Dick’s Sporting Goods reported a slight decline in earnings in the third quarter, but results came in at the higher end of guidance. Consolidated same-store sales increased 1.1 percent. Same-store sales for Dick’s Sporting Goods increased 1.7 percent, while Golf Galaxy decreased 8.9 percent.

Third Quarter Results

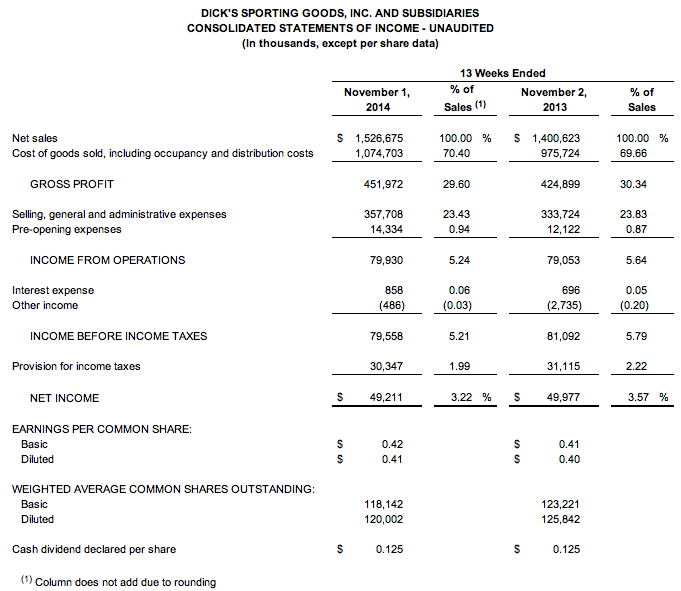

The company reported consolidated net income for the third quarter ended November 1, 2014 of $49.2 million, or 41 cents per diluted share, compared to the company’s expectations provided on August 19, 2014 of 38 cents to 42 cents per diluted share. For the third quarter ended November 2, 2013, the company reported consolidated net income of $50.0 million, or 40 cents per diluted share.

Net sales for the third quarter of 2014 increased 9.0 percent to approximately $1.5 billion. Consolidated same store sales increased 1.1 percent, compared to the company’s guidance of an approximate 1 to 3 percent increase. Same store sales for Dick’s Sporting Goods increased 1.7 percent, while Golf Galaxy decreased 8.9 percent. Third quarter 2013 consolidated same store sales increased 3.3 percent, adjusted for the shifted retail calendar due to the 53rd week in 2012.

“Our third quarter earnings were at the higher end of our guidance, but continued pressures in golf and hunting kept our comp sales at the lower end of our expectations,” said Edward W. Stack, chairman and CEO. “The balance of our business, excluding golf and hunting, continued to deliver strong results, posting a 4.6 percent comp increase for the quarter. The performance in these other categories, such as women’s and youth apparel, are good indicators that our recent actions to reallocate space and payroll within our stores are paying off.”

Store openings

E-commerce penetration for the third quarter of 2014 was 7.3 percent of total sales, compared to 6.5 percent in the third quarter last year.

In the third quarter, the company opened 24 new Dick’s Sporting Goods stores, one new Golf Galaxy store and seven new Field & Stream stores. The company also relocated one Dick’s Sporting Goods store and one Golf Galaxy store, remodeled five Dick’s Sporting Goods stores and closed one Dick’s Sporting Goods store. As of November 1, 2014, the company operated 597 Dick’s Sporting Goods stores in 46 states, with approximately 32.0 million square feet and 80 Golf Galaxy stores in 29 states, with approximately 1.4 million square feet.

Store count, square footage and new stores are listed in a table later in the release under the heading “Store Count and Square Footage.”

In the beginning of the fourth quarter, the company opened six new Dick’s Sporting Goods stores, completing its 2014 store development program. The company opened a total of 45 net new Dick’s Sporting Goods stores, one new Golf Galaxy store and eight new Field & Stream stores. The company also relocated five Dick’s Sporting Goods stores and two Golf Galaxy stores and remodeled five Dick’s Sporting Goods stores in 2014. The company also plans to close two Golf Galaxy stores that are at the end of their leases during the fourth quarter.

Balance Sheet

The company ended the third quarter of 2014 with approximately $78 million in cash and cash equivalents and approximately $281 million in outstanding borrowings under its revolving credit facility. This compares to cash and cash equivalents of approximately $66 million and $116 million of borrowings under its $500 million revolving credit facility at the end of the third quarter of 2013. Over the course of the last 12 months, the company utilized capital to invest in omni-channel growth, including Field & Stream, and returned over $410 million to shareholders through share repurchases and quarterly dividends.

Total inventory was 12.4 percent higher at the end of the third quarter of 2014 as compared to the end of the third quarter of 2013, including inventory to support the company’s Field & Stream stores, and inventory for the upcoming holiday season.

Year-to-Date Results

The company reported consolidated non-GAAP net income for the 39 weeks ended November 1, 2014 of $192.2 million, or $1.58 per diluted share. For the 39 weeks ended November 2, 2013, the company reported consolidated non-GAAP net income of $199.3 million, or $1.59 per diluted share.

On a GAAP basis, the company reported consolidated net income for the 39 weeks ended November 1, 2014 of $188.7 million, or $1.55 per diluted share. For the 39 weeks ended November 2, 2013, on a GAAP basis, the company reported consolidated net income of $199.0 million, or $1.58 per diluted share. The GAAP to non-GAAP reconciliations are included in a table later in the release under the heading “Non-GAAP Net Income and Earnings Per Share Reconciliations.”

Net sales for the 39 weeks ended November 1, 2014 increased 9.1 percent from last year’s period to $4.7 billion due to the opening of new stores coupled with a consolidated same store sales increase of 2.0 percent.

Capital Allocation

In the third quarter of 2014, the company repurchased approximately 1.6 million shares of its common stock at an average cost of $45.98 per share, for a total cost of $75.0 million. To date, the company has repurchased $455.6 million of common stock under its $1 billion share repurchase authorization.

On November 13, 2014, the company’s Board of Directors authorized and declared a quarterly dividend in the amount of $0.125 per share on the company’s Common Stock and Class B Common Stock. The dividend is payable in cash on December 26, 2014 to stockholders of record at the close of business on December 5, 2014.

Current 2014 Outlook

Full Year 2014

- Based on an estimated 121 million diluted shares outstanding, the company now anticipates reporting consolidated non-GAAP earnings per diluted share of approximately $2.75 to 2.85, excluding a gain on the sale of an asset and golf restructuring charges. For the 52 weeks ended February 1, 2014, the company reported consolidated earnings per diluted share of $2.69.

- Consolidated same store sales are now expected to increase approximately 1 to 2 percent, compared to a 1.9 percent increase in fiscal 2013.

Previously, it expected comps for the year to gain between 1 and 3 percent. The earnings guidance was the same.

Fourth Quarter 2014

- Based on an estimated 120 million diluted shares outstanding, the company currently anticipates reporting consolidated earnings per diluted share of approximately $1.18 to 1.28 in the fourth quarter of 2014, compared to consolidated earnings per diluted share of $1.11 in the fourth quarter of 2013.

- Consolidated same store sales are currently expected to increase approximately 1 to 3 percent in the fourth quarter of 2014, as compared to a 7.3 percent increase in the fourth quarter of 2013, adjusted for the shifted retail calendar due to the 53rd week in 2012.

Capital Expenditures

In 2014, the company anticipates capital expenditures to be approximately $340 million on a gross basis and approximately $245 million on a net basis. In 2013, capital expenditures were approximately $286 million on a gross basis and approximately $238 million on a net basis.