, a decrease of $3.6 million year-over-year, and favorable versus expectations due to difference in timing of new store openings.

Earnings before tax (EBT) was $297.1 million, or 9.7 percent of net sales, compared to a non-GAAP EBT of $321.1 million, or 10.6 percent of net sales in Q3 2023. The company said this included an unfavorable impact from the calendar shift of approximately 95 basis points.

“In total, we delivered earnings per diluted share of $2.75,” stated company CFO Navdeep Gupta on the conference call. “This compares to a non-GAAP earnings per diluted share of $2.85 [in Q3] last year. As I mentioned earlier, the current year included an unfavorable impact from the calendar shift of 35 cents in earnings per diluted share.”

Nine-Month Year-to-Date Summary

Year-to-date through the third quarter, consolidated net sales increased 4.8 percent to $9.55 billion year-over-year. Adjusting for the calendar shift, comps reportedly increased 4.7 percent, driven by a 3.7 percent increase in average ticket and a 1 percent increase in transactions.

EBT was $1.12 billion for the quarter, or 11.8 percent of net sales, compared to non-GAAP EBT of $975.3 million or 10.7 percent of net sales in the comparative 39-week period last year.

“In total, we delivered earnings per diluted share of $10.43 [for the YTD period], said Gupta. “This compares to non-GAAP earnings per diluted share of $9.08 last year, an increase of 15 percent for the 39-week period.”

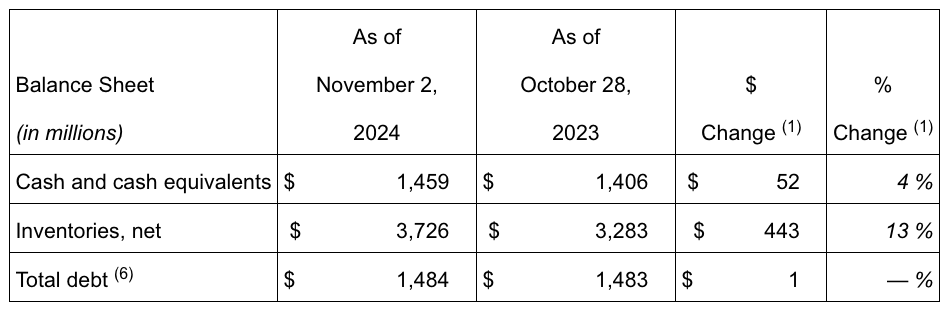

Balance Sheet Summary

The company had no outstanding borrowings under its revolving credit facility in 2024 and 2023.

Quarterly Dividend

On November 25, 2024, the company’s Board of Directors authorized and declared a quarterly dividend of $1.10 per share on the company’s common stock and Class B common stock. The dividend is payable in cash on December 27, 2024, to stockholders of record at the close of business on December 13, 2024.

Share Repurchase Program

During the 39 weeks ended November 2, 2024, the company repurchased 0.8 million shares of its common stock under its share repurchase program at an average price of $203.98 per share, for a total cost of $170.3 million. As of November 2, 2024, the company had $609.3 million remaining under its authorization.

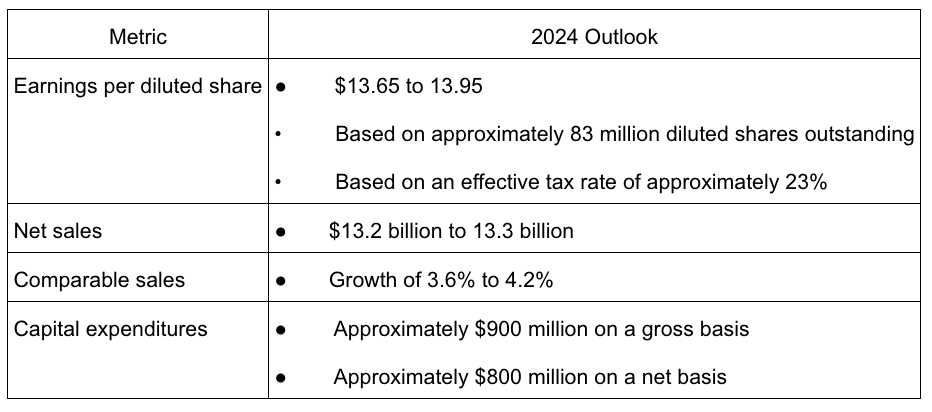

Full Year 2024 Outlook

“As a result of our strong performance in the quarter and the continued confidence we have in our business, we are again raising our full year outlook,” offered Hobart.

DKS raised its full-year 2024 guidance for comparable sales growth to a range of 3.6 percent to 4.2 percent, up from 2.5 percent to 3.5 percent previously. The company also raised full year 2024 earnings per diluted share guidance to a range of $13.65 to 13.95, up from $13.55 to 13.90 previously.

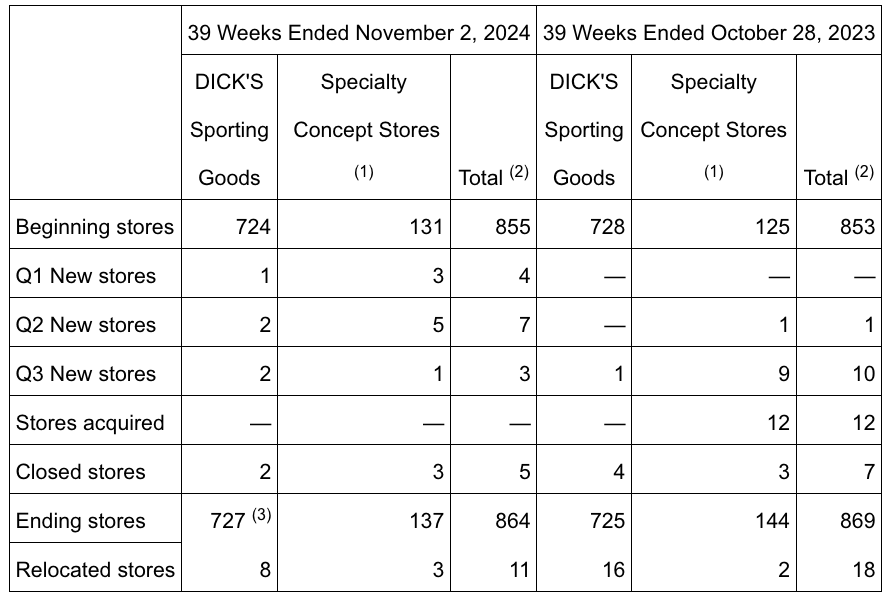

Store Count and Square Footage

The following table summarizes store activity for the periods indicated.

Other Company Notes

- Beginning in fiscal 2024, DKS revised its method for calculating comparable sales to include GameChanger revenue. Prior year information has been revised to reflect this change for comparability purposes.

- The company declared and paid quarterly dividends of $1.10 per share in fiscal 2024 and $1.00 per share in fiscal 2023.

Image courtesy Dick’s Sporting Goods, Inc.