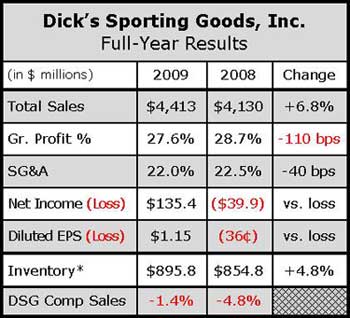

Riding growth sparked by several key factors, Dicks Sporting Goods swung to a profit in the 2009 fourth quarter, outpacing analysts estimates and prompting management to issue a more positive outlook for fiscal 2010. Management at the Pittsburgh, PA-based sporting goods chain said favorable same-store sales, new store openings and the introduction of e-commerce pushed revenues up 10.7% to $1.34 billion in Q4 from $1.21 billion (as adjusted) in a highly-promotional Q4 in the prior year. Transactions increased 3% for the quarter, offsetting an incremental decline in sales-per-transaction.

Specifically, management said 2.5% growth in same-store sales, which didnt include results from the companys newly-initiated Web business, benefited from harsh winter weather that spurned strong sell-through of certain apparel and footwear offerings. For footwear, management also cited strength from Reeboks new toning line, which COO Joe Schmidt said could continue to be a major factor for the footwear category going forward.

The retailers Golf Galaxy business comped up 5.9%, and management said they were relatively enthusiastic about the golf business as compared to last year, and noted strength from new TaylorMade drivers, the new Callaway Diablo line and Nikes new SQ Machspeed line. Management declined to give details on the DSG golf business, but confirmed that the segment generated comp growth to an even greater degree than the Golf Galaxy business. As expected, the companys guns and ammunition were down versus the prior year on tough comparisons related to the 2008 elections.

Among other results, DKS reported a net income of $67.4 million, or 56 cents per diluted share, in Q4, compared to a (GAAP) net loss of $105.6 million, or 94 cents per share, in the prior-year period. Fourth quarter earnings include a non-cash impairment charge and merger and integration costs. As noted, consolidated same-store sales for the fourth quarter increased 2.5%, driven by 2.4% growth and 5.9% growth in Dicks SG stores and Golf Galaxy, respectively.

Gross margin for the quarter was 29.2% of sales, down one basis point from last year. Management blamed the incremental dip on the deleveraging of e-commerce, freight, and distribution costs, but added that it was mostly offset by a 31 basis point increase in consolidated merchandise margins. Merchandise margins increased primarily due to the reduction of promotional activity at Golf Galaxy stores.

SG&A expenses were $276.7 million, up 20.1% from SG&A of $241.7 million a year ago. Management attributed the increase to its advertising campaign in southern California, which supported its stores during their first holiday season in the region. About $11 million of the 2009 SG&A increase came from consolidation of the companys e-commerce business from GSI Commerce.

In 2009, DSG opened 24 new DSG stores and one new Golf Galaxy.

Regarding outlook, the company expects consolidated earnings per share of approximately $1.32 to $1.35 for fiscal 2010. Same-store sales are expected to increase 2% to 3% for the year and will include Dicks SGs e-commerce business. Management said the company expects to open at least 24 new DSG locations and approximately five new Golf Galaxy stores.

For the first quarter of 2010, DKS anticipates consolidated earnings of 12 cents to 13 cents per diluted share. Same-store sales are expected to increase 2% to 3% and will also include e-commerce results.

First quarter gross margin is expected to improve as a result of merchandise margin improvement, which is expected to come as a result of comparisons against a Q109 that included a clearance event at Golf Galaxy and the liquidation at Chicks Sporting Goods amidst its conversion to the DSG format. Dicks SG expects to open approximately five new Dicks Sporting Goods stores in the first quarter.